UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of October 2023

Commission

File Number: 001-40842

VALENS

SEMICONDUCTOR LTD.

(Exact

name of registrant as specified in its charter)

8

Hanagar St. POB 7152

Hod

Hasharon 4501309

Israel

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒

Form 40-F

☐

EXPLANATORY

NOTE

Valens

Semiconductor Ltd. (the “Company” or “Registrant”) hereby furnishes the following documents:

| i. | Notice

and Proxy Statement with respect to the Company’s Annual General Meeting of Shareholders

to be held on November 22, 2023, describing the proposals to be voted upon at the meeting,

the procedure for voting in person or by proxy at the meeting and various other details related

to the meeting; and |

| ii. | a

Proxy Card whereby holders of Company’s shares may vote at the meeting without attending

in person. |

This

Report on Form 6-K is incorporated by reference into the Registrant’s registration statements on Form S-8 (File No. 333-259849).

TABLE

OF CONTENTS

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

VALENS

SEMICONDUCTOR LTD. |

| |

|

|

|

| |

By:

|

/s/

Gideon Ben-Zvi |

| |

|

Name: |

Gideon

Ben-Zvi |

| |

|

Title: |

Chief

Executive Officer |

Date:

October 17, 2023

3

Exhibit 99.1

October 17, 2023

Dear Valens Semiconductor Ltd. Shareholders:

We cordially invite you to

attend the Annual General Meeting of Shareholders of Valens Semiconductor Ltd. (the “Meeting”), to be held on

November 22, 2023 at 4:00 p.m. (Israel time), at our headquarters at 8 Hanagar St. POB 7152, Hod Hasharon 4501309, Israel.

At the Meeting, shareholders

will be asked to consider and vote on the matters listed in the enclosed Notice of Annual General Meeting of Shareholders. Our board of

directors recommends that you vote FOR each of the proposals listed in the Notice.

Only shareholders of record

at the close of business on October 16, 2023 are entitled to notice of and to vote at the Meeting.

Whether or not you plan to

attend the Meeting, it is important that your shares be represented and voted at the Meeting. Accordingly, after reading the enclosed

Notice of Annual General Meeting of Shareholders and the accompanying proxy statement, please complete, sign, date and mail the enclosed

proxy card in the envelope provided or vote by telephone or over the Internet in accordance with the instructions on your proxy card.

We look forward to greeting

as many of you as can attend the Meeting.

| |

Sincerely, |

| |

Peter Mertens |

| |

Chairman of the Board of Directors |

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

To be Held at 4:00 p.m. (Israel time) on Wednesday,

November 22, 2023

Dear Valens Semiconductor Ltd. Shareholders:

We cordially invite you to

attend the Annual General Meeting of shareholders (the “Meeting”) of Valens Semiconductor Ltd. (the “Company”),

to be held on Wednesday, November 22, 2023 at 4:00 p.m. (Israel time), at our headquarters at 8 Hanagar St. POB 7152, Hod Hasharon 4501309,

Israel (the telephone number at that address is +972-9-7626900).

The following matters are

on the agenda for the Meeting (collectively, the “Proposals”):

| |

(1) |

to re-elect each of Gideon Ben Zvi, Yahal Zilka, and Michael Linse as Class II directors, to hold office until the close of the Company’s annual general meeting of shareholders in 2026, and until their respective successors are duly elected and qualified, or until their office is vacated in accordance with our Articles of Association (as defined below) or the Companies Law (as defined below); and |

| |

(2) |

to approve the re-appointment of Kesselman & Kesselman, registered public accounting firm, a member firm of PricewaterhouseCoopers International Limited, as the Company’s independent registered public accounting firm for the year ending December 31, 2023 and until the next annual general meeting of shareholders, and to authorize the Company’s board of directors (with power of delegation to its audit committee) to set the fees to be paid to such auditors. |

In addition to considering

and voting on the foregoing Proposals, members of the Company’s management will be available at the Meeting to discuss the consolidated

financial statements of the Company for the fiscal year ended December 31, 2022. A copy of the Annual Report on Form 20-F filed with the

U.S. Securities and Exchange Commission (“SEC”) on March 1, 2023, including the audited consolidated financial

statements for the year ended December 31, 2022, is available for viewing and downloading on the SEC’s website at www.sec.gov as

well as on the “Investor Relations” portion of our Company’s website at https://investors.valens.com/financials/sec-filings/sec-filings-details/default.aspx?FilingId=15622761.

You are entitled to receive

notice of, and vote at, the Meeting if you are a shareholder of record at the close of business on October 16, 2023, in person or through

a broker, trustee or other nominee that is one of our shareholders of record at such time, or which appear in the participant listing

of a securities depository on that date.

