Triple Flag Precious Metals Corp. (with its subsidiaries,

“Triple Flag” or the “Company”) (TSX:TFPM, NYSE:TFPM) announced

today that the Toronto Stock Exchange (the “TSX”) has accepted the

notice filed by Triple Flag to renew its normal course issuer bid

(the “NCIB”).

Under the NCIB, Triple Flag is authorized to purchase up to

10,078,488 of its common shares (the “Common Shares”) (out of the

201,569,762 Common Shares issued and outstanding as at November 1,

2023), representing 5% of Triple Flag’s issued and outstanding

Common Shares, during the period starting on November 15, 2023 and

ending on November 14, 2024.

In deciding to establish the NCIB, Triple Flag believes that the

purchase of Common Shares from time to time can be undertaken at

prices that make the acquisition of such Common Shares an

appropriate use of Triple Flag’s available funds and an appropriate

mechanism for returning capital to its shareholders.

Triple Flag may make any purchases through the facilities of the

TSX, the New York Stock Exchange (the “NYSE”) and alternative

trading systems, if eligible, or by such other means as may be

permitted by the TSX, the NYSE or under applicable law by a

registered investment dealer (or an affiliate of the dealer),

including private agreement purchases or share purchase program

agreement purchases if Triple Flag receives, if applicable, an

issuer bid exemption order in the future from applicable securities

regulatory authorities in Canada for such purchases. Daily

repurchases on the TSX will be limited to a maximum of 26,350

Common Shares, representing 25% of the average daily trading volume

on the TSX of 105,401 Common Shares for the period from May 1, 2023

to October 31, 2023 (net of repurchases made by Triple Flag during

that time period), except where purchases are made in accordance

with the “block purchase exception” of the TSX rules. Rule 10b-18

of the United States Securities Exchange Act of 1934 contains

similar volume-based restrictions on daily purchases on the NYSE,

subject to certain exceptions for block repurchases. All Common

Shares that are repurchased by Triple Flag under the NCIB will be

cancelled.

Purchase and payment for the Common Shares will be made by

Triple Flag in accordance with the requirements of the TSX and

applicable Canadian and United States securities laws. The price

that Triple Flag will pay for the Common Shares in open market

transactions acquired by it will be the market price of the Common

Shares at the time of acquisition or such other price as may be

permitted by the TSX. Any private agreement purchases made under an

exemption order, if applicable, may be at a discount to the

prevailing market price.

Triple Flag has also entered into an automatic share purchase

plan (the “ASPP”) with the designated broker responsible for the

NCIB to allow for the purchase of Common Shares under the NCIB at

times when Triple Flag would ordinarily not be permitted to

purchase its Common Shares due to regulatory restrictions and

customary self-imposed blackout periods.

Pursuant to the ASPP, prior to entering into a blackout period,

Triple Flag may, but is not required to, instruct the designated

broker to make purchases under the NCIB in accordance with the

terms of the ASPP. Such purchases will be determined by the

designated broker in its sole discretion based on parameters

established by Triple Flag prior to the blackout period in

accordance with the rules of the TSX, the NYSE, applicable

securities laws and the terms of the ASPP. The ASPP has been

pre-cleared by the TSX and will be implemented effective January 1,

2024.

Outside of the pre-determined blackout periods, Common Shares

may be purchased under the NCIB based on the discretion of Triple

Flag’s management, in compliance with the rules of the TSX, the

NYSE and applicable securities laws. All repurchases made under the

ASPP will be included in computing the number of Common Shares

purchased under the NCIB.

Although Triple Flag has a present intention to acquire its

Common Shares pursuant to the NCIB, Triple Flag will not be

obligated to make any purchases and purchases may be suspended by

Triple Flag at any time. Decisions regarding any future repurchases

will depend on certain factors, such as market conditions, share

price and other opportunities to invest capital for growth. Triple

Flag may elect to suspend or discontinue share repurchases at any

time, in accordance with applicable laws.

For its NCIB that began on November 15, 2022 and expired on

November 14, 2023, Triple Flag previously sought and received

approval from the TSX to repurchase up to 2,000,000 of its Common

Shares. Of this amount, Triple Flag repurchased a total of

1,439,042 Common Shares, consisting of 1,437,992 Common Shares

purchased through the facilities of the TSX for a total cost of

approximately C$26.8 million (representing an average cost of

C$18.66 per Common Share) and 1,050 Common Shares purchased through

the facilities of the NYSE for a total cost of approximately

US$15,000 (representing an average cost of US$14.50 per Common

Share). Triple Flag repurchased the Common Shares through the

facilities of the TSX, the NYSE and alternative trading

systems.

