false

0001745916

0001745916

2023-11-28

2023-11-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 28, 2023

PennyMac

Financial Services, Inc.

(Exact name of registrant as specified in

its charter)

| Delaware |

001-38727 |

83-1098934 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

| 3043 Townsgate Road, Westlake Village, California |

91361 |

| (Address of principal executive offices) |

(Zip Code) |

(818) 224-7442

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

PFSI |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

As

previously disclosed in the periodic reports of PennyMac Financial Services, Inc. (the “Company”), on November 5,

2019, Black Knight Servicing Technologies, LLC (“BKST”) filed a Complaint and Demand for Jury Trial in the Fourth Judicial

Circuit Court in and for Duval County, Florida (the “Florida State Court”), captioned Black Knight Servicing Technologies,

LLC v. PennyMac Loan Services, LLC (“PLS”), Case No. 2019-CA-007908 (the “BK Complaint”). Allegations

contained within the BK Complaint included breach of contract and misappropriation of MSP® System trade secrets in order to develop

an imitation mortgage-processing system intended to replace the MSP® System. The BK Complaint sought damages for breach of contract

and misappropriation of trade secrets in excess of $340 million, injunctive relief under the Florida Uniform Trade Secrets Act

(the “FUTSA”) and declaratory judgment of ownership of all intellectual property and software developed by or on behalf of

PLS as a result of its wrongful use of and access to the MSP® System and related trade secret and confidential information. On March 30,

2020, the Florida State Court granted a motion to compel arbitration filed by PLS.

On

November 28, 2023, the arbitrator issued an interim award (the “Interim Award”) granting in part and denying in part

BKST’s breach of contract claim and denying BKST’s claim of trade secrets misappropriation under the FUTSA. The arbitrator

awarded BKST damages in the amount of $155,230,792, the amount of which represents six years of avoided license fees, plus prejudgment

interest and reasonable attorney fees, but denied all of BKST’s claims for injunctive and declaratory relief. Accordingly, all intellectual

property and software developed by or on behalf of PLS, including PLS’ loan servicing technology known as Servicing Systems Environment,

or SSE, remain the proprietary technology of PLS, free and clear of any restrictions on use. The Interim

Award is subject to statutory periods allowing either party to move to correct or modify the Interim

Award or move to vacate the Interim Award before it is confirmed in the Florida State Court. As a result, there can be no certainty that

the Interim Award will not be subject to change.

Item 7.01 Regulation FD Disclosure.

The Company expects

to record an accrual for the Interim Award that will be reflected in its financial results for the fourth quarter of fiscal year 2023 as

further disclosed in Exhibit 99.1 and incorporated herein by reference.

The information in Item 7.01 of this Current Report on Form 8-K,

including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, or otherwise subject to the liabilities of Section 18, nor shall it be deemed incorporated by reference into

any disclosure document relating to the Company, except to the extent, if any, expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report on Form 8-K and

Exhibit 99.1 hereto contain “forward-looking statements”, including statements regarding the Interim Award and the ongoing

proceedings relating thereto. Forward-looking statements can generally be identified by the use of words such as “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “plan,” “project,” “potential,” “seek,” “should,”

“think,” “will,” “would” and similar expressions, or they may use future dates. Forward-looking statements

in this Form 8-K and Exhibit 99.1 include, without limitation (i) statements regarding the terms and conditions of

the Interim Award, which may be subject to change, (ii) the Company’s expectations as to a legal reserve for the Interim Award

and the potential impact of the Interim Award and the ongoing proceedings on the Company’s financial position and results of operations,

which may be subject to change and (iii) the ownership and/or use of the SSE technology by the Company in the future. These forward-looking

statements are subject to assumptions, risks and uncertainties that may change at any time, and readers are therefore cautioned that actual

results could differ materially from those expressed in any forward-looking statements. Factors that could cause actual results to differ

include, among other things: risks and uncertainties discussed in the Company’s filings with the SEC, including the “Risk

Factors” sections of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022. The Company

undertakes no obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except

as expressly required by law. All forward-looking statements in this Form 8-K and Exhibit 99.1 are qualified in their entirety

by this cautionary statement.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

