Form SC TO-T/A - Tender offer statement by Third Party: [Amend]

May 24 2024 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or

13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 13)

MORPHOSYS AG

(Name of Subject Company (Issuer))

NOVARTIS BIDCO AG

an indirect wholly owned subsidiary of

NOVARTIS AG

(Name of Filing Persons (Offerors))

Ordinary Shares, no Par Value

(Title of Class of Securities)

617760202

(CUSIP Number of Class of Securities)

Karen L. Hale

Chief Legal Officer

Novartis AG

Lichstrasse 35

CH-4056 Basel

Switzerland

Telephone: +41-61-324-1111

Fax: +41-61-324-7826

(Name, Address, and Telephone Number of Person

Authorized to Receive Notices and Communications on Behalf of Filing Persons)

With a copy to:

| |

Jenny Hochenberg

Freshfields Bruckhaus Deringer US LLP

601 Lexington Ave.

New York, NY 10022

Telephone: +1 646 863-1626 |

|

|

Doug Smith

Freshfields Bruckhaus Deringer LLP

100 Bishopsgate

London EC2P 2SR

United Kingdom

+44 20 7936 4000 |

|

Check the appropriate boxes below to designate any transactions to

which the statement relates:

| x | third-party tender offer subject to Rule 14d-1. |

| ¨ | issuer tender offer subject to Rule 13e-4. |

| ¨ | going-private transaction subject to Rule 13e-3. |

| ¨ | amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final

amendment reporting the results of the tender offer: ¨

If applicable, check the appropriate box(es) below

to designate the appropriate rule provision(s) relied upon:

| ¨ | Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ | Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

This Amendment No. 13

(this “Amendment”) amends and supplements the Tender Offer Statement on Schedule TO filed with the Securities and Exchange

Commission (the “SEC”) on April 11, 2024 (together with any amendments and supplements hereto, the “Schedule

TO”) by Novartis AG, a stock corporation organized under the Laws of Switzerland (“Novartis”) and Novartis

BidCo AG, a stock corporation organized under the Laws of Switzerland and an indirect wholly owned subsidiary of Novartis AG (the “Bidder”

and, together with the Novartis, the “Filing Persons”). The Schedule TO relates to the voluntary takeover offer

(the “Takeover Offer”) by the Bidder to purchase all no-par value registered shares (the “MorphoSys Shares”)

in MorphoSys AG (“MorphoSys”), including the MorphoSys Shares represented by American Depositary Shares (“MorphoSys

ADSs”), pursuant to a Business Combination Agreement, dated as of February 5, 2024, among MorphoSys and the Filing Persons.

The terms and conditions of the Takeover Offer are described in the Offer Document, dated as of April 11, 2024, copy of which was

filed as Exhibit (a)(1)(A) to the Schedule TO (the “Offer Document”), and, where applicable, the related

Declaration of Acceptance or ADS Letter of Transmittal and the instructions thereto, copies of which were filed as Exhibits (a)(1)(B) and

(a)(1)(E), respectively, to the Schedule TO.

This Amendment is being filed

solely to amend and supplement items to the extent specifically provided herein. Except as otherwise set forth in this Amendment,

the information set forth in the Schedule TO, including all exhibits thereto, remains unchanged and is incorporated herein by reference

to the extent relevant to the items in this Amendment. This Amendment should be read together with the Schedule TO.

ITEMS 1 THROUGH 11.

Items 1 through 11 of the

Schedule TO are hereby amended and supplemented by adding the following:

On May 24, 2024, the

Bidder submitted a notification of major holdings to the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht,

BaFin) (the “Notification of Major Holdings”) announcing that the Bidder acquired 29,970,913 MorphoSys Shares, representing

approximately 79.46% of the share capital and the voting rights, excluding treasury shares held by MorphoSys, as of May 23, 2024.

The Notification of Major Holdings is filed hereto as Exhibit (a)(5)(T) and is incorporated herein by reference.

ITEM 12. EXHIBITS.

Item 12 of the Schedule TO

is hereby amended and supplemented by adding the following:

SIGNATURES

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: May 24, 2024

| |

NOVARTIS BIDCO AG |

| |

|

| |

By: |

/s/ David Quartner |

| |

|

Name: |

David Quartner |

| |

|

Title: |

As Attorney |

| |

|

|

|

| |

By: |

/s/ Lukas Gilgen |

| |

|

Name: |

Lukas Gilgen |

| |

|

Title: |

As Attorney |

| |

|

|

|

| |

NOVARTIS AG |

| |

|

| |

By: |

/s/ David Quartner |

| |

|

Name: |

David Quartner |

| |

|

Title: |

As Attorney |

| |

|

|

|

| |

By: |

/s/ Lukas Gilgen |

| |

|

Name: |

Lukas Gilgen |

| |

|

Title: |

As Attorney |

Exhibit (a)(5)(T)

Notification of Major Holdings

This form is for information purpose only. From

1 July 2020 on submission of a notification to BaFin and to the

company must be made electronically. The notification to BaFin has

to be submitted by using BaFin’s MVP-Portal.

x

Notification of Major Holdings

or

¨ Correction

of a notification of Major Holdings dated |

| 1. Details of issuer |

|

Name:

MorphoSys AG |

Legal Entity Identifier (LEI):

529900493806K77LRE72

|

|

Street, Street number:

Semmelweisstrasse 7 |

Postal code:

82152 |

City:

Planegg

|

2.