You can vote your

ordinary shares, no par value (the “Ordinary Shares” or the “Shares”) by

attending the Meeting or by completing and signing the proxy card to be distributed with the proxy statement or by voting by

telephone or Internet. If you hold Shares through a bank, broker or other nominee (i.e., in “street name”) which is one

of our shareholders of record at the close of business on October 16, 2023, or which appears in the participant listing of a

securities depository on that date, you must follow the instructions included in the voting instruction form you receive from your

bank, broker or nominee, and may also be able to submit voting instructions to your bank, broker or nominee by phone or via the

Internet. Please be certain to have your control number from your voting instruction form ready for use in providing your voting

instructions. If you hold your Shares in “street name,” you must obtain a legal proxy from the record holder to enable

you to participate in and to vote your Shares at the Meeting (or to appoint a proxy to do so).

Our board of directors

recommends that you vote “FOR” each of the above Proposals, which are described in the attached proxy statement.

The presence (in person or

by proxy) of any two or more shareholders holding, in the aggregate, at least 25% of the voting power of the Shares constitutes a quorum

for purposes of the Meeting. If such quorum is not present within half an hour from the time scheduled for the Meeting, the Meeting will

be adjourned to the following week (to the same day, time and place or to a specified day, time and place). At such adjourned meeting

the presence of at least one or more shareholders in person or by proxy (regardless of the voting power represented by their Shares) will

constitute a quorum.

The last date for submitting

a request to include a Proposal in accordance with Section 66(b) of the Israeli Companies Law, 5759-1999, is October 24, 2023. A copy

of the proxy statement (which includes the full version of the proposed resolutions) and a proxy card is being distributed to shareholders

and also furnished to the SEC in a Report of Foreign Private Issuer on Form 6-K. To the extent that there are any additional agenda items

that our Board of Directors determines to add as a result of any such submission, we will publish an updated notice and proxy card with

respect to the Meeting, no later than October 31, 2023, to be furnished to the SEC in a Report of Foreign Private Issuer on Form 6-K.

Shareholders are also able

to review the proxy statement at the “Investor Relations” portion of our website https://investors.valens.com/home/default.aspx

or at our headquarters at 8 Hanagar St. POB 7152, Hod Hasharon 4501309, Israel, upon prior notice and during regular working hours (telephone

number: +972-7696900) until the date of the Meeting.

Whether or not you plan to

attend the Meeting, it is important that your Shares be represented and voted at the Meeting. Accordingly, after reading the Notice of

Annual General Meeting of Shareholders and the Proxy Statement, please complete, sign, date and mail the proxy card in the envelope provided

or vote by telephone or over the Internet in accordance with the instructions on your proxy card. If voting by mail, the proxy card must

be received by no later than 11:59 p.m. EDT on November 21, 2023 to be validly included in the tally of Shares voted at the Meeting. Submitting

your proxy does not deprive you of your right to attend the Meeting, to revoke the proxy or to vote your shares in person. Detailed proxy

voting instructions will be provided both in the proxy statement and in the proxy card. Our proxy statement is furnished herewith.

| |

By Order of the Board of Directors, |

| |

|

| |

Peter Mertens |

| |

Chairperson of the Board of Directors |

Valens Semiconductor Ltd.

Proxy Statement

______________

Annual General Meeting of Shareholders

To Be Held at 4:00 p.m. (Israel time) on Wednesday,

November 22, 2023

This proxy statement is being

furnished in connection with the solicitation of proxies on behalf of the board of directors (the “Board”) of

Valens Semiconductor Ltd. (the “Company” or “Valens”) to be voted at an Annual General

Meeting of Shareholders (the “Meeting”), and at any adjournment or postponement thereof, pursuant to the accompanying

Notice of Annual General Meeting of Shareholders. The Meeting will be held on Wednesday, November 22, 2023, at 4:00 p.m. (Israel time),

at our headquarters at 8 Hanagar St. POB 7152, Hod Hasharon 4501309, Israel.

This proxy statement, the

attached Notice of Annual General Meeting of Shareholders and the enclosed proxy card or voting instruction form are being made available

to holders of the Company’s ordinary shares, no par value (the “Ordinary Shares” or the “Shares”),

beginning October 20, 2023.

You are entitled to receive

notice of, and vote at, the Meeting if you are a shareholder of record at the close of business on October 16, 2023, in person or through

a broker, trustee or other nominee that is one of our shareholders of record at such time, or which appear in the participant listing

of a securities depository on that date. You can vote your Shares by attending the Meeting or by following the instructions under “How

You Can Vote” below. Our Board urges you to vote your Shares so that they will be counted at the Meeting or at any postponements

or adjournments of the Meeting.

Agenda Items

The following matters are

on the agenda for the Meeting:

| |

(1) |

to re-elect each of Gideon Ben Zvi, Yahal Zilka, and Michael Linse as Class II directors, to hold office until the close of the Company’s annual general meeting of shareholders in 2026, and until their respective successors are duly elected and qualified; and |

| |

(2) |

to approve the re-appointment of Kesselman & Kesselman, registered public accounting firm, a member firm of PricewaterhouseCoopers International Limited, as the Company’s independent registered public accounting firm for the year ending December 31, 2023 and until the next annual general meeting of shareholders, and to authorize the Company’s board of directors (with power of delegation to its audit committee) to set the fees to be paid to such auditors. |

In addition to considering

and voting on the foregoing Proposals, members of the Company’s management will be available at the Meeting to discuss the consolidated

financial statements of the Company for the fiscal year ended December 31, 2022.

