UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

September

2024

Commission File Number: 001-38230

QUDIAN INC.

Tower A, AVIC Zijin Plaza,

Siming District, Xiamen, Fujian Province 361000,

China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

TABLE OF CONTENTS

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

QUDIAN INC. |

| |

|

|

| |

By: |

/s/ Min Luo |

|

| |

|

|

|

| |

Name: |

Min Luo |

| |

Title: |

Chairman and Chief Executive Officer |

Date: September 6, 2024

Exhibit 99.1

Qudian Inc. Reports

Second Quarter 2024

Unaudited Financial

Results

XIAMEN, China,

September 6, 2024/PRNewswire/ -- Qudian Inc. (“Qudian” or “the Company” or “We”) (NYSE: QD),

a consumer-oriented technology company in China, today announced its unaudited financial results for the quarter ended June 30,

2024.

Second Quarter

2024 Financial Highlights:

| ● | Total

revenues were RMB53.3 million (US$7.3 million), compared to RMB11.1 million for the same

period of last year |

| ● | Net

income attributable to Qudian’s shareholders was RMB99.8 million (US$13.7 million),

compared to net loss of RMB76.9 million for the same period of last year; net income per

diluted ADS was RMB0.53 (US$0.07) for the second quarter of 2024 |

| ● | Non-GAAP

net income attributable to Qudian’s shareholders was RMB99.8 million (US$13.7 million),

compared to Non-GAAP net loss of RMB76.9 million for the same period of last year. We exclude

share-based compensation expenses from our non-GAAP measures. Non-GAAP net income per diluted

ADS was RMB0.53 (US$0.07) for the second quarter of 2024 |

The

Company’s last-mile delivery business has made steady progress in 2024, which generated approximately RMB46.2 million in revenue

in second quarter of 2024, compared to RMB4.3 million for the second quarter of 2023. Moving forward,

the Company expects to remain steadfast in its commitment to executing its business transition and simultaneously maintaining prudent

cash management to safeguard its balance sheet.

Second Quarter

Financial Results

Sales

income and others increased to RMB53.3 million (US$7.3 million), which was mostly attributable

to sales income generated by last-mile delivery business, compared with RMB11.1 million for the second quarter of 2023, which was mainly

attributable to sales income generated by QD Food business. We have completely wound down the QD Food business in 2023.

Total

operating costs and expenses increased to RMB110.8 million (US$15.2 million) from RMB106.7

million for the second quarter of 2023.

Cost

of revenues increased to RMB46.2 million (US$6.4 million) from RMB12.7 million for the second

quarter of 2023, primarily due to the increase in service cost related to last-mile delivery business.

General

and administrative expenses decreased by 27.9% to RMB47.2 million (US$6.5 million) from RMB65.4

million for the second quarter of 2023, primarily due to the reduce in professional services fees after the Company completed research

and consultation for last-mile delivery business in its early stage.

Research

and development expenses increased by 53.4% to RMB15.2 million (US$2.1 million) from RMB9.9

million for the second quarter of 2023, primarily due to the increase in staff head count as the Company continues to explore new business

opportunities, which led to a corresponding increase in staff salaries.

Loss

from operations was RMB57.4 million (US$7.9 million), compared to RMB94.1 million for the

second quarter of 2023.

Interest

and investment income, net increased to RMB89.5 million (US$12.3 million) from RMB6.8 million

for the second quarter of 2023, primarily attributable to the increase of income from investments in the second quarter of 2024.

Gain

on derivative instrument increased to RMB58.4 million (US$8.0 million) from RMB10.4 million

for the second quarter of 2023, mainly attributable to the increase in quoted price of the underlying equity securities relating to the

derivative instruments we held.

Net

income attributable to Qudian’s shareholders was RMB99.8 million (US$13.7 million),

compared to net loss attributable to Qudian’s shareholders of RMB76.9 million in the second quarter of 2023. Net income per diluted

ADS was RMB0.53 (US$0.07).

