USD Partners LP (NYSE: USDP) (the “Partnership”) announced today

its operating and financial results for the three months and year

ended December 31, 2022. Financial highlights with respect to the

fourth quarter of 2022 include the following:

- Generated Net Cash Provided by Operating Activities of $8.3

million, Adjusted EBITDA(1) of $13.3 million and Distributable Cash

Flow(1) of $9.6 million

- Reported Net Loss of $3.2 million

- Declared a quarterly cash distribution of $0.1235 per unit

($0.494 per unit on an annualized basis)

- Announced that its sponsor (the “Sponsor”) will waive the

fourth quarter distribution on all of its 17.3 million units,

reducing this quarterly distribution by approximately $2.1

million

“The underlying economics that support our DRUbit™ by Rail™

network were positive in 2022 and improved significantly in the

fourth quarter of the year. As a result, the network continues to

operate at or above our expected capacity transporting DRUbit™

through the Partnership’s Hardisty terminal to our Sponsor’s

destination terminal in Port Arthur, TX,” said Dan Borgen, the

Partnership’s Chief Executive Officer. “With Canadian storage

utilization levels currently at the high end of the historical

averages and the industry’s current expectations around growth in

Canadian oil sands production in 2023 and 2024, we are focused on

renewing, extending, or replacing agreements that expired during

2022 and those that are set to expire this year. Given the

non-hazardous and non-flammable characteristics of the DRUbit™

product that we are moving, we continue to have detailed

discussions regarding our DRUbit™ by Rail™ network with new and

existing customers to provide safer and economically beneficial

Canadian crude transportation options. We remain committed to

continuing the conversion of our dilbit capacity to our long term

sustainable DRUbit™ program.”

“Also, as previously mentioned, in order to support the

Partnership’s current liquidity position during this recontracting

cycle, our Sponsor decided to waive its right to the fourth quarter

distribution on its 17.3 million units without impacting the

distribution to the remaining unitholders,” Borgen added.

Partnership’s Fourth Quarter 2022 Liquidity, Operational and

Financial Results

Substantially all of the Partnership’s cash flows are generated

from multi-year, take-or-pay terminalling services agreements

related to its crude oil terminals, which include minimum monthly

commitment fees. The Partnership’s customers include major

integrated oil companies, refiners and marketers, the majority of

which are investment-grade rated.

The Partnership’s financial statements have been retrospectively

recast to include the pre-acquisition results of the Hardisty South

acquisition that occurred in the second quarter of 2022 because the

acquisition represented a business combination between entities

under common control.

The Partnership’s revenues for the fourth quarter of 2022

relative to the same quarter in 2021 were lower primarily due to

lower revenues at the combined Hardisty Terminal due to a reduction

in contracted capacity at both the legacy Hardisty and Hardisty

South terminals that was effective July 1, 2022. Revenues were also

lower at the combined Hardisty terminal due to an unfavorable

variance in the Canadian exchange rate on the Partnership’s

Canadian-dollar denominated contracts during the fourth quarter of

2022 as compared to the fourth quarter of 2021. Revenue was lower

at the Stroud Terminal due to the conclusion of the Partnership’s

terminalling services contracts with the sole customer effective

July 1, 2022. Also impacting the variance in revenues at the Stroud

terminal was the deferral of revenues associated with make-up right

options that occurred during the fourth quarter of 2021 with no

similar occurrence in the fourth quarter of 2022. The Partnership

also had lower revenue generated at its Casper Terminal associated

with lower throughput volumes at the terminal. Partially offsetting

these decreases in revenue was higher revenue at the Partnership’s

West Colton Terminal resulting from the commencement of the

renewable diesel contract that occurred in December 2021.

The Partnership experienced lower operating costs during the

fourth quarter of 2022 as compared to the fourth quarter of 2021.

Selling, general and administrative costs (“SG&A costs”)

associated with the Hardisty South entities were lower, as

discussed in more detail below. The Partnership also experienced

lower pipeline fee expense which is directly attributable to the

associated decrease in the combined Hardisty terminal revenues

previously discussed, as compared to the fourth quarter of 2021. In

addition, subcontracted rail services costs were lower due to

decreased throughput at the terminals. Depreciation and

amortization expenses were lower in the fourth quarter of 2022 as

compared to the same period in 2021, primarily associated with the

decrease in the carrying value of the assets at the Casper terminal

due to the impairment that was recognized in September 2022.