We are not aware of any other

matters that will come before the Meeting. If any other matters are presented properly at the Meeting, the persons designated as proxies

intend to vote upon such matters in accordance with their best judgment and the recommendation of the Board.

Board Recommendation

Our Board unanimously

recommends that you vote “FOR” each of the above Proposals.

Quorum and Adjournment

On October 16, 2023, we had

a total of 103,735,618 Shares issued and outstanding. Each Share outstanding as of the close of business on October 16, 2023, is entitled

to one vote on each of the Proposals to be presented at the Meeting.

Under our Amended and Restated

Articles of Association (the “Articles of Association”), the Meeting will be properly convened if at least two

shareholders attend the Meeting in person or sign and return proxies, provided that they hold Shares representing at least 25% of our

voting power. If such quorum is not present within half an hour from the time scheduled for the Meeting, the Meeting will be adjourned

to the following week (to the same day, time and place or to a specified day, time and place). At such adjourned meeting the presence

of at least one or more shareholders in person or by proxy (regardless of the voting power represented by their Shares) will constitute

a quorum.

Abstentions and “broker

non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A “broker non-vote” occurs

when a bank, broker or other holder of record holding Shares for a beneficial owner attends the Meeting but does not vote on a particular

Proposal because that holder does not have discretionary voting power for that particular item and has not received instructions from

the beneficial owner. Brokers that hold Shares in “street name” for clients (as described below) typically have authority

to vote on “routine” Proposals even when they have not received instructions from beneficial owners. The only item on the

Meeting agenda that may be considered routine is Proposal No. 2 relating to the reappointment of the Company’s independent registered

public accounting firm for the fiscal year ending December 31, 2023; however, we cannot be certain whether this will be treated as a routine

matter since our proxy statement is prepared in compliance with the Israeli Companies Law 5759-1999 (the “Companies Law”),

rather than the rules applicable to domestic U.S. reporting companies. Therefore, it is important for a shareholder that holds Shares

through a bank or broker to instruct its bank or broker how to vote its Shares, if the shareholder wants its Shares to count for the Proposals.

Vote Required for Approval of Each of the

Proposals

The affirmative vote of the

holders of a majority of the voting power represented and voting in person or by proxy is required to approve each of the Proposals. Each

Share outstanding as of the close of business on October 16, 2023, is entitled to one vote on each of the Proposals to be presented at

the Meeting.

Apart from for the purpose

of determining a quorum, broker non-votes will not be counted as present and are not entitled to vote. Abstentions will not be treated

as either a vote “FOR” or “AGAINST” a matter.

How You Can Vote

You can vote either in person

at the Meeting or by authorizing another person as your proxy, whether or not you attend the Meeting. You may vote in any of the manners

below:

| |

● |

By Internet- If you are a shareholder

of record, you can submit a proxy over the Internet by logging on to the website listed on the enclosed proxy card, entering your control

number located on the enclosed proxy card and submitting a proxy by following the on-screen prompts. If you hold Shares in “street

name,” and if the brokerage firm, bank or other similar nominee that holds your Shares offers Internet voting, you may follow the

instructions shown on the enclosed voting instruction form in order to submit your proxy over the Internet; |

| |

● |

By telephone- If you are a

shareholder of record, you can submit a proxy by telephone by calling the toll-free number listed on the enclosed proxy card, entering

your control number located on the enclosed proxy card and following the prompts. If you hold Shares in “street name,” and

if the brokerage firm, bank or other similar organization that holds your Shares offers telephone voting, you may follow the instructions

shown on the enclosed voting instruction form in order to submit a proxy by telephone; or |

| |

● |

By mail- If you are a shareholder of record, you can submit a proxy by completing, dating, signing and returning your proxy card in the postage-paid envelope provided. You should sign your name exactly as it appears on the enclosed proxy card. If you are signing in a representative capacity (for example, as a guardian, executor, trustee, custodian, attorney or officer of a corporation), please indicate your name and title or capacity. If you hold Shares in “street name,” you have the right to direct your brokerage firm, bank or other similar organization on how to vote your Shares, and the brokerage firm, bank or other similar organization is required to vote your Shares in accordance with your instructions. To provide instructions to your brokerage firm, bank or other similar organization by mail, please complete, date, sign and return your voting instruction form in the postage-paid envelope provided by your brokerage firm, bank or other similar organization. |

Registered Holders

If you are a shareholder of

record whose Shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, you

can also vote your Shares by attending the Meeting or by completing and signing a proxy card. In such case, these proxy materials are

being sent directly to you. As the shareholder of record, you have the right to grant your voting proxy directly to the individuals listed

as proxies on the proxy card or to vote in person at the Meeting. Please follow the instructions on the proxy card. You may change your

mind and cancel your proxy card by sending us a written notice, by signing and returning a proxy card with a later date, or by voting

in person or by proxy at the Meeting. We will not be able to count a proxy card from a registered holder unless we receive it at our headquarters

at 8 Hanagar St. POB 7152, Hod Hasharon 4501309, Israel, or Continental Stock Transfer & Trust Company receives it in the enclosed

envelope no later than 11:59 p.m. EDT on Tuesday, November 21, 2023.