Reason for notification (multiple reasons possible)

x

Acquisition/disposal of shares with voting rights

¨

Acquisition/disposal of instruments

¨

Change of breakdown of voting rights

¨

Other reason:

|

| 3.

Details of person subject to the notification obligation |

|

Natural

person (first name, surname):

Date of birth: |

Legal

entity:

Novartis AG

City of registered office, country:

Lichtstrasse 35, 4056 Basel, Switzerland

|

|

4.

Name(s) of shareholder(s) holding directly 3% or more voting rights, if different from 3.

Novartis BidCo AG |

| 5. Date on which threshold was crossed or reached: 23.05.2024 |

| 6. Total positions |

| |

% of voting rights

attached to shares

(total of 7.a.) |

% of voting rights

through instruments

(total of 7.b.1. + 7.b.2.) |

Total of both in %

(7.a. + 7.b.) |

Total number of voting rights

pursuant to

Sec. 41 WpHG |

| New |

79.46% |

0.00% |

0.00% |

37,716,423 |

|

Previous

notification |

11.56% |

0.00% |

0.00% |

|

| 7. Details on total positions |

| a. Voting rights attached to shares (Sec. 33, 34 WpHG) |

| ISIN |

Absolute |

In % |

|

Direct

(Sec. 33 WpHG) |

Indirect

(Sec. 34 WpHG) |

Direct

(Sec. 33 WpHG) |

Indirect

(Sec. 34 WpHG) |

| DE0006632003 |

0 |

29,970,913 |

0.00% |

79.46% |

| |

|

|

% |

% |

| Total |

29,970,913 |

79.46% |

|

b.1.

Instruments according to Sec. 38 (1) no. 1 WpHG

(please use annex

in case of more than 3 instruments) |

| Type of instrument |

Expiration or

maturity date |

Exercise or

conversion period |

Voting rights

absolute |

Voting rights

in % |

| |

|

|

0 |

0.00% |

| |

|

|

|

% |

| |

|

|

|

% |

| |

|

Total |

0 |

0.00% |

|

b.2.

Instruments according to Sec. 38 (1) no. 2 WpHG

(please use annex

in case of more than 3 instruments) |

| Type of instrument |

Expiration or

maturity date |

Exercise or

conversion

period |

Cash or physical

settlement |

Voting rights

absolute |

Voting rights

in % |

| |

|

|

|

0 |

0.00% |

| |

|

|

|

|

% |

| |

|

|

|

|

% |

| |

|

|

Total |

0 |

0.00% |

8. Information

in relation to the person subject to the notification obligation (please tick the applicable box):

¨

Person subject to the notification (3.) obligation

is not controlled nor does it control any other undertaking(s) holding directly or indirectly an interest in the (underlying)

issuer (1.).

x

Full chain of controlled undertakings starting

with the ultimate controlling natural person or legal entity (in case of more than four undertakings

please always provide only to BaFin also an organizational chart):

|

| Name |

% of voting rights

(if at least 3% or

more) |

% of voting rights through

instruments

(if at least 5% or more) |

Total of both

(if at least 5%

or more) |

| Novartis AG |

% |

% |

% |

| Novartis Pharma AG |

% |

% |

% |

| Novartis BidCo AG |

79.46% |

% |

79.46% |

|

9. In case

of proxy voting according to Sec. 34 (3) WpHG

(only in case

of attribution of voting rights in accordance with Sec. 34 (1) sent. 1 no. 6 WpHG)

Date of

general meeting:

Total positions (6.) after general meeting: |

% of voting rights attached to

shares |

% of voting rights through

instruments |

Total of both |

| % |

% |

% |

|

10. Other

useful information

|

Annex (only for BaFin) –

1. Identity of the person subject

to the notification obligation:

Street: Lichtstrasse

Street number: 35

Postal code: 4056

City: Basel

Country: Switzerland

In

case of legal entities: x registered

office ¨ business

address

Contact person: David Quartner

Phone number: +41 79 193 62 72

Fax number:

E-mail: david.quartner@novartis.com

|

|

2. Identity of notifier (if

different from 1.)

Name: Dr. Rebecca Hettich

Company: Freshfields Bruckhaus Deringer Rechtsanwälte Steuerberater

PartG mbB

Street: Bockenheimer Anlage

Street number: 44

Postal code: 60322

City: Frankfurt am Main

Country: Germany

Phone number: +49 172 6643 834

Fax number:

E-mail: rebecca.hettich@freshfields.com

|

|

3. Other useful information:

|

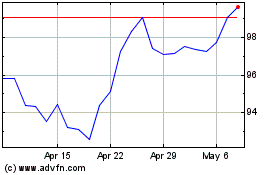

Novartis (NYSE:NVS)

Historical Stock Chart

From May 2024 to Jun 2024

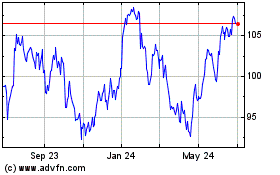

Novartis (NYSE:NVS)

Historical Stock Chart

From Jun 2023 to Jun 2024