UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

May 12, 2015

Date of Report (Date of earliest event reported)

OWENS-ILLINOIS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

1-9576 |

|

22-2781933 |

|

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

|

One Michael Owens Way |

|

|

|

Perrysburg, Ohio |

|

43551-2999 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(567) 336-5000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

On May 12, 2015, Owens-Illinois, Inc. (the “Company”), through its indirect, wholly owned subsidiary Owens-Brockway Glass Container Inc. (“Owens-Brockway”), a Delaware corporation, Vitro, S.A.B. de C.V. (“Vitro”), a Mexican sociedad anónima bursátil de capital variable, Distribuidora Álcali, S.A. de C.V. (“Distribuidora”), a Mexican sociedad anónima de capital variable and Vitro Packaging, LLC (“Vitro Packaging” and together with Vitro and Distribuidora, “Sellers”), a U.S. limited liability company, entered into a stock purchase agreement (the “Purchase Agreement”), pursuant to which Owens-Brockway has agreed to acquire Sellers’ food and beverage glass containers business as conducted in the United States, Mexico and Bolivia (the “Business”).

Transaction Overview

Upon the terms and conditions set forth in the Purchase Agreement, which has been unanimously approved by the Company’s board of directors, the Company has agreed to purchase the Business from Sellers pursuant to a stock purchase (the “Transaction”). Upon the closing of the Transaction, Owens-Brockway will pay to Sellers approximately $2.15 billion in cash to acquire the Business, on a cash-free, debt-free basis, subject to a working capital adjustment and certain other adjustments.

Conditions to the Transaction

The completion of the Transaction is subject to certain customary closing conditions, including:

· expiration or termination of the waiting period (and any extensions thereof) applicable under the Hart-Scott-Rodino Antitrust Improvements Act of 1976;

· the receipt of all required clearances, approvals or authorizations required by certain Mexican governmental entities under applicable antitrust and foreign investment laws; and

· the absence of any order, judgment, injunction, law or other legal restraint prohibiting the consummation of the Transaction.

Each party’s obligation to consummate the Transaction is also subject to certain additional closing conditions, including (i) the accuracy of the other party’s representations and warranties contained in the Purchase Agreement (subject to certain materiality qualifiers) and (ii) the other party’s compliance in all material respects with its covenants and agreements contained in the Purchase Agreement.

Other Terms of the Transaction

The Purchase Agreement contains customary representations, warranties and covenants by each party that are subject, in some cases, to specified exceptions and qualifications contained in the Purchase Agreement. The covenants include, among others, the following: (i) Sellers are obligated to operate the Business in the ordinary course consistent with past practice between the execution of the Purchase Agreement and the closing of the Transaction, (ii) Sellers agree not to engage in certain transactions with respect to the Business between the execution of the Purchase Agreement and the closing of the Transaction, except with the written consent of Owens-Brockway (not to be unreasonably withheld) and (iii) Sellers agree, under the terms specified in the Purchase Agreement, not to compete with the Business (subject to certain exceptions) for a period of three years after the closing date of the transaction.

Each of the parties is required to use its respective reasonable best efforts to consummate the Transaction, including effecting certain regulatory filings described in the Purchase Agreement and obtaining all necessary consents and authorizations to consummate the Transaction. Without limiting the foregoing, nothing in the Purchase Agreement requires Owens-Brockway, in order to obtain the required consents from antitrust authorities, to take any action with

2

respect to itself, the Business or any of their respective subsidiaries or affiliates including agreeing to the sale, divestiture or disposition of assets of Owens-Brockway or the Business (or any combination thereof) or taking actions that would limit Owens-Brockway’s freedom of action with respect to its assets or assets of the Business (or any combination thereof); provided, however, that if requested by an antitrust governmental body, Owens-Brockway is required to take all actions necessary to divest or dispose of any of its businesses, products, rights, services, assets or properties so long as such divestiture, individually or in the aggregate, would result in the loss of EBITDA of the Business and Owens-Brockway combined and its affiliates of less than $30 million during the most recently available 12-month period ending on the date such divestiture is requested by an antitrust governmental body.

The Purchase Agreement contains customary termination provisions in favor of both parties, including if the initial closing of the Transaction has not occurred within nine months from the date thereof (subject to extension by either party for up to three additional months in the event that required antitrust approvals have not been obtained). In the event the Purchase Agreement is terminated under certain circumstances, including terminations related to the failure to obtain the required antitrust approvals, Owens-Brockway must make a cash payment of $150 million to Sellers as Sellers’ sole and exclusive remedy.