Fourth quarter 2021 SG&A costs include service fees paid by

Hardisty South to the Sponsor related to a services agreement that

was in place with the Sponsor prior to the Partnership’s

acquisition of Hardisty South. Upon the Partnership’s acquisition

of Hardisty South, the services agreement between the acquired

entities and the Sponsor was terminated and a similar agreement was

established between those entities and the Partnership. This

resulted in the service fee income being allocated to the

Partnership, and therefore offsetting the expense in Hardisty South

for periods subsequent to the acquisition date of April 1,

2022.

The Partnership had a net loss of $3.2 million in the fourth

quarter of 2022 as compared to net income of $4.3 million in the

fourth quarter of 2021. The decrease is primarily because of the

operating factors discussed above coupled with higher interest

expense incurred during the fourth quarter of 2022 resulting from

higher interest rates and a higher balance of debt outstanding

during the quarter, partially offset by a decrease in commitment

fees, as compared to the fourth quarter of 2021. The Partnership

also had higher non-cash losses associated with the Partnership’s

interest rate derivatives recognized in the fourth quarter of 2022

that were partially offset by the cash proceeds from the settlement

of the Partnership’s interest rate derivative that occurred in

October 2022.

Net Cash Provided by Operating Activities for the quarter

decreased 33% relative to the fourth quarter of 2021. The decrease

in the Partnership’s operating cash flow resulting from the

conclusion of some of the Partnership’s terminalling agreements was

partially offset by the previously mentioned cash settlement of the

Partnership’s interest rate derivative that occurred in October

2022. Net cash provided by Operating Activities was also impacted

by the general timing of receipts and payments of accounts

receivable, accounts payable and deferred revenue balances.

Adjusted EBITDA for the fourth quarter of 2022 increased by 12%

when compared to the same period in 2021 and includes the impact of

the aforementioned settlement of the Partnership’s interest rate

derivative that occurred in October 2022. Distributable Cash Flow

(“DCF”) decreased 10% for the current quarter relative to the

fourth quarter of 2021 due to higher cash paid for interest and

taxes during the quarter.

As of December 31, 2022, the Partnership had approximately $2.5

million of unrestricted cash and cash equivalents and undrawn

borrowing capacity of $60 million on its $275.0 million senior

secured credit facility, subject to the Partnership’s continued

compliance with financial covenants. As of the end of the fourth

quarter of 2022, the Partnership had borrowings of $215.0 million

outstanding under its revolving credit facility. The Partnership’s

acquisition of Hardisty South is treated as a Material Acquisition

under the terms of its senior secured credit facility. As a result,

the Partnership’s available borrowings was limited to 5.0 times its

12-month trailing consolidated EBITDA through December 31, 2022, at

which point it reverted back to 4.5 times the Partnership’s

12-month trailing consolidated EBITDA. As such, the borrowing

capacity and available borrowings under the senior secured credit

facility, including unrestricted cash and cash equivalents, was

approximately $55.5 million as of December 31, 2022. The

Partnership was in compliance with its financial covenants as of

December 31, 2022.

In January 2023, the Partnership entered into an amendment to

its senior secured credit facility. Among other things, the

amendment provides the Partnership with relief from compliance with

the senior secured credit facility’s maximum consolidated leverage

ratio and minimum consolidated interest coverage ratio through the

senior secured credit facility’s current maturity date, as

Management works to obtain renewals, extensions or replacements of

agreements that expired during 2022 and those that are set to

expire this year. Additional details regarding the amendment are

included in the Partnership’s Current Report on Form 8-K filed on

February 6, 2023.

The Partnership’s senior secured credit facility expires on

November 2, 2023. The Partnership is in active discussions with the

administrative agent and other banks within the lender group, as

well as other potential financing sources, regarding the possible

extension, renewal or replacement of the senior secured credit

facility.

On January 26, 2023, the Partnership declared a quarterly cash

distribution of $0.1235 per unit ($0.494 per unit on an annualized

basis), the same as the amount distributed in the prior quarter.