If you provide specific instructions

(by marking a box) with regard to the Proposals, your Shares will be voted as you instruct. If you sign and return your proxy card or

voting instruction form without giving specific instructions your Shares will be voted in favor of each Proposal in accordance with the

recommendation of the Board. The persons named as proxies in the enclosed proxy card will vote in their discretion on any other matters

that properly come before the Meeting, including the authority to adjourn the Meeting pursuant to Article 30 of the Articles of Association.

Beneficial Owners

If you are a beneficial owner

of Shares held in a brokerage account or by a trustee or nominee, these proxy materials are being forwarded to you together with a voting

instruction form by the broker, trustee or nominee or an agent hired by the broker, trustee or nominee. As a beneficial owner, you have

the right to direct your broker, trustee or nominee how to vote, and you are also invited to attend the Meeting.

Because a beneficial owner

is not a shareholder of record, you may not vote those Shares directly at the Meeting unless you obtain a “legal proxy” from

the broker, trustee or nominee that holds your Shares, giving you the right to vote the Shares at the Meeting. Your broker, trustee or

nominee has enclosed or provided voting instructions for you to use in directing the broker, trustee or nominee how to vote your Shares.

Who Can Vote

You are entitled to receive

notice of, and vote at, the Meeting if you are a shareholder of record at the close of business on October 16, 2023, in person or through

a broker, trustee or other nominee that is one of our shareholders of record at such time, or which appear in the participant listing

of a securities depository on that date.

Revocation of Proxies

Shareholders of record may

revoke the authority granted by their execution of proxies at any time before the effective exercise thereof by filing with us a written

notice of revocation or duly executed proxy bearing a later date, or by voting in person at the Meeting. A shareholder who holds Shares

in “street name” should follow the directions of, or contact, the bank, broker or nominee if he, she or it desires to revoke

or modify previously submitted voting instructions.

Solicitation of Proxies

Proxies are being distributed

to shareholders on or about October 20, 2023. Certain officers, directors, employees and agents of Valens, may solicit proxies by telephone,

emails, or other personal contact. We will bear the cost for the solicitation of the proxies, including postage, printing, and handling,

and will reimburse the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of Shares.

Voting Results

The final voting results will

be tallied by the Company based on the information provided by Continental Stock Transfer & Trust Company or otherwise, and the overall

results of the Meeting will be published following the Meeting in a Report of Foreign Private Issuer on Form 6-K that will be furnished

to the U.S. Securities and Exchange Commission, or the SEC.

Availability of Proxy Materials

Copies of the proxy card,

the notice of the Meeting and this proxy statement are available at the “Investor Relations” portion of our website,

https://investors.valens.com/home/default.aspx. The contents of that website are not a part of this proxy statement.

Assistance in Voting your Shares

Your vote is important.

If you have questions about how to vote your Shares, you may contact Daphna Golden, Vice President Investor Relations, at investors@valens.com.

COMPENSATION

OF EXECUTIVE OFFICERS

For information concerning

the annual compensation earned during 2022 by our five most highly compensated executive officers see Item 6.B. of our Annual Report on

Form 20-F for the year ended December 31, 2022, as filed with the SEC on March 1, 2023 (the “Annual Report”),

a copy of which is available at the “Investor Relations” portion of our website at https://investors.valens.com/financials/sec-filings/sec-filings-details/default.aspx?FilingId=15622761.

CORPORATE

GOVERNANCE

Overview

Valens

is committed to effective corporate governance and independent oversight by our Board.

Under

our Articles of Association, the number of directors on our board of directors can be no less than three and no more than eleven directors,

as may be fixed from time to time by the Board, divided into three classes with staggered three-year terms. Each class of directors

consists, as nearly as possible, of one-third of the total number of directors constituting the entire board of directors. At

each annual general meeting of our shareholders, the election or re-election of directors following the expiration of the term of office

of the directors of that class of directors will be for a term of office that expires on the third annual general meeting following such

election or re-election. Each director will hold office until the annual general meeting of our shareholders for the year in which such

director’s term expires, unless the tenure of such director expires earlier pursuant to the Companies Law or unless such director

is removed by a vote of 65% of the total voting power of our shareholders in accordance with our Articles of Association.