Non-GAAP net

income attributable to Qudian’s shareholders was RMB99.8 million (US$13.7 million), compared to Non-GAAP net loss attributable

to Qudian’s shareholders of RMB75.5 in the second quarter of 2023. Non-GAAP net income per diluted ADS was RMB0.53 (US$0.07).

Cash Flow

As of June 30,

2024, the Company had cash and cash equivalents of RMB4,849.0 million (US$667.2 million) and restricted cash

of RMB52.0 million (US$7.2 million).

For

the second quarter of 2024, net cash used in operating activities was RMB1,184.3 million (US$163.0 million), mainly due to payments for

labor-related costs and expenses and purchase of time and structured deposit. Net cash used in investing

activities was RMB898.1 million (US$123.6 million), mainly due to purchase of short-term investments and purchase of property and equipment

for the construction of the Company’s innovation park. Net cash used in financing activities was RMB114.4 million (US$15.7 million),

mainly due to the repurchase of ordinary shares.

Last-mile

Delivery Business

In response to

the surging demand for cross-border e-commerce transactions, the Company has proactively sought innovative logistic services and solutions

to meet global consumers’ expectations for swift and top-tier delivery services. In December 2022, the Company launched its

last-mile delivery services under the brand name of “Fast Horse.” The business was initially launched on a trial basis and

has gradually achieved meaningful scale in Australia during the second quarter of 2023. As of the date of this release, the Company’s

last-mile delivery service is available in Australia and New Zealand.

Update on

Share Repurchase

As previously

disclosed, the Company established a share repurchase program in June 2022, under which the Company may purchase up to US$200 million

worth of its Class A ordinary shares and/or ADSs over a 24-month period. From the launch of the share repurchase program on June 13,

2022 to June 12, 2024, the Company has in aggregate purchased 64.3 million ADSs in the open market for a total amount of approximately

US$113.0 million (an average price of $1.8 per ADS) pursuant to the share repurchase program.

Our Board approved

a share repurchase program in March 2024 to purchase up to US$300 million worth of Class A ordinary shares or ADSs in the next

36 months starting from June 13, 2024. From the launch of the share repurchase program on June 13, 2024 to September 3,

2024, the Company has in aggregate purchased 4.3 million ADSs in the open market for a total amount of approximately US$8.0 million (an

average price of $1.9 per ADS) pursuant to the share repurchase program.

As of September 3,

2024, the Company has in aggregate purchased 158.6 million ADSs for a total amount of approximately US$702.3 million (an average price

of $4.4 per ADS).

About Qudian

Inc.

Qudian Inc. ("Qudian")

is a consumer-oriented technology company. The Company historically focused on providing credit solutions to consumers. Qudian is exploring

innovative logistics services to satisfy consumers' demand for e-commerce transactions by leveraging its technology capabilities.

For

more information, please visit http://ir.qudian.com.

Use of Non-GAAP

Financial Measures

We use Non-GAAP

net income/loss attributable to Qudian’s shareholders, a Non-GAAP financial measure, in evaluating our operating results and for

financial and operational decision-making purposes. We believe that Non-GAAP net income/loss attributable to Qudian’s shareholders

helps identify underlying trends in our business by excluding the impact of share-based compensation expenses, which are non-cash charges.

We believe that Non-GAAP net income/loss attributable to Qudian’s shareholders provides useful information about our operating

results, enhances the overall understanding of our past performance and future prospects and allows for greater visibility with respect

to key metrics used by our management in its financial and operational decision-making.

Non-GAAP net

income/loss attributable to Qudian’s shareholders is not defined under U.S. GAAP and is not presented in accordance with U.S. GAAP.

This Non-GAAP financial measure has limitations as an analytical tool, and when assessing our operating performance, cash flows or our

liquidity, investors should not consider them in isolation, or as a substitute for net loss /income, cash flows provided by operating

activities or other consolidated statements of operation and cash flow data prepared in accordance with U.S. GAAP.

