Pitney Bowes' New Cash Tender Offers - Analyst Blog

March 12 2013 - 2:50PM

Zacks

Pitney Bowes

Inc. (PBI) announced a cash tender

offer for some of its Notes. These include any or all of its 4.875%

Medium-Term Notes due 2014, 5.000% Notes due 2015 and 4.750%

Medium-Term Notes due 2016. All these notes are issued by Pitney

Bowes.

In addition to the terms and conditions set by the company’s

Offer to Purchase dated Feb 26, 2013, and the related Letter of

Transmittal, the company has also expressed its intentions to start

a new offer and sell new debt securities through an underwritten

public offering.

Unless extended or terminated earlier, the offer will expire on

Mar 25, 2013. The proceeds from the new debt security issue along

with the company’s cash in hand will be utilized to finance the

buyback of the notes validly tendered.

Currently, there is a $1350 million aggregate principal amount

of Notes outstanding that the company intends to buy. The revised

maximum series tender cap for the notes were $0.2 billion for the

2014 notes, $0.14 billion for the 2015 notes and $ 0.075 billion

for the 2016 notes.

As per the tender offer, the holders who surrender their notes

at or prior to 5 p.m., New York City time, on Mar 11, 2013 (unless

extended), will be qualified to receive the ‘Total Consideration’

on the notes, indicating an early tender payment of $30 per $1,000

principal amount of the Notes on all such notes.

For notes tendered after the Early Tender Date but prior to 5

p.m., New York City time, on Mar 25, 2013 (unless extended),

holders will be eligible to receive only the applicable Total

Consideration, less the applicable Early Tender Payment on the

Settlement Date.

Goldman Sachs & Co. (GS), and J.P.

Morgan Securities (JPM) are the joint dealer manager

agents for the Tender Offers. Additionally, Global Bondholder

Services Corporation is acting as solicitation and information

agent for the Offers.

During the last few quarters the company has been incurring huge

capital expenditure, which significantly affected its free cash

flow balance. Free cash flow was also impacted by higher working

capital requirements, due to the timing of disbursements and less

of a benefit from finance receivables. The continuing economic

uncertainty remains a matter of concern.

A sizeable portion of Pitney Bowes’ total borrowings have been

issued in the commercial paper markets. Although Pitney Bowes

continues to have unencumbered access to these markets, the current

economic uncertainties may affect its borrowing power.

Given its deteriorating cash flows and aggressive capex plans,

it makes sense for PBI to cut down its debt as a part of its

capital management plan. The resultant extension of maturities

would also support its cash balances.

Pitney Bowes currently has a Zacks Rank #4 (Sell), so it might

not be a good stock to consider at the moment. However, some other

companies that are worth looking into include Tyco

International (TYC) which has a Zacks Rank #2 (Buy) and

Symantec Corp. (SYMC), which has a Zacks Rank #1

(Strong Buy).

GOLDMAN SACHS (GS): Free Stock Analysis Report

JPMORGAN CHASE (JPM): Free Stock Analysis Report

PITNEY BOWES IN (PBI): Free Stock Analysis Report

SYMANTEC CORP (SYMC): Free Stock Analysis Report

TYCO INTL LTD (TYC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

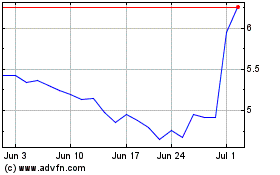

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

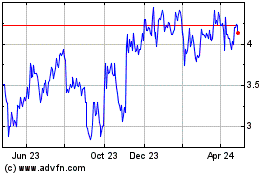

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jul 2023 to Jul 2024