0000920371false00009203712023-10-232023-10-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 23, 2023

Simpson Manufacturing Co., Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-13429 | | 94-3196943 |

| (State or other jurisdiction of incorporation) | | (Commission file number) | | (I.R.S. Employer Identification No.) |

5956 W. Las Positas Boulevard, Pleasanton, CA 94588

(Address of principal executive offices)

(Registrant’s telephone number, including area code): (925) 560-9000

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | SSD | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-2) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240. 13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 23, 2023, Simpson Manufacturing Co., Inc. issued a press release announcing financial results for the quarter ended September 30, 2023, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by this reference.

This information is furnished pursuant to Item 2.02 and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | Simpson Manufacturing Co., Inc. |

| | | | (Registrant) |

| | | | | |

| | | | | |

| | | | | |

| DATE: | October 23, 2023 | | By | /s/ Brian J. Magstadt |

| | | | | Brian J. Magstadt |

| | | | | Chief Financial Officer |

Exhibit 99.1 Press Release dated October 23, 2023

SIMPSON MANUFACTURING CO., INC. ANNOUNCES 2023 THIRD QUARTER FINANCIAL RESULTS

Pleasanton, CA – October 23, 2023

| | | | | |

l

| Net sales of $580.1 million increased 4.8% year-over-year |

| |

l

| Income from operations of $140.2 million increased 14.2% year-over-year |

l

| Diluted earnings per share of $2.43 increased 18.0% year-over-year |

l

| Declared $0.27 per share quarterly cash dividend |

| |

| |

| |

Simpson Manufacturing Co., Inc. (the “Company”) (NYSE: SSD), an industry leader in engineered structural connectors and building solutions, today announced its financial results for the third quarter of 2023. Refer to the “Segment and Product Group Information” table below for additional segment information (including information about the Company’s Asia/Pacific segment and Administrative and All Other segment).

All comparisons below (which are generally indicated by words such as “increased,” “decreased,” “remained,” or “compared to”), unless otherwise noted, are comparing the quarter ended September 30, 2023, with the quarter ended September 30, 2022.

2023 Third Quarter Financial Highlights

•Consolidated net sales of $580.1 million increased 4.8% from $553.7 million.

◦North America net sales of $456.8 million increased 4.4% from $437.8 million, mostly due to higher volumes partially offset by price decreases in effect earlier in 2023.

◦Europe net sales of $119.0 million increased 6.4% from $111.9 million, primarily due to the positive effect of approximately $7.9 million in foreign currency translation, partly offset by lower volumes.

•Consolidated gross profit of $282.9 million increased 15.7% from $244.5 million. Gross margin increased to 48.8% from 44.2%.

◦North America gross margin increased to 51.8% from 47.5%, primarily due to lower raw material costs, offset by higher warehouse and freight costs, as a percentage of net sales.

◦Europe gross margin increased to 37.9% from 31.5%, primarily due to a decrease in raw material costs as a percentage of net sales. Cost of sales in the prior year period included a $2.9 million inventory fair-value adjustment as a result of purchase accounting with respect to the acquisition of FIXCO Invest S.A.S ("ETANCO").

•Consolidated income from operations of $140.2 million increased 14.2% from $122.8 million. The increase was primarily due to increased consolidated gross profit, which was partly offset by higher operating expenses, including increased variable compensation and personnel costs as a result of the increase in the number of employees supporting production, engineering and sales activities. Operating expenses were partly offset by lower acquisition and integration costs including lower professional fees. Consolidated operating margin increased to 24.2% from 22.2%.

◦North America income from operations of $135.6 million increased 6.5% from $127.3 million. The increase was primarily due to higher gross profit, which was partly offset by increased personnel costs from the increase in the number of employees supporting production, engineering and sales activities and variable compensation.

◦Europe income from operations of $15.5 million increased 151.3% from $6.1 million, primarily due to higher gross profit (partly due to the prior year $2.9 million raw material fair-value adjustment as noted above) and lower acquisition and integration costs, which were partly offset by increases in personnel costs and variable compensation.

