Current Report Filing (8-k)

March 23 2023 - 4:25PM

Edgar (US Regulatory)

false 0001610682 0001610682 2023-03-20 2023-03-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 20, 2023

USD Partners LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-36674 |

|

30-0831007 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

811 Main Street, Suite 2800

Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

(281) 291-0510

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Units Representing Limited Partner Interests |

|

USDP |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On March 20, 2023, USDP CCR LLC (the “Seller”), an indirect, wholly-owned subsidiary of USD Partners LP (the “Partnership”), entered into a Membership Interest Purchase Agreement (the “Purchase Agreement”) with South 49 Holdings Ltd., a member of the Midstream Energy Partners group of companies (collectively, the “Buyer”). Upon the terms and subject to the conditions set forth in the Purchase Agreement, the Seller agreed to sell the Partnership’s Casper rail terminal, by means of a sale of all of the equity interests of the subsidiary of the Partnership which owns the terminal, to the Buyer for a cash purchase price of approximately $33 million (the “Transaction”), subject to customary adjustments. The Transaction is expected to close prior to the end of the second quarter of 2023. The Partnership intends to use a majority of the proceeds from the Transaction, net of expenses, to repay borrowings outstanding under the Partnership’s revolving credit facility and to retain the remaining proceeds to support general partnership purposes.

The Purchase Agreement contains customary representations and warranties, covenants, termination rights, and indemnification provisions, subject to specified limitations. In addition, the completion of the Transaction is subject to certain customary conditions.

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase Agreement attached as Exhibit 10.1 to this Form 8-K, which is incorporated herein by reference.

| Item 7.01 |

Regulation FD Disclosure. |

On March 23, 2023, the Partnership issued a press release announcing certain of the matters described in this Current Report on Form 8-K. A copy of this press release is attached hereto as Exhibit 99.1 to this Current Report. The information set forth in this item 7.01 and in Exhibit 99.1 shall not be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

Cautionary Note Regarding Forward-Looking Statements

This Current Report contains forward-looking statements within the meaning of U.S. federal securities laws, including statements with respect closing of the Transaction and the use of net proceeds from the Transaction. Words and phrases such as “expect” and “intend” and similar expressions are used to identify such forward-looking statements. However, the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements relating to the Partnership are based on management’s expectations, estimates and projections about the Partnership, its interests and the energy industry in general on the date this press release was issued. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in such forward-looking statements. Factors that could cause actual results or events to differ materially from those described in the forward-looking statements include those factors set forth under the heading “Risk Factors” and elsewhere in the Partnership’s most recent Annual Report on Form 10-K and in the Partnership’s subsequent filings with the Securities and Exchange Commission. The Partnership is under no obligation (and expressly disclaims any such obligation) to update or alter its forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

| * |

Certain schedules and similar attachments have been omitted pursuant to Item 601(a)(5) of Regulation S-K and will be provided to the SEC upon request |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

USD Partners LP (Registrant) |

|

|

|

|

|

|

|

|

By: |

|

USD Partners GP LLC, |

|

|

|

|

|

|

its general partner |

|

|

|

|

| Date: March 23, 2023 |

|

|

|

By: |

|

/s/ Adam Altsuler |

|

|

|

|

Name: |

|

Adam Altsuler |

|

|

|

|

Title: |

|

Executive Vice President and Chief Financial Officer |

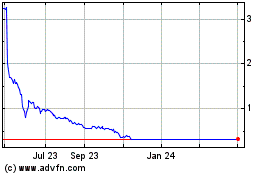

USD Partners (NYSE:USDP)

Historical Stock Chart

From Nov 2024 to Dec 2024

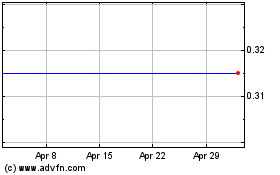

USD Partners (NYSE:USDP)

Historical Stock Chart

From Dec 2023 to Dec 2024