The Company, through its direct, wholly-owned subsidiary, Owens-Illinois Group, Inc. and Owens-Brockway, has obtained debt financing commitments from Deutsche Bank AG New York Branch, Deutsche Bank AG Cayman Islands Branch and Deutsche Bank Securities Inc. to provide sufficient funds to finance the acquisition, including the payment of the aggregate purchase price. The availability of financing pursuant to such commitments is subject to various customary conditions, including no material adverse change to the Business and the consummation of the acquisition. There is no financing condition to the Transaction.

Both Owens-Brockway and the Sellers have agreed, following the closing, to indemnify the other party for losses arising from certain breaches of the Purchase Agreement and for certain other liabilities, subject to certain limitations.

ITEM 7.01. REGULATION FD DISCLOSURE.

A copy of the press release announcing the acquisition, and the attached investor presentation are furnished pursuant to this Item 7.01 as Exhibits 99.1 and 99.2, respectively, to this Current Report.

The information in this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section. Furthermore, the information in this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed to be incorporated by reference into the filings of the registrant under the Securities Act of 1933 regardless of any general incorporation language in such filings.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

|

Exhibit |

|

|

|

No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release dated May 13, 2015 |

|

|

|

|

|

99.2 |

|

Owens-Illinois, Inc. Acquisition of Vitro’s Food & Beverage Glass Container Business Slides |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

OWENS-ILLINOIS, INC. |

|

|

|

|

|

|

|

Date: May 13, 2015 |

By: |

/s/ John A. Haudrich |

|

|

Name: |

John A. Haudrich |

|

|

Title: |

Vice President and Acting Chief Financial Officer |

4

EXHIBIT INDEX

|

Exhibit |

|

|

|

No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release dated May 13, 2015 |

|

|

|

|

|

99.2 |

|

Owens-Illinois, Inc. Acquisition of Vitro’s Food & Beverage Glass Container Business Slides |

5

Exhibit 99.1

FOR IMMEDIATE RELEASE

|

For more information, contact: |

|

|

|

David Johnson |

|

Lisa Babington |

|

Vice President, Investor Relations |

|

Director, Corporate Communications |

|

Perrysburg, Ohio, US |

|

Perrysburg, Ohio, US |

|

567 336 2600 |

|

567 336 1445 |

|

dave.johnson@o-i.com |

|

lisa.babington@o-i.com |

O-I to Acquire Vitro’s Food and Beverage Business for $2.15 Billion

Provides a Leading Position in Mexico; Expected to be Accretive to

Cash Flow and EPS in 2016

Perrysburg, Ohio (May 13, 2015) — Owens-Illinois, Inc. (NYSE: OI) announced today that it has reached a definitive agreement with Vitro, S.A.B. de C.V. (BMV: VITROA), to acquire Vitro’s food and beverage glass container business in an all-cash transaction valued at approximately $2.15 billion. Vitro is the largest supplier of glass containers in Mexico. The transaction, which has been approved by the boards of directors of both companies, is subject to approval by Vitro’s shareholders and customary regulatory approvals. The deal is expected to close within 12 months.

The transaction provides O-I with a competitive position in the attractive and growing glass segment of the packaging market in Mexico, further enhancing O-I’s position as the world’s foremost glass container producer. The agreement includes Vitro’s five plants in Mexico and one in Bolivia, which together employ 4,700 people. The current leadership of Vitro’s food and beverage glass container business will remain in place following the transaction close. The acquired business is expected to generate estimated annual revenue of $945 million and adjusted EBITDA of $278 million(1). Further, O-I expects to realize approximately $30 million in run-rate cost synergies by 2018 through a combination of procurement savings and operating efficiencies. The transaction is expected to be accretive to cash flow and earnings per share in the first year after closing.

“We have long admired Vitro’s business, and this transaction marks an important strategic step for O-I in that it allows us to establish a strong position in the attractive glass container segment in Mexico,” said Al Stroucken, chairman and CEO of O-I. “Vitro’s leading position, long-term customer relationships and proven record of innovation and new product development will enable us to capitalize on commercial opportunities in Mexico. In the third year after close, this compelling transaction is expected to add approximately $0.50 to our earnings per share and at least $100 million in free cash flow, positioning us to drive even greater value for shareholders.”