•Net income was $104.0 million, or $2.43 per diluted share of the Company's common stock, compared to net income of $88.2 million, or $2.06 per diluted share.

•Cash flow provided by operating activities increased approximately $79.7 million from $124.9 million to $204.6 million, mostly from increases in net income and decreases in working capital.

•Cash flow used in investing activities increased approximately $9.8 million from $12.0 million to $21.8 million. Capital expenditures were approximately $22.5 million compared to $9.7 million.

Management Commentary

“We delivered solid financial performance in a challenging operating environment with third quarter net sales of $580.1 million increasing 4.8% over the prior year quarter led by improved volumes in our North America segment,” commented Mike Olosky, President and Chief Executive Officer of Simpson Manufacturing Co., Inc. "We achieved double-digit volume growth year-over-year in our commercial, national retail and building technology markets as we have continued to execute on our strategies, enabling us to win new applications and customers. While Europe net sales were relatively flat year-over-year on a local currency basis, our gross margin has continued to improve versus historical levels and ETANCO continues to perform well.”

Mr. Olosky concluded, “While 2023 U.S. housing starts will likely finish below 2022 levels, we continue to believe in the sustainable strength of the housing market in the mid to long-term given the shortage of new housing. However, based on the current interest rate environment and the resultant impact on the housing market, we anticipate that our fourth quarter 2023 results will start reflecting some downward pressure, in addition to typical seasonality, compared to the third quarter of 2023. Further, while our operations throughout the Company were mostly down for approximately three days in mid-October due to a cybersecurity incident, the swift actions of our dedicated team and commitment to our customers led us to resume shipments to clear our backlog within just one week. Looking ahead, we continue to believe that we have ample opportunities to pursue our growth initiatives and enhance stockholder value over time.”

Corporate Developments

•On October 19, 2023, the Company’s Board of Directors (the "Board") declared a quarterly cash dividend of $0.27 per share, estimated to be $11.5 million in total. The dividend will be payable on January 25, 2024, to the Company's stockholders of record as of January 4, 2024.

Business Outlook

The Company has updated its 2023 financial outlook based on three quarters of financial information to reflect its latest expectations regarding demand trends, raw material costs and operating expenses. Based on business trends and conditions as of today, October 23, 2023, the Company's outlook for the full fiscal year ending December 31, 2023 is as follows:

•Operating margin is now estimated to be in the range of 22.0% to 22.5%.

•The effective tax rate is estimated to be in the range of 25% to 26%, including both federal and state income tax rates and assuming no tax law changes are enacted.

•Capital expenditures are estimated to be approximately $100.0 million depending on a number of various external factors.

•The Company continues to make progress on its efforts to integrate ETANCO into its operations and to realize previously identified offensive and defensive synergies in the years ahead. However, the Company expects these efforts will result in ongoing integration costs through 2023 and beyond.

Conference Call Details

Investors, analysts and other interested parties are invited to join the Company’s third quarter 2023 financial results conference call on Monday, October 23, 2023, at 5:00 pm Eastern Time (2:00 pm Pacific Time). To participate, callers may dial (877) 407-0792 (U.S. and Canada) or (201) 689-8263 (International) approximately 10 minutes prior to the start time. The call will be webcast simultaneously and can be accessed through https://viavidwebcastscom/startherejsp?ei=1634882&tp_key=4c1fcebd79 or a link on the Company’s website at ir.simpsonmfg.com. For those unable to participate during the live broadcast, a replay of the call will also be available beginning that same day at 8:00 p.m. Eastern Time until 11:59 p.m. Eastern Time on Monday, November 6, 2023 by dialing (844) 512–2921 (U.S. and Canada) or (412) 317–6671 (International) and entering the conference ID: 13741278. The webcast will remain posted on the Investor Relations section of Simpson's website at ir.simpsonmfg.com for 90 days.

A copy of this earnings release will be available prior to the call, accessible through the Investor Relations section of the Company's website at ir.simpsonmfg.com.

About Simpson Manufacturing Co., Inc.

