Saul Centers, Inc. Reports First Quarter 2005 Earnings BETHESDA,

Md., May 4 /PRNewswire-FirstCall/ -- Saul Centers, Inc. (NYSE:BFS),

an equity real estate investment trust, announced its first quarter

2005 operating results. Total revenues for the quarter ended March

31, 2005 increased 15.1% to $30,307,000 compared to $26,341,000 for

the 2004 quarter. Operating income before minority interests and

preferred stock dividends increased 3.7% to $8,639,000 compared to

$8,329,000 for the comparable 2004 quarter. After preferred stock

dividends and minority interests, the Company reported net income

available to common stockholders of $4,610,000 or $0.28 per share

(basic & diluted) for the 2005 quarter, a per share increase of

3.7% compared to net income available to common stockholders of

$4,305,000 or $0.27 per share (basic & diluted) for the 2004

quarter. Overall same property revenues for the total portfolio

increased 4.3% for the 2005 first quarter compared to the same

quarter in 2004 and same property operating income increased 3.1%.

The same property comparisons exclude the results of operations of

properties not in operation for each of the comparable reporting

periods. Property operating income is calculated as total property

revenue less property operating expenses, provision for credit

losses and real estate taxes. Same center property operating income

in the shopping center portfolio increased 2.9% for the 2005 first

quarter, compared to the prior year's quarter, despite the

departure of two tenants, whose spaces combined total 152,000

square feet, and the resulting loss of revenues relating to these

tenants during the entire 2005 quarter. While these spaces

represent approximately 2.0% of the Company's total gross leaseable

area, the combined rent payments were less than 1.0% of the

Company's 2004 annual revenues. The loss of rental revenues from

these tenants at Great Eastern Plaza and Southside Plaza was more

than overcome by increased rental revenue from redevelopments of

portions of Thruway and Southdale and operations at the balance of

the Company's shopping center portfolio. Same property operating

income in the office portfolio grew 3.6% for the 2005 quarter, due

primarily to the completion of re-tenanting of space at 601

Pennsylvania Avenue, which was being prepared for new occupancy

during a portion of early 2004. As of March 31, 2005, 92.4% of the

portfolio was leased, compared to 94.2% a year earlier. On a same

property basis, 92.2% of the portfolio was leased, compared to the

prior year level of 94.2%. The comparative decrease in the 2005

same property leasing percentage is largely attributable to the

early departure of the two tenants at Great Eastern Plaza and

Southside Plaza. Funds From Operations (FFO) available to common

shareholders (after deducting preferred stock dividends) increased

11.7% to $12,254,000 in the 2005 first quarter compared to

$10,967,000 for the same quarter in 2004. The $1,287,000 increase

in FFO available to common shareholders in the 2005 quarter

resulted from the combination of (1) increased operating income

from retail acquisition and development properties and (2)

successful leasing efforts in the core portfolio, primarily at

Thruway, Southdale and 601 Pennsylvania Avenue. On a diluted per

share basis, FFO available to common shareholders increased 7.7% to

$0.56 per share in 2005 compared to $0.52 for the 2004 quarter.

FFO, a widely accepted non-GAAP financial measure of operating

performance for real estate investment trusts, is defined as net

income, plus minority interests, extraordinary items and real

estate depreciation and amortization, excluding gains and losses

from property sales. In March 2005, the Company acquired the

126,000 square foot Albertsons anchored, Palm Springs Center for a

purchase price of $17.5 million. This grocery anchored neighborhood

shopping center located in Altamonte Springs near Orlando is the

Company's second Florida center. The property is 100% leased and

includes tenants complementing Albertsons, such as Office Depot,

Mimi's Cafe and Toojay's Deli. Saul Centers is a self-managed,

self-administered equity real estate investment trust headquartered

in Bethesda, Maryland. Saul Centers currently operates and manages

a real estate portfolio of 41 community and neighborhood shopping

center and office properties totaling approximately 7.3 million

square feet of leaseable area. Over 80% of the Company's cash flow

is generated from properties in the metropolitan Washington,

DC/Baltimore area. Saul Centers, Inc. Condensed Consolidated

Balance Sheets ($ in thousands) March 31, December 31, 2005 2004

Assets (Unaudited) Real estate investments Land $125,308 $119,029

Buildings 536,327 521,161 Construction in progress 45,548 42,618

707,183 682,808 Accumulated depreciation (185,884) (181,420)

