Saul Centers, Inc. Reports Fourth Quarter and Annual 2004 Operating

Results BETHESDA, Md., Feb. 23 /PRNewswire-FirstCall/ -- Saul

Centers, Inc. (NYSE:BFS), an equity real estate investment trust

(REIT), announced its operating results for the quarter and year

ended December 31, 2004. Total revenues for the quarter ended

December 31, 2004 increased 13.2% to $29,569,000 compared to

$26,129,000 for the 2003 quarter. Operating income, defined as net

income available to common stockholders before gain on property

sold, minority interests and preferred stock dividends increased

9.3% to $8,256,000 compared to $7,556,000 for the comparable 2003

quarter. After preferred stock dividends, the Company reported net

income available to common stockholders of $4,228,000 or $0.26 per

share (basic & fully diluted) for the 2004 quarter, a per share

decrease of 7.1% compared to net income available to common

stockholders of $4,471,000 or $0.28 per share (basic & fully

diluted) for the 2003 quarter. Increased operating income in the

2004 fourth quarter was more than offset by (1) a full quarter of

preferred stock dividends in 2004 ($2,000,000) versus a partial

quarter in 2003 ($1,244,000); (2) increased accounting and

administrative expenses related primarily to new Sarbanes-Oxley

documentation and compliance requirements; and (3) the 2003 fourth

quarter gain of $182,000 resulting from the State of Maryland's

condemnation and purchase of a piece of land at Avenel Business

Park for improvement of an interchange on I-270, adjacent to the

property. Overall same property revenues for the total portfolio

increased 2.3% for the 2004 fourth quarter compared to the same

quarter in 2003 and same property operating income increased 2.8%.

The same property comparisons exclude the results of operations of

properties not in operation for each of the comparable reporting

periods. Property operating income is calculated as total property

revenue less property operating expenses, provision for credit

losses and real estate taxes. Same center operating income in the

shopping center portfolio decreased 2.2% for the 2004 fourth

quarter, due primarily to a $425,000 lease termination fee

collected from a former shopping center tenant in the prior year's

quarter. Same property operating income in the office portfolio

grew 14.9% for the 2004 quarter, due primarily to the completion of

lease-up of space and new tenant occupancy at 601 Pennsylvania

Avenue contributing an incremental $240,000, and the collection of

a lease termination fee and a payment from a former bankrupt tenant

at Avenel Business Park and a lease termination fee at Washington

Square totaling a combined $264,000. Excluding the impact of 601

Pennsylvania Avenue, overall portfolio same property operating

growth was 1.8% for the 2004 quarter. For the year ended December

31, 2004, total revenues increased 15.3% to $112,842,000 compared

to $97,884,000 for the 2003 year. Operating income before gain on

property sold, minority interests and preferred stock dividends

increased 24.2% to $33,707,000 compared to $27,146,000 for the 2003

year. After preferred stock dividends, the Company reported net

income available to common stockholders of $18,174,000 or $1.13 per

share (basic) and $1.12 per share (fully diluted) for the 2004

year, resulting in a fully diluted per share decrease of 2.6%

compared to net income available to common stockholders of

$17,998,000 or $1.15 per share (basic & fully diluted) for the

2003 year. Increased operating income in the 2004 year was more

than offset by (1) a full year of preferred stock dividends in 2004

($8,000,000) versus a partial year in 2003 ($1,244,000); (2)

