Saul Centers Inc - Statement of Changes in Beneficial Ownership (4)

June 25 2008 - 4:08PM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Expires:

February 28, 2011

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934, Section 17(a) of the Public

Utility Holding Company Act of 1935 or Section 30(f) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

SAUL B FRANCIS II

|

2. Issuer Name

and

Ticker or Trading Symbol

SAUL CENTERS INC

[

BFS

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__

X

__ Director

__

X

__ 10% Owner

__

X

__ Officer (give title below)

_____ Other (specify below)

Chief Executive Officer

|

|

(Last)

(First)

(Middle)

7501 WISCONSIN AVENUE, 15TH FLOOR

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

6/24/2008

|

|

(Street)

BETHESDA, MD 20814

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Common Shares

|

|

|

|

|

|

|

|

1809.635

|

D

|

|

|

Common Shares

|

|

|

|

|

|

|

|

7620.625

|

I

(1)

|

See footnote

(1)

|

|

Common Shares

|

|

|

|

|

|

|

|

4072.379

|

I

(2)

|

See footnote

(2)

|

|

Common Shares

|

|

|

|

|

|

|

|

8320.625

|

I

(3)

|

See footnote

(3)

|

|

Common Shares

|

|

|

|

|

|

|

|

72278.436

|

I

(4)

|

See footnote

(4)

|

|

Common Shares

|

|

|

|

|

|

|

|

1441629.488

|

I

(5)

|

See footnote

(5)

|

|

Common Shares

|

|

|

|

|

|

|

|

267009.043

|

I

(6)

|

See footnote

(6)

|

|

Common Shares

|

|

|

|

|

|

|

|

434644.518

|

I

(7)

|

See footnote

(7)

|

|

Common Shares

|

|

|

|

|

|

|

|

35062.400

|

I

(8)

|

See footnote

(8)

|

|

Common Shares

|

|

|

|

|

|

|

|

225330.859

|

I

(9)

|

See footnote

(9)

|

|

Common Shares

|

|

|

|

|

|

|

|

658.679

|

I

(13)

|

See footnote

(13)

|

|

Common Shares

|

|

|

|

|

|

|

|

403725.618

|

I

(14)

|

See footnote

(14)

|

|

Common Shares

|

6/24/2008

|

|

S

|

|

1500000

|

D

|

$46.50

|

3412992.103

|

I

(15)

|

See footnote

(15)

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Stock Option

|

$25.78

|

|

|

|

|

|

|

4/26/2004

|

4/26/2014

|

Common Stock

|

2500

|

|

2500

|

D

|

|

|

Stock Option

|

$33.22

|

|

|

|

|

|

|

5/6/2005

|

5/6/2015

|

Common Stock

|

2500

|

|

2500

|

D

|

|

|

Phantom Stock

(12)

|

$53.49

(10)

|

|

|

|

|

|

|

(11)

|

(11)

|

Common Stock

|

138.343

|

|

16026.929

|

D

|

|

|

Stock Option

|

$40.35

|

|

|

|

|

|

|

5/1/2006

|

5/1/2016

|

Common Stock

|

2500

|

|

2500

|

D

|

|

|

Stock Option

|

$54.17

|

|

|

|

|

|

|

4/27/2007

|

4/27/2017

|

Common Stock

|

2500

|

|

2500

|

D

|

|

|

Units

|

$53.49

(16)

|

|

|

|

|

|

|

(16)

|

(16)

|

Common Stock

|

5416415

|

|

5416415

|

I

|

See footnote

(17)

|

|

Stock Option

|

$50.15

|

|

|

|

|

|

|

4/25/2008

|

4/25/2018

|

Common Stock

|

2500

|

|

2500

|

D

|

|

|

Explanation of Responses:

|

|

(

1)

|

Owned by the Elizabeth Willoughby Saul Trust, of which the reporting person is sole beneficiary. Ms. Saul is the daughter of the reporting person. The reporting person disclaims beneficial ownership of these shares.

|

|

(

2)

|

Owned by The Sharon Elizabeth Saul Trust, of which the reporting person is sole beneficiary. Ms. Saul is the daughter of the reporting person. The reporting person disclaims beneficial ownership of these shares.