PENNYMAC FINANCIAL SERVICES, INC. |

| |

|

| Dated: December 4, 2023 |

/s/ Daniel S. Perotti |

| |

Daniel S. Perotti |

| |

Senior Managing Director and Chief Financial Officer |

Exhibit 99.1

INVESTOR UPDATE PennyMac Financial Services, Inc. December 2023

2 This presentation contains forward - looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, regarding management’s beliefs, estimates, projections and assumptions with respect to, among other things, our financial results, future operations, business plans and in vestment strategies, as well as industry and market conditions, all of which are subject to change. Words like “believe,” “expect,” “anticipate,” “promise,” “project,” “plan,” and other expression s o r words of similar meanings, as well as future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” are generally intended to identify forward - looking statements. Actual results and o perations for any future period may vary materially from those projected herein and from past results discussed herein. These forward - looking statements include, but are not limited to: ( i ) statements regarding the terms and conditions of the Interim Award, which may be subject to change, (ii) the Company’s expectations as to a legal reserve for the Interim Award and the potential impact of th e I nterim Award and the ongoing proceedings on the Company’s financial position and results of operations, which may be subject to change and (iii) the ownership and/or use of the SSE technology b y t he Company in the future (iv) future loan origination, servicing and production, including future production, operating and hedge expenses; as well as other business and financial expectations. Fa ctors which could cause actual results to differ materially from historical results or those anticipated include, but are not limited to: interest rate changes; declines in real estate or si gni ficant changes in U.S. housing prices or activity in the U.S. housing market; the continually changing federal, state and local laws and regulations applicable to the highly regulated industry in which we op era te; lawsuits or governmental actions that may result from any noncompliance with the laws and regulations applicable to our business; the mortgage lending and servicing - related regulations p romulgated by the Consumer Financial Protection Bureau and its enforcement of these regulations; our dependence on U.S. government - sponsored entities and changes in their current roles or the ir guarantees or guidelines; changes to government mortgage modification programs; the licensing and operational requirements of states and other jurisdictions applicable to our busines s, to which our bank competitors are not subject; foreclosure delays and changes in foreclosure practices; changes in macroeconomic and U.S. real estate market conditions; difficulties inherent in a dju sting the size of our operations to reflect changes in business levels; purchase opportunities for mortgage servicing rights and our success in winning bids; our substantial amount of indebtedness; in creases in loan delinquencies, defaults and forbearances; our reliance on PennyMac Mortgage Investment Trust (NYSE: PMT) as a significant contributor to our mortgage banking business; mai nta ining sufficient capital and liquidity and compliance with financial covenants; our obligation to indemnify third - party purchasers or repurchase loans if loans that we originate, acquire, service or assist in the fulfillment of, fail to meet certain criteria or characteristics or under other circumstances; our obligation to indemnify PMT if our services fail to meet certain criteria o r c haracteristics or under other circumstances; investment management and incentive fees; conflicts of interest in allocating our services and investment opportunities among us and our advised en tit ies; the effect of public opinion on our reputation; our exposure to risks of los s and disruptions in operations resulting from adverse weather conditions, man - made or natural disasters, climate change and pandemics; our ability to effectively identify, manage and hedge our credit, interest rate, prepayment, liquidity and climate risks; our initiation or expansion of new business activities or st rategies; our ability to detect misconduct and fraud; our ability to mitigate cybersecurity risks and cyber incidents; our ability to pay dividends to our stockholders; and our organizational structure a nd certain requirements in our charter documents. You should not place undue reliance on any forward - looking statement and should consider all of the uncertainties and risks described above, as well as those more fully discussed in reports and other documents filed by the Company with the Securities and Exchange Commission from time to time. The Company undertakes no obligation to publicly u pda te or revise any forward - looking statements or any other information contained herein, and the statements made in this presentation are current as of the date of this presentation on ly. FORWARD - LOOKING STATEMENTS

