Item 1.01

Entry into a Material Definitive Agreement

Class D Preferred Unit and Warrant Purchase Agreement

On July 2, 2019 (the “

Closing Date

”), NGL Energy Partners LP, a Delaware limited partnership (the “

Partnership

”), entered into a Class D Preferred Unit and Warrant Purchase Agreement (the “

Purchase Agreement

”) with EIG Neptune Equity Aggregator, L.P. and FS Energy and Power Fund (together, the “

Purchasers

”), pursuant to which the Partnership agreed to issue and sell to the Purchasers in a private placement (the “

Private Placement

”) $400 million in aggregate initial liquidation preference of the Partnership’s Class D Preferred Units (the “

Preferred Units

”) and warrants (the “

Warrants

”) to purchase 17,000,000 common units representing limited partner interests in the Partnership (“

Common Units

”). The aggregate purchase price for the Preferred Units and Warrants was $400 million. The Warrants are subject to vesting and exercise terms described in Item 3.02 hereof.

Pursuant to the terms of the Purchase Agreement, the Partnership will pay a cash closing fee in the amount of $8 million to affiliates of the Purchasers.

The Purchase Agreement contains customary representations and warranties by the Partnership and the Purchasers, and each of the Partnership and the Purchasers have agreed to indemnify the other for losses resulting from a breach of any of their respective representations, warranties or covenants.

The information regarding the Preferred Units and the Warrants set forth in Item 3.02 hereof is incorporated by reference into this Item 1.01.

The description of the Purchase Agreement is qualified in its entirety by reference to the full text of the Purchase Agreement, which is filed as Exhibit 10.1 hereto, and is incorporated into this Item 1.01 by reference.

Warrants

On July 2, 2019, pursuant to the Purchase Agreement, the Partnership issued to the Purchasers Warrants

exercisable in the aggregate for 17,000,000 Common Units

. The information regarding the Warrants set forth in Item 3.02 hereof is incorporated by reference into this Item 1.01.

Registration Rights Agreement

On July 2, 2019, in connection with the Purchase Agreement and the closing of the Private Placement, the Partnership entered into a Registration Rights Agreement (the “

Registration Rights Agreement

”), by and among the Partnership and the Purchasers.

Pursuant to the Registration Rights Agreement, the Partnership is required to prepare and file a registration statement (the “

Registration Statement

”) within 180 days of the Closing Date (as defined in the Registration Rights Agreement), to permit the public resale of (i) the Preferred Units, (ii) the Common Units issued or issuable upon the exercise of the Warrants, (iii) the Common Units that are issuable pursuant to the terms of the Preferred Units in connection with a redemption of the Preferred Units and (iv) any Common Units issued in lieu of cash as liquidated damages under the Registration Rights Agreement. The Partnership is also required to use its commercially reasonable efforts to cause the Registration Statement to become effective no later than 360 days after the Closing Date (the “

Registration Statement Deadline

”).

The Registration Rights Agreement provides that if the Registration Statement is not declared effective on or prior to the Registration Statement Deadline, the Partnership will be liable to the

2

Purchasers for liquidated damages in accordance with a formula, subject to the limitations set forth in the Registration Rights Agreement. Such liquidated damages would be payable in cash, or if payment in cash would breach any covenant or a cause a default under a credit facility or any other debt instrument filed by the Partnership as an exhibit to a periodic report filed with the United States Securities and Exchange Commission (the “

SEC

”), then such liquidated damages would be payable in the form of newly issued Common Units. In addition, the Registration Rights Agreement grants the Purchasers piggyback registration rights. These registration rights are transferable to affiliates of the Purchasers and, in certain circumstances, to third parties.

The description of the Registration Rights Agreement is qualified in its entirety by reference to the full text of the Registration Rights Agreement, which is filed as Exhibit 4.1 hereto, and is incorporated into this Item 1.01 by reference.

Board Rights Agreement

On July 2, 2019, pursuant to the Purchase Agreement, the Partnership entered into a Board Representation Rights Agreement by and among the General Partner, the Partnership and certain affiliates of the Purchasers (the “

Board Rights Agreement

”). Under the terms of the Board Rights Agreement, affiliates of the Purchasers will have the right to designate up to one director on the board of directors of the General Partner, so long as the Purchasers and their respective affiliates, in the aggregate, own either at least (i) (A) 50% of the number of Preferred Units issued on the Closing Date or (B) 50% of the aggregate liquidation preference of any class or series of Class D Parity Securities (as defined in the Amended and Restated Partnership Agreement (as defined below)), or (ii) Warrants and/or Common Units that, in the aggregate, comprise 10% or more of the then-outstanding Common Units.

The description of the Board Rights Agreement is qualified in its entirety by reference to the full text of the Board Rights Agreement, which is filed as Exhibit 10.2 hereto, and is incorporated into this Item 1.01 by reference.

Voting Agreement

On July 2, 2019, members of the General Partner holding a majority of the membership interests of the General Partner entered into a Voting Agreement (the “

Voting Agreement

”) pursuant to which the members of the General Partner named therein agreed to vote their respective membership interests of the General Partner in accordance with the terms of the Board Rights Agreement. In addition, under the Voting Agreement, the members of the General Partner named therein agreed to use reasonable best efforts to cause the approval of an amendment to the Third Amended and Restated Limited Liