Oppenheimer to Pay $3 Million to Settle Case Over Nontraditional ETFs

June 08 2016 - 2:30PM

Dow Jones News

Oppenheimer & Co. agreed to pay $3 million to settle

regulatory charges that it sold leveraged and inverse

exchange-traded funds to retail clients without reasonable

supervision.

As part of the agreement, the company neither admitted nor

denied the charges, but it did consent to the findings of the

Financial Industry Regulatory Authority.

The allegations come as the Securities and Exchange Commission

moves to limit the widely sold products amid concerns over how well

retail investors understand them, even after nearly $30 billion has

flowed into the products.

Finra said Oppenheimer didn't enforce its own policies to not

encourage retail clients to purchase the nontraditional ETFs and to

not executive customer's orders unless they met certain income and

net worth criteria.

Oppenheimer will pay a $2.25 million fine and $716,831 in

restitution to affected clients.

ETFs are typically meant to mimic the performance of underlying

assets such as a group of stocks while remaining easier to trade

than mutual funds. The leveraged versions use futures or

derivatives to multiply the daily returns of an index, sometimes

striving to double or triple the return. Inverse ETFs seek to

return the opposite of the index. When these nontraditional ETFs

are held for longer than a day, compounding can lead to returns

that vary significantly from the underlying assets, making them

unpredictable and risky to hold for longer periods.

Finra alleged that Oppenheimer solicited and executed

nontraditional ETF purchases to retail customers who shouldn't have

been allowed to have them.

For example, an unidentified 89-year-old customer with an annual

income of $50,000 held 96 solicited nontraditional ETFs for an

average of 32 days and lost $51,847, Wall Street's regulatory

organization said.

From August 2009 to September 2013, more than 760 Oppenheimer

representatives executed more than 30,000 nontraditional ETF

transactions totaling about $1.7 billion, according to Finra.

In 2012, a number of other banks settled similar charges, paying

more than $9.1 million.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

June 08, 2016 14:15 ET (18:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

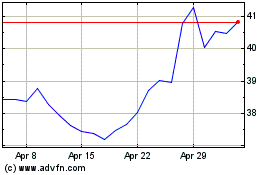

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Jul 2023 to Jul 2024