UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024.

Commission File Number 33-65728

CHEMICAL AND MINING COMPANY OF CHILE INC.

(Translation of registrant’s name into English)

El Trovador 4285, Santiago, Chile (562) 2425-2000

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F:_X_ Form 40-F

| | | | | | | | |

|

For Immediate Release SQM REPORTS EARNINGS FOR THE SIX MONTHS ENDED JUNE 30, 2024 | |

| | |

Highlights

|

•SQM reported total revenues for the six months ended June 30, 2024 of US$2,378.1 million compared to total revenues of US$4,315.6 million for the same period last year. |

•Net loss(1),(2) for the six months ended June 30, 2024 of (US$655.9) million or (US$2.30) per share, compared to net income(2) of US$1,330.1 million or US$4.66 per share for the same period last year. |

•Strong sales volumes growth in lithium, iodine and fertilizer businesses. |

•Record-high quarterly sales volumes in lithium and iodine businesses, surpassing 52,000 metric tons and 4,000 metric tons, respectively. |

•Signed definitive partnership agreement with Codelco to jointly develop and operate lithium assets in the Salar de Atacama until 2060. |

•Signed a long-term agreement with Hyundai Motors Co. Ltd. and Kia Corporation. |

•Launched SQM International Lithium to develop our lithium business outside of Chile. |

|

| SQM will hold a conference call to discuss these results on Wednesday, August 21, 2024 at 12:00pm ET (12:00pm Chile time). |

Participant Dial-In (Toll Free): 1-844-282-4852 |

Participant International Dial-In: 1-412-317-5626 |

| Webcast: https://event.choruscall.com/mediaframe/webcast.html?webcastid=FRfGBEBZ |

Santiago, Chile. August 20, 2024.- Sociedad Química y Minera de Chile S.A. (SQM) (NYSE: SQM; Santiago Stock Exchange: SQM-B, SQM-A) reported today net loss(1),(2) for the six months ended June 30, 2024, of (US$655.9) million or (US$2.30) per share, compared to US$1,330.1 million or US$4.66 per share reported for the same period last year.

Gross profit(3) reached US$752.5 million (31.6% of revenues) for the six months ended June 30, 2024, lower than US$1,920.7 million (44.5% of revenues) recorded for the six months ended June 30, 2023. Revenues totaled US$2,378.1 million for the six months ended June 30, 2024, representing a decrease of 44.9% compared to US$4,315.6 million reported for the six months ended June 30, 2023.

The Company also announced net income for the second quarter of 2024 of US$213.6 million or US$0.75 per share, a decrease of 63.2% compared to US$580.2 million or US$2.03 per share for the second quarter of 2023. Gross profit for the second quarter of 2024 reached US$383.9 million, 55.1% lower than the US$855.1 million reported for the second quarter of 2023. Revenues totaled US$1,293.6 million for the second quarter of 2024, a decrease of 37.0% compared to US$2,051.7 million for the second quarter of 2023.

SQM’s Chief Executive Officer, Ricardo Ramos, stated, “We are very pleased to highlight that during the second quarter, we entered into a partnership agreement with Codelco to extend our operations in the Salar de Atacama until 2060. Together with Codelco, we are working to fulfill the remaining conditions for the partnership to take effect in 2025. The most pivotal of these is the consultation process with the communities surrounding the Salar de Atacama. We are committed to reaching a mutually beneficial agreement with the Atacameño communities founded upon the most rigorous standards, transparency and promotion of the human rights of these communities.”

He continued by saying, “In the second quarter, we continued to see positive sales volumes growth in the lithium, iodine and fertilizer businesses. While sales volumes in the lithium and iodine businesses again reached record levels, increasing by more than 20% and 11%, respectively, compared to the same period last year, sales volumes in the fertilizer business confirmed the strong demand recovery trends anticipated since the beginning of the year, increasing by more than 20% compared to the same period last year.”