Our

Board currently consists of nine directors. Each of our seven non-employee directors was determined by our Board to be independent under

NYSE corporate governance rules.

Corporate Governance Practices

Below, we summarize the key governance practices

and policies that our Board believes help advance our goals and protect the interests of our shareholders, including:

Corporate

Governance Best Practices |

| ✔ |

7 of 9 Directors are independent |

✔ |

Direct Board member and committee interaction with executive team and key employees |

| ✔ |

Fully independent committees |

✔ |

Offer equity and cash compensation which we believe incentivizes our executive officers to deliver both short-term and long-term shareholder value |

| ✔ |

Annual Board and committee self-evaluations |

✔ |

Set annual incentive targets to our chief executive officer based on measurable performance objectives |

| ✔ |

Performance-based compensation |

✔ |

Cap cash bonus payments and annual equity-based compensation |

| ✔ |

Regularly review the executive compensation and peer group data |

|

|

For more information regarding our Board, its

committees and our corporate governance practices, see “Part I, Item 6.C. Board Practices” of our Annual Report on Form 20-F.

PROPOSAL 1

RE-ELECTION OF DIRECTORS

Background

Under the Companies Law and our Articles of Association,

the management of our business is vested in our Board. The Board may exercise all powers and may take all actions that are not specifically

granted to our shareholders.

Our Articles of Association

provide that our Board must consist of at least three and not more than eleven directors, including external directors, if any were elected.

Our Board currently has

ten directors and is divided into three classes with staggered three-year terms as follows:

| |

● |

the Class I directors are Eyal Kishon, Moshe Lichtman

and Dror Jerushalmi, and their terms expire at our annual meeting of shareholders to be held in 2025;

|

| |

● |

the Class II directors are Gideon Ben Zvi, Yahal

Zilka, and Michael Linse, and their terms expire at the Meeting; and

|

| |

● |

the Class III directors are Adi Yarel Toledano, Ker Zhang and Peter Mertens, and their terms expire at our annual meeting of shareholders to be held in 2024. |

At each annual general meeting

of our shareholders, the election or re-election of directors following the expiration of the term of office of the directors of that

class will be for a term of office that expires on the date of the third annual general meeting following such election or re-election.

At the Meeting, shareholders

will be asked to re-elect each of Gideon Ben Zvi, Yahal Zilka, and Michael Linse. Each of Yahal Zilka and Michael Linse qualify as an

independent director under the listing standards of the NYSE. Each of Yahal Zilka and Michael Linse is a member of the compensation committee.

If re-elected at the Meeting,

each of Gideon Ben Zvi, Yahal Zilka, and Michael Linse will serve until the 2026 annual general meeting of our shareholders, and until

his successor has been duly elected and qualified, or until his office is vacated in accordance with our Articles of Association or the

Companies Law.

In accordance with the Companies

Law, each of Gideon Ben Zvi, Yahal Zilka, and Michael Linse has certified to us that he or she meets all the requirements of the Companies

Law for election as a director of a public company, and possesses the necessary qualifications and has sufficient time to fulfill his

duties as a director of Valens, taking into account the size and special needs of Valens.

During 2022, each of the

directors standing for re-election at the Meeting attended at least 95% of our Board and Board committee meetings, as applicable.

The Nominating, Corporate

Governance and Sustainability Committee of our Board and our Board recommended that each of Gideon Ben Zvi, Yahal Zilka, and Michael Linse

be re-elected at the Meeting as a Class II director for a term to expire at the 2026 annual general meeting of our shareholders, and until

his successor has been duly elected and qualified, or until his office is vacated in accordance with our Articles of Association or the

Companies Law. Our Board approved this recommendation.

Biographical information

concerning Gideon Ben Zvi, Yahal Zilka, and Michael Linse is set forth below:

Gideon

Ben Zvi has served as the Chief Executive Officer of Valens since 2020 and as a member of the board of directors of Valens since

2011 and as such, is deeply familiar with Valens, its business and technology. From 2007 to 2020, Mr. Ben Zvi served as a venture

partner at Aviv Venture Capital. In the past five years, Mr. Ben Zvi served as a Chairman of the board of directors of BriefCam (until

acquired by Canon), Chairman of the board of directors of Cellium, Chairman of the board of directors of enVerid Systems and co-founded Aristagora

VC. Mr. Ben Zvi brings more than 30 years of experience as a serial entrepreneur, having previously served as CEO in different companies

and led three exit events. Mr. Ben Zvi has also served as a board member at Bezalel Academy of Arts and Design in Jerusalem and board

member and chair of committees at Jerusalem Transport Master Plan Team (JTMT). Mr. Ben Zvi holds a BSc is Computer Science and Math

from Hebrew University Jerusalem (HUJI) and an MBA from HUJI.