The Sponsor waived the fourth quarter distribution on all of its

17.3 million units, reducing this quarterly distribution by

approximately $2.1 million. The distribution was paid on February

17, 2023, to unitholders of record at the close of business on

February 8, 2023. The Partnership’s board determined to keep the

distribution unchanged from the prior quarter and to evaluate the

distribution on a quarterly basis going forward and will take into

consideration updated commercial progress, including the

Partnership’s ability to renew, extend or replace its customer

agreements at the Hardisty and Stroud Terminals, current market

conditions, and management’s expectations regarding future

performance.

Fourth Quarter 2022 Conference Call Information

The Partnership will host a conference call and webcast

regarding fourth quarter 2022 results at 11:00 a.m. Eastern Time

(10:00 a.m. Central Time) on Thursday, March 2, 2023.

To listen live over the Internet, participants are advised to

log on to the Partnership’s website at www.usdpartners.com and

select the “Events & Presentations” sub-tab under the

“Investors” tab. To join via telephone, participants may dial (800)

225-9448 domestically or +1 (203) 518-9708 internationally,

conference ID 8541298. Participants are advised to dial in at least

five minutes prior to the call.

An audio replay of the conference call will be available for

thirty days by dialing (800) 839-2391 domestically or +1 (402)

220-7205 internationally, conference ID 8541298. In addition, a

replay of the audio webcast will be available by accessing the

Partnership’s website after the call is concluded.

About USD Partners LP

USD Partners LP is a fee-based, growth-oriented master limited

partnership formed in 2014 by US Development Group, LLC (“USD”) to

acquire, develop and operate midstream infrastructure and

complementary logistics solutions for crude oil, biofuels and other

energy-related products. The Partnership generates substantially

all of its operating cash flows from multi-year, take-or-pay

contracts with primarily investment grade customers, including

major integrated oil companies, refiners and marketers. The

Partnership’s principal assets include a network of crude oil

terminals that facilitate the transportation of heavy crude oil

from Western Canada to key demand centers across North America. The

Partnership’s operations include railcar loading and unloading,

storage and blending in on-site tanks, inbound and outbound

pipeline connectivity, truck transloading, as well as other related

logistics services. In addition, the Partnership provides customers

with leased railcars and fleet services to facilitate the

transportation of liquid hydrocarbons and biofuels by rail.

USD, which owns the general partner of USD Partners LP, is

engaged in designing, developing, owning, and managing large-scale

multi-modal logistics centers and energy-related infrastructure

across North America. USD’s solutions create flexible market access

for customers in significant growth areas and key demand centers,

including Western Canada, the U.S. Gulf Coast and Mexico. Among

other projects, USD is currently pursuing the development of a

premier energy logistics terminal on the Houston Ship Channel with

capacity for substantial tank storage, multiple docks (including

barge and deepwater), inbound and outbound pipeline connectivity,

as well as a rail terminal with unit train capabilities. For

additional information, please visit texasdeepwater.com.

Information on websites referenced in this release is not part of

this release.

Non-GAAP Financial Measures

The Partnership defines Adjusted EBITDA as Net Cash Provided by

Operating Activities adjusted for changes in working capital items,

interest, income taxes, foreign currency transaction gains and

losses, and other items which do not affect the underlying cash

flows produced by the Partnership’s businesses. Adjusted EBITDA is

a non-GAAP, supplemental financial measure used by management and

external users of the Partnership’s financial statements, such as

investors and commercial banks, to assess:

- the Partnership’s liquidity and the ability of the

Partnership’s businesses to produce sufficient cash flows to make

distributions to the Partnership’s unitholders; and

- the Partnership’s ability to incur and service debt and fund

capital expenditures.

The Partnership defines Distributable Cash Flow, or DCF, as

Adjusted EBITDA less net cash paid for interest, income taxes and

maintenance capital expenditures. DCF does not reflect changes in

working capital balances. DCF is a non-GAAP, supplemental financial

measure used by management and by external users of the

Partnership’s financial statements, such as investors and

commercial banks, to assess:

- the amount of cash available for making distributions to the

Partnership’s unitholders;

- the excess cash flow being retained for use in enhancing the

Partnership’s existing business; and

- the sustainability of the Partnership’s current distribution

rate per unit.

The Partnership believes that the presentation of Adjusted

EBITDA and DCF in this press release provides information that

enhances an investor’s understanding of the Partnership’s ability

to generate cash for payment of distributions and other purposes.