1 Includes the net effect of accounting adjustments for the payments of the specific tax on mining activities for the exploitation of lithium for the six months ended June 30, 2024, in a total amount of US$1,106.9 million. For more detail, please refer to Note (1) to this Earnings release.

| | | | | |

| SQM S.A. 2Q2024 Earnings release | 1 |

Mr. Ramos further stated, “The strong sales volumes growth in the lithium business in the second quarter was offset by significantly lower average realized lithium prices, as a result of lower market prices when compared to the same period last year. We see this pricing trend continuing in the second half of this year, with current lithium price indices in China nearly 20% lower than the average lithium price indices in the second quarter of 2024. This trend could have a negative impact on our realized prices, which reflect the prevailing market price trends, in the second half of the year. Given current price levels, we anticipate that some lithium producers may reduce their output, as many projects, especially greenfield, are not economically viable at these prices. In our situation, while we continue to advance our previously announced expansions, we are currently reevaluating specific markets and initiatives that may be less attractive in the near term under these conditions.”

Mr. Ramos closed by saying, “In light of our confidence in the long-term growth of the lithium industry, we launched SQM International Lithium to focus on developing SQM's lithium business outside of Chile. Leveraging our expertise in exploration, project development, M&A and innovation, SQM International Lithium’s objective is to expand the portfolio of lithium assets we have with various partners outside of Chile, allowing us to increase SQM's production volumes by at least 100,000 metric tons of LCE per year by the end of this decade.”

Capex Plan

The total capex for 2024 is expected to reach US$1.6 billion, including the acquisition of the Andover lithium project through our Azure Minerals Limited joint venture in Australia of approximately US$350 million, the Dixin plant acquisition in China of approximately US$140 million, capex associated with our lithium carbonate and lithium hydroxide capacity expansions in Chile, capex associated with our nitrates and iodine capacity expansions, and maintenance of approximately US$150 million.

Segment Analysis

Lithium and Derivatives

Revenues for lithium and derivatives totaled US$1,212.1 million during the six months ended June 30, 2024, a decrease of 61.0% compared to US$3,110.8 million recorded for the six months ended June 30, 2023.

Revenues for lithium and derivatives totaled US$664.7 million for the second quarter of 2024, a decrease of 54.6% compared to US$1,464.6 million recorded for the second quarter of 2023.

Lithium and Derivatives Sales Volumes and Revenues:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 6M2024 | | 6M2023 | | 2024/2023 |

| Lithium and Derivatives | | Th. MT | | 95.7 | | 75.4 | | 20.3 | | 27% |

| Lithium and Derivatives Revenues | | MUS$ | | 1,212.1 | | 3,110.8 | | (1,898.7) | | | (61) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2Q2024 | | 2Q2023 | | 2024/2023 |

| Lithium and Derivatives | | Th. MT | | 52.3 | | 43.1 | | 9.2 | | 21% |

| Lithium and Derivatives Revenues | | MUS$ | | 664.7 | | 1,464.6 | | (799.9) | | | (55) | % |

Revenues in the lithium business line during the second quarter of 2024 were affected by significantly lower average sales prices, partially offset by significantly higher sales volumes, when compared to the same period last year. Average sales price for the second quarter of 2024 reached almost US$12,700 per metric ton, a decrease of 62.6% compared to average sales price reported for the second quarter of 2023. Our lithium sales volumes reached almost 52,300 metric tons for the second quarter of 2023, an increase of 21.3% compared to sales volumes reported for the same period last year.

Our realized average sales prices were significantly lower for the second quarter of 2024, when compared to the same period last year, as a result of lower market prices during this period. Since our sales contracts are tied to market price indices, our realized sales prices reflect the prevailing market price trends. The current decline in lithium prices could have a negative impact on our realized prices in the second half of this year.

Our production guidance remains the same as announced earlier this year and we expect to produce approximately 210,000 metric tons of lithium carbonate equivalent from our production facilities. We expect that our sales volumes in the second half of the year could be similar to the sales volumes reported for the first half of 2024.

| | | | | |

| SQM S.A. 2Q2024 Earnings release | 2 |

Gross profit(3) for the Lithium and Derivatives segment accounted for 46.0% of SQM’s consolidated gross profit for the six months ended June 30, 2024.