BLACK KNIGHT LITIGATION OUTCOME 3 Background • In November 2019, Black Knight (1) filed a lawsuit against Pennymac (2) that alleged Pennymac misappropriated trade secrets and breached their contracts in order to copy Black Knight’s mortgage servicing platform MSP in creating its Servicing Systems Environment (SSE) servicing platform • Black Knight’s original suit sought over $340 million in damages and ownership of the intellectual property related to SSE; t he suit was ultimately transferred to arbitration Outcome and Impact • On November 28, 2023, the arbitrator of the lawsuit categorically rejected Black Knight’s claims of misappropriation of trade se crets, but partially granted their breach of contract claim • The arbitrator affirmed Pennymac’s ownership of its SSE mortgage servicing platform, providing Pennymac the unfettered ability to utilize its intellectual property in SSE in any way that it sees fit for the benefit of its customers and stakeholders • The arbitrator also issued an interim award of approximately $155 million (plus interest and legal expenses) to Black Knight rel ated to the breach of contract claim – The arbitrator concluded (wrongfully in our view) that Pennymac's access to MSP allowed it to increase the speed of developing SSE, and awarded Black Knight lost profits in the form of licensing fees it would have otherwise received from Pennymac over a longer development period – A litigation reserve related to this interim award is expected to be recorded in 4Q23, reducing earnings and book value per s har e by approximately $2.85 • Pennymac has ample liquidity to fulfill the interim award payment, with $1.2B of cash on its balance sheet at September 30, 2023 Potential Opportunities • SSE has performed extraordinarily well since its launch in 2019, meaningfully enhancing Pennymac’s capabilities and reducing servicing costs per loan – SSE enabled Pennymac to successfully implement significant automation and efficiencies of its CARES Act forbearance programs, improving the custom er experience for and allowing Pennymac greater ability to rehabilitate borrowers and redeliver loans during and following the pandemic – Servicing costs per loan have declined by over 30% since Pennymac implemented SSE • With this technology free and clear of any restrictions on use or development, we believe there is potential for additional o ppo rtunities and benefits for the company over time (1) Black Knight Servicing Technologies, LLC (2) PennyMac Loan Services, LLC, a wholly - owned subsidiary of PennyMac Financial Services, Inc. (NYSE: PFSI)

4 FOURTH QUARTER 2023 BUSINESS UPDATE – PRODUCTION AND SERVICING (1) Includes volume fulfilled for PennyMac Mortgage Investment Trust (NYSE:PMT) (2) Includes locks related to both PFSI and PMT loan acquisitions (3) Unpaid principal balance. As of 11/30/23; includes volumes subserviced for PMT • Correspondent acquisitions of $16.8 billion and locks of $18.0 billion to date in 4Q23 (1,2) • Broker Direct originations of $1.6 billion and locks of $2.1 billion to date in 4Q23 • Consumer Direct originations of $0.6 billion and locks of $0.9 billion to date in 4Q23 • Production margins through November have been relatively consistent with levels reported in 3Q23 • Servicing portfolio has grown to $601.4 billion in UPB (3) – Approximately 20% of total servicing portfolio has a note rate of 5% or higher (3) Fundings ($ in billions) 3Q23 Oct-23 Nov-23 4Q23TD Correspondent Acquisitions (1) 21.5$ 8.8$ 8.1$ 16.8$ Broker Direct Originations 2.2$ 0.8$ 0.8$ 1.6$ Consumer Direct Originations 1.3$ 0.3$ 0.3$ 0.6$ Total acquisitions/originations 25.1$ 9.9$ 9.1$ 19.0$ 3Q23 Oct-23 Nov-23 4Q23TD Correspondent Locks (2) 23.9$ 9.3$ 8.6$ 18.0$ Broker Direct Locks 3.0$ 1.0$ 1.1$ 2.1$ Consumer Direct Locks 1.7$ 0.5$ 0.5$ 0.9$ Total Locks 28.6$ 10.8$ 10.2$ 21.0$ Interest Rate Lock Commitments ($ in billions)

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

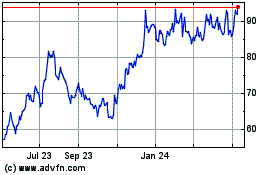

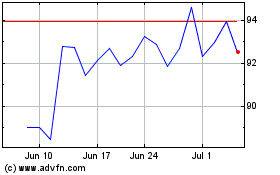

PennyMac Financial Servi... (NYSE:PFSI)

Historical Stock Chart

From Apr 2024 to May 2024

PennyMac Financial Servi... (NYSE:PFSI)

Historical Stock Chart

From May 2023 to May 2024