Simpson Manufacturing Co., Inc., headquartered in Pleasanton, California, through its subsidiaries, including Simpson Strong-Tie Company Inc., designs, engineers and is a leading manufacturer of wood construction products, including connectors, truss plates, fastening systems, fasteners and shear walls, and concrete construction products, including adhesives, specialty chemicals, mechanical anchors, powder actuated tools and reinforcing fiber materials. The Company primarily supplies its building product solutions to both the residential and commercial markets in North America and Europe. The Company's common stock trades on the New York Stock Exchange under the symbol "SSD."

Copies of Simpson Manufacturing's Annual Report to Stockholders and its proxy statements and other SEC filings, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, are made available free of charge on the company's web site on the same day they are filed with the SEC. To view these filings, visit the Investor Relations section of the Company's web site at ir.simpsonmfg.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally can be identified by words such as "anticipate," "believe," "estimate," "expect," "intend," "plan," "outlook," "target," "continue," "predict," "project," "change," "result," "future," "will," "could," "can," "may," "likely," "potentially," or similar expressions. Forward-looking statements are all statements other than those of historical fact and include, but are not limited to, statements about future financial and operating results, our plans, objectives, business outlook, priorities, expectations and intentions, expectations for sales and market growth, comparable sales, earnings and performance, stockholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for services, share repurchases, our ongoing integration of ETANCO, our strategic initiatives, including the impact of these initiatives on our strategic and operational plans and financial results, and any statement of an assumption underlying any of the foregoing.

Forward-looking statements are subject to inherent uncertainties, risks and other factors that are difficult to predict and could cause our actual results to vary in material respects from what we have expressed or implied by these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those expressed in or implied by our forward-looking statements include the effect of global pandemics such as the COVID-19 pandemic and other widespread public health crisis and their effects on the global economy, the effects of inflation and labor and supply shortages, on our operations, the operations of our customers, suppliers and business partners, and our ongoing integration of ETANCO, as well as those discussed in the "Risk Factors" and " Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of our most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and other reports we file with the SEC.

We caution that you should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Readers are urged to carefully review and consider the various disclosures made in our reports filed with the SEC that advise of the risks and factors that may affect our business, results of operations and financial condition.

Simpson Manufacturing Co., Inc. and Subsidiaries

UNAUDITED Consolidated Condensed Statements of Operations

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net sales | $ | 580,084 | | | $ | 553,662 | | | $ | 1,712,093 | | | $ | 1,640,464 | |

| Cost of sales | 297,167 | | | 309,139 | | | 888,835 | | | 899,828 | |

| Gross profit | 282,917 | | | 244,523 | | | 823,258 | | | 740,636 | |

| Research and development and engineering expense | 24,751 | | | 17,084 | | | 67,035 | | | 49,892 | |

| Selling expense | 52,391 | | | 42,539 | | | 151,497 | | | 124,449 | |

| General and administrative expense | 64,793 | | | 60,319 | | | 197,267 | | | 172,511 | |

| Total operating expenses | 141,935 | | | 119,942 | | | 415,799 | | | 346,852 | |

| Acquisition and integration related costs | 785 | | | 1,866 | | | 4,086 | | | 14,681 | |

| Gain on disposal of assets | (16) | | | (100) | | | (223) | | | (1,227) | |

| Income from operations | 140,213 | | | 122,815 | | | 403,596 | | | 380,330 | |

| | | | | | | |

Interest income (expense), net and other | 1,292 | | | (2,983) | | | 18 | | | (6,568) | |

| Other & foreign exchange loss, net | (1,429) | | | (1,707) | | | (1,471) | | | (3,814) | |

| | | | | | | |

| | | | | | | |

| Income before taxes | 140,076 | | | 118,125 | | | 402,143 | | | 369,948 | |

| Provision for income taxes | 36,055 | | | 29,882 | | | 102,958 | | | 93,559 | |

| Net income | $ | 104,021 | | | $ | 88,243 | | | $ | 299,185 | | | $ | 276,389 | |