Specialty Plant Nutrition (SPN)

Revenues from our Specialty Plant Nutrition business line for the six months ended June 30, 2024 totaled US$468.2 million, almost flat when compared to US$468.4 million reported for the six months ended June 30, 2023.

Revenues from our Specialty Plant Nutrition business line for the second quarter of 2024 totaled US$260.5 million, representing a 5.3% increase when compared to US$247.5 million reported for the second quarter of 2023.

Specialty Plant Nutrition Sales Volumes and Revenues:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 6M2024 | | 6M2023 | | 2024/2023 |

| Specialty Plant Nutrition Total Volumes | | Th. MT | | 471.7 | | 389.8 | | 81.9 | | 21 | % |

| Sodium Nitrate | | Th. MT | | 9.7 | | 8.8 | | 0.9 | | 10% |

| Potassium Nitrate and Sodium Potassium Nitrate | | Th. MT | | 275.8 | | 212.4 | | 63.5 | | 30% |

| Specialty Blends | | Th. MT | | 108.9 | | 99.4 | | 9.5 | | 10% |

| Other specialty plant nutrients (*) | | Th. MT | | 77.3 | | 69.2 | | 8.1 | | 12% |

| Specialty Plant Nutrition Revenues | | MUS$ | | 468.2 | | 468.4 | | (0.2) | | | (0) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2Q2024 | | 2Q2023 | | 2024/2023 |

| Specialty Plant Nutrition Total Volumes | | Th. MT | | 267.7 | | 221.7 | | 46.0 | | 21 | % |

| Sodium Nitrate | | Th. MT | | 2.2 | | 2.1 | | 0.1 | | 5% |

| Potassium Nitrate and Sodium Potassium Nitrate | | Th. MT | | 157.2 | | 123.6 | | 33.7 | | 27% |

| Specialty Blends | | Th. MT | | 66.0 | | 59.8 | | 6.2 | | 10% |

| Other specialty plant nutrients (*) | | Th. MT | | 42.2 | | 36.2 | | 6.0 | | 17% |

| Specialty Plant Nutrition Revenues | | MUS$ | | 260.5 | | 247.5 | | 13.0 | | | 5 | % |

*Includes trading of other specialty fertilizers.

The higher specialty plant nutrition business line revenues in the second quarter of 2024 were the result of significantly higher sales volumes compared to the same period in 2023, which offset a lower realized average price in the same period. Our average price decreased 12.8% year-on-year while our sales volumes increased 20.8% during the second quarter of 2024 compared to the same period last year.

We have observed positive trends in the potassium nitrate market during the first half of this year, characterized by robust demand growth and stable market prices. We anticipate that total potassium nitrate market demand could increase by close to 13% compared to the total demand seen in 2023. Consequently, our sales volumes are expected to outpace this demand growth, increasing by nearly 20% in 2024 compared to 2023. We expect that the price stability seen in the first half of 2024 could continue throughout the year if current market conditions remain unchanged.

Gross profit(3) for SPN segment accounted for 12.2% of SQM’s consolidated gross profit for the six months ended June 30, 2024.

Iodine and Derivatives

Revenues from sales of iodine and derivatives during the six months ended June 30, 2024, totaled US$509.3 million, an increase of 10.5% compared to US$461.0 million reported for the six months ended June 30, 2023.

Revenues from sales of iodine and derivatives during the second quarter of 2024, totaled US$269.2 million, an increase of 21.6% compared to US$221.3 million reported for the second quarter of 2023.

| | | | | |

| SQM S.A. 2Q2024 Earnings release | 3 |

Iodine and Derivative Sales Volumes and Revenues:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 6M2024 | | 6M2023 | | 2024/2023 |

| Iodine and Derivatives | | Th. MT | | 7.8 | | 6.6 | | 1.2 | | 18% |

| Iodine and Derivatives Revenues | | MUS$ | | 509.3 | | 461.0 | | 48.3 | | 10% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2Q2024 | | 2Q2023 | | 2024/2023 |

| Iodine and Derivatives | | Th. MT | | 4.1 | | 3.2 | | 0.9 | | 28% |

| Iodine and Derivatives Revenues | | MUS$ | | 269.2 | | 221.3 | | 47.8 | | 22% |

We reported record-high quarterly sales volumes of over 4,100 metric tons for the second quarter of 2024, an increase of 28.9% compared to the sales volumes reported for the second quarter of 2023. Our average realized price in the second quarter increased by 0.8% compared to the first quarter of 2024, breaking the downward price trend seen in the previous quarters, driven by strong demand growth.