The GAAP measure most directly comparable to Adjusted EBITDA and

DCF is Net Cash Provided by Operating Activities. Adjusted EBITDA

and DCF should not be considered alternatives to Net Cash Provided

by Operating Activities or any other measure of liquidity presented

in accordance with GAAP. Adjusted EBITDA and DCF exclude some, but

not all, items that affect Net Cash Provided by Operating

Activities and these measures may vary among other companies. As a

result, Adjusted EBITDA and DCF may not be comparable to similarly

titled measures of other companies. Reconciliations of Net Cash

Provided by Operating Activities to Adjusted EBITDA and DCF are

presented in this press release.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of U.S. federal securities laws, including statements

with respect to the ability of the Partnership and USD to achieve

contract extensions, new customer agreements and expansions; the

ability of the Partnership to extend, renew or replace its senior

secured credit facility; the ability of the Partnership and USD to

develop existing and future additional projects and expansion

opportunities (including successful completion of USD’s DRU) and

whether those projects and opportunities developed by USD would be

made available for acquisition, or acquired, by the Partnership;

volumes at, and demand for, the Partnership’s terminals; and the

amount and timing of future distribution payments and distribution

growth. Words and phrases such as “expect,” “plan,” “intent,”

“believes,” “projects,” “begin,” “anticipates,” “subject to” and

similar expressions are used to identify such forward-looking

statements. However, the absence of these words does not mean that

a statement is not forward-looking. Forward-looking statements

relating to the Partnership are based on management’s expectations,

estimates and projections about the Partnership, its interests and

the energy industry in general on the date this press release was

issued. These statements are not guarantees of future performance

and involve certain risks, uncertainties and assumptions that are

difficult to predict. Therefore, actual outcomes and results may

differ materially from what is expressed or forecast in such

forward-looking statements. Factors that could cause actual results

or events to differ materially from those described in the

forward-looking statements include the Partnership’s ability to

enter into new contracts for uncontracted capacity and to renew

expiring contracts and changes in general economic conditions and

commodity prices, as well as those factors set forth under the

heading “Risk Factors” and elsewhere in the Partnership’s most

recent Annual Report on Form 10-K and in the Partnership’s

subsequent filings with the Securities and Exchange Commission

(many of which may be amplified by the COVID-19 pandemic and the

recent significant reductions in demand for and prices of crude

oil, natural gas and natural gas liquids). The Partnership is under

no obligation (and expressly disclaims any such obligation) to

update or alter its forward-looking statements, whether as a result

of new information, future events or otherwise, except as required

by law.

______________________________

(1)

The Partnership presents both GAAP and non-GAAP financial

measures in this press release to assist in understanding the

Partnership’s liquidity and ability to fund distributions. See

“Non-GAAP Financial Measures” and reconciliations of Net Cash

Provided by Operating Activities, the most directly comparable GAAP

measure, to Adjusted EBITDA and Distributable Cash Flow in this

press release.

(2)

The Partnership calculates quarterly Distributable Cash Flow

Coverage by dividing Distributable Cash Flow for the quarter as

presented in this press release by the cash distributions declared

for the quarter, or approximately $2.0 million. The Sponsor waived

the fourth quarter distribution on all of its 17.3 million units,

reducing this quarterly distribution by approximately $2.1

million.

USD Partners LP

Consolidated Statements of

Operations

For the Three Months and the

Years Ended December 31, 2022 and 2021

(unaudited)

For the Three Months

Ended

For the Years Ended

December 31,

December 31,

2022

2021 (1)

2022

2021 (1)

(in thousands)

Revenues Terminalling services

$

19,537

$

32,317

$

104,409

$

196,180

Terminalling services — related party

679

226

2,666

2,753

Fleet leases — related party

300

984

3,037

3,935

Fleet services

—

—

—

24

Fleet services — related party

90

228

986

910

Freight and other reimbursables

10

142

524

683

Freight and other reimbursables — related party

33

—

33

—

Total revenues

20,649

33,897

111,655

204,485

Operating costs Subcontracted rail services

3,246

4,308

13,583

17,828

Pipeline fees

5,459

8,251

28,084

54,248

Freight and other reimbursables

43

142

557

683

Operating and maintenance

2,354

3,088

11,818

11,738

Operating and maintenance — related party

—

159

258

244

Selling, general and administrative

2,443

2,480

13,328

11,249

Selling, general and administrative — related party

2,250

4,902

12,457

59,443

Impairment of intangibles and long-lived assets

—

—

71,612

—

Depreciation and amortization

2,281

5,789

19,643

23,167

Total operating costs

18,076

29,119

171,340

178,600

Operating income (loss)