Yahal

Zilka has served as a member of the board of directors of Valens since the early days of the company in 2007. Mr. Zilka

is a veteran venture investor with over 24 years of experience. He is a co-founder and managing partner of 10D and also a co-founder and

managing partner of Magma Venture Partners (“Magma”). Prior to co-founding Magma, Mr. Zilka served as

CFO of VocalTec Communications and led it from seed to its public offering on NASDAQ. Mr. Zilka brings many years of experience as

an entrepreneur, mentor and executive with strong financial, operational, and hands-on management experience, as well as strategic

relationships with industry leaders. Mr. Zilka currently serves as Director on the boards of Gloat, Exodigo, Obligo, ScyllaDB, Pente

Networks, MyZorro. Previously, Mr. Zilka served on the boards of Waze (acquired by Google, NASDAQ: GOOG), Onavo (acquired by Facebook,

NASDAQ:FB), DesignArt Networks (acquired by Qualcomm, NASDAQ: QCOM) and Phonetic Systems (acquired by Nuance, NASDAQ: NUAN), Argus (acquired

by Continental), Applitools (acquired by Thoma Bravo in 2021), Sightera-Magisto (acquired by Vimeo, NASDAQ: VMEO) and Optimal Plus (acquired

by National Instruments, NASDAQ: NATI). Mr. Zilka is a valuable member of Valens’ Board of Directors because of his extensive

experience in venture capital and his prior track record as a director.

Michael

Linse has served as a member of the Board of Valens since 2018. Mr. Linse has also served as the founder and managing director

of Linse Capital LLC since October 2015, a growth equity firm investing in late-stage technology companies, and Levitate Capital, a venture

capital firm, since March 2017. Mr. Linse serves as a director at ChargePoint Inc. (NYSE: CHPT). Prior to founding Linse Capital,

Mr. Linse served as a partner at Kleiner Perkins Caufield & Byers (“KPCB”) from 2009 until March 2016. Prior

to joining KPCB, Mr. Linse worked at Goldman Sachs for over a decade, most recently as Managing Director of the alternative energy

investing team. Mr. Linse holds a B.A. in Economics from Harvard University and an MBA from Harvard Business School. Mr. Linse

is a valuable member of Valens’ Board of Directors because of his extensive experience in venture capital and technology investment.

Proposal

The shareholders are being

asked to re-elect each of Gideon Ben Zvi, Yahal Zilka, and Michael Linse for a term to expire at the 2026 annual general meeting of our

shareholders, and until their respective successors are duly elected and qualified, or until their offices are vacated in accordance with

our Articles of Association or the Companies Law.

It is proposed that the

following resolutions be adopted at the Meeting:

FURTHER RESOLVED,

that Gideon Ben Zvi be re-elected as a Class II director, to hold office until the close of the Company’s annual general meeting

of shareholders in 2026, and until his successor has been duly elected and qualified, or until his office is vacated in accordance with

our Articles of Association or the Companies Law;

RESOLVED, that Yahal

Zilka be re-elected as a Class II director, to hold office until the close of the Company’s annual general meeting of shareholders

in 2026, and until his successor has been duly elected and qualified, or until his office is vacated in accordance with our Articles of

Association or the Companies Law; and

FURTHER RESOLVED,

that Michael Linse be re-elected as a Class II director, to hold office until the close of the Company’s annual general meeting

of shareholders in 2026, and until his successor has been duly elected and qualified, or until his office is vacated in accordance with

our Articles of Association or the Companies Law.

Vote Required

See “Vote Required

for Approval of Each of the Proposals” above.

Board Recommendation

The Board recommends

a vote “FOR” the re-election of each of Gideon Ben Zvi, Yahal Zilka, and Michael Linse as a Class II director for a term to

expire at the 2026 annual general meeting.

PROPOSAL 2

RE-APPOINTMENT OF INDEPENDENT AUDITORS

AND AUTHORIZATION OF THE BOARD TO FIX THIER REMUNERATION

Background

Under the Companies Law, the

appointment of independent public accountants requires the approval of the shareholders of the Company. Our audit committee and Board

have approved the appointment of Kesselman & Kesselman, a member of PricewaterhouseCoopers International Limited, as our independent

registered public accountants for the year ending December 31, 2023, subject to the approval of our shareholders.

The following table sets forth

the total compensation that was paid by the Company and its subsidiaries to the Company’s independent auditors, Kesselman &

Kesselman, a member of PricewaterhouseCoopers International Limited, in each of the previous two fiscal years:

| | |

2022 | | |

2021 | |

| | |

(in thousands dollars) | |

| Audit fees(1) | |

| 304 | | |

| 262 | |

| Audit-related fees(2) | |

| 20 | | |

| 409 | |

| Tax fees(3) | |

| 58 | | |

| 70 | |

| All other fees(4) | |

| 1 | | |

| 1 | |

| Total | |

| 383 | | |

| 742 | |

| (1) |

“Audit fees” for

the years ended December 31, 2021 and 2022 include fees for services performed by our independent public accounting firm in

connection with our annual audit consolidated financial statements, certain procedures regarding our quarterly financial results submitted

in a Report of Foreign Private Issuer on Form 6-K, and services that are normally provided by our independent registered public accounting

firm in connection with statutory and regulatory filings, including in connection with review of registration statements and consents.

