0001261654FALSE00012616542023-12-182023-12-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 18, 2023

UNIVERSAL TECHNICAL INSTITUTE, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-31923 | 86-0226984 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | |

4225 East Windrose Drive, Suite 200 Phoenix, AZ (Address of principal executive offices) | 85032 (Zip Code) |

(623) 445-9500

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | UTI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

☐ Emerging growth company

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Director

Since June 2016, Christopher Shackelton, a Managing Partner at Coliseum Capital Management, LLC (“Coliseum”), has served as a designee (the “Series A Designee”) to the board of directors (the “Board”) of Universal Technical Institute, Inc., a Delaware corporation (the “Company”), at the election of the holders of Series A Preferred Stock, par value $0.0001 per share (the “Series A Preferred Stock”). In connection with the Repurchase and Conversion as further disclosed in Item 8.01 of this Current Report on Form 8-K, the designation right of the holders of Series A Preferred Stock terminated. In light of Mr. Shackelton’s many contributions to the Board during his tenure as the Series A Designee, and in connection with the Repurchase (as discussed below), the Board appointed Mr. Shackelton as a Class III director of the Board, with an appointment to serve until the Company’s 2025 annual meeting of stockholders.

As a condition to the Repurchase Agreement (as defined below), Mr. Shackelton was appointed to serve as a director of the Board. As Managing Partner and a co-founder of Coliseum, Mr. Shackelton has an indirect interest in the transactions disclosed in Item 8.01 of this Current Report on Form 8-K.

Mr. Shackelton’s biography and compensation for his service on the Board are described in detail in the Company’s definitive proxy statement dated January 17, 2023 under the headings “Continuing Directors” and “Compensation of Non-Management Directors”, respectively.

Item 8.01 Other Events.

Repurchase of Series A Preferred Stock

On December 18, 2023, Universal Technical Institute, Inc., a Delaware corporation (the “Company”), entered into a preferred stock repurchase agreement (the “Repurchase Agreement”) with Coliseum Capital Partners, L.P. and Blackwell Partners LLC – Series A (the “Selling Stockholders”), pursuant to which the Company repurchased, directly from the Selling Stockholders, 33,300 shares of Series A Preferred Stock (the “Series A Shares”) for an aggregate purchase price of $10,780,000 (the “Repurchase”). The purchase price was calculated based upon the volume-weighted average trading price (the “Initial VWAP”) of the Common Stock on the New York Stock Exchange (the “NYSE”) on December 18, 2023 multiplied by 1.0 million (which is the number of shares of Common Stock issuable upon conversion of the Series A Shares acquired). Under the terms of the Repurchase Agreement, if the VWAP of the Common Stock on the NYSE from and including December 19, 2023 to and including December 22, 2023 is greater than the Initial VWAP (up to a maximum of $13.00 per share), then the aggregate purchase price will be adjusted to reflect such difference. The Repurchase Agreement contains customary representations, warranties, and covenants of the parties.

The Board established a pricing committee, comprised solely of independent directors not affiliated with the Selling Stockholders, and such pricing committee approved the Repurchase Agreement. The Company will fund the Repurchase with cash on hand.

Conversion of Series A Preferred Stock

On December 18, 2023, immediately following the Repurchase and in accordance with its rights under the Certificate of Designations for the Series A Preferred Stock (the “Certificate of Designations”), the Company notified all holders of Series A Preferred Stock that the Company had achieved the Conversion Trigger (as defined in the Certificate of Designations) and had elected to convert, automatically as of the notice date without any further action by the Series A Holders, all of the outstanding shares of Series A Preferred Stock, at the Conversion Rate as set forth in the Certificate of Designations (the “Conversion”).

