Pfizer Shares Drive Dow Higher

July 22 2020 - 2:11PM

Dow Jones News

By Joe Wallace and Karen Langley

A climb in shares of Pfizer boosted the Dow Jones Industrial

Average Wednesday after the US. government agreed to pay the

drugmaker and partner BioNTech to secure doses of their

experimental Covid-19 vaccine.

The blue-chip index gained 0.3%, or about 68 points. The S&P

500 added 0.3%, while the Nasdaq Composite edged down 0.1%.

Pfizer rose 4.2%. Under the $1.95 billion agreement, the U.S.

will receive 100 million doses of the vaccine, if it is cleared by

regulators, and could also acquire another 500 million doses. The

vaccine is set to enter late-stage testing this month.

Investors have welcomed any signs of progress toward a vaccine

that could allow economic activity to resume without a subsequent

rise in infections. Drugmakers stand poised to benefit: The U.S.

also has vaccine deals with other companies including

AstraZeneca.

"The experts were telling us, back in February, March and April,

it's going to be five years before we see a vaccine, and here we

are with some possible good news on vaccine that's going to hit

this year," said Phil Orlando, chief equity market strategist at

Federated Hermes. "I think the market is taking that very

favorably."

Corporate earnings remained a key focus for investors Wednesday,

with some of the technology companies that have driven much of the

stock market's recovery since March due to report quarterly

results. Investors will get fresh cues about the outlook for the

sector when Microsoft, whose shares have risen 34% in 2020, reports

results for its fourth quarter after the close of trading.

"For Microsoft, expectations are probably quite high," said Hani

Redha, a portfolio manager at PineBridge Investments. "There will

be some sense of how well cloud [computing] in particular has

fared."

Tesla is also due to release earnings Wednesday. The

electric-vehicle maker's shares have soared in recent months, in

part on increased expectations that it will report a fourth

straight quarterly profit. That could qualify Tesla for inclusion

in the S&P 500.

Shares in Snap dropped 6.4% after the company reported slowing

revenue growth for the second quarter. Shares in Spotify Technology

rose 5.9% after The Wall Street Journal reported that the streaming

company had reached a new licensing agreement with Vivendi's

Universal Music Group.

HCA Healthcare's shares gained 11% after the company reported

higher profit in the second quarter.

Wednesday's moves came after China's Foreign Ministry said the

U.S. had instructed China to close its consulate in Houston. That

raised the specter of an escalation in tensions between the world's

two largest economies and prompted Beijing to condemn the move as

outrageous and unprecedented.

The rising tension weighed on markets overseas. The regional

Stoxx Europe 600 index fell 0.9%. Hong Kong's flagship Hang Seng

Index dropped 2.3%.

"On the face of it, like the scale of the virus, this is a very

serious development," said Richard McGuire, head of rates strategy

at Rabobank. "Sentiment has been knocked, but only modestly, given

this further escalation of tensions between two of the world's

superpowers."

President Trump this month dimmed hopes of a phase-two trade

deal with China, saying the relationship between the two countries

had been too badly damaged by the pandemic.

Among investors' other concerns: Senate Majority Leader Mitch

McConnell said Tuesday that Congress is unlikely to pass a new

fiscal stimulus bill quickly. The White House and Senate

Republicans are struggling to bridge divisions on a payroll-tax

cut, school funding and other issues.

In a sign of investors' continued caution, the yield on 10-year

Treasury notes slipped to 0.589%, according to Tradeweb, from

0.606% Tuesday. The drop in yields suggests fund managers expect

tepid inflation and weak growth.

"The bond market is much more pessimistic than the equity

market, and I think the equity market is right," said Patrik Lang,

head of equity research at Swiss private bank Julius Baer. China's

quick economic recovery shows U.S. growth could also pick up

quickly once coronavirus is under control, according to Mr.

Lang.

--Xie Yu contributed to this article.

Write to Joe Wallace at Joe.Wallace@wsj.com and Karen Langley at

karen.langley@wsj.com

(END) Dow Jones Newswires

July 22, 2020 13:56 ET (17:56 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

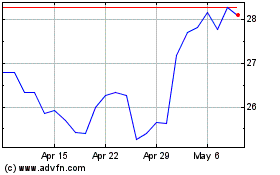

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024