2,573

4,778

(59,685

)

25,885

Interest expense

3,945

1,762

10,670

6,990

Loss (gain) associated with derivative instruments

1,473

(1,661

)

(12,327

)

(4,129

)

Foreign currency transaction loss (gain)

113

136

2,055

(707

)

Other income, net

(35

)

(19

)

(90

)

(31

)

Income (loss) before income taxes

(2,923

)

4,560

(59,993

)

23,762

Provision for income taxes

288

274

1,293

933

Net income (loss)

$

(3,211

)

$

4,286

$

(61,286

)

$

22,829

_______________

(1)

The Partnership's consolidated financial statements have been

retrospectively recast to include the pre-acquisition results of

the Hardisty South Terminal, which we acquired effective April 1,

2022, because the transaction was between entities under common

control.

USD Partners LP

Consolidated Statements of

Cash Flows

For the Three Months and the

Years Ended December 31, 2022 and 2021

(unaudited)

For the Three Months

Ended

For the Years Ended

December 31,

December 31,

2022

2021 (1)

2022

2021 (1)

Cash flows from operating activities: (in thousands) Net

income (loss)

$

(3,211

)

$

4,286

$

(61,286

)

$

22,829

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: Depreciation and amortization

2,281

5,789

19,643

23,167

Loss (gain) associated with derivative instruments

1,473

(1,661

)

(12,327

)

(4,129

)

Settlement of derivative contracts

8,849

(283

)

15,878

(1,112

)

Unit based compensation expense

1,142

1,424

4,845

5,698

Loss associated with disposal of assets

—

—

3

11

Deferred income taxes

(238

)

100

90

(78

)

Amortization of deferred financing costs

271

534

1,170

1,232

Impairment of intangibles and long-lived assets

—

—

71,612

—

Changes in operating assets and liabilities: Accounts receivable

34

(1,665

)

4,616

1,749

Accounts receivable – related party

(50

)

(436

)

1,638

580

Prepaid expenses, inventory and other assets

398

(3,674

)

5,669

(2,109

)

Other assets – related party

—

—

—

15

Accounts payable and accrued expenses

44

4,897

(4,355

)

4,989

Accounts payable and accrued expenses – related party

(96

)

3,509

(856

)

8,440

Deferred revenue and other liabilities

(2,350

)

(135

)

(9,174

)

(3,050

)

Deferred revenue and other liabilities – related party

(275

)

(390

)

75

(346

)

Net cash provided by operating activities

8,272

12,295

37,241

57,886

Cash flows from investing activities: Additions of property

and equipment

(63

)

(637

)

(468

)

(5,187

)

Reimbursement of capital expenditures from collaborative

arrangement

(25

)

—

1,749

—

Acquisition of Hardisty South entities from Sponsor

—

—

(75,000

)

—

Net cash used in investing activities

(88

)

(637

)

(73,719

)

(5,187

)

Cash flows from financing activities: Payments for deferred

financing costs

—

(1,595

)

(13

)

(1,595

)

Distributions

(4,292

)

(3,446

)

(15,738

)

(13,307

)

Vested Phantom Units used for payment of participant taxes

—

(1

)

(1,096

)

(860

)

Proceeds from long-term debt

—

—

75,000

—

Repayments of long-term debt

(7,000

)

(7,037

)

(29,396

)

(43,493

)

Net cash provided by (used in) financing activities

(11,292

)

(12,079

)

28,757

(59,255

)

Effect of exchange rates on cash

81

(656

)

784

(1,226

)

Net change in cash, cash equivalents and restricted cash

(3,027

)

(1,077

)

(6,937

)

(7,782

)

Cash, cash equivalents and restricted cash – beginning of period

8,807

13,794

12,717

20,499

Cash, cash equivalents and restricted cash – end of period

$

5,780

$

12,717

$

5,780

$

12,717

_______________

(1)

The Partnership's consolidated financial statements have been

retrospectively recast to include the pre-acquisition results of

the Hardisty South Terminal, which we acquired effective April 1,

2022, because the transaction was between entities under common

control.

