Oil States Announces Third Quarter 2003 Earnings HOUSTON, Oct. 27

/PRNewswire-FirstCall/ -- Oil States International, Inc. today

reported net income of $11.3 million, or $0.23 per diluted share,

for the quarter ended September 30, 2003 compared to net income of

$10.2 million, or $0.21 per diluted share, in the third quarter of

2002. The Company generated $177.2 million of revenues and $23.9

million of EBITDA (defined as net income plus interest, taxes,

depreciation and amortization) compared to $154.6 million and $20.1

million, respectively, in the third quarter of 2002(1). This

year-over-year improvement of 14.6% in revenues and 18.8% in EBITDA

was the result of an improvement in North American drilling

activity, continued strong deepwater development and incremental

results of the Company's acquisitions completed in the third

quarter 2002. The Company's effective tax rate for the third

quarter of 2003 was 26.6% compared to an effective tax rate of

22.6% in the third quarter of 2002. Capital expenditures during the

third quarter of 2003 totaled $11.4 million. For the first nine

months of 2003, the Company reported net income of $34.9 million,

or $0.71 per diluted share, on revenues of $526.3 million and

EBITDA of $73.1 million. For the corresponding period in 2002, the

Company reported net income of $28.2 million, or $0.58 per diluted

share, on revenues of $456.0 million and $56.0 million of EBITDA.

This performance represents year-over-year revenue and EBITDA

increases of 15.4% and 30.7%, respectively. BUSINESS SEGMENT

RESULTS Well Site Services Benefiting from increases in North

American drilling and workover activity, Well Site Services'

revenues and EBITDA were $56.6 million and $12.5 million,

respectively, in the third quarter of 2003 compared to $44.3

million and $8.9 million in the third quarter of 2002. With a year-

over-year increase of 33.7% in the North American drilling rig

count and a year-over-year increase of 20.1% in the North American

workover rig count, the Company had improved utilization and

efficiency of its Well Site Services' assets, generating increases

of 27.8% and 40.6% in revenues and EBITDA, respectively. These

improved activity levels were partially offset by continued

weakness in the US offshore drilling and workover markets, limiting

the Company's ability to achieve full utilization or to

significantly increase prices in several of its Well Site Services

business lines. Offshore Products For the third quarter of 2003,

Offshore Products generated $59.3 million of revenues and $10.9

million of EBITDA, compared to $55.5 million of revenues and $10.9

million of EBITDA in the third quarter of 2002. Gross margins

decreased slightly to 27.3% in the third quarter of 2003 from 28.0%

in the third quarter of 2002, as a result of product mix and lower

realized margins on rig equipment products. Offshore Products'

backlog was $72.9 million at September 30, 2003 compared to $80.2

million at June 30, 2003 and $104.0 million at September 30, 2002.