increased personnel expenses particularly related to the Company's

acquisition and development program; and (3) increased accounting

and administrative expenses related primarily to new Sarbanes-Oxley

documentation and compliance requirements. Overall same property

revenues for the total portfolio increased 4.2% for the 2004 year

compared to the 2003 year and same property operating income

increased 5.0%. Same center operating income in the shopping center

portfolio increased 2.2% for the 2004 year. Same property operating

income in the office portfolio grew 11.2% for the 2004 year, due

primarily to the completion of lease-up of space and new tenant

occupancy at 601 Pennsylvania Avenue. Excluding the impact of 601

Pennsylvania Avenue, overall portfolio same property operating

income growth was 2.5% for the 2004 year. As of December 31, 2004,

93.9% of the portfolio was leased, compared to 94.4% a year

earlier. On a same property basis, 94.0% of the portfolio was

leased, compared to the prior year level of 94.4%. The comparative

decrease in the year end 2004 same property leasing percentage is

largely attributable to the departure of a 39,000 square foot local

grocer at Southside Plaza in suburban Richmond, Virginia. Funds

From Operations (FFO) available to common shareholders (after

deducting preferred stock dividends) increased 7.2% to $12,084,000

in the 2004 fourth quarter compared to $11,274,000 for the same

quarter in 2003. The $810,000 increase in FFO available to common

shareholders in the 2004 quarter resulted from the combination of

(1) increased operating income from retail acquisition and

development properties and (2) successful leasing efforts in the

core portfolio, primarily at 601 Pennsylvania Avenue; offset in

part by the payment of $2,000,000 (compared to $1,244,000 for a

portion of the 2003 quarter) in preferred dividends relating to the

November 2003 offering. On a fully diluted per share basis, FFO

available to common shareholders increased 3.7% to $.56 per share

in 2004 compared to $.54 for the 2003 quarter. FFO available to

common shareholders for the 2004 year increased by $3,291,000

(7.5%) to $47,031,000. Fully diluted per share FFO available to

common shareholders increased 4.8% to $2.20 per share in 2004

compared to $2.10 for the 2003 year. FFO, a widely accepted

non-GAAP financial measure of operating performance for real estate

investment trusts, is defined as net income plus minority

interests, extraordinary items and real estate depreciation and

amortization, excluding gains and losses from property sales. Saul

Centers is a self-managed, self-administered equity real estate

investment trust headquartered in Bethesda, Maryland. Saul Centers

currently operates and manages a real estate portfolio of 40

community and neighborhood shopping center and office properties

totaling approximately 7.2 million square feet of leasable area.

Over 80% of the Company's cash flow is generated from properties in

the metropolitan Washington, DC/Baltimore area. Saul Centers, Inc.

Condensed Consolidated Balance Sheets ($ in thousands) December 31,

December 31, 2004 2003 Assets (Unaudited) Real estate investments

Land $119,029 $82,256 Buildings 521,161 436,371 Construction in

progress 42,618 33,488 682,808 552,115 Accumulated depreciation

(181,420) (164,823) 501,388 387,292 Cash and cash equivalents

33,561 45,244 Accounts receivable and accrued income, net 20,654

14,642 Lease acquisition costs, net 17,745 15,344 Prepaid expenses

2,421 2,609 Deferred debt costs, net 5,011 4,224 Other assets 2,616

2,261 Total assets $583,396 $471,616 Liabilities Mortgage notes

payable $453,646 $357,248 Dividends and distributions payable

10,424 9,454 Accounts payable, accrued expenses and other

liabilities 12,318 7,793 Deferred income 6,044 4,478 Total

liabilities 482,432 378,973 Stockholders' Equity Preferred stock

100,000 100,000 Common stock 164 159 Additional paid in capital

106,886 91,469 Accumulated deficit (106,086) (98,985) Total

stockholders' equity 100,964 92,643 Total liabilities and

stockholders' equity $583,396 $471,616 Saul Centers, Inc. Condensed

Consolidated Statements of Operations (In thousands, except per

share amounts) Three Months Ended Year Ended December 31, December

31, 2004 2003 2004 2003 Revenue (Unaudited) (Unaudited) Base rent

$23,774 $20,434 $91,125 $78,167 Expense Recoveries 4,352 3,965

16,712 14,438 Percentage Rent 491 593 1,635 1,695 Other 952 1,137

3,370 3,584 Total revenue 29,569 26,129 112,842 97,884 Operating

Expenses Property operating expenses 3,122 3,102 12,070 11,363

Provision for credit losses 189 53 488 171 Real estate taxes 2,585

2,189 9,789 8,580 Interest expense and deferred debt amortization

7,114 6,449 27,022 26,573 Depreciation and amortization 5,828 4,962

21,324 17,838 General and administrative 2,475 1,818 8,442 6,213

Total operating expenses 21,313 18,573 79,135 70,738 Operating

Income 8,256 7,556 33,707 27,146 Gain on property disposition - 182

572 182 Minority Interests (2,028) (2,023) (8,105) (8,086) Net

Income 6,228 5,715 26,174 19,242 Preferred Dividends (2,000)