USD Partners LP Consolidated Balance Sheets

At December 31, 2022 and 2021 (unaudited)

December 31,

December 31,

2022

2021 (1)

ASSETS

(in thousands)

Current assets Cash and cash equivalents

$

2,530

$

5,541

Restricted cash

3,250

7,176

Accounts receivable, net

2,169

6,764

Accounts receivable — related party

409

2,051

Prepaid expenses

3,188

4,538

Inventory

—

3,027

Other current assets

1,746

129

Total current assets

13,292

29,226

Property and equipment, net

106,894

157,854

Intangible assets, net

3,526

48,886

Operating lease right-of-use assets

1,508

5,658

Other non-current assets

1,556

5,392

Total assets

$

126,776

$

247,016

LIABILITIES AND PARTNERS’ CAPITAL Current liabilities

Accounts payable and accrued expenses

$

3,771

$

7,706

Accounts payable and accrued expenses — related party

765

14,131

Deferred revenue

3,562

7,575

Deferred revenue — related party

128

—

Long-term debt, current portion

214,092

4,251

Operating lease liabilities, current

700

4,674

Other current liabilities

7,907

9,012

Other current liabilities — related party

11

64

Total current liabilities

230,936

47,413

Long-term debt, net

—

167,370

Operating lease liabilities, non-current

688

793

Other non-current liabilities

7,556

9,585

Total liabilities

239,180

225,161

Commitments and contingencies Partners’ capital Common units

(108,263

)

16,355

General partner units

—

5,678

Accumulated other comprehensive loss

(4,141

)

(178

)

Total partners’ capital

(112,404

)

21,855

Total liabilities and partners’ capital

$

126,776

$

247,016

_______________

(1)

The Partnership's consolidated financial statements have been

retrospectively recast to include the pre-acquisition results of

the Hardisty South Terminal, which we acquired effective April 1,

2022, because the transaction was between entities under common

control.

USD Partners LP

GAAP to Non-GAAP

Reconciliations

For the Three Months and the

Years Ended December 31, 2022 and 2021

(unaudited)

For the Three Months

Ended

For the Years Ended

December 31,

December 31,

2022

2021 (1)

2022

2021 (1)

(in thousands)

Net cash provided by operating activities

$

8,272

$

12,295

$

37,241

$

57,886

Add (deduct): Amortization of deferred financing costs

(271

)

(534

)

(1,170

)

(1,232

)

Deferred income taxes

238

(100

)

(90

)

78

Changes in accounts receivable and other assets

(382

)

5,775

(11,923

)

(235

)

Changes in accounts payable and accrued expenses

52

(8,406

)

5,211

(13,429

)

Changes in deferred revenue and other liabilities

2,625

525

9,099

3,396

Interest expense, net

3,912

1,761

10,604

6,986

Provision for income taxes

288

274

1,293

933

Foreign currency transaction loss (gain) (2)

113

136

2,055

(707

)

Non-cash deferred amounts (3)

(1,517

)

927

(4,878

)

2,960

Adjusted EBITDA attributable to Hardisty South entities prior to

acquisition (4)

—

(739

)

(258

)

(1,529

)

Adjusted EBITDA

13,330

11,914

47,184

55,107

Add (deduct): Cash paid for income taxes, net (5)

(198

)

(63

)

(1,064

)

(906

)

Cash paid for interest

(3,501

)

(1,230

)

(8,374

)

(5,912

)

Maintenance capital expenditures, net

—

(16

)

(56

)

(541

)

Cash paid for income taxes, interest and maintenance capital

expenditures attributable to Hardisty South entities prior to

acquisition (6)

—

54

59

534

Distributable cash flow

$

9,631

$

10,659

$

37,749

$

48,282

_______________

(1)

The Partnership's consolidated financial statements have been

retrospectively recast to include the pre-acquisition results of

the Hardisty South Terminal, which we acquired effective April 1,

2022, because the transaction was between entities under common

control.

(2)

Represents foreign exchange transaction amounts associated with

activities between the Partnership's U.S. and Canadian

subsidiaries.

(3)

Represents the change in non-cash contract assets and liabilities

associated with revenue recognized at blended rates based on tiered

rate structures in certain of the Partnership's customer contracts

and deferred revenue associated with deficiency credits that are

expected to be used in the future prior to their expiration.