We have seen a much stronger than anticipated demand growth in the iodine market during the first half of the year. We believe that this trend could continue in the second half of year, with total iodine demand growth reaching approximately 7% in 2024 when compared to the previous year. We estimate that the majority of this demand growth is coming from multiple application, mainly X-ray contrast media and LCD/LED screens segments. Given these positive trends in iodine demand, we believe our sales volumes could increase in 2024 compared to sales volumes reported for 2023, surpassing 14,500 metric tons. We have seen a slight increase in the iodine prices since the first quarter of this year and believe that strong demand growth and limited supply could lead to further price increases in the second half of this year.

Gross profit(3) for the Iodine and Derivatives segment accounted for 37.7% of SQM’s consolidated gross profit for the six months ended June 30, 2024.

Potassium

Potassium revenues for the six months ended June 30, 2024 totaled US$136.7 million, lower than revenues reported during the six months ended June 30, 2023, which totaled US$153.1 million, representing a 10.7% decrease.

Potassium revenues for the second quarter of 2024 totaled US$73.1 million, higher than revenues reported during the second quarter of 2023, which totaled US$66.2 million, representing a 10.4% increase.

Potassium Sales Volumes and Revenues:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 6M2024 | | 6M2023 | | 2024/2023 |

| Potassium | | Th. MT | | 352.9 | | 261.8 | | 91.2 | | 35 | % |

| Potassium Revenues | | MUS$ | | 136.7 | | 153.1 | | (16.4) | | | (11) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2Q2024 | | 2Q2023 | | 2024/2023 |

| Potassium | | Th. MT | | 189.5 | | 124.3 | | 65.3 | | 53 | % |

| Potassium Revenues | | MUS$ | | 73.1 | | 66.2 | | 6.9 | | | 10 | % |

Potassium revenues during the second quarter of 2024 were higher when compared to the same period last year, as a result of significantly higher sales volumes, partially offset by lower average sales price reported for the second quarter of 2024 compared to the same period last year. We have seen strong demand growth in the first half of 2024 and expect that total global demand could surpass 70 million metric tons in 2024. Our sales volumes could reach 650,000 metric tons this year.

Gross profit(3) for Potassium segment accounted for 2.0% of SQM’s consolidated gross profit for the six months ended June 30, 2024.

Industrial Chemicals

Industrial chemicals revenues for the six months ended June 30, 2024 reached US$42.4 million, 62.5% lower than US$113.1 million recorded for the six months ended June 30, 2023.

| | | | | |

| SQM S.A. 2Q2024 Earnings release | 4 |

Industrial chemicals revenues for the second quarter of 2024 reached US$20.5 million, 56.5% lower than US$47.1 million recorded for the second quarter of 2023.

Industrial Chemicals Sales Volumes and Revenues:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 6M2024 | | 6M2023 | | 2024/2023 |

| Industrial Nitrates | | Th. MT | | 28.4 | | 119.6 | | -91.2 | | (76)% |

| Industrial Chemicals Revenues | | MUS$ | | 42.4 | | 113.1 | | (70.7) | | (63)% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2Q2024 | | 2Q2023 | | 2024/2023 |

| Industrial Nitrates | | Th. MT | | 13.9 | | 48.6 | | -34.6 | | (71)% |

| Industrial Chemicals Revenues | | MUS$ | | 20.5 | | 47.1 | | (26.6) | | (56)% |

Industrial chemicals revenues during the second quarter of 2024 were significantly lower compared to revenues reported for the same period last year, as a result of significantly lower sales volumes which offset higher average sales prices. Last year's sales volumes were related to solar salt shipments under the contract which was completed in 2023. Our quarterly sales volumes in 2024 should be relatively flat quarter over quarter. We believe that the industrial chemicals market prices could also remain stable for the reminder of the year.