We mitigate these

limitations by reconciling the Non-GAAP financial measure to the most comparable U.S. GAAP performance measure, all of which should be

considered when evaluating our performance.

For more information

on this Non-GAAP financial measure, please see the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results"

set forth at the end of this press release.

Exchange Rate

Information

This announcement

contains translations of certain RMB amounts into U.S. dollars ("US$") at specified rates solely for the convenience of the

reader. Unless otherwise stated, all translations from RMB to US$ were made at the rate of RMB7.2672 to US$1.00, the noon buying rate

in effect on June 28, 2024, in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that

the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular rate or at all.

Statement

Regarding Preliminary Unaudited Financial Information

The unaudited

financial information set out in this earnings release is preliminary and subject to potential adjustments. Adjustments to the consolidated

financial statements may be identified when audit work has been performed for the Company's year-end audit, which could result in significant

differences from this preliminary unaudited financial information.

Safe Harbor

Statement

This announcement

contains forward-looking statements. These statements are made under the "safe harbor" provisions of the United States Private

Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will,"

"expects," "anticipates," "future," "intends," "plans," "believes," "estimates"

and similar statements. Among other things, the expectation of its collection efficiency and delinquency, contain forward-looking statements.

Qudian may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders,

in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements

that are not historical facts, including statements about Qudian's beliefs and expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained

in any forward-looking statement, including but not limited to the following: Qudian's goal and strategies; Qudian's expansion plans;

Qudian's future business development, financial condition and results of operations; Qudian's expectations regarding demand for, and

market acceptance of, its products; Qudian's expectations regarding keeping and strengthening its relationships with customers, business

partners and other parties it collaborates with; general economic and business conditions; and assumptions underlying or related to any

of the foregoing. Further information regarding these and other risks is included in Qudian's filings with the SEC. All information provided

in this press release and in the attachments is as of the date of this press release, and Qudian does not undertake any obligation to

update any forward-looking statement, except as required under applicable law.

For investor

and media inquiries, please contact:

In China:

Qudian Inc.

Tel: +86-592-596-8208

E-mail:

ir@qudian.com

QUDIAN INC.