(1) Revenue and adjusted EBITDA estimates are based on 3/31/15 (last 12 months) plus an estimate of full year 2016 new business signed in 2014.

“O-I is a clear leader in the global glass container market and is the ideal partner for Vitro’s food and beverage container business,” said Adriàn Sada González, Chairman of Vitro, S.A.B. de C.V. “We have a great deal in common with O-I and look forward to the expertise they bring to help meet the growing demands of our customers.”

O-I has secured committed financing from Deutsche Bank to fund the transaction and expects to utilize the strong free cash flow of the combined business to reduce leverage following the transaction.

Deutsche Bank Securities is serving as financial advisor to O-I on the transaction and Simpson Thacher & Bartlett LLP is serving as legal advisor.

# # #

About O-I

Owens-Illinois, Inc. (NYSE: OI) is the world’s largest glass container manufacturer and preferred partner for many of the world’s leading food and beverage brands. The Company had revenues of $6.8 billion in 2014 and employs approximately 21,100 people at 75 plants in 21 countries. With global headquarters in Perrysburg, Ohio, USA, O-I delivers safe, sustainable, pure, iconic, brand-building glass packaging to a growing global marketplace. For more information, visit o-i.com.

O-I’s Glass Is Life™ movement promotes the widespread benefits of glass packaging in key markets around the globe. Learn more about the reasons to choose glass and join the movement at glassislife.com.

Conference call scheduled for May 13, 2015

O-I CEO Al Stroucken, COO Andres Lopez and acting CFO John Haudrich will conduct a conference call to discuss the transaction on Wednesday, May 13, 2015, at 8:00 a.m., Eastern Time. A live webcast of the conference call, including presentation materials, will be available on the O-I website, www.o-i.com/investors, in the Presentations & Webcast section.

The conference call also may be accessed by dialing 888-733-1701 (U.S. and Canada) or 706-634-4943 (international) by 7:50 a.m., Eastern Time, on May 13. Ask for the O-I conference call. A replay of the call will be available on the O-I website, www.o-i.com/investors, for a year following the call.

Forward-looking statements

This document contains “forward-looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933. Forward-looking statements reflect the Company’s current expectations and projections about future events at the time, and thus involve uncertainty and risk. The words “believe,” “expect,” “anticipate,” “will,” “could,” “would,” “should,” “may,” “plan,” “estimate,” “intend,” “predict,” “potential,” “continue,” and the negatives of these words and other similar expressions generally identify forward-looking statements. It is possible the Company’s future financial performance may differ from expectations due to a variety of factors including, but not limited to the following: (1) foreign currency fluctuations relative to the U.S. dollar, specifically the Euro, Brazilian real, Colombian peso and Australian dollar, (2) changes in capital availability or cost, including

interest rate fluctuations and the ability of the Company to refinance debt at favorable terms, (3) the general political, economic and competitive conditions in markets and countries where the Company has operations, including uncertainties related to economic and social conditions, disruptions in capital markets, disruptions in the supply chain, competitive pricing pressures, inflation or deflation, and changes in tax rates and laws, (4) consumer preferences for alternative forms of packaging, (5) cost and availability of raw materials, labor, energy and transportation, (6) the Company’s ability to manage its cost structure, including its success in implementing restructuring plans and achieving cost savings, (7) consolidation among competitors and customers, (8) the ability of the Company to acquire businesses and expand plants, integrate operations of acquired businesses, achieve expected synergies and achieve estimated financial results, (9) the ability of the Company to close acquisition transactions, (10) whether acquisition transactions will be approved by competition and other regulatory authorities, (11) whether acquisition transactions will be accretive to the Company’s earnings and/or cash flow, (12) whether acquisition transactions will create shareholder value, (13) the Company’s ability to deleverage following an acquisition and reach an expected leverage ratio (14) unanticipated expenditures with respect to environmental, safety and health laws, (15) the Company’s ability to further develop its sales, marketing and product development capabilities, and (16) the timing and occurrence of events which are beyond the control of the Company, including any expropriation of the Company’s operations, floods and other natural disasters, events related to asbestos-related claims, and the other risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 and any subsequently filed Annual Report on Form 10-K or Quarterly Report on Form 10-Q. It is not possible to foresee or identify all such factors. Any forward-looking statements in this document are based on certain assumptions and analyses made by the Company in light of its experience and perception of historical trends, current conditions, expected future developments, and other factors it believes are appropriate in the circumstances. Forward-looking statements are not a guarantee of future performance and actual results or developments may differ materially from expectations. While the Company continually reviews trends and uncertainties affecting the Company’s results of operations and financial condition, the Company does not assume any obligation to update or supplement any particular forward-looking statements contained in this document.

