Few current retirees take a new job in their golden years—but

more than half of future retirees expect to continue working during

retirement, driven by uncertainty about Social Security and their

own financial preparedness, a new study from PGIM Investments

reveals. PGIM Investments is the global manufacturer and fund

distributor of PGIM, Inc., the $1 trillion global investment

management business of Prudential Financial, Inc. (NYSE: PRU).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20180710005020/en/

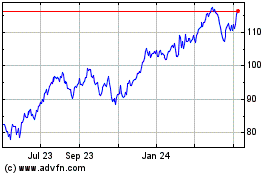

Expected sources of income in retirement.

(Graphic: Business Wire)

The study, the 2018 Retirement Preparedness Study: A

Generational Challenge, commissioned by PGIM Investments and

conducted by The Harris Poll, found that while only 6 percent of

today’s retirees work, 52 percent of pre-retiree Baby Boomers,

58 percent of pre-retiree Gen Xers, and 43 percent of

pre-retiree Millennials expect to take on a full- or part-time job

during retirement. These expectations may be linked to

pre-retirees’ decreased reliance on Social Security—for example,

only 51 percent of Millennials expect to receive these benefits at

all.

“While changes in retirement expectations are often driven by

pure economics, these study results also suggest a mind shift in

how people are thinking about retirement. However, pre-retirees’

actions don’t always back up their goals,” said Stuart Parker,

president and CEO of PGIM Investments. “To help them bridge this

gap, the asset management industry will need to rethink the way

that it does business and bring products and services in line with

changing customer needs.”

According to PGIM Investments’ study:

The “dream retirement” is changing

- Pre-retirees are more likely to base

their decision about when to retire on their wealth rather than

their age with half of Gen Xers and 62 percent of Millennials

saying they will retire when they have saved enough money.

Current retirees decided when to retire largely based on their age

and eligibility for Social Security and pensions.

- Millennials are more likely to start

a business in retirement (20 percent) than Gen Xers

(9 percent) or Boomers (four percent). Nearly four in 10

pre-retirees (39 percent) say they want to volunteer after they

retire.

- More than half (51 percent) of

current retirees say they’re “living the dream.”

On average, these individuals started saving six years earlier

than other retirees. Compared with those who aren’t living their

dream retirement, these individuals are more likely to have

pensions and diversified sources of income. They also are more

likely to have been able to retire at their planned retirement

age.

Pre-retirees need to evolve their saving habits

Recently, trustees for Social Security announced that the

program is operating at a deficit and will need to pull money from

its reserves for the first time since 1982. Pre-retirees may not be

prepared to fill the gap, PGIM Investments’ study finds:

- Social Security benefits are the

most critical source of income for 61 percent of retirees.

By comparison, only 70 percent of Gen Xers and 51 percent of

Millennials expect Social Security benefits when they retire.

- Millennials are least likely to rely

on Social Security for retirement income and are more heavily

invested in cash and less invested in equities; nearly one in

three aren’t saving for retirement at all.

- More than half (53 percent) of

pre-retirees are unsure how much they need for retirement. Gen

Xers have the highest estimates of the savings they need, but

almost one in five aren’t saving for retirement at all.

- Pre-retirees need to expect the

unexpected—51 percent of retirees say they retired earlier than

expected. Of that group, half say they retired more than five

years earlier than planned. In many cases, the reasons were

involuntary, including health problems (29% of the early retirees),

layoffs or restructurings (14%), the need to care for a loved one

(13%), and the inability to find a new job (10%).

To address growing consumer need for retirement income planning,

Prudential Financial, along with 23 other leading financial

services organizations, established the Alliance for Lifetime

Income to help educate Americans about the value of having

protected income in retirement.

For more study results, download the report: 2018 Retirement

Preparedness Study: A Generational Challenge.

About the study

A total of 1,514 interviews were conducted online by The Harris

Poll from Jan. 18 through Feb. 1, 2018, among U.S. residents age 21

and over, employed full-time, part-time, self-employed, a

stay-at-home spouse or retired, and a primary or shared financial

decision maker for their household. Results were weighted

separately to bring them in line with their actual proportions in

the population.

About PGIM Investments

PGIM Investments offers more than 100 funds globally across a

broad spectrum of asset classes and investment styles. Clients can

also choose from a variety of investment vehicles including

closed-end funds and target date funds such as the Prudential Day

One Mutual Fund series. All products draw on PGIM’s globally

diversified investment platform that encompasses the expertise of

managers across fixed income, equities and real estate.

About PGIM and Prudential Financial Inc.

With 15 consecutive years of positive third-party institutional

net flows, PGIM is the global investment management business of

Prudential Financial, Inc. (NYSE: PRU)— a top-10 investment manager

globally according to Pensions & Investments’ 2018 Top Money

Managers List, with more than $1 trillion in assets under

management as of March 31, 2018. PGIM’s businesses offer a range of

investment solutions for retail and institutional investors around

the world across a broad range of asset classes, including

fundamental equity, quantitative equity, public fixed income,

private fixed income, real estate and commercial mortgages. Its

businesses have offices in 16 countries across four continents. For

more information, please visit pgim.com.

Prudential’s additional businesses offer a variety of products

and services, including life insurance, annuities and

retirement-related services. For more information about Prudential,

please visit news.prudential.com.

This material is being provided for informational or educational

purposes only and does not take into account the investment

objectives or financial situation of any client or prospective

clients. The information is not intended as investment advice and

is not a recommendation about managing or investing your retirement

savings. Clients seeking information regarding their particular

investment needs should contact a financial professional.

The target date is the approximate date when investors plan to

retire and may begin withdrawing their money. The asset allocation

of the target date funds will become more conservative until the

date which is ten years prior to the target date by lessening the

equity exposure and increasing the exposure in fixed income

investments. The principal value of an investment in a target date

fund is not guaranteed at any time, including the target date.

There is no guarantee that the fund will provide adequate

retirement income. A target date fund should not be selected solely

based on age or retirement date. Before investing, participants

should carefully consider the fund's investment objectives, risks,

charges and expenses, as well as their age, anticipated retirement

date, risk tolerance, other investments owned, and planned

withdrawals.

The Prudential Day One Funds may be offered as mutual funds.

You should consider the investment objectives, risks, charges and

expenses of each fund carefully before investing. The prospectus

and summary prospectus contain this and other information about the

fund. Contact your financial professional for a prospectus and

summary prospectus. Read them carefully before investing.

Shares of the registered mutual funds are offered through

Prudential Investment Management Services LLC (PIMS), Newark, NJ, a

Prudential Financial company.

Investing involves risks. Some investments have more risk than

others. The investment return and principal value will fluctuate

and the investment, when sold, may be worth more or less than the

original cost and it is possible to lose money.

© 2018 Prudential Financial, Inc. and its related entities.

Prudential, the Prudential logo, the Rock symbol, Prudential Day

One, PGIM and the PGIM logo are service marks of Prudential

Financial, Inc. and its related entities, registered in many

jurisdictions worldwide.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180710005020/en/

MEDIA:Kristin Meza,

973-367-4104kristin.meza@prudential.com

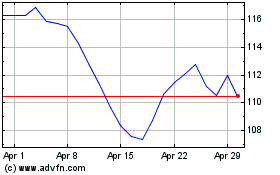

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Jul 2023 to Jul 2024