Gross profit(3) for the Industrial Chemicals segment accounted for 2.3% of SQM’s consolidated gross profit for the six months ended June 30, 2024.

Other Commodity Fertilizers & Other Income

Revenues from sales of other commodity fertilizers and other income reached US$9.5 million for the six months ended June 30, 2024, an increase compared to US$9.3 million for the six months ended June 30, 2023.

Financial Information

Cost of Sales

Cost of sales amounted to US$1,625.7 million for the six months ended June 30, 2024, a decrease of 32.1% compared to US$2,394.9 million for the same period in 2023.

Our cost of sales related to our lithium and potassium business lines includes lease payments to Corfo and, therefore, fluctuates with our sales prices of lithium and potassium products. For the six months ended June 30, 2024, cost of sales related to our lithium business line reflects the impact of lithium sulfate inventory cost adjustments as a result of lower lithium sales prices.

Administrative Expenses

Administrative expenses totaled US$83.7 million (3.5% of revenues) for the six months ended June 30, 2024, compared to US$86.6 million (2.0% of revenues) for the six months ended June 30, 2023.

Financial Indicators

Net Financial Expenses

Net financial expenses for the six months ended June 30, 2024 totaled US$52.7 million, compared to net financial expenses of US$7.7 million for the six months ended June 30, 2023.

Income Tax Expense

For the six months ended June 30, 2024, the income tax expense, including the net effect of the payments of the specific tax on mining activities in Chile applied to the exploitation of lithium in the total amount of US$1,106.9 million (see Note (1) below), reached US$1,241.2 million, compared to an income tax expense of US$503.3 million during the six months ended June 30, 2023.

| | | | | |

| SQM S.A. 2Q2024 Earnings release | 5 |

The income tax expense, excluding the net effect of accounting adjustments for the payments of the specific tax on mining activities for the exploitation of lithium, reached US$134.3 million for the six months ended June 30, 2024, representing an effective tax rate of 22.9%. The Chilean corporate tax rate was 27.0% in 2023 and 2024.

Adjusted EBITDA(4)

Adjusted EBITDA for the six months ended June 30, 2024, was US$816.8 million (Adjusted EBITDA margin of 34.3%), compared to US$1,964.3 million (Adjusted EBITDA margin of 45.5%) for the six months ended June 30, 2023.

Adjusted EBITDA for the second quarter of 2024 was US$413.3 million (Adjusted EBITDA margin of 31.9%), compared to US$876.6 million (Adjusted EBITDA margin of 42.7%) for the second quarter of 2023.

Notes:

(1) The Chilean Internal Revenue Service (“SII” in its Spanish acronym) has sought to broaden the application of the specific tax on mining activities in Chile to the extraction of lithium, a substance that is not concessionable by law, and has levied taxes as of December 31, 2023 in the amount of US$986.3 million on our subsidiary SQM Salar SpA. (“SQM Salar”) for the tax years 2012 to 2023 (business years 2011 to 2022) on that basis. SQM Salar has paid the tax assessments for US$201.3 million, for which seven tax claims have been filed against the SII challenging these taxes (the “Claims”), and the tax assessment for US$785.0 million, for which a claim has not yet been filed. Both amounts were accounted for as non-current tax assets in the consolidated financial statement for the year ended December 31, 2023, filed with the Chilean Financial Market Commission (“CMF” in its Spanish acronym). In the case covering the 2017-2018 tax years, the Tax and Customs Court upheld SQM Salar’s claim and ordered that these tax assessments be annulled. This case ruling was appealed by the SII, and on April 5, 2024 the Santiago Court of Appeal issued a ruling revoking the previous ruling handed down by the Tax and Customs Court covering the 2017-2018 tax years. Although the ruling of the Santiago Court of Appeal does not affect all other Claims and is still subject to appeal by SQM Salar, it prompted the review of the accounting treatment for the Claims by the SQM's Board of Directors. Consequently, in its financial statements for six months ended June 30, 2024 files with the CMF, SQM recognized a tax expense adjustment amounting to US$1,106.9 million, corresponding to US$926.7 million for the business years 2011 to 2022, US$162.7 million for the 2023 business year and US$17.5 million for the six months ended June 30, 2024, which corresponds to the impact that the interpretation of the Santiago Court of Appeal ruling could have on the Claims.