Exhibit 99.2

|

|

O-I’s Acquisition of Vitro’s Food & Beverage Glass Container Business May 13, 2015 |

|

|

Safe Harbor Comments Forward-Looking Statements This document contains "forward-looking" statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933. Forward-looking statements reflect the Company's current expectations and projections about future events at the time, and thus involve uncertainty and risk. The words “believe,” “expect,” “anticipate,” “will,” “could,” “would,” “should,” “may,” “plan,” “estimate,” “intend,” “predict,” “potential,” “continue,” and the negatives of these words and other similar expressions generally identify forward-looking statements. It is possible the Company's future financial performance may differ from expectations due to a variety of factors including, but not limited to the following: (1) foreign currency fluctuations relative to the U.S. dollar, specifically the Euro, Brazilian real, Colombian peso and Australian dollar, (2) changes in capital availability or cost, including interest rate fluctuations and the ability of the Company to refinance debt at favorable terms, (3) the general political, economic and competitive conditions in markets and countries where the Company has operations, including uncertainties related to economic and social conditions, disruptions in capital markets, disruptions in the supply chain, competitive pricing pressures, inflation or deflation, and changes in tax rates and laws, (4) consumer preferences for alternative forms of packaging, (5) cost and availability of raw materials, labor, energy and transportation, (6) the Company’s ability to manage its cost structure, including its success in implementing restructuring plans and achieving cost savings, (7) consolidation among competitors and customers, (8) the ability of the Company to acquire businesses and expand plants, integrate operations of acquired businesses, achieve expected synergies and achieve estimated financial results, (9) the ability of the Company to close acquisition transactions, (10) whether acquisition transactions will be approved by competition and other regulatory authorities, (11) whether acquisition transactions will be accretive to the Company’s earnings and/or cash flow, (12) whether acquisition transactions will create shareholder value, (13) the Company’s ability to deleverage following an acquisition and reach an expected leverage ratio (14) unanticipated expenditures with respect to environmental, safety and health laws, (15) the Company’s ability to further develop its sales, marketing and product development capabilities, and (16) the timing and occurrence of events which are beyond the control of the Company, including any expropriation of the Company’s operations, floods and other natural disasters, events related to asbestos-related claims, and the other risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 and any subsequently filed Annual Report on Form 10-K or Quarterly Report on Form 10-Q. It is not possible to foresee or identify all such factors. Any forward-looking statements in this document are based on certain assumptions and analyses made by the Company in light of its experience and perception of historical trends, current conditions, expected future developments, and other factors it believes are appropriate in the circumstances. Forward-looking statements are not a guarantee of future performance and actual results or developments may differ materially from expectations. While the Company continually reviews trends and uncertainties affecting the Company's results of operations and financial condition, the Company does not assume any obligation to update or supplement any particular forward-looking statements contained in this document. 1 |

|

|

Safe Harbor Comments Regulation G The information presented here regarding EBITDA, EBITDA margins, EBITDA less capital spending and leverage ratio (non-GAAP measures) are not defined terms under U.S. generally accepted accounting principles (GAAP). Non-GAAP measures should not be construed as an alternative to the reported results determined in accordance with GAAP. Management has included this non-GAAP information to assist in understanding the comparability of results of ongoing operations. Management uses non-GAAP information principally for internal reporting, forecasting, budgeting and calculating compensation payments. Management believes that the non-GAAP presentation allows the board of directors, management, investors and analysts to better understand the Company’s financial performance in relationship to core operating results and the business outlook. Vitro’s Food and Beverage Business Financial Information The financial information the Company provides in this presentation for Vitro’s food and beverage business is unaudited and incorporates significant assumptions and estimates. This presentation contains historical financial information for Vitro’s food and beverage business based on data provided by Vitro management which are unaudited and have not been reviewed by the Company’s independent accountants. The Company plans to file separate Vitro food and beverage financial statements and pro forma O-I financial information giving effect to the Vitro food and beverage business acquisition in a Current Report on Form 8-K within the prescribed time period following consummation of the Vitro food and beverage acquisition, as required by SEC rules. However, the Company cannot ensure that there will not be material differences between the historical financial information for Vitro’s food and beverage business provides in this presentation and the audited financial statements that the Company intends to file in a Current Report on Form 8-K. 2 |