| Earnings per common share: | | | | | | | |

| Basic | $ | 2.44 | | | $ | 2.06 | | | $ | 7.01 | | | $ | 6.42 | |

| Diluted | $ | 2.43 | | | $ | 2.06 | | | $ | 6.98 | | | $ | 6.40 | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 42,673 | | | 42,813 | | | 42,651 | | | 43,044 | |

| Diluted | 42,882 | | | 42,916 | | | 42,893 | | | 43,173 | |

| Cash dividend declared per common share | $ | 0.27 | | | $ | 0.26 | | | $ | 0.80 | | | $ | 0.77 | |

| Other data: | | | | | | | |

| Depreciation and amortization | $ | 18,180 | | | $ | 16,197 | | | $ | 54,224 | | | $ | 44,521 | |

| | | | | | | |

| Pre-tax equity-based compensation expense | $ | 6,625 | | | $ | 3,546 | | | $ | 17,789 | | | $ | 12,986 | |

Simpson Manufacturing Co., Inc. and Subsidiaries

UNAUDITED Consolidated Condensed Balance Sheets

(In thousands)

| | | | | | | | | | | | | | | | | | | | |

| | September 30, | | December 31, |

| | 2023 | | 2022 | | 2022 |

| Cash and cash equivalents | | $ | 571,006 | | | $ | 309,262 | | | $ | 300,742 | |

| Trade accounts receivable, net | | 351,164 | | | 334,449 | | | 269,124 | |

| Inventories | | 504,446 | | | 540,020 | | | 556,801 | |

| | | | | | |

| Other current assets | | 45,052 | | | 48,416 | | | 52,583 | |

| Total current assets | | 1,471,668 | | | 1,232,147 | | | 1,179,250 | |

| Property, plant and equipment, net | | 382,508 | | | 341,233 | | | 361,555 | |

| Operating lease right-of-use assets | | 66,144 | | | 48,196 | | | 57,652 | |

| Goodwill | | 483,413 | | | 467,990 | | | 495,672 | |

| Intangible assets, net | | 356,450 | | | 330,533 | | | 362,917 | |

| Other noncurrent assets | | 48,773 | | | 84,159 | | | 46,925 | |

| Total assets | | $ | 2,808,956 | | | $ | 2,504,258 | | | $ | 2,503,971 | |

| Trade accounts payable | | $ | 95,267 | | | $ | 98,646 | | | $ | 97,841 | |

| Long-term debt, current portion | | 22,500 | | | 22,500 | | | 22,500 | |

| Accrued liabilities and other current liabilities | | 309,802 | | | 225,020 | | | 228,222 | |

| Total current liabilities | | 427,569 | | | 346,166 | | | 348,563 | |

| Operating lease liabilities, net of current portion | | 53,808 | | | 38,650 | | | 46,882 | |

| Long-term debt, net of current portion and issuance costs | | 539,072 | | | 660,164 | | | 554,539 | |

| Deferred income tax and other long-term liabilities | | 119,015 | | | 121,723 | | | 140,608 | |

| Stockholders' equity | | 1,669,492 | | | 1,337,555 | | | 1,413,379 | |

| Total liabilities and stockholders' equity | | $ | 2,808,956 | | | $ | 2,504,258 | | | $ | 2,503,971 | |

Simpson Manufacturing Co., Inc. and Subsidiaries

UNAUDITED Segment and Product Group Information

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Nine Months Ended | | |

| | September 30, | | % | | September 30, | | % |

| 2023 | | 2022 | | change* | | 2023 | | 2022 | | change* |

| Net Sales by Reporting Segment | | | | | | | | | | | |

| North America | $ | 456,820 | | $ | 437,770 | | 4.4% | | $ | 1,328,617 | | $ | 1,332,911 | | (0.3)% |

| Percentage of total net sales | 78.8 | % | | 79.1 | % | | | | 77.6 | % | | 81.3 | % | | |

| Europe | 119,043 | | 111,903 | | 6.4% | | 371,074 | | 296,592 | | 25.1% |

| Percentage of total net sales | 20.5 | % | | 20.2 | % | | | | 21.7 | % | | 18.1 | % | | |

