Chinese EV Makers' Shares Rise, Led by Tesla's Gains, Appetite for Tech

June 14 2023 - 1:39AM

Dow Jones News

By Bingyan Wang

Shares of Chinese electric vehicle makers rose early Wednesday,

helped by positive news for global tech companies as well as a

strong run by U.S. rival Tesla's shares.

Hong Kong-listed shares of Li Auto, Xpeng and NIO were up 8.2%,

7.3% and 6.8%, respectively, at mid-day, after Tesla shares rose

for a record 13th straight session, boosted after General Motors

last week said its upcoming EVs would make use of Tesla's charging

hardware.

The tech-heavy U.S. Nasdaq index has gained ground for four

consecutive sessions, and appetite for tech was further boosted by

a relatively subdued U.S. inflation print Tuesday, which raised

hopes of a pause in Fed rate hikes.

Closer to home, XPeng said this week that had more than 25,000

pre-sale orders for its all-electric G6 model in China in the three

days after its first production models hit showrooms. Shares have

gained about 28% in the past four trading sessions, reversing their

losses from earlier this year.

NIO was helped by Chinese media reports Monday that it is in

talks with other brands to share its battery swap system, citing

comments by NIO's founder. The technology would allow EV drivers to

quickly exchange depleted batteries for fully-charged ones.

NIO also announced Monday that it will cut vehicle prices,

following other companies' cuts, in a bid to attract more

buyers.

Li Auto said Tuesday that its weekly sales volume reached a

record-high 8,400 units as of June 11. Shares have now risen 73%

year to date.

Still, some analysts say all EV makers will face headwinds in

the longer term given rising competition and subdued Chinese

consumption.

Some investment banks lowered their stock ratings and price

targets for NIO after it posted an earnings miss on Friday.

Analysts believe NIO is likely to face increased margin pressure

and that growth boosted by price cuts may be unsustainable.

Citi analysts said in a research note Monday that while Xpeng's

new SUV received higher-than-expected orders after its launch, the

trend is unlikely to last. They maintained a sell rating on the

stock, saying the model is "unlikely to change the big picture for

the company" amid rising competition.

Write to Bingyan Wang at bingyan.wang@wsj.com

(END) Dow Jones Newswires

June 14, 2023 01:24 ET (05:24 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

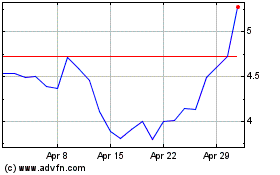

NIO (NYSE:NIO)

Historical Stock Chart

From Jun 2024 to Jul 2024

NIO (NYSE:NIO)

Historical Stock Chart

From Jul 2023 to Jul 2024