Tubular Services Tubular Services generated $61.3 million of

revenues and $1.9 million of EBITDA in the third quarter of 2003

compared to $54.8 million of revenues and $1.7 million of EBITDA in

the third quarter of 2002. The average US rig count increased 27.6%

to 1,088 rigs in the third quarter of 2003 compared to 853 average

rigs working in the third quarter of 2002. Tubular Services shipped

69.8 thousand tons of OCTG in the third quarter of 2003 compared to

59.2 thousand tons in the third quarter of 2002. The third quarter

of 2002 results included $4.5 million of higher margin

international sales which did not occur in the third quarter of

2003. The Company's revenues per ton in the third quarter of 2003

declined 4.8% from those of the third quarter 2002. Gross margin

for the third quarter of 2003 declined to 5.9% compared to 6.4% in

the third quarter of 2002. OCTG inventory at September 30, 2003 was

$72.7 million compared to $72.6 million at June 30, 2003 and $56.0

million at September 30, 2002. As of September 30, 2003,

approximately 60% of Oil States' OCTG inventory was committed to

customer orders. "We performed very well in the third quarter of

2003 as North American drilling and workover activity continued to

strengthen," stated Douglas E. Swanson, Oil States' President and

Chief Executive Officer. "We continued to experience good

utilization of our assets and shipments of our products. However,

the low level of offshore drilling in the US continued to hamper

our Well Site Services and Tubular Services segments. Looking

forward to the remainder of 2003, we expect to see continued strong

land drilling activity in the US and Canada. However, we do not

foresee a meaningful recovery in deeper land and offshore drilling

activity in the US by year end." Oil States International, Inc. is

a diversified solutions provider for the oil and gas industry. With

locations around the world, Oil States is a leading manufacturer of

products for deepwater production facilities and subsea pipelines,

and a leading supplier of a broad range of services to the oil and

gas industry, including production-related rental tools, work force

accommodations and logistics, oil country tubular goods

distribution, hydraulic workover services and land drilling

services. Oil States is organized in three business segments --

Offshore Products, Tubular Services and Well Site Services, and is

publicly traded on the New York Stock Exchange under the symbol

OIS. Please visit Oil States International's website at

http://www.oilstatesintl.com/ . The foregoing contains

forward-looking statements within the meaning of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements are those that do not state historical

facts and are, therefore, inherently subject to risks and

uncertainties. The forward-looking statements included herein are

based on current expectations and entail various risks and

uncertainties that could cause actual results to differ materially

from those forward-looking statements. Such risks and uncertainties

include, among other things, risks associated with the general

nature of the oilfield service industry and other factors discussed

within the "Business" section of the Form 10-K for the year ended

December 31, 2002 filed by Oil States with the SEC on March 13,

2003. (1) The term EBITDA consists of net income plus interest,

taxes, depreciation and amortization. EBITDA is not a measure of

financial performance under generally accepted accounting

principles. You should not consider it in isolation from or as a

substitute for net income or cash flow measures prepared in

accordance with generally accepted accounting principles or as a

measure of profitability or liquidity. Additionally, EBITDA may not

be comparable to other similarly titled measures of other

companies. The Company has included EBITDA as a supplemental

disclosure because its management believes that EBITDA provides

useful information regarding our ability to service debt and to

fund capital expenditures and provides investors a helpful measure

for comparing its operating performance with the performance of

other companies that have different financing and capital

structures or tax rates. The Company uses EBITDA to compare and to

monitor the performance of its business segments to other

comparable public companies and as a benchmark for the award of

incentive compensation under its annual incentive compensation

plan. Oil States International, Inc. Statements of Operations (in

thousands, except per share amounts) (unaudited) Three Months Ended

Nine Months Ended September 30, September 30, 2003 2002 2003 2002

Revenue $177,170 $154,595 $526,310 $456,033 Costs and expenses:

Cost of sales 139,355 121,756 411,653 363,599 Selling, general and

administrative 14,306 12,697 42,037 36,888 Depreciation and

amortization 6,978 5,942 20,347 16,871 Other expense / (income)

(162) 46 3 (69) Operating income 16,693 14,154 52,270 38,744

Interest income 157 143 319 354 Interest expense (1,654) (1,158)

(5,020) (3,172) Other income 248 30 509 354 Income before income

taxes 15,444 13,169 48,078 36,280 Income tax expense (4,110)

(2,981) (13,221) (8,065) Net income applicable to common stock

$11,334 $10,188 $34,857 $28,215 Net income per common share Basic

$0.23 $0.21 $0.72 $0.58 Diluted $0.23 $0.21 $0.71 $0.58 Average

shares outstanding Basic 48,554 48,297 48,515 48,260 Diluted 49,212

48,934 49,155 48,827 Segment Data: Revenues Well Site Services

$56,560 $44,268 $188,284 $161,747 Offshore Products 59,303 55,500

174,050 134,727 Tubular Services 61,307 54,827 163,976 159,559

Total Revenues $177,170 $154,595 $526,310 $456,033 EBITDA (A) Well

Site Services $12,474 $8,872 $43,907 $32,840 Offshore Products

10,934 10,901 28,880 24,060 Tubular Services 1,948 1,669 4,619

3,035 Corporate / Other (1,437) (1,316) (4,280) (3,966) Total

EBITDA $23,919 $20,126 $73,126 $55,969 Operating Income / (Loss)

Well Site Services $7,315 $4,591 $29,426 $20,468 Offshore Products

9,063 9,376 23,200 19,504 Tubular Services 1,761 1,515 3,951 2,578

Corporate / Other (1,446) (1,328) (4,307) (3,806) Total Operating

Income $16,693 $14,154 $52,270 $38,744 Oil States International,

Inc. Consolidated Balance Sheets (in thousands) (unaudited) Sep.

