TXO Partners, L.P. Announces Entry Into Definitive Agreements for Assets in the Greater Williston Basin

June 25 2024 - 4:15PM

Business Wire

TXO Partners, L.P. (NYSE: TXO) (“TXO”) announced today that it

has entered into separate purchase agreements with Eagle Mountain

Energy Partners (A Pearl Energy Investments Portfolio Company) and

a private company to purchase assets in the Elm Coulee field in

Montana and the Russian Creek field in North Dakota for total cash

considerations of $243 million and 2.5 million common units of TXO,

subject to customary purchase price adjustments.

“TXO uniquely operates as a production and distribution entity,

which focuses on cash flow from our legacy assets. As significant

owners, our leadership is focused, determined and disciplined,”

stated Bob R. Simpson, Chairman and CEO. “This acquisition in the

Elm Coulee field represents the return to a region where our team

previously had success. We expect the significant oil-in-place

targets, with the application of our technology, to create equity

value while delivering high returns.”

“With an eye to a stronger future, we have diligently looked at

many candidates in the last seventeen months as a public company.

We believe the combination of these two assets fits perfectly with

our expertise and capital allocation strategy. These transactions

provide the right blend of low decline rate, high margin and growth

potential for TXO,” commented Brent Clum, the President of Business

Operations and CFO. “We expect these assets to be accretive on

every relevant measure, but most importantly to cash flow and

distributions. It’s a natural evolution to creating equity

value.”

Each of the transactions are expected to close in the third

quarter of 2024, subject to satisfaction of customary closing

conditions. If consummated, the transactions are expected to add

approximately 4,500 daily barrels of oil equivalent production

(~90% liquids) and Proved Developed reserves of approximately

17,000 Mboe, as of April 1, 2024 as determined by Cawley, Gillespie

& Associates using SEC pricing.

TXO’s counsel in connection with the Acquisitions is Welborn

Sullivan Meck & Tooley, P.C. EMEP’s financial advisor for the

sale of its assets to TXO is Jefferies LLC and its counsel is

O'Melveny & Myers LLP.

About TXO Partners, L.P. TXO Partners, L.P. is a master

limited partnership focused on the acquisition, development,

optimization and exploitation of conventional oil, natural gas, and

natural gas liquid reserves in North America. TXO’s current acreage

positions are concentrated in the Permian Basin of West Texas and

New Mexico and the San Juan Basin of New Mexico and Colorado.

Cautionary Statement Concerning Forward-Looking

Statements Certain statements contained in this press release

constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements include the words such as “may,”

“assume,” “forecast,” “could,” “should,” “will,” “plan,” “believe,”

“anticipate,” “intend,” “estimate,” “expect,” “project,” “budget”

and similar expressions, although not all forward-looking

statements contain such identifying words. These forward-looking

statements include statements regarding the pending acquisitions,

including our ability to satisfy the conditions to closing and the

expected timing and benefits of the acquisitions, our financing of

the acquisitions, our strategy, descriptions of future operations,

prospects, plans and objectives of management, future cash flow and

distributions and our ability to execute our strategy, . These

forward-looking statements are based on management’s current

belief, based on currently available information, as to the outcome

and timing of future events at the time such statement was made,

and it is possible that the results described in this press release

will not be achieved. Our assumptions and future performance are

subject to a wide range of business risks, uncertainties and

factors, including, without limitation, the following: our ability

to consummate the proposed acquisitions on the terms currently

contemplated; our ability to meet distribution expectations and

projections; the volatility of oil, natural gas and NGL prices; our

ability to safely and efficiently operate TXO’s assets;

uncertainties about our estimated oil, natural gas and NGL

reserves, including the impact of commodity price declines on the

economic producibility of such reserves, and in projecting future

rates of production; and the risks and other factors disclosed in

TXO’s filings with the SEC, including its Annual Report on Form

10-K, Quarterly Reports on Form 10-Q and Current Reports on Form

8-K.

Any forward-looking statement speaks only as of the date on

which it is made, and, except as required by law, TXO does not

undertake any obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240625140211/en/

TXO Partners Brent W. Clum President, Business Operations &

CFO 817.334.7800 ir@txopartners.com

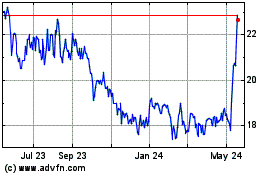

TXO Partners (NYSE:TXO)

Historical Stock Chart

From Nov 2024 to Dec 2024

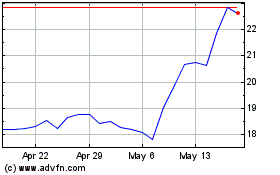

TXO Partners (NYSE:TXO)

Historical Stock Chart

From Dec 2023 to Dec 2024