|

|

(

3)

|

Owned by the Patricia English Saul Trust, of which the reporting person is sole beneficiary. Ms. Saul is the daughter of the reporting person. The reporting person disclaims beneficial ownership of these shares.

|

|

(

4)

|

Owned by Patricia E. Saul, the reporting person's spouse.

|

|

(

5)

|

Owned by The B.F. Saul Company Employees' Profit Sharing Reinvestment Trust (the "Pension Trust", a profit sharing retirement plan for the benefit of the employees of B.F. Saul Company and other participating employers. The Pension Trust is administered by four trustees, one of which is the reporting person. The reporting person disclaims benefical ownership of the securities in the Pension Trust that exceed his pecuniary interest in the Pension Trust.

|

|

(

6)

|

Owned by B.F. Saul Property Company, which is a wholly-owned subsidiary of B.F. Saul Company, of which the reporting person is Chairman of the Board and Chief Executive Officer.

|

|

(

7)

|

Owned by Dearborn, L.L.C., the sole member of which is B.F. Saul Real Estate Investment Trust, of which the reporting person is Chairman of the Board and the majority owner.

|

|

(

8)

|

Owned by Van Ness Square Corporation, of which the reporting person is Chairman of the Board and Chief Executive Officer.

|

|

(

9)

|

Owned by B.F. Saul Company, of which the reporting person is Chairman of the Board and Chief Executive Officer.

|

|

(

10)

|

1 for 1

|

|

(

11)

|

Under the terms of the reporting person's Deferred Fee Agreement, payment of shares of the issuer's common stock commences at such time as the reporting person ceases to be a director of the issuer. Payment will be a lump sum upon termination of directorship.

|

|

(

12)

|

Pursuant to the issuer's Deferred Compensation Plan under its 2004 Stock Plan and the Deferred Fee Agreement executed by the reporting person, the reporting person has elected to defer receipt of his director's fees, and receive phantom stock, the amount of which is calculated as the quotient of the dollar value of fees deferred, divided by the fair market value of the issuer's shares on the date the phantom stock is received.

|

|

(

13)

|

Owned by Avenel Executive Park, PH II L.L.C., the sole member of which is B.F. Saul Real Estate Investment Trust, of which the reporting person is Chairman of the Board and the majority owner.

|

|

(

14)

|

Owned by Westminster Investing Corporation, of which the reporting person is Chairman of the Board and Chief Executive Officer.

|

|

(

15)

|

Owned by B.F. Saul Real Estate Investment Trust, of which the reporting person is Chairman of the Board and the majority owner.

|

|

(

16)

|

Represents units of limited partnership interest of Saul Holdings Limited Partnership, of which the issuer is the general partner. Units are redeemable for an equal number of shares of the issuer's common stock. Subject to the restrictions on exercise discussed in the following sentence, units are exercisable at any time and have no expiration date. Units are only exercisable to the extent that such exercise would not cause the reporting person and certain affiliates to beneficially own collectively greater than 39.9% of the issuer's outstanding capital stock, as calculated pursuant to the issuer's Articles of Incorporation.

|

|

(

17)

|

Units are held by B.F. Saul Real Estate Investment Trust (2,550,866 units), Dearborn, L.L.C. (1,815,922 units), B.F. Saul Property Company (224,496 units), Avenel Executive Park Phase II, L.L.C. (10,967 units), Van Ness Square Corporation (574,111 units) and Westminster Investing Corporation (240,053 units).

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

SAUL B FRANCIS II

7501 WISCONSIN AVENUE

15TH FLOOR

BETHESDA, MD 20814

|

X

|

X

|

Chief Executive Officer

|

|

Signatures

|

|

Scott V. Schneider, by Power of Attorney

|

|

6/25/2008

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

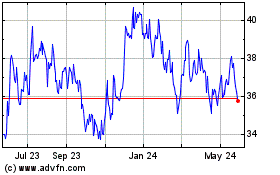

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

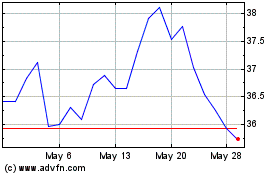

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jul 2023 to Jul 2024