|

|

Compelling strategic transaction 3 Acquisition of Vitro’s food & beverage glass container business Well-run, profitable glass container business A leading producer in Mexico and Bolivia High margin business, in line with O-I South America performance Expands presence into an important, strategic geography Purchase price of $2.15 billion Multiple of 7.0x1 on LTM 3/31/15 pro forma adj. EBITDA, incl. synergies Includes additional contracted new business Provides achievable, low-risk synergy opportunities Expected EPS accretion of $0.30 - $0.402 in Year 1 Grows to ~$0.50 in Year 3, as synergies are realized Expected FCF accretion of >$100 million by Year 3 1 See Appendix: Vitro F&B pro forma adjusted EBITDA and transaction multiple calculation 2 Subject to final purchase accounting and tax related factors |

|

|

Overview of Vitro F&B business 4 A leading Mexican multi-segment glass packaging supplier Long-term relationships with blue-chip customers 19 furnaces across 5 facilities in Mexico and 1 in Bolivia Produced ~4.7 billion glass containers in 2014 ~4,700 employees 2014 sales by end use1 1 Vitro’s food and beverage business; source: Vitro management estimates 2 Vitro F&B pro forma revenue. See Appendix: Vitro F&B pro forma adjusted EBITDA and transaction multiple calculation 3 Vitro F&B pro forma adjusted EBITDA. See Appendix: Vitro F&B pro forma adjusted EBITDA and transaction multiple calculation 4 Vitro F&B pro forma adjusted EBITDA, including synergies. See Appendix: Vitro F&B pro forma adjusted EBITDA and transaction multiple calculation Vitro F&B LTM 3/31/15 $ millions Pro forma Revenue2 $945 Pro forma adjusted EBITDA3 $278 Pro forma adjusted EBITDA4, including synergies $308 Wine & Spirits 30% Food 30% Soft drinks 23% Beer 12% Other 5% |

|

|

Mexican markets strong and growing 5 Glass holds stable share of Mexican packaging market Glass Other Source: Vitro management estimates Source: Euromonitor Mexico is 4th largest market for beer production Sustainable growth for glass segment of food & beverage packaging Source: Euromonitor Higher growth rates in wine, spirits and RTD Source: Euromonitor China 26% USA 14% Brazil 8% Mexico 5% Germany 5% Spain 4% Russia 4% Other 34% 21 22 22 22 23 23 24 24 25 15 18 21 24 27 2010 2011 2012 2013 2014 2015E 2016E 2017E 2018E Total glass unit vol. (in bn ) 669 701 743 787 816 849 885 924 965 0 200 400 600 800 1000 1200 2010 2011 2012 2013 2014 2015E 2016E 2017E 2018E Total glass unit vol. (in mm) |

|

|

6 Vitro F&B: a natural fit with O-I Seamlessly serve our customers Complementary manufacturing systems Similar technology to O-I Opportunities to leverage know-how Vitro F&B and O-I have similar product offerings Key segments: beer, food, spirits, wine Long history of operations Equal commitments to quality and long-term customer relationships Combined footprint in the Americas |

|

|

Expanding our customer base 7 More than 50% of sales under contract Price adjustment formulas for key costs New Customers Common Customers |

|

|

O-I broadened its relationship with CBI in 2014 Operating JV with CBI in Mexico to supply adjacent brewery Signed supplemental long-term supply agreement Vitro signed 7-year supply contract with CBI in 2014 Phase 1 implemented in 2015, served from pre-existing footprint Phase 2 to begin in Jan 2016, served from new furnace in Monterrey Deal broadens relationship with CBI 8 |