|

| (2) |

“Audit-related fees”

or the year ended December 31, 2021 and 2022, consist of fees billed for assurance and related services that are reasonably

related to the performance of the audit or review of our year-end financial statements

and are not reported under “Audit Fees.” These services include due diligence related to mergers and acquisitions and

consultation concerning financial accounting and reporting standards.

|

| (3) |

“Tax

fees” for the years ended December 31, 2021 and 2022 include fees for professional services rendered by our independent

registered public accounting firm for tax compliance and tax advice and tax planning services on actual or contemplated transactions.

|

| (4) |

“Other fees” for the years ended December 31, 2021 and 2022 include fees for services rendered by our independent registered public accounting firm with respect to automation tool. |

Our audit committee has adopted

a pre-approval policy for the engagement of our independent accountant to perform certain audit and non-audit services. Pursuant to this

policy, which is designed to assure that such engagements do not impair the independence of our auditors, the audit committee pre-approves

annually a catalog of specific audit and non-audit services in the categories of audit services, audit-related services and tax services

that may be performed by our independent accountants. Our audit committee pre-approved all the audit services and all of the non-audit

services provided to us and to our subsidiaries since our pre-approval policy was adopted.

Proposal

It is proposed that the following

resolution be adopted at the Meeting:

RESOLVED, to re-appoint

Kesselman & Kesselman, a member of PricewaterhouseCoopers International Limited, as the Company’s independent registered public

accounting firm for the year ending December 31, 2023 and until the next annual general meeting of shareholders, and to authorize the

Company’s board of directors (with power of delegation to its audit committee) to set the fees to be paid to such auditors.

Vote Required

See “Vote Required

for Approval of Each of the Proposals” above.

Board Recommendation

The Board recommends

a vote “FOR” the ratification of the re-appointment Kesselman & Kesselman, a member of PricewaterhouseCoopers International

Limited, as our independent registered public accounting firm for the year ending December 31, 2023.

PRESENTATION AND DISCUSSION OF AUDITED CONSOLIDATED

FINANCIAL STATEMENTS

In addition to considering

the foregoing agenda items at the Meeting, we will also present our audited consolidated financial statements for the fiscal year ended

December 31, 2022. A copy of the Annual Report on Form 20-F filed with the SEC on March 1, 2023, including the audited consolidated financial

statements for the year ended December 31, 2022, is available for viewing and downloading on the SEC’s website at www.sec.gov as

well as on the “Investor Relations” portion of our Company’s website at https://investors.valens.com/financials/sec-filings/sec-filings-details/default.aspx?FilingId=15622761.

OTHER BUSINESS

The Board is not aware of

any other matters that may be presented at the Meeting other than those described in this proxy statement. If any other matters do properly

come before the Meeting, including the authority to adjourn the Meeting pursuant to Article 30 of the Company’s Articles of Association,

it is intended that the persons named as proxies will vote, pursuant to their discretionary authority, according to their best judgment

in the interest of the Company.

ADDITIONAL INFORMATION

Our Annual Report on Form

20-F filed with the SEC on March 1, 2023, is available for viewing and downloading on the SEC’s website at www.sec.gov as well as

under the “Investor Relations” portion of the Company’s website at https://investors.valens.com/financials/sec-filings/sec-filings-details/default.aspx?FilingId=15622761.

The Company is subject to

the information reporting requirements of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”),

applicable to foreign private issuers. The Company fulfills these requirements by filing and furnishing reports with or to (as applicable)

the SEC. The Company’s filings with the SEC are available to the public on the SEC’s website at www.sec.gov. As a foreign

private issuer, the Company is exempt from the rules under the Exchange Act related to the furnishing and content of proxy statements.

The circulation of this proxy statement should not be taken as an admission that the Company is subject to those proxy rules.

| |

By Order of the Board of Directors, |

| |

|

| |

Peter Mertens |

| |

Chairperson of the Board of Directors |

Dated: October 17, 2023

12

Exhibit 99.2

VALENS SEMICONDUCTOR LTD.

(THE “COMPANY”)

PROXY

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS

I, the undersigned, shareholder of Valens

Semiconductor Ltd. (the “Company”), hereby nominate, constitute and appoint Gideon Ben Zvi, Chief

Executive Officer of the Company and Yael Rozenberg, Interim Chief Financial Officer of the Company, and each of them as my true and

lawful proxy and attorney(s) with full power of substitution for me and in my name, place and stead, to represent and vote all of

the ordinary shares, no par value per share of the Company (the “Shares”), which the undersigned is entitled to

vote at the Annual General Meeting of Shareholders (the “Meeting”) to be held at the offices of the Company,

located at 8 Hanagar St. POB 7152, Hod Hasharon 4501309, Israel, on Wednesday, November 22, 2023, at 4:00 p.m. (Israel time), and at

any adjournments or postponements thereof, upon the following matters, which are more fully described in the Notice of the Meeting

and Proxy Statement, dated October 17, 2023, relating to the Meeting (the “Proxy Statement”). Subject to

applicable law and the rules of NYSE, in the absence of such instructions, the Shares represented by properly executed and received

proxies will be voted “FOR” the proposed resolution to be presented at the Meeting or any adjournment(s) or

postponement(s) thereof for which the board of directors of the Company recommends a “FOR” vote.