Unaudited

Condensed Consolidated Statements of Operations

| | |

Three months ended June 30, | |

(In thousands except for number

of shares and per-share data) | |

2023 | | |

2024 | |

| | |

| | |

(Unaudited) | | |

(Unaudited) | |

| | |

RMB | | |

RMB | | |

US$ | |

| Revenues: | |

| | | |

| | | |

| | |

| Sales income and others | |

| 11,088 | | |

| 53,328 | | |

| 7,338 | |

| Total revenues | |

| 11,088 | | |

| 53,328 | | |

| 7,338 | |

| Operating cost and expenses: | |

| | | |

| | | |

| | |

| Cost of revenues | |

| (12,667 | ) | |

| (46,248 | ) | |

| (6,364 | ) |

| Sales and marketing | |

| - | | |

| (1,054 | ) | |

| (145 | ) |

| General and administrative | |

| (65,419 | ) | |

| (47,165 | ) | |

| (6,490 | ) |

| Research and development | |

| (9,918 | ) | |

| (15,219 | ) | |

| (2,094 | ) |

| Expected credit reversal for receivables and other assets | |

| (17,313 | ) | |

| (751 | ) | |

| (103 | ) |

| Impairment loss from other assets | |

| (1,343 | ) | |

| (387 | ) | |

| (53 | ) |

| Total operating cost and expenses | |

| (106,660 | ) | |

| (110,824 | ) | |

| (15,249 | ) |

| Other operating income | |

| 1,470 | | |

| 119 | | |

| 16 | |

| | |

| | | |

| | | |

| | |

| Loss from operations | |

| (94,102 | ) | |

| (57,377 | ) | |

| (7,895 | ) |

| Interest and investment income, net | |

| 6,798 | | |

| 89,485 | | |

| 12,314 | |

| Gain from equity method investments | |

| 2,661 | | |

| 820 | | |

| 113 | |

| Gain on derivative instruments | |

| 10,434 | | |

| 58,376 | | |

| 8,033 | |

| Foreign exchange loss, net | |

| (42 | ) | |

| (1,186 | ) | |

| (163 | ) |

| Other income | |

| 16,622 | | |

| 714 | | |

| 98 | |

| Other expenses | |

| (308 | ) | |

| (342 | ) | |

| (47 | ) |

| Net (loss)/income before income taxes | |

| (57,937 | ) | |

| 90,490 | | |

| 12,453 | |

| Income tax (expenses)/benefit | |

| (18,928 | ) | |

| 9,297 | | |

| 1,279 | |

| Net (loss)/income | |

| (76,865 | ) | |

| 99,787 | | |

| 13,732 | |

| Net (loss)/income attributable to Qudian Inc.'s shareholders | |

| (76,865 | ) | |

| 99,787 | | |

| 13,732 | |

| | |

| | | |

| | | |

| | |

| (Loss)/Earnings per share for Class A and Class B ordinary shares: | |

| | | |

| | | |

| | |

| Basic | |

| (0.34 | ) | |

| 0.54 | | |

| 0.07 | |

| Diluted | |

| (0.34 | ) | |

| 0.53 | | |

| 0.07 | |

| | |

| | | |

| | | |

| | |

| (Loss)/Earnings per ADS (1 Class A ordinary share equals 1 ADSs): | |

| | | |

| | | |

| | |

| Basic | |

| (0.34 | ) | |

| 0.54 | | |

| 0.07 | |

| Diluted | |

| (0.34 | ) | |

| 0.53 | | |

| 0.07 | |

| | |

| | | |

| | | |

| | |

| Weighted average number of Class A and Class B ordinary shares outstanding: | |

| | | |

| | | |

| | |

| Basic | |

| 223,467,498 | | |

| 184,571,121 | | |

| 184,571,121 | |

| Diluted | |

| 226,379,819 | | |

| 189,684,527 | | |

| 189,684,527 | |

| Other comprehensive income: | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| 65,401 | | |

| 14,489 | | |

| 1,994 | |

| Total comprehensive (loss)/income | |

| (11,464 | ) | |

| 114,276 | | |

| 15,726 | |

| Total comprehensive (loss)/income attributable to Qudian Inc.'s shareholders | |

| (11,464 | ) | |

| 114,276 | | |

| 15,726 | |

QUDIAN INC.