| Asia/Pacific | 4,221 | | 3,989 | | 5.8% | | 12,402 | | 10,961 | | 13.1% |

| | | | | | | | | | | | |

| | $ | 580,084 | | $ | 553,662 | | 4.8% | | $ | 1,712,093 | | $ | 1,640,464 | | 4.4% |

| Net Sales by Product Group** | | | | | | | | | | | |

| Wood Construction | $ | 495,623 | | $ | 478,554 | | 3.6% | | $ | 1,468,585 | | $ | 1,428,745 | | 2.8% |

| Percentage of total net sales | 85.4 | % | | 86.4 | % | | | | 85.8 | % | | 87.1 | % | | |

| Concrete Construction | 84,141 | | 74,933 | | 12.3% | | 242,131 | | 211,119 | | 14.7% |

| Percentage of total net sales | 14.5 | % | | 13.5 | % | | | | 14.1 | % | | 12.9 | % | | |

| Other | 320 | | 175 | | 82.9% | | 1,377 | | 600 | | 129.3 |

| | $ | 580,084 | | $ | 553,662 | | 4.8% | | $ | 1,712,093 | | $ | 1,640,464 | | 4.4% |

| Gross Profit (Loss) by Reporting Segment | | | | | | | | | | | |

| North America | $ | 236,451 | | $ | 207,948 | | 13.7% | | $ | 680,218 | | $ | 645,166 | | 5.4% |

| North America gross margin | 51.8 | % | | 47.5 | % | | | | 51.2 | % | | 48.4 | % | | |

| Europe | 45,115 | | 35,215 | | 28.1% | | 139,538 | | 91,691 | | 52.2% |

| Europe gross margin | 37.9 | % | | 31.5 | % | | | | 37.6 | % | | 30.9 | % | | |

| Asia/Pacific | 1,771 | | 1,402 | | N/M | | 4,515 | | 3,948 | | N/M |

| Administrative and all other | (420) | | (42) | | N/M | | (1,013) | | (169) | | N/M |

| | $ | 282,917 | | $ | 244,523 | | 15.7% | | $ | 823,258 | | $ | 740,636 | | 11.2% |

| Income (Loss) from Operations | | | | | | | | | | | |

| North America | $ | 135,633 | | $ | 127,318 | | 6.5% | | $ | 393,456 | | $ | 400,336 | | (1.7)% |

| North America operating margin | 29.7 | % | | 29.1 | % | | | | 29.6 | % | | 30.0 | % | | |

| Europe | 15,450 | | 6,149 | | 151.3% | | 42,894 | | 10,339 | | 314.9% |

| Europe operating margin | 13.0 | % | | 5.5 | % | | | | 11.6 | % | | 3.5 | % | | |

| Asia/Pacific | 477 | | 234 | | N/M | | 718 | | 898 | | N/M |

| Administrative and all other | (11,347) | | (10,886) | | N/M | | (33,472) | | (31,243) | | N/M |

| | $ | 140,213 | | $ | 122,815 | | 14.2% | | $ | 403,596 | | $ | 380,330 | | 6.1% |

| | | | | | | | |

| * | Unfavorable percentage changes are presented in parentheses, if any. |

| ** | The Company manages its business by geographic segment but presents sales by product group as additional information. |

| N/M | Statistic is not material or not meaningful. |

CONTACT:

Addo Investor Relations

investor.relations@strongtie.com

(310) 829-5400

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

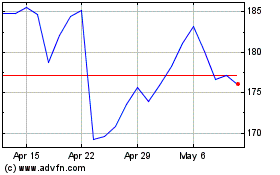

Simpson Manufacturing (NYSE:SSD)

Historical Stock Chart

From Apr 2024 to May 2024

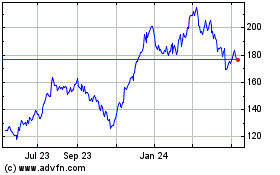

Simpson Manufacturing (NYSE:SSD)

Historical Stock Chart

From May 2023 to May 2024