SQM maintains its firm position regarding the erroneous application of the specific tax on mining activity to the exploitation of lithium, a substance that is not concessionable by law in Chile, which had been recognized by the SII itself in the past, as well as by the executive, legislative and judicial powers in Chile. SQM Salar will continue to actively defend its position in the Claims. For more information, see Note 21.3 to our consolidated financial statements as of June 30, 2024 filed with the CMF.

(2) Net income (loss) refers to the comprehensive income (loss) attributable to controlling interests.

(3) A significant portion of SQM’s cost of sales are costs related to common productive processes (mining. crushing. leaching. etc.) which are distributed among the different final products. To estimate gross profit by business line in both periods covered by this release, the Company employed similar criteria on the allocation of common costs to the different business areas. This gross profit distribution should be used only as a general and approximated reference of the margins by business line.

(4) Adjusted EBITDA = EBITDA – Other income – Other gains (losses) - Share of Profit of associates and joint ventures accounted for using the equity method + Other expenses by function + Net impairment gains on reversal (losses) of financial assets – Finance income – Currency differences. EBITDA = Profit for the Period + Depreciation and Amortization Expenses + Finance Costs + Income Tax. Adjusted EBITDA margin = Adjusted EBITDA/revenues. We have included adjusted EBITDA to provide investors with a supplemental measure of our operating performance. We believe adjusted EBITDA is important supplemental measure of operating performance because it eliminates items that have less bearing on our operating performance and thus highlights trends in our core business that may not otherwise be apparent when relying solely on IFRS financial measures. Adjusted EBITDA has important limitations as analytical tool. For example, adjusted EBITDA does not reflect (a) our cash expenditures, or future requirements for capital expenditures or contractual commitments; (b) changes in, or cash requirements for, our working capital needs; (c) the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; and (d) tax payments. Although we consider the items excluded in the calculation of non-IFRS measures to be less relevant to evaluate our performance, some of these items may continue to take place and accordingly may reduce the cash available to us.

| | | | | |

| SQM S.A. 2Q2024 Earnings release | 6 |

We believe that the presentation of the non-IFRS financial measures described above is appropriate. However, these non-IFRS measures have important limitations as analytical tools, and you should not consider them in isolation, or as substitutes for analysis of our results as reported under IFRS. Because of these limitations, we primarily rely on our results as reported in accordance with IFRS and use EBITDA and adjusted EBITDA only supplementally.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the 2nd quarter | | For the six months ended Jun. 30, |

| (US$ millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| Profit for the Period | | 214.8 | | | 580.8 | | | (653.9) | | | 1,332.3 | |

| (+) Depreciation and amortization expenses | | 74.7 | | | 66.6 | | | 148.0 | | | 130.2 | |

| (+) Finance costs | | 54.4 | | | 32.0 | | | 101.3 | | | 59.3 | |

| (+) Income tax expense | | 72.4 | | | 221.4 | | | 1,241.2 | | | 503.3 | |

| EBITDA | | 416.3 | | | 900.7 | | | 836.7 | | | 2,025.1 | |

| (-) Other income | | 1.3 | | | 14.5 | | | 2.6 | | | 32.2 | |

| (-) Other gains (losses) | | (0.1) | | | 1.6 | | | (2.1) | | | 1.3 | |

| (-) Share of Profit of associates and joint ventures accounted for using the equity method | | 2.3 | | | (3.1) | | | 6.9 | | | (2.7) | |

| (+) Other Expenses | | (26.9) | | | (6.0) | | | (43.1) | | | (22.0) | |

| (+) Impairment of financial assets and reversal of impairment losses | | 0.9 | | | (0.6) | | | 1.5 | | | (1.6) | |