|

|

Transaction economics 9 Consideration $2.15 billion, all cash Purchase multiple 7.0x1 on LTM 3/31/15 pro forma adj. EBITDA, incl. synergies Synergies $30 million annual savings run rate expected by Year 3 Financing Financing package of $2.25 billion has been fully committed by Deutsche Bank Includes ~$100 million for VAT to be refunded post-closing Financial impact High EBITDA margin business Expected to be cash flow and EPS accretive in Year 1 Combined net leverage ratio of 3.8x2 Timing Expected to close within 12 months, subject to Vitro shareholder approval and customary regulatory approvals 1 See Appendix: Vitro F&B pro forma adjusted EBITDA and transaction multiple calculation 2 See Appendix: Combined leverage ratio |

|

|

Vitro F&B growth: 3% CAGR in revenue and 8% in EBITDA1 Vitro F&B: superior financial performance 10 Strong EBITDA margins2 Proven ability to generate cash2 1 Historical growth for Vitro F&B from 2011 through LTM 3/31/15 (not including incremental CBI impact) 2 Source: Vitro data from Vitro management. Competitor and rigid packaging peer data from public filings. Rigid packaging peers: Ball, Crown and Silgan. EBITDA definitions may vary by company. See Appendix for O-I and O-I South America reconciliations. 26.0% 24.5% 19.0% 19.0% 17.9% 17.6% 13.3% Vitro's food & beverage glass containers O-I South America Competitor A Competitor B O-I Competitor C Rigid packaging peers 2012 – 2014 average adjusted EBITDA margins 18.6% 17.1% 13.0% 12.8% 9.7% 9.7% 5.7% O-I South America Vitro's food & beverage glass containers O-I Competitor A Competitor C Rigid packaging peers Competitor B 2012 – 2014 average (adjusted EBITDA – CapEx) margins |

|

|

Clear opportunities to achieve synergies 11 $30 million annual synergy target ~3% of Vitro F&B revenue Operational efficiencies Procurement savings Highly confident in achieving synergies Leverage O-I’s glass making expertise O-I’s history of productivity gains At JV with CBI in Mexico At CIV in Brazil Leverage O-I’s scale in procurement Momentum with Vitro F&B leadership Projected annual synergies $8M $15M $30M Year 1 Year 2 Year 3 |

|

|

Significant positive impact on O-I 12 2 $ millions Owens-Illinois (LTM 3/31/15)1 Vitro F&B Total Sales $6,566 $9452 $7,511 Adjusted EBITDA $1,180 $3083 $1,488 % margin 18.0% 32.6% 19.8% Adjusted EBITDA – CapEx $813 $247 $1,060 % of sales 12.4% 26.1% 14.1% 1 See Appendix: O-I: Reconciliations of adjusted EBITDA and margins 2 Vitro F&B pro forma revenue. See Appendix: Vitro F&B pro forma adjusted EBITDA and transaction multiple calculation 3 Vitro F&B pro forma adjusted EBITDA, including synergies. See Appendix: Vitro F&B pro forma adjusted EBITDA and transaction multiple calculation |

|

|

Balanced capital allocation Transaction increases O-I’s net leverage ratio to ~3.8x1 Primarily focused on debt reduction in Year 1 Anti-dilutive share repurchases of ~$25 million in Year 1 Ramp up shareholder yield in Years 2 and 3 Deleveraging still a priority May initiate a modest dividend Shareholder yield expected to be > $100 million by Year 3 Anticipate leverage ratio of ~3.0x within 3 years 1 See Appendix: Combined leverage ratio 13 |

|

|

Transaction to drive long-term value creation 14 Aligns well with O-I market strategy and global footprint Includes highly productive operations and effective management Shares commitment to high-quality product for leading brand owners Expands top-tier customer base Provides low-risk opportunities for synergies Expected to be accretive to cash flow and earnings in Year 1 Generates strong and stable free cash flow Delivers return above cost of capital |

|

|

Appendix 15 |

|

|

Vitro F&B pro forma adjusted EBITDA and transaction multiple calculation Source: Based on Vitro management estimates Vitro F&B ($ millions) Pro forma revenue (3/31/15 LTM + estimate of full year 2016 new business signed in 2014) $ 945 Pro forma adjusted EBITDA (3/31/15 LTM + estimate of full year 2016 new business signed in 2014) $ 278 O-I run rate synergies (by Year 3) 30 Pro forma adjusted EBITDA, including synergies $ 308 Transaction Purchase price $ 2,150 Multiple of pro forma adjusted EBITDA, incl. synergies (times) 7.0 x |