(1,244) (8,000) (1,244) Net Income Available to Common Stockholders

$4,228 $4,471 $18,174 $17,998 Per Share Amounts: Net income

available to common stockholders (basic) $0.26 $0.28 $1.13 $1.15

Net income available to common stockholders (fully diluted) $0.26

$0.28 $1.12 $1.15 Weighted average common stock outstanding: Common

stock 16,352 15,817 16,154 15,591 Effect of dilutive options 100 25

57 17 Fully diluted weighted average common stock 16,452 15,842

16,211 15,608 Saul Centers, Inc. Supplemental Information

(Unaudited) (In thousands, except per share amounts) Three Months

Ended Year Ended December 31, December 31, 2004 2003 2004 2003

Reconciliation of Net Income to Funds From Operations (FFO) (1) Net

Income $6,228 $5,715 $26,174 $19,242 Less: Gain on sale of property

- (182) (572) (182) Add: Real property depreciation &

amortization 5,828 4,962 21,324 17,838 Add: Minority Interests

2,028 2,023 8,105 8,086 FFO 14,084 12,518 55,031 44,984 Less:

Preferred dividends (2,000) (1,244) (8,000) (1,244) FFO available

to common shareholders $12,084 $11,274 $47,031 $43,740 Weighted

average shares outstanding: Fully diluted weighted average common

stock 16,452 15,842 16,211 15,608 Convertible limited partnership

units 5,198 5,187 5,194 5,182 Fully diluted & converted

weighted average shares 21,650 21,029 21,405 20,790 Per Share

Amounts: FFO available to common shareholders $0.56 $0.54 $2.20

$2.10 Reconciliation of Net Income to Same Property Operating

Income Net Income $6,228 $5,715 $26,174 $19,242 Add: Interest

expense and deferred debt amortization 7,114 6,449 27,022 26,573

Add: Depreciation and amortization 5,828 4,962 21,324 17,838 Add:

General and administrative 2,475 1,818 8,442 6,213 Less: Gain on

property disposition - (182) (572) (182) Less: Interest income (82)

(53) (257) (91) Add: Minority Interests 2,028 2,023 8,105 8,086

Property operating income 23,591 20,732 90,238 77,679 Less:

Acquisitions & developments (2,834) (537) (9,684) (985) Total

same property operating income $20,757 $20,195 $80,554 $76,694

Total Shopping Centers $14,014 $14,328 $53,997 $52,811 Total Office

Properties 6,743 5,867 26,557 23,883 Total same property operating

income $20,757 $20,195 $80,554 $76,694 (1) FFO is a widely accepted

non-GAAP financial measure of operating performance of real estate

investment trusts ("REITs"). FFO is defined by the National

Association of Real Estate Investment Trusts as net income,

computed in accordance with GAAP, plus minority interests,

extraordinary items and real estate depreciation and amortization,

excluding gains or losses from property sales. FFO does not

represent cash generated from operating activities in accordance

with GAAP and is not necessarily indicative of cash available to

fund cash needs, which is disclosed in the Consolidated Statements

of Cash Flows in the Company's SEC reports for the applicable

periods. FFO should not be considered as an alternative to net

income, its most directly comparable GAAP measure, as an indicator

of the Company's operating performance, or as an alternative to

cash flows as a measure of liquidity. Management considers FFO a

supplemental measure of operating performance and along with cash

flow from operating activities, financing activities and investing

activities, it provides investors with an indication of the ability

of the Company to incur and service debt, to make capital

expenditures and to fund other cash needs. FFO may not be

comparable to similarly titled measures employed by other REITs.

DATASOURCE: Saul Centers, Inc. CONTACT: Scott V. Schneider of Saul

Centers, Inc., +1-301-986-6220 Web site:

http://www.saulcenters.com/

Copyright

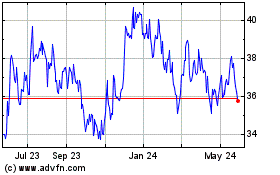

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

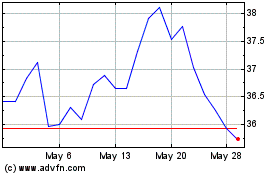

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jul 2023 to Jul 2024