This Proxy, when properly executed, will be

voted in the manner directed herein by the undersigned.

Shareholders entitled to notice of and to vote

at the Meeting or at any adjournment(s) or postponement(s) thereof shall be determined as of the close of business on Monday, October

16, 2023, the record date fixed by the board of directors of the Company for such purpose.

Should any other matter requiring a vote of

the shareholders arise, the proxies named above are authorized to vote in accordance with their best judgment in the interest of the Company.

Any and all proxies given by the undersigned prior to this proxy are hereby revoked.

WHETHER OR NOT YOU EXPECT TO ATTEND THE

MEETING, PLEASE COMPLETE, DATE, AND SIGN THIS FORM OF PROXY AND MAIL THE ENTIRE PROXY PROMPTLY, ALONG WITH PROOF OF IDENTITY IN

ACCORDANCE WITH THE COMPANY’S PROXY STATEMENT, IN THE ENCLOSED ENVELOPE OR VOTE OVER THE TELEPHONE OR INTERNET AS INSTRUCTED

IN THESE MATERIALS IN ORDER TO ASSURE REPRESENTATION OF THESE SHARES. NO POSTAGE NEED TO BE AFFIXED IF THE PROXY IS MAILED IN THE

UNITED STATES.

(Continued and to be signed

on the reverse side)

THE BOARD OF DIRECTORS OF THE COMPANY

RECOMMENDS YOU VOTE “FOR” ALL THE PROPOSALS. PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE OR VOTE OVER THE TELEPHONE OR INTERNET AS INSTRUCTED IN THESE MATERIALS.

PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE ☒.

Proposal 1a: To re-elect Gideon Ben Zvi as

a Class II director, to hold office until the close of the Company’s annual general meeting of shareholders in 2026, and until

his respective successor is duly elected and qualified, or until his office is vacated in

accordance with our Articles of Association or the Companies Law;

| ☐ FOR |

☐ AGAINST |

☐ ABSTAIN |

Proposal 1b: To re-elect Yahal Zilka as

a Class II director, to hold office until the close of the Company’s annual general meeting of shareholders in 2026, and until his

respective successor is duly elected and qualified, or until his office is vacated in accordance

with our Articles of Association or the Companies Law;

| ☐ FOR |

☐ AGAINST |

☐ ABSTAIN |

Proposal 1c: To re-elect Michael Linse

as a Class II director, to hold office until the close of the Company’s annual general meeting of shareholders in 2026, and until

his respective successor is duly elected and qualified, or until his office is vacated in

accordance with our Articles of Association or the Companies Law;

| ☐ FOR |

☐ AGAINST |

☐ ABSTAIN |

Proposal 2: To re-appoint Kesselman &

Kesselman, a member of PricewaterhouseCoopers International Limited, as the Company’s independent registered public accounting firm

for the year ending December 31, 2023 and until the next annual general meeting of shareholders, and to authorize the Company’s

board of directors (with power of delegation to its audit committee) to set the fees to be paid to such auditors;

| ☐ FOR |

☐

AGAINST |

☐

ABSTAIN |

In their discretion, the proxies are authorized

to vote upon such other matters as may properly come before the Meeting or any adjournment or postponement thereof.

To change the address on your account,

please check the box on the right and indicate your new address in the address space above. Please note that changes to the

registered name(s) on the account may not be submitted via this method. ☐

The undersigned acknowledges receipt of the Notice

and Proxy Statement.

| |

Date: __________, ____ |

| Signature of Shareholder |

|

| |

|

| |

Date: __________, ____ |

| Signature of Shareholder (Joint Owners) |

|

Note: Please sign exactly as your name or names

appear on this Proxy. When shares are held jointly, the senior holder should sign. When signing as executor, administrator, attorney,

trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized

officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.

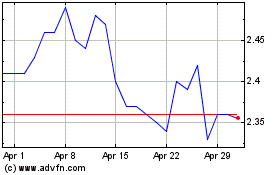

Valens Semiconductor (NYSE:VLN)

Historical Stock Chart

From Apr 2024 to May 2024

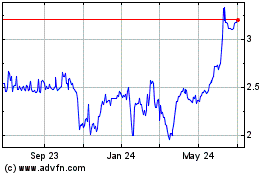

Valens Semiconductor (NYSE:VLN)

Historical Stock Chart

From May 2023 to May 2024