Press Release

On December 19, 2023, the Company issued a press release announcing the Repurchase and the Conversion. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Item 9.01 - Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description of Exhibits |

| 99.1 | | |

| 104 | | Cover page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | Universal Technical Institute, Inc. |

| | | | | |

| Dated: | December 19, 2023 | | By: | | /s/ Christopher Kevane |

| | | Name: | | Christopher Kevane |

| | | Title: | | Senior Vice President and Chief Legal Officer |

FOR IMMEDIATE RELEASE

Universal Technical Institute, Inc. Announces Conversion of All

Series A Preferred Stock into Common Stock

PHOENIX (December 19, 2023) – Universal Technical Institute, Inc. (NYSE: UTI) (the “Company”), a leading workforce solutions provider of transportation, skilled trades and healthcare education programs, today announced that it achieved the Company conversion option and thus has effected the conversion of all the Company’s Series A Preferred Stock into Common Stock, effective December 18, 2023. The Company’s outstanding Common Stock increases by 19.3 million shares as a result of the conversion.

Immediately prior to the conversion, the Company purchased 33,300 shares of Series A Preferred Stock convertible into 1,000,000 shares of Common Stock owned by Coliseum Capital Management, LLC (“Coliseum”) and certain affiliates. In addition, the Company announced that its board of directors appointed to the board as a Class III director Chris Shackelton, Co-founder and Managing Partner of Coliseum. Mr. Shackelton previously served UTI as a director designated by the holders of the Series A Preferred Stock.

“This represents an important milestone for our Company,” said Jerome Grant, Chief Executive Officer, Universal Technical Institute, Inc. “We continue to benefit from the support of our longtime investment partners at Coliseum and Chris Shackelton, whose leadership we appreciate.”

Chris Shackelton said, “We are grateful for the tremendous partnership with UTI over the past seven years. The Company’s progress has been remarkable, and we congratulate Jerome and the leadership team. Looking ahead, UTI has meaningful untapped potential, and we are excited to continue helping to build shareholder value.”

About Universal Technical Institute, Inc.

Universal Technical Institute, Inc. (NYSE: UTI) (the “Company”) was founded in 1965 and is a leading workforce solutions provider of transportation, skilled trades and healthcare education programs whose mission is to serve students, partners and communities by providing quality education and support services for in-demand careers across a number of highly skilled fields. The Company is comprised of two divisions: Universal Technical Institute (“UTI”) and Concorde Career Colleges (“Concorde”). UTI operates 16 campuses located in 9 states and offers a wide range of transportation and skilled trades technical training programs under brands such as UTI, MIAT College of Technology, Motorcycle Mechanics Institute, Marine Mechanics Institute and NASCAR Technical Institute. Concorde operates across 17 campuses in 8 states, offering programs in the allied health, dental, nursing, patient care and diagnostic fields. For more information, visit www.uti.edu or www.concorde.edu, visit us on LinkedIn at @UniversalTechnicalInstitute and @Concorde Career Colleges or on X (formerly Twitter) @news_UTI or @ConcordeCareer.

Media Contact:

Susan Aspey

Vice President, Corporate Affairs & External Communications

Universal Technical Institute, Inc.

(202) 549-0534

saspey@uti.edu

Investor Relations Contact:

Matt Glover or Jackie Keshner

Gateway Group, Inc.

(949) 574-3860

UTI@gatewayir.com

v3.23.4

Cover Page

|

Dec. 18, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 18, 2023

|

| Entity Registrant Name |

UNIVERSAL TECHNICAL INSTITUTE, INC

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-31923

|

| Entity Tax Identification Number |

86-0226984

|

| Entity Central Index Key |

0001261654

|

| Amendment Flag |

false

|

| Entity Address, Address Line One |

4225 East Windrose Drive

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Phoenix

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85032

|

| City Area Code |

623

|

| Local Phone Number |

445-9500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

UTI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

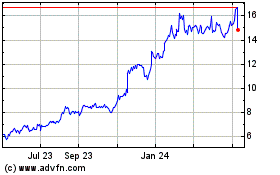

Universal Technical Inst... (NYSE:UTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

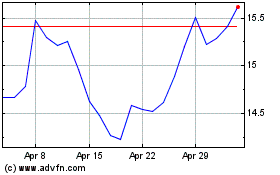

Universal Technical Inst... (NYSE:UTI)

Historical Stock Chart

From Apr 2023 to Apr 2024