Amounts presented are net of the corresponding prepaid Gibson

pipeline fee that will be recognized as expense concurrently with

the recognition of revenue.

(4)

Adjusted EBITDA attributable to the Hardisty South entities for the

three months ended March 31, 2022 and the three months and year

ended December 31, 2021 was excluded from the Partnership’s

Adjusted EBITDA, as these amounts were generated by the Hardisty

South entities prior to the Partnership’s acquisition and

therefore, they were not amounts that could be distributed to the

Partnership’s unitholders. Refer to the table provided below for a

reconciliation of “Net cash provided by operating activities” to

Adjusted EBITDA for the Hardisty South entities prior to

acquisition.

(5)

Includes the net effect of tax refunds of $84 thousand received in

the second quarter of 2022 associated with carrying back U.S. net

operating losses incurred during 2020 and prior periods allowed for

by the provisions of the CARES Act. Also includes the net effect of

tax refunds of $31 thousand received in the third quarter of 2022

associated with prior period Canadian taxes.

(6)

Cash payments made for income taxes, interest and maintenance

capital expenditures attributable to the Hardisty South entities

for the three months ended March 31, 2022 and the three months and

year ended December 31, 2021 were excluded from the Partnership’s

DCF calculations, as these amounts were generated by the Hardisty

South entities prior to the Partnership’s acquisition. Included for

the three months ended March 31, 2022 was $59 thousand of cash paid

for interest. Included for the three months ended December 31, 2021

was $54 thousand of cash paid for interest. Included for the year

ended December 31, 2021 was $165 thousand of cash paid for income

taxes, $440 thousand of cash paid for interest, partially offset by

a net refund of $71 thousand related to maintenance capital

expenditures.

The following table sets forth a reconciliation of “Net cash

provided by operating activities,” the most directly comparable

financial measure calculated and presented in accordance with GAAP,

to Adjusted EBITDA attributable to the Hardisty South entities

prior to our acquisition of the entities:

Three Months EndedDecember 31, 2021 Year

endedDecember 31, 2021 Three months endedMarch 31, 2022

Net cash provided by (used in) operating

activities

$

2,854

$

10,761

$

(1,475

)

Add (deduct): Amortization of deferred financing costs

(25

)

(101

)

(84

)

Deferred income taxes

(191

)

(238

)

(53

)

Changes in accounts receivable and other assets

40

(5,510

)

(217

)

Changes in accounts payable and accrued expenses

(2,291

)

(6,714

)

155

Changes in deferred revenue and other liabilities

582

4,265

488

Interest expense, net

77

499

117

Provision for income taxes

13

233

59

Foreign currency transaction loss (gain)

15

(1,020

)

1,600

Non-cash deferred amounts (1)

(335

)

(646

)

(332

)

Adjusted EBITDA (2)

$

739

$

1,529

$

258

_______________

(1)

Represents the change in non-cash contract assets and liabilities

associated with revenue recognized at blended rates based on tiered

rate structures in certain of the customer contracts.

(2)

Adjusted EBITDA associated with the Hardisty South entities prior

to the Partnership's acquisition includes the impact of expenses

pursuant to a services agreement with USD for the provision of

services related to the management and operation of transloading

assets. These expenses totaled $2.9 million and $52.2 million for

the three months and year ended December 31, 2021, respectively and

$3.2 million for the three months ended March 31, 2022. Upon the

Partnership's acquisition of the entities effective April 1, 2022,

the services agreement with USD was cancelled and a similar

agreement was established with the Partnership.

Category: Earnings

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230301005816/en/

Adam Altsuler Executive Vice President, Chief Financial Officer

(281) 291-3995 aaltsuler@usdg.com

Jennifer Waller Sr. Director, Financial Reporting and Investor

Relations (832) 991-8383 jwaller@usdg.com

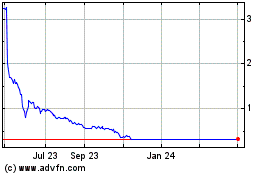

USD Partners (NYSE:USDP)

Historical Stock Chart

From Nov 2024 to Dec 2024

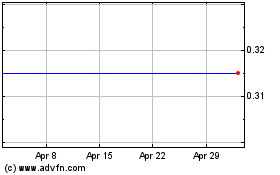

USD Partners (NYSE:USDP)

Historical Stock Chart

From Dec 2023 to Dec 2024