About Triple Flag

Triple Flag is a pure play, precious-metals‐focused streaming

and royalty company. We offer bespoke financing solutions to the

metals and mining industry with exposure primarily to gold and

silver in the Americas and Australia, with a total of 234 assets,

including 15 streams and 219 royalties. These investments are tied

to mining assets at various stages of the mine life cycle,

including 32 producing mines and 202 development and exploration

stage projects, and other assets. Triple Flag is listed on the TSX

and NYSE, under the ticker “TFPM”.

Cautionary Note Regarding Forward-Looking Information and

Statements:

This news release contains “forward-looking information” within

the meaning of applicable Canadian securities laws and

“forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995,

respectively (collectively referred to herein as “forward-looking

information”). Forward-looking information may be identified by the

use of forward-looking terminology such as “plans”, “targets”,

“expects”, “is expected”, “budget”, “scheduled”, “estimates”,

“outlook”, “forecasts”, “projection”, “prospects”, “strategy”,

“intends”, “anticipates”, “believes”, or variations of such words

and phrases or terminology which states that certain actions,

events or results “may”, “could”, “would”, “might”, “will”, “will

be taken”, “occur” or “be achieved”. Our assessments of, and

expectations for, future periods (including, but not limited to,

repurchases of our common shares), are considered forward-looking

information. In addition, any statements that refer to

expectations, intentions, projections or other characterizations of

future events or circumstances contain forward-looking information.

Statements containing forward-looking information are not

historical facts but instead represent management’s expectations,

estimates and projections regarding possible future events or

circumstances.

The forward-looking information included in this news release is

based on our opinions, estimates and assumptions considering our

experience and perception of historical trends, current conditions

and expected future developments, as well as other factors that we

currently believe are appropriate and reasonable in the

circumstances. The forward-looking information contained in this

news release is also based upon a number of assumptions, including

the ongoing operation of the properties in which we hold a stream

or royalty interest by the owners or operators of such properties

in a manner consistent with past practice; the accuracy of public

statements and disclosures made by the owners or operators of such

underlying properties; and the accuracy of publicly disclosed

expectations for the development of underlying properties that are

not yet in production. These assumptions include, but are not

limited to, the following: assumptions in respect of current and

future market conditions and the execution of our business

strategies, that operations, or ramp-up where applicable, at

properties in which we hold a royalty, stream or other interest,

continue without further interruption through the period, and the

absence of any other factors that could cause actions, events or

results to differ from those anticipated, estimated, intended or

implied. Despite a careful process to prepare and review the

forward-looking information, there can be no assurance that the

underlying opinions, estimates and assumptions will prove to be

correct. Forward-looking information is also subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance, or achievements to

be materially different from those expressed or implied by such

forward-looking information. Such risks, uncertainties and other

factors include, but are not limited to, those set forth under the

caption “Risk Factors” in our most recently filed annual

information form which is available on SEDAR+ at www.sedarplus.ca

and on EDGAR at www.sec.gov. For clarity, mineral resources that

are not mineral reserves do not have demonstrated economic

viability and inferred resources are considered too geologically

speculative for the application of economic considerations.

Although we have attempted to identify important risk factors

that could cause actual results or future events to differ

materially from those contained in forward-looking information,

there may be other risk factors not presently known to us or that

we presently believe are not material that could also cause actual

results or future events to differ materially from those expressed

in such forward-looking information. There can be no assurance that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such information. Accordingly, readers should not place undue

reliance on forward-looking information, which speaks only as of

the date made. The forward-looking information contained in this

news release represents our expectations as of the date of this

news release and is subject to change after such date. We disclaim

any intention or obligation or undertaking to update or revise any

forward-looking information whether as a result of new information,

future events or otherwise, except as required by applicable

securities laws. All the forward-looking information contained in

this news release is expressly qualified by the foregoing

cautionary statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231113561879/en/

Investor Relations: David Lee Vice President, Investor

Relations +1 (416) 304-9770 ir@tripleflagpm.com

Media: Gordon Poole, Camarco +44 (0) 7730 567 938

tripleflag@camarco.co.uk

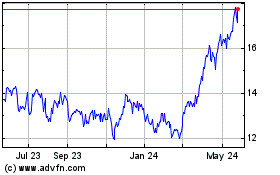

Triple Flag Precious Met... (NYSE:TFPM)

Historical Stock Chart

From Nov 2024 to Dec 2024

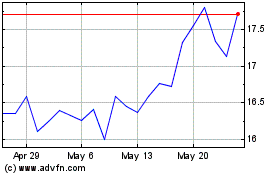

Triple Flag Precious Met... (NYSE:TFPM)

Historical Stock Chart

From Dec 2023 to Dec 2024