| (-) Finance income | | 22.2 | | | 21.0 | | | 48.5 | | | 51.7 | |

| (-) Foreign currency translation differences | | 3.3 | | | (3.1) | | | 5.6 | | | 2.0 | |

| Adjusted EBITDA | | 413.3 | | | 876.6 | | | 816.8 | | | 1,964.3 | |

| | | | | |

| SQM S.A. 2Q2024 Earnings release | 7 |

Consolidated Statement of Financial Position

| | | | | | | | | | | |

| As of Jun. 30, | | As of Dec. 31, |

| (US$ millions) | 2024 | | 2023 |

| | | |

| Total Current Assets | 5,229.7 | | 5,866.1 |

| Cash and cash equivalents | 1,033.1 | | 1,041.4 |

| Other current financial assets | 1,109.8 | | 1,325.8 |

| Accounts receivable (1) | 747.0 | | 950.4 |

| Inventory | 1,709.5 | | 1,774.6 |

| Others | 630.4 | | 773.9 |

| | | |

| Total Non-current Assets | 5,543.2 | | 5,839.4 |

| Other non-current financial assets | 37.5 | | 248.3 |

| Investments in related companies | 632.7 | | 86.4 |

| Property, plant and equipment | 3,998.5 | | 3,609.9 |

| Other Non-current Assets | 874.5 | | 1,894.8 |

| | | |

| Total Assets | 10,772.9 | | 11,705.6 |

| | | |

| Total Current Liabilities | 2,392.6 | | 2,351.1 |

| Short-term debt | 1,515.4 | | 1,256.5 |

| Others | 877.2 | | 1,094.6 |

| | | |

| Total Long-Term Liabilities | 3,405.4 | | 3,787.5 |

| Long-term debt | 2,946.2 | | 3,213.4 |

| Others | 459.2 | | 574.1 |

| | | |

| Shareholders’ Equity before Minority Interest | 4,936.9 | | 5,530.7 |

| | | |

| Minority Interest | 38.0 | | 36.2 |

| | | |

| Total Shareholders’ Equity | 4,974.9 | | 5,566.9 |

| | | |

| Total Liabilities & Shareholders’ Equity | 10,772.9 | | 11,705.6 |

| | | |

| Liquidity (2) | 2.2 | | 2.5 |

__________________________________________

(1)Accounts receivable + accounts receivable from related companies

(2)Current assets / current liabilities

| | | | | |

| SQM S.A. 2Q2024 Earnings release | 8 |

Consolidated Statement of Income

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the 2nd quarter | | For the six months ended Jun. 30, |

| (US$ millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| Revenues | | 1,293.6 | | 2,051.7 | | 2,378.1 | | 4,315.6 |

| | | | | | | | |

| Lithium and Derivatives | | 664.7 | | 1,464.6 | | 1,212.1 | | 3,110.8 |

Specialty Plant Nutrition (1) | | 260.5 | | 247.5 | | 468.2 | | 468.4 |

| Iodine and Derivatives | | 269.2 | | 221.3 | | 509.3 | | 461.0 |

| Potassium | | 73.1 | | 66.2 | | 136.7 | | 153.1 |

| Industrial Chemicals | | 20.5 | | 47.1 | | 42.4 | | 113.1 |

| Other Income | | 5.7 | | 5.1 | | 9.5 | | 9.3 |

| | | | | | | | |

| Cost of Sales | | (909.7) | | (1,196.7) | | (1,625.7) | | | (2,394.9) | |

| | | | | | | | |

| Gross Profit | | 383.9 | | 855.1 | | 752.5 | | 1,920.7 |

| | | | | | | | |

| Administrative Expenses | | (45.3) | | (45.2) | | (83.7) | | | (86.6) | |

| Financial Expenses | | (54.4) | | (32.0) | | (101.3) | | | (59.3) | |

| Financial Income | | 22.2 | | 21.0 | | 48.5 | | 51.7 |

| Exchange Difference | | 3.3 | | (3.1) | | 5.6 | | 2.0 | |

| Other | | (22.5) | | 6.3 | | (34.3) | | 7.2 | |

| | | | | | | | |

| Income Before Taxes | | 287.2 | | 802.1 | | 587.4 | | 1,835.6 |

| | | | | | | | |

| Income Tax | | (72.4) | | | (221.4) | | | (1,241.2) | | | (503.3) | |

| | | | | | | | |

| Net Income before minority interest | | 214.8 | | 580.8 | | (653.9) | | 1,332.3 |

