Solaris Oilfield Infrastructure, Inc. Prices Public Offering

November 09 2017 - 5:57PM

Business Wire

Solaris Oilfield Infrastructure, Inc. (NYSE: SOI) (“Solaris”)

announced today the pricing of a public offering of 7,000,000

shares of its Class A common stock (“common stock”) at $15.75 per

share, of which 3,000,000 shares are to be sold by Solaris and

4,000,000 shares are to be sold by the selling stockholders named

in the registration statement on Form S-1 (the “registration

statement”) filed previously with the U.S. Securities and Exchange

Commission (“SEC”). The selling stockholders have granted the

underwriters a 30-day option to purchase from the selling

stockholders up to an additional 1,050,000 shares of common stock.

Solaris’ common stock is traded on the New York Stock Exchange

under the ticker symbol “SOI.” The offering is expected to close on

November 14, 2017, subject to customary closing conditions.

Solaris intends to use the net proceeds it receives from the

offering for general corporate purposes, including to fund its 2017

capital program. Solaris will not receive any net proceeds from the

sale by the selling stockholders of shares of common stock.

Credit Suisse and Goldman Sachs & Co. LLC acted as joint

book-running managers for the offering. The offering of these

securities will be made only by means of a prospectus that meets

the requirements of Section 10 of the Securities Act of 1933. A

copy of the prospectus may be obtained from:

Credit Suisse Securities (USA) LLCAttention: Prospectus

DepartmentEleven Madison AvenueNew York, New York 10010Telephone:

(800) 221-1037newyork.prospectus@credit-suisse.com

Goldman Sachs & Co. LLCAttention: Prospectus Department200

West StreetNew York, NY 10282Telephone: (866) 471-2526Fax: (212)

902-9316prospectusgroup-ny@ny.email.gs.com

About Solaris Oilfield Infrastructure, Inc.

Solaris manufactures and provides patented mobile proppant

management systems that unload, store and deliver proppant at oil

and natural gas well sites. The systems are designed to address the

challenges associated with transferring large quantities of

proppant to the well site, including the cost and management of

last mile logistics. The systems are deployed in many of the most

active oil and natural gas basins in the United States,

including the Permian Basin, the Eagle Ford Shale, the SCOOP/STACK

formations and the Haynesville Shale. Solaris is also constructing

a new high-capacity transload facility in Kingfisher,

Oklahoma, which will serve customers with operations in the

SCOOP/STACK formations.

Important Information

A registration statement relating to these securities has been

filed with, and declared effective by, the SEC. The registration

statement may be obtained free of charge at the SEC’s website at

www.sec.gov under “Solaris Oilfield Infrastructure, Inc.” This

press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or

jurisdiction.

Cautionary Statement Concerning Forward-Looking

Statements

Certain statements contained in this press release constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements, including statements regarding the closing of the

public offering and Solaris’ use of proceeds from the offering,

represent Solaris’ expectations or beliefs concerning future

events, and it is possible that the results described in this press

release will not be achieved. These forward-looking statements are

subject to risks, uncertainties and other factors, many of which

are outside of Solaris’ control, that could cause actual results to

differ materially from the results discussed in the forward-looking

statements.

Any forward-looking statement speaks only as of the date on

which it is made, and, except as required by law, Solaris does not

undertake any obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise. New factors emerge from time to time, and it is not

possible for Solaris to predict all such factors. When considering

these forward-looking statements, you should keep in mind the risk

factors and other cautionary statements in the prospectus filed

with the SEC in connection with Solaris’ public offering. The risk

factors and other factors noted in Solaris’ prospectus could cause

its actual results to differ materially from those contained in any

forward-looking statement.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171109006731/en/

Solaris Oilfield Infrastructure, Inc.Kyle S. Ramachandran,

281-501-3070Chief Financial

OfficerIR@solarisoilfield.com

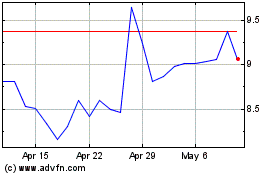

Solaris Oilfield Infrast... (NYSE:SOI)

Historical Stock Chart

From Oct 2024 to Nov 2024

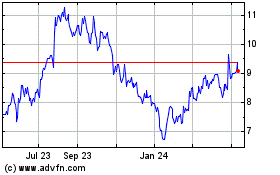

Solaris Oilfield Infrast... (NYSE:SOI)

Historical Stock Chart

From Nov 2023 to Nov 2024