|

|

Combined leverage ratio 17 1 Includes $100 million for value-added tax to be paid at closing and refunded post-closing. 2 The combined leverage ratio calculated here does not necessarily conform with the definition in the Bank Credit Agreement. ($ millions) O-I Gross Debt as of March 31, 2015 $ 3,621 New Transaction Debt 1 2,250 Combined Gross Debt 5,871 O-I Cash and Cash Equivalents as of March 31, 2015 (257) Combined Net Debt $ 5,614 O-I adjusted EBITDA LTM 3/31/15 $ 1,180 Vitro F&B LTM 3/31/15 pro forma adjusted EBITDA, including synergies 308 Combined adjusted EBITDA $ 1,488 Combined Leverage Ratio2 Gross Debt 3.9 x Net Debt 3.8 x |

|

|

O-I: Reconciliations of adjusted EBITDA and margins 18 $ Millions LTM ended Year ended December 31 March 31, 2015 2014 2013 2012 2010 Earnings (loss) from continuing operations $ 94 $ 126 $ 215 $ 220 $ 297 Interest expense 229 235 239 248 249 Provision for income taxes 90 92 120 108 129 Depreciation 324 335 350 378 369 Amortization of intangibles 83 83 47 34 22 EBITDA 820 871 971 988 1,066 Adjustments to EBITDA: Asia Pacific goodwill adjustment Charges for asbestos-related costs 135 135 145 155 79 Restructuring, asset impairment and other 91 91 119 168 13 Pension settlement charges 65 65 Non-income tax charge 69 69 Gain on China land compensation (61) Adjusted EBITDA $ 1,180 $ 1,231 $ 1,235 $ 1,250 $ 1,236 Capital spending 367 369 361 290 4,278 640 Adjusted EBITDA less capital spending $ 813 $ 862 $ 874 $ 960 3,638 Net Sales $ 6,566 $ 6,784 $ 6,967 $ 7,000 Adjusted EBITDA Margins: 2.9 Adjusted EBITDA / Net Sales 18.0% 18.1% 17.7% 17.9% 2012-2014 avg. Adjusted EBITDA margin 17.9% Adjusted EBITDA less capital spending / Net Sales 12.4% 12.7% 12.5% 13.7% 2010 from I-Day slide 2012-2014 avg. Adjusted EBITDA less capital spending margin 13.0% |

|

|

O-I South America: reconciliation of segment operating profit to earnings from continuing operations before income taxes 19 $ Millions Years ended December 31, Segment Operating Profit: 2014 2013 2012 Europe $ 353 $ 305 $ 307 North America 240 307 288 South America 227 204 227 Asia Pacific 88 131 113 Reportable segment totals 908 947 935 Items excluded from Segment Operating Profit: Retained corporate costs and other (100) (119) (106) Restructuring, asset impairment and related charges (91) (119) (168) Charge for Venezuela currency remeasurement Charge for asbestos related costs (135) (145) (155) Pension settlement charge (65) Non-income tax charge (69) Gain on China land compensation 61 Interest expense (230) (229) (239) Earnings (loss) from continuing operations before income taxes $ 218 $ 335 $ 328 South American Segment: Segment operating profit $ 227 $ 204 $ 227 Depreciation and amortization 79 72 70 Adjusted EBITDA $ 306 $ 276 $ 297 Capital Spending 55 80 75 Adjusted EBITDA less capital spending $ 251 $ 196 $ 222 Net Sales $ 1,159 $ 1,186 $ 1,252 Margins: Adjusted EBITDA / Net Sales 26.4% 23.3% 23.7% 2012-2014 avg. Adjusted EBITDA / Net Sales 24.5% Adjusted EBITDA / Net Sales 21.7% 16.5% 17.7% 2012-2014 avg. Adjusted EBITDA less capital spending / Net Sales 18.6% |

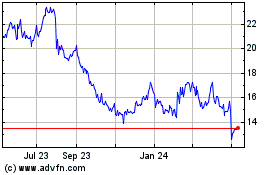

OI Glass (NYSE:OI)

Historical Stock Chart

From Jun 2024 to Jul 2024

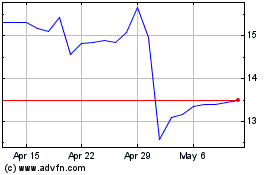

OI Glass (NYSE:OI)

Historical Stock Chart

From Jul 2023 to Jul 2024