Rogers, Shaw to Combine in $16 Billion Deal -- Update

March 15 2021 - 9:47AM

Dow Jones News

By Dave Sebastian

Rogers Communications Inc. has agreed to buy Shaw Communications

Inc. for about 20 billion Canadian dollars, equivalent to roughly

$16 billion, combining two Canadian communications companies as

they seek to invest in Canada's rollout of fifth-generation

wireless service.

The cash purchase price, at C$40.50 a share, reflects a premium

of about 69.5% to Shaw's closing price Friday. The Shaw family will

receive 23.6 million Class B shares of Rogers as part of the deal,

making it one of the combined company's largest shareholders, the

companies said.

The combined entity will invest C$2.5 billion in 5G networks

over the next five years across Western Canada, a move they said

would help close the digital divide between urban and rural

communities.

The companies said they will continue offering wireless plans

without overage fees, and Rogers won't increase wireless prices for

Freedom Mobile customers for at least three years after the

transaction's closing, expected in the first half of 2022.

The deal could lead to savings of more than C$1 billion a year

within two years of closing and add to earnings and cash flow per

share of the first year after closing, the companies said. Out of

the deal, Rogers said it anticipates lower wholesale charges and

network costs, as well as the elimination of duplicative technology

and infrastructure.

Two members of the Shaw family will join Rogers's board,

including Shaw Executive Chairman and Chief Executive Brad Shaw,

the companies said. Mr. Shaw's father, JR Shaw, founded the company

more than 50 years ago under the name Capital Cable Television

Co.

"Without a doubt, my father would be proud of this moment,

combining forces with the company founded by his old friend to

deliver more Canadians world class connectivity, more choice, and

better value," Mr. Shaw said.

Toronto-based Rogers said it would spend an additional C$3

billion for network, services and technology investments. It will

also create a C$1 billion fund for connecting rural, remote and

indigenous communities to high-speed internet in four Western

Canadian provinces, Rogers said.

The broadband and wireless investments will create up to 3,000

net new jobs in Western Canada, the companies said. The Western

head office of the combined company will remain at Shaw Court in

Calgary, with the president of Western operations and other senior

roles to be based there, the companies said. The combined company

will have 10,000 people across Alberta, British Columbia, Manitoba

and Saskatchewan, they said.

Michael Dabaie contributed to this article.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

March 15, 2021 09:32 ET (13:32 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

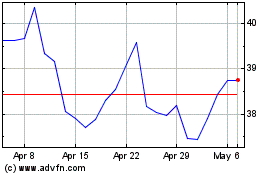

Rogers Communications (NYSE:RCI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Rogers Communications (NYSE:RCI)

Historical Stock Chart

From Jan 2024 to Jan 2025