Nine Energy Service, Inc. Receives Notice from NYSE Regarding Continued Listing Requirements

October 25 2024 - 8:30AM

Business Wire

Nine Energy Service, Inc. (NYSE: NINE) (“Nine” or the “Company”)

announced today that it received written notice (the “Notice”) from

the New York Stock Exchange (the “NYSE”) on October 21, 2024, that

the Company is not in compliance with the continued listing

standards set forth in Section 802.01B of the NYSE Listed Company

Manual because its average global market capitalization over a

consecutive 30 trading-day period and its last reported

stockholders’ equity were both below $50 million.

In accordance with NYSE procedures, the Company has 45 days from

its receipt of the Notice to submit a business plan to the NYSE

demonstrating how it intends to regain compliance with the NYSE’s

continued listing standards within 18 months. The Company intends

to develop and submit a business plan within 45 days of receipt of

the Notice that demonstrates its ability to regain compliance with

the NYSE’s continued listing standards within the required

timeframe. The Listings Operations Committee of the NYSE (the

“Committee”) will then review the business plan for final

disposition.

In the event the Committee accepts the plan, the Company will be

subject to quarterly review for compliance with the business plan.

In the event the Committee does not accept the business plan, the

Company will be subject to delisting procedures and suspension by

the NYSE.

The Notice has no immediate impact on the listing of the

Company’s common stock, which will continue to trade on the NYSE.

In addition, the Notice does not affect the Company’s business

operations or its SEC reporting requirements and does not conflict

with or cause an event of default under any of the Company’s

material debt or other agreements.

About Nine Energy Service

Nine Energy Service is an oilfield services company that offers

completion solutions within North America and abroad. The Company

brings years of experience with a deep commitment to serving

clients with smarter, customized solutions and world-class

resources that drive efficiencies. Serving the global oil and gas

industry, Nine continues to differentiate itself through superior

service quality, wellsite execution and cutting-edge technology.

Nine is headquartered in Houston, Texas with operating facilities

in the Permian, Eagle Ford, Haynesville, SCOOP/STACK, Niobrara,

Barnett, Bakken, Marcellus, Utica and Canada.

For more information on the Company, please visit Nine’s website

at nineenergyservice.com.

Forward-Looking Statements

The foregoing contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Forward-looking

statements are those that do not state historical facts and are,

therefore, inherently subject to risks and uncertainties.

Forward-looking statements also include statements that refer to or

are based on projections, uncertain events or assumptions. The

forward-looking statements included herein, such as those regarding

the Company’s plan to regain compliance with NYSE listing

standards, are based on current expectations and entail various

risks and uncertainties that could cause actual results to differ

materially from those forward-looking statements. Such risks and

uncertainties include, among other things, the Company’s business

being cyclical and dependent on the level of capital spending and

well completions by the onshore oil and natural gas industry, which

is volatile, strongly influenced by current and expected oil and

natural gas prices, and may be affected by geopolitical and

economic developments in the U.S. and globally, including

conflicts, instability, acts of war or terrorism in oil producing

countries or regions, particularly Russia, the Middle East, South

America and Africa, as well as actions by members of the

Organization of the Petroleum Exporting Countries and other oil

exporting nations; general economic conditions and inflation,

particularly, cost inflation with labor or materials; equipment and

supply chain constraints; the Company’s ability to attract and

retain key employees, technical personnel and other skilled and

qualified workers; the Company’s ability to maintain existing

prices or implement price increases on its products and services;

pricing pressures, reduced sales or reduced market share as a

result of intense competition in the markets for the Company’s

dissolvable plug products; conditions inherent in the oilfield

services industry, such as equipment defects, liabilities arising

from accidents or damage involving the Company’s fleet of trucks or

other equipment, explosions and uncontrollable flows of gas or well

fluids, and loss of well control; the Company’s ability to

implement and commercialize new technologies, services and tools;

the Company’s ability to grow its completion tool business

domestically and internationally; the adequacy of the Company’s

capital resources and liquidity, including the ability to meet its

debt obligations; the Company’s ability to manage capital

expenditures; the Company’s ability to accurately predict customer

demand, including that of its international customers; the loss of,

or interruption or delay in operations by, one or more significant

customers, including certain of the Company’s customers outside of

the United States; the loss of or interruption in operations of one

or more key suppliers; the incurrence of significant costs and

liabilities resulting from litigation or claims for personal injury

or property damage; cybersecurity risks; changes in laws or

regulations regarding issues of health, safety and protection of

the environment; and other factors described in the “Risk Factors”

and “Business” sections of the Company’s most recently filed Annual

Report on Form 10-K and subsequently filed Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K. Readers are cautioned

not to place undue reliance on forward-looking statements, which

speak only as of the date hereof, and, except as required by law,

the Company undertakes no obligation to update those statements or

to publicly announce the results of any revisions to any of those

statements to reflect future events or developments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241025050334/en/

Nine Energy Service Investor Contact: Heather Schmidt

Vice President, Strategic Development, Investor Relations and

Marketing (281) 730-5113 investors@nineenergyservice.com

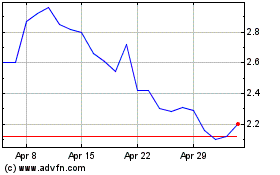

Nine Energy Service (NYSE:NINE)

Historical Stock Chart

From Dec 2024 to Jan 2025

Nine Energy Service (NYSE:NINE)

Historical Stock Chart

From Jan 2024 to Jan 2025