30, Jun. 30, Dec. 31, 2003 2003 2002 Assets Current assets Cash

$15,001 $14,039 $11,118 Accounts receivable 135,462 120,445 116,875

Inventory 132,584 132,434 118,338 Prepaid and other current assets

6,958 7,714 9,475 Total current assets 290,005 274,632 255,806

Property, plant and equipment, net 179,704 175,358 167,146 Goodwill

217,525 216,134 213,051 Other long term assets 8,838 9,005 8,213

Total assets $696,072 $675,129 $644,216 Liabilities and

stockholders' equity Current liabilities Accounts payable and

accrued liabilities $92,263 $82,385 $84,049 Income taxes payable

5,700 4,554 1,229 Current portion of long term debt 841 868 913

Deferred Revenue 7,885 7,434 8,949 Other current liabilities 841

860 1,402 Total current liabilities 107,530 96,101 96,542 Long term

debt 126,369 129,416 133,292 Deferred income taxes 19,859 19,961

18,303 Postretirement healthcare and other benefits 2,739 3,386

5,280 Other liabilities 4,393 3,967 3,220 Total liabilities 260,890

252,831 256,637 Stockholders' equity Common stock 486 486 485

Additional paid-in capital 328,605 328,351 327,801 Retained

earnings 99,243 87,909 64,386 Accumulated other comprehensive

income/(loss) 7,189 5,838 (4,921) Treasury stock (341) (286) (172)

Total stockholders' equity 435,182 422,298 387,579 Total

liabilities and stockholders' equity $696,072 $675,129 $644,216 Oil

States International, Inc. Additional Quarterly Segment and

Operating Data (unaudited) Three Months Ended September 30, 2003

2002 Additional Well Site Services Financial Data ($ in thousands)

Revenues Accommodations $29,001 $20,749 Hydraulic Workover Services

7,679 7,146 Rental Tools 10,504 8,333 Land Drilling 9,376 8,040

Total Revenues $56,560 $44,268 EBITDA (A) Accommodations $5,872

$3,864 Hydraulic Workover Services 1,145 1,179 Rental Tools 3,011

1,719 Land Drilling 2,446 2,110 Total EBITDA $12,474 $8,872

Operating Income Accommodations $3,798 $2,094 Hydraulic Workover

Services 240 402 Rental Tools 1,528 537 Land Drilling 1,749 1,558

Total Operating Income $7,315 $4,591 Well Site Services

Supplemental Operating Data Accommodations Operating Statistics

Average Mandays Served 4,279 3,304 Average Camps Rented Canadian

Side-by-Side Camps 11 8 US Offshore Steel Buildings (10 foot wide)

77 87 Hydraulic Workover Services Operating Statistics Average

Units Available 29 27 Utilization 29.8% 29.9% Average Day Rate ($

in thousands per day) $9.6 $9.6 Average Daily Cash Margin ($ in

thousands per day) $2.3 $2.9 Land Drilling Operating Statistics

Average Rigs Available 15 13 Utilization 91.6% 95.0% Implied Day

Rate ($ in thousands per day) $7.4 $7.1 Implied Daily Cash Margin

($ in thousands per day) $2.1 $2.0 Offshore Products Backlog ($ in

millions) $72.9 $104.0 Tubular Services Operating Data Shipments

(Tons in thousands) 69.8 59.2 Quarter end Inventory ($ in

thousands) $72,740 $56,012 (A) EBITDA consists of net income plus

interest, taxes, depreciation, and amortization. See footnote (4)

on page 23 of the Company's Annual Report on Form 10K for the year

December 31, 2002 for an explanation of this non-GAAP financial

measure. DATASOURCE: Oil States International, Inc. CONTACT: Cindy

B. Taylor of Oil States International, Inc., +1-713-652-0582 Web

site: http:www.oilstatesintl.com

Copyright

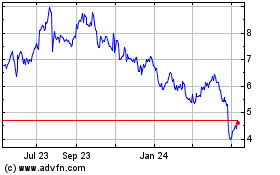

Oil States (NYSE:OIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Oil States (NYSE:OIS)

Historical Stock Chart

From Jul 2023 to Jul 2024