| | | | | | | | |

| Minority Interest | | (1.2) | | | (0.5) | | | (2.1) | | | (2.2) | |

| | | | | | | | |

| Net Income | | 213.6 | | 580.2 | | (655.9) | | 1,330.1 |

| Net Income per Share (US$) | | 0.75 | | 2.03 | | (2.30) | | 4.66 |

__________________________________________

(1)Includes other specialty fertilizers

| | | | | |

| SQM S.A. 2Q2024 Earnings release | 9 |

About SQM

SQM is a global company that is listed on the New York Stock Exchange and the Santiago Stock Exchange (NYSE: SQM; Santiago Stock Exchange: SQM-B, SQM-A). SQM develops and produces diverse products for several industries essential for human progress, such as health, nutrition, renewable energy and technology through innovation and technological development. We aim to maintain our leading world position in the lithium, potassium nitrate, iodine and thermo-solar salts markets.

For further information, contact:

Gerardo Illanes / gerardo.illanes@sqm.com

Irina Axenova / irina.axenova@sqm.com

Isabel Bendeck / isabel.bendeck@sqm.com

For media inquiries, contact:

Maria Ignacia Lopez / ignacia.lopez@sqm.com

Pablo Pisani / pablo.pisani@sqm.com

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “plan,” “believe,” “estimate,” “expect,” “strategy,” “should,” “will” and similar references to future periods. Examples of forward-looking statements include, among others, statements we make concerning the completion and implementation of the proposed partnership with Codelco, the development of Salar Futuro Project, Company’s capital expenditures, financing sources, Sustainable Development Plan, business and demand outlook, future economic performance, anticipated sales volumes and sales prices, profitability, revenues, expenses, or other financial items, anticipated cost synergies and product or service line growth.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are estimates that reflect the best judgment of SQM management based on currently available information. Because forward-looking statements relate to the future, they involve a number of risks, uncertainties and other factors that are outside of our control and could cause actual results to differ materially from those stated in such statements, including our ability to successfully implement the Sustainable Development Plan. Therefore, you should not rely on any of these forward-looking statements. Readers are referred to the documents filed by SQM with the United States Securities and Exchange Commission, including the most recent annual report on Form 20-F, which identifies other important risk factors that could cause actual results to differ from those contained in the forward-looking statements. All forward-looking statements are based on information available to SQM on the date hereof and SQM assumes no obligation to update such statements, whether as a result of new information, future developments or otherwise, except as required by law.

| | | | | |

| SQM S.A. 2Q2024 Earnings release | 10 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

| CHEMICAL AND MINING COMPANY OF CHILE INC. |

| (Registrant) |

| Date: August 20, 2024 | /s/ Gerardo Illanes |

| By: Gerardo Illanes |

| CFO |

Persons who are to respond to the collection of information contained SEC 1815 (04-09) in this form are not required to respond unless the form displays currently valid OMB control number.

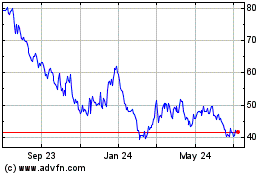

Sociedad Quimica y Miner... (NYSE:SQM)

Historical Stock Chart

From Nov 2024 to Dec 2024

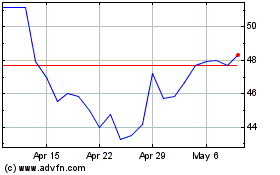

Sociedad Quimica y Miner... (NYSE:SQM)

Historical Stock Chart

From Dec 2023 to Dec 2024