Current Report Filing (8-k)

December 22 2020 - 4:40PM

Edgar (US Regulatory)

0001040829

false

0001040829

2020-12-22

2020-12-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 22, 2020 (December 22, 2020)

RYMAN HOSPITALITY PROPERTIES, INC.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

|

1-13079

|

|

73-0664379

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

One Gaylord Drive

Nashville, Tennessee

|

37214

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number,

including area code: (615) 316-6000

(Former name or former address, if changed

since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on

Which Registered

|

|

Common Stock, par value $.01

|

|

RHP

|

|

New York Stock Exchange

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a)

of the Exchange Act. ¨

|

ITEM 1.01

|

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

|

On December 22,

2020 (the “Effective Date”), Ryman Hospitality Properties, Inc. (the “Company”) entered into Amendment

No. 2 (the “Second Amendment”) to the Sixth Amended and Restated Credit Agreement dated as of October 31,

2019 (the “Existing Credit Agreement”), among the Company, as a guarantor, its subsidiary RHP Hotel Properties, LP

(the “Borrower”), as borrower, certain other subsidiaries of the Company party thereto, as guarantors (the “Guarantors”),

certain subsidiaries of the Company party thereto, as pledgors, the lenders party thereto and Wells Fargo Bank, National Association,

as administrative agent (collectively, the “Lender Parties”), as amended by Amendment No. 1 to the Existing Credit

Agreement, effective as of April 23, 2020 (the “First Amendment”).

The Second Amendment

provides for certain amendments to the Existing Credit Agreement as amended by the First Amendment, including the following:

|

|

·

|

The continued waiver of all financial covenants in the Existing Credit Agreement through April 1, 2022 (the “Extended

Temporary Waiver Period”);

|

|

|

·

|

Confirmation of the Company’s continued ability to borrow the remaining amounts available

under the Company’s revolving credit facility (subject to the minimum liquidity covenant described below);

|

|

|

·

|

Continuation of the covenant that the Company must maintain unrestricted liquidity (in the form

of unrestricted cash on hand or undrawn availability under the Company’s revolving credit facility) of at least $100 million

until the Company demonstrates financial covenant compliance following the expiration or earlier termination of the Extended Temporary

Waiver Period (the “Restricted Period”);

|

|

|

·

|

Continuation of certain negative covenants and restrictions (as modified by the provisions of Sections

3(e) through 3(l) of the Second Amendment), including but not limited to limitations on additional indebtedness, investments,

dividends, share repurchases and capital expenditures during the Restricted Period;

|

The leverage-based

interest rate pricing grid in the Existing Credit Agreement, which is based on the ratio of the Company’s consolidated funded

indebtedness to total asset value, has been revised to provide that during the Restricted Period:

|

|

·

|

Outstanding borrowings under the $700 million revolving credit facility portion of the Existing Credit Agreement will bear

interest at an annual rate equal to, at the Borrower’s option, either (a) a designated London Inter-bank (“LIBO”)

or LIBO replacement) rate (as defined in the Existing Credit Agreement) plus an applicable margin of 1.95% (increasing to 2.25%

for the period from April 1, 2021 through the end of the Restricted Period), or (b) a designated base rate (as defined

in the Existing Credit Agreement) plus an applicable margin of 0.95% (increasing to 1.25% for the period from April 1, 2021

through the end of the Restricted Period); and

|

|

|

·

|

Outstanding borrowings under the $300 million term loan A portion of the Existing Credit Agreement will bear interest at an

annual rate equal to, at the Borrower’s option, either (a) a designated LIBO (or LIBO replacement) rate (as defined

in the Existing Credit Agreement) plus an applicable margin of 1.90% (increasing to 2.25% for the period from April 1, 2021

through the end of Restricted Period) or (b) a designated base rate (as defined in the Existing Credit Agreement) plus an

applicable margin of 0.90% (increasing to 1.25% for the period from April 1, 2021 through the end of the Restricted Period).

|

The Company may

elect to terminate the Extended Temporary Waiver Period prior to expiration. Upon the expiration or earlier termination of the

Extended Temporary Waiver Period, financial covenant compliance under the Existing Credit Agreement will be calculated as follows:

|

|

·

|

For the first quarter following expiration or earlier termination of the Extended Temporary Waiver Period, the Company will

be required to satisfy the following financial covenants (as such covenants are defined in the Existing Credit Agreement), using

a designated annualized calculation based on the Company’s most recently completed fiscal quarter, as applicable and as outlined

in Section 3(i) of the Second Amendment:

|

|

Consolidated Funded Indebtedness to Total Asset Value:

|

70%

|

|

|

|

|

Consolidated Fixed Charge Coverage Ratio:

|

1:1

|

|

|

|

|

Implied Debt Service Coverage Ratio:

|

1.1:1

|

|

|

·

|

Thereafter, the Company will be required to satisfy financial covenants at the levels set forth in the Existing Credit Agreement

using a designated annualized calculation based on the Company’s most recently completed fiscal quarters, as applicable and

as outlined in Section 3(j) of the Second Amendment.

|

No additional revolving credit advances

were made at closing. The Company is required to use any proceeds from borrowings drawn during the Restricted Period to fund operating

expenses, debt service of the Company and its subsidiaries and permitted capital expenditures and investments (as such restrictions

were modified by the Second Amendment).

|

ITEM 2.03

|

CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT.

|

The information set

forth above in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

|

ITEM 7.01

|

REGULATION FD DISCLOSURE.

|

On December 22,

2020, the Company issued a press release announcing the completion of the Second Amendment. A copy of the press release is furnished

herewith as Exhibit 99.1 and is incorporated herein by reference.

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS.

|

|

|

|

|

(d)

|

Exhibits

|

|

|

|

|

10.1

|

Amendment No. 2 to Sixth Amended and Restated Credit Agreement, dated December 22, 2020,

among Ryman Hospitality Properties, Inc., as a guarantor, RHP Hotel Properties, LP, as borrower, certain other subsidiaries

of Ryman Hospitality Properties, Inc. party thereto, as guarantors, certain subsidiaries of Ryman Hospitality Properties, Inc.

party thereto, as pledgors, the lenders party thereto and Wells Fargo Bank, National Association, as administrative agent.

|

|

|

|

|

99.1

|

Press

Release of Ryman Hospitality Properties, Inc. dated December 22, 2020.

|

|

|

|

|

104

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

RYMAN HOSPITALITY PROPERTIES, INC.

|

|

|

|

|

|

Date: December 22, 2020

|

By:

|

/s/

Scott J. Lynn

|

|

|

Name:

|

Scott

J. Lynn

|

|

|

Title:

|

Executive Vice President, General Counsel and Secretary

|

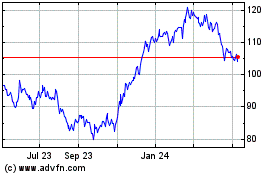

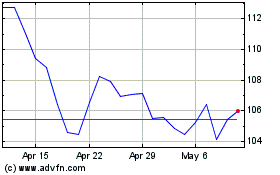

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jul 2023 to Jul 2024