521,299 501,388 Cash and cash equivalents 11,668 33,561 Accounts

receivable and accrued income, net 21,270 20,654 Lease acquisition

costs, net 18,046 17,745 Prepaid expenses 1,862 2,421 Deferred debt

costs, net 6,093 5,011 Other assets 4,562 2,616 Total assets

$584,800 $583,396 Liabilities Mortgage notes payable $450,876

$453,646 Dividends and distributions payable 10,464 10,424 Accounts

payable, accrued expenses and other liabilities 13,106 12,318

Deferred income 7,787 6,044 Total liabilities 482,233 482,432

Stockholders' Equity Preferred stock 100,000 100,000 Common stock

165 164 Additional paid in capital 110,313 106,886 Accumulated

deficit (107,911) (106,086) Total stockholders' equity 102,567

100,964 Total liabilities and stockholders' equity $584,800

$583,396 Saul Centers, Inc. Condensed Consolidated Statements of

Operations (In thousands, except per share amounts) Three Months

Ended March 31, 2005 2004 Revenue (Unaudited) Base rent $24,132

$21,276 Expense Recoveries 4,980 3,894 Percentage Rent 504 444

Other 691 727 Total revenue 30,307 26,341 Operating Expenses

Property operating expenses 3,773 2,892 Provision for credit losses

54 69 Real estate taxes 2,583 2,391 Interest expense and deferred

debt amortization 7,409 6,266 Depreciation and amortization 5,615

4,638 General and administrative 2,234 1,756 Total operating

expenses 21,668 18,012 Operating Income 8,639 8,329 Minority

Interests (2,029) (2,024) Net Income 6,610 6,305 Preferred

Dividends (2,000) (2,000) Net Income Available to Common

Stockholders $4,610 $4,305 Per Share Net Income Available to Common

Stockholders : Basic and diluted $0.28 $0.27 Weighted average

common stock outstanding : Common stock 16,468 15,947 Effect of

dilutive options 89 27 Diluted weighted average common stock 16,557

15,974 Saul Centers, Inc. Supplemental Information (In thousands,

except per share amounts) Three Months Ended March 31, 2005 2004

(1) (Unaudited) Reconciliation of Net Income to Funds From

Operations (FFO) Net Income $6,610 $6,305 Add: Real property

depreciation & amortization 5,615 4,638 Add: Minority Interests

2,029 2,024 FFO 14,254 12,967 Less: Preferred dividends (2,000)

(2,000) FFO available to common shareholders $12,254 $10,967

Weighted average shares outstanding: Diluted weighted average

common stock 16,557 15,974 Convertible limited partnership units

5,201 5,190 Diluted & converted weighted average shares 21,758

21,164 Per Share Amounts: FFO available to common shareholders

$0.56 $0.52 Reconciliation of Net Income to Same Property Operating

Income Net Income $6,610 $6,305 Add: Interest expense and deferred

debt amortization 7,409 6,266 Add: Depreciation and amortization

5,615 4,638 Add: General and administrative 2,234 1,756 Less:

Interest income (140) (88) Add: Minority Interests 2,029 2,024

Property operating income 23,757 20,901 Less: Acquisitions &

developments (2,692) (479) Total same property operating income

$21,065 $20,422 Total Shopping Centers $14,417 $14,007 Total Office

Properties 6,648 6,415 Total same property operating income $21,065

$20,422 (1) FFO is a widely accepted non-GAAP financial measure of

operating performance of real estate investment trusts ("REITs").

FFO is defined by the National Association of Real Estate

Investment Trusts as net income, computed in accordance with GAAP,

plus minority interests, extraordinary items and real estate

depreciation and amortization, excluding gains or losses from

property sales. FFO does not represent cash generated from

operating activities in accordance with GAAP and is not necessarily

indicative of cash available to fund cash needs, which is disclosed

in the Consolidated Statements of Cash Flows in the Company's SEC

reports for the applicable periods. FFO should not be considered as

an alternative to net income, its most directly comparable GAAP

measure, as an indicator of the Company's operating performance, or

as an alternative to cash flows as a measure of liquidity.

Management considers FFO a supplemental measure of operating

performance and along with cash flow from operating activities,

financing activities and investing activities, it provides

investors with an indication of the ability of the Company to incur

and service debt, to make capital expenditures and to fund other

cash needs. FFO may not be comparable to similarly titled measures

employed by other REITs. DATASOURCE: Saul Centers, Inc. CONTACT:

Scott V. Schneider of Saul Centers, Inc., +1-301-986-6220 Web site:

http://www.saulcenters.com/

Copyright

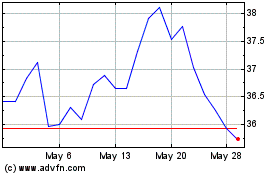

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

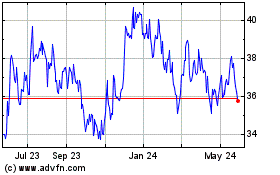

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jul 2023 to Jul 2024