Unaudited Condensed Consolidated Balance Sheets

| | |

As of March 31, | | |

As of June 30, | |

(In thousands except for number

of shares and per-share data) | |

2024 | | |

2024 | |

| | |

| | |

(Unaudited) | | |

(Unaudited) | |

| | |

RMB | | |

RMB | | |

US$ | |

| ASSETS: | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 7,039,968 | | |

| 4,849,019 | | |

| 667,247 | |

| Restricted cash | |

| 53,644 | | |

| 51,984 | | |

| 7,153 | |

| Time and structured deposit | |

| 1,624,612 | | |

| 2,948,606 | | |

| 405,742 | |

| Short-term investments | |

| 316,526 | | |

| 1,091,177 | | |

| 150,151 | |

| Accounts receivables | |

| 36,149 | | |

| 39,418 | | |

| 5,424 | |

| Other current assets | |

| 733,375 | | |

| 615,275 | | |

| 84,664 | |

| Total current assets | |

| 9,804,274 | | |

| 9,595,479 | | |

| 1,320,381 | |

| Non-current assets: | |

| | | |

| | | |

| | |

| Right-of-use assets | |

| 162,276 | | |

| 163,246 | | |

| 22,463 | |

| Investment in equity method investee | |

| 149,750 | | |

| 150,691 | | |

| 20,736 | |

| Long-term investments | |

| 210,436 | | |

| 210,448 | | |

| 28,959 | |

| Property and equipment, net | |

| 1,340,884 | | |

| 1,410,125 | | |

| 194,040 | |

| Intangible assets | |

| 2,929 | | |

| 2,764 | | |

| 380 | |

| Other non-current assets | |

| 622,008 | | |

| 469,476 | | |

| 64,602 | |

| Total non-current assets | |

| 2,488,283 | | |

| 2,406,750 | | |

| 331,180 | |

| TOTAL ASSETS | |

| 12,292,557 | | |

| 12,002,229 | | |

| 1,651,561 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Short-term lease liabilities | |

| 19,884 | | |

| 19,789 | | |

| 2,723 | |

| Derivative instruments-liability | |

| 343,743 | | |

| 248,228 | | |

| 34,157 | |

| Accrued expenses and other current liabilities | |

| 327,459 | | |

| 202,856 | | |

| 27,914 | |

| Income tax payable | |

| 97,647 | | |

| 25,947 | | |

| 3,571 | |

| Total current liabilities | |

| 788,733 | | |

| 496,820 | | |

| 68,365 | |

| Non-current liabilities: | |

| | | |

| | | |

| | |

| Long-term lease liabilities | |

| 49,688 | | |

| 51,432 | | |

| 7,077 | |

| Total non-current liabilities | |

| 49,688 | | |

| 51,432 | | |

| 7,077 | |

| Total liabilities | |

| 838,421 | | |

| 548,252 | | |

| 75,442 | |

| Shareholders' equity: | |

| | | |

| | | |

| | |

| Class A Ordinary shares | |

| 132 | | |

| 132 | | |

| 18 | |

| Class B Ordinary shares | |

| 44 | | |

| 44 | | |

| 6 | |

| Treasury shares | |

| (1,082,373 | ) | |

| (1,196,636 | ) | |

| (164,663 | ) |

| Additional paid-in capital | |

| 4,031,610 | | |

| 4,031,438 | | |

| 554,744 | |

| Accumulated other comprehensive loss | |

| (55 | ) | |

| 14,434 | | |

| 1,986 | |

| Retained earnings | |

| 8,504,778 | | |

| 8,604,565 | | |

| 1,184,028 | |

| Total shareholders' equity | |

| 11,454,136 | | |

| 11,453,977 | | |

| 1,576,119 | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | |

| 12,292,557 | | |

| 12,002,229 | | |

| 1,651,561 | |

| QUDIAN INC. |

| Unaudited Reconciliation of GAAP And Non-GAAP Results |

| | |

Three months ended June 30, | |

| | |

2023 | | |

2024 | |

(In thousands except for number

of shares and per-share data) | |

| | |

(Unaudited) | | |

(Unaudited) | |

| | |

RMB | | |

RMB | | |

US$ | |

| Total net (loss)/income attributable to Qudian Inc.'s shareholders | |

| (76,865 | ) | |

| 99,787 | | |

| 13,732 | |

| Add: Share-based compensation expenses | |

| 1,335 | | |

| 1 | | |

| 0 | |

| Non-GAAP net (loss)/income attributable to Qudian Inc.'s shareholders | |

| (75,530 | ) | |

| 99,788 | | |

| 13,732 | |

| | |

| | | |

| | | |

| | |

| Non-GAAP net (loss)/income per share—basic | |

| (0.34 | ) | |

| 0.54 | | |

| 0.07 | |

| Non-GAAP net (loss)/income per share—diluted | |

| (0.34 | ) | |

| 0.53 | | |

| 0.07 | |

| Weighted average shares outstanding—basic | |

| 223,467,498 | | |

| 184,571,121 | | |

| 184,571,121 | |

| Weighted average shares outstanding—diluted | |

| 226,379,819 | | |

| 189,684,527 | | |

| 189,684,527 | |

Exhibit 99.2

Qudian Inc. Announces

Change of Auditor

XIAMEN, China,

September 6, 2024/PRNewswire/ -- Qudian Inc. (“Qudian” or “the Company” or “We”) (NYSE: QD),

a consumer-oriented technology company, today announced the appointment of BDO China Shu Lun Pan Certified Public Accountants LLP (“BDO”)

as the Company’s independent registered public accounting firm, effective on September 6, 2024.

BDO succeeds

Ernst & Young Hua Ming LLP (“EY”), which previously was the independent auditor providing audit services to the

Company. The change of the Company’s independent auditor was made after careful consideration and was approved by the Audit Committee

and the Board of Directors of the Company. The decision to change auditor was not as a result of any disagreement between the Company

and EY on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures.

EY’s audit

reports on the Company’s consolidated financial statements as of and for the years ended December 31, 2022 and 2023 did not

contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting

principles.

During each of

the years ended December 31, 2022 and 2023, and during the subsequent interim period through September 6, 2024, there have

been (i) no disagreements (as defined in Item 16F(a)(1)(iv) of Form 20-F and the related instructions thereto) with EY

on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements,

if not resolved to the satisfaction of EY, would have caused EY to make reference to the subject matter of the disagreements in connection

with its reports on the consolidated financial statements for such years, and (ii) no reportable events (as defined in Item 16F(a)(1)(v) of

Form 20-F).

During the Company’s

two most recent fiscal years ended December 31, 2023, and during the subsequent interim period prior to the engagement of BDO on

September 6, 2024, neither the Company nor anyone acting on its behalf consulted with BDO on either (a) the application of

accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on

the Company’s financial statements, and neither a written report nor oral advice was provided to the Company by BDO that BDO concluded

was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue,

or (b) any matter that was the subject of a disagreement, as that term is defined in Item 16F(a)(1)(iv) of Form 20-F (and

the related instructions thereto) or a reportable event as set forth in Item 16F(a)(1)(v) of Form 20-F.

The Company is

working closely with EY and BDO to ensure a seamless transition.

The Board of

Directors of the Company would like to express its sincere gratitude to EY for its professionalism and quality of services rendered to

the Company over the past few years.

About Qudian

Inc.

Qudian is a consumer-oriented

technology company. The Company historically focused on providing credit solutions to consumers. Qudian is exploring innovative logistics

services to satisfy consumers’ demand for e-commerce transactions by leveraging its technology capabilities.

Safe Harbor

Statement

This announcement

contains forward-looking statements. These statements are made under the “safe harbor” provisions of the United States Private

Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,”

“expects,” “anticipates,” “future,” “intends,” “plans,” “believes,”

“estimates” and similar statements. Among other things, the expectation of its collection efficiency and delinquency, contain

forward-looking statements. Qudian may also make written or oral forward-looking statements in its periodic reports to the SEC, in its

annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or

employees to third parties. Statements that are not historical facts, including statements about Qudian's beliefs and expectations, are

forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual

results to differ materially from those contained in any forward-looking statement, including but not limited to the following: Qudian's

goal and strategies; Qudian's expansion plans; Qudian's future business development, financial condition and results of operations; Qudian's

expectations regarding demand for, and market acceptance of, its products; Qudian's expectations regarding keeping and strengthening

its relationships with customers, business partners and other parties it collaborates with; general economic and business conditions;

and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Qudian's

filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release,

and Qudian does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor

and media inquiries, please contact:

In China:

Qudian Inc.

Tel: +86-592-596-8208

E-mail: ir@qudian.com

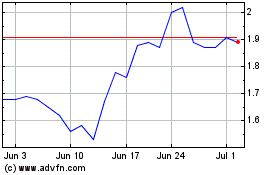

Qudian (NYSE:QD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Qudian (NYSE:QD)

Historical Stock Chart

From Dec 2023 to Dec 2024