PG&E Planned Trading Curbs Jar Investors -- WSJ

February 26 2019 - 3:02AM

Dow Jones News

By Peg Brickley

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 26, 2019).

An indication from PG&E Corp. that it might restrict trading

in its debt has set alarm bells ringing among distressed investing

funds that have swarmed around the California utility's

mega-billion-dollar bankruptcy case.

Papers filed in U.S. Bankruptcy Court in San Francisco in recent

days warn of threats to the market where PG&E's bonds are being

bought and sold if the utility pursues one of many potential paths

to getting out of chapter 11.

Valuable tax breaks could be at risk if there is too much

trading in PG&E's debt, which could trip triggers in Internal

Revenue Service rules, the company said. Some $4 billion in net

operating losses are available to offset taxable income but, under

the tax code, that could be reduced if too much stock or debt

changes hands. PG&E is asking a judge to consider limiting the

trading action, and bondholders are fighting back.

"The requested relief not only directly impairs the rights and

interests of the claimholders, it also threatens market liquidity,"

wrote lawyers for an unofficial committee of unsecured bondholders.

The official committee that represents all unsecured creditors,

including bondholders, said PG&E is moving too soon to head off

a threat that may never materialize, and trampling creditors'

rights in the process.

"The relief requested today may cast a shadow of uncertainty,

create an overhang on the market and trading of the senior notes

and disrupt the trading or liquidity of the senior notes," BOKF

N.A., a trustee for more than $17 billion in bond debt, said in a

separate filing.

PG&E wants the right to set limits on major trades in debt,

as well as stock, to safeguard against tax-law restrictions on

change in ownership. The company hasn't determined the shape of its

bankruptcy exit plan, but it is possible creditors could be given

stock in exchange for their debt, which could affect the calculus

for ownership changes.

The proposed trading restrictions will be up for review this

week, at the San Francisco utility's second major court hearing

after its January decision to file for chapter 11 protection. A

representative for the company declined to comment.

Hit with lawsuits from thousands of people with damage claims

stemming from years of wildfires, PG&E filed for bankruptcy

without a clear path to get out. It is expected to reorganize, but

the form of that reorganization is up in the air.

PG&E's bankruptcy has multiple moving parts, from figuring

out the wildfire damages to dealing with big power contracts. Each

dispute will be an investment opportunity for traders, a chance to

make money as prices rise and fall in response to developments in

the courtroom.

One of the first names to pop up on PG&E's court docket in

San Francisco was Seth Klarman's Baupost Group LLC, a hedge fund

that made hundreds of millions of dollars trading in Westinghouse

Electric Co.'s debt during the company's bankruptcy case. Not far

behind was Paul Singer's Elliott Management Corp., another hedge

fund adept at profiting from trades in the debt of bankrupt

companies.

Business claims, too, will be traded during PG&E's

bankruptcy, as suppliers owed money by the utility look to limit

their risk by selling their bankruptcy claims to distressed

investors amassing stakes.

It is against that backdrop that PG&E is asking preapproval

for trade limits that will only kick in if its path out of chapter

11 is one that will set off complex triggers in federal tax

law.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

February 26, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

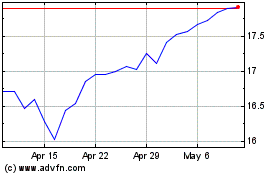

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2024 to May 2024

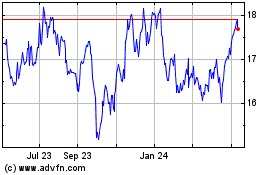

PG&E (NYSE:PCG)

Historical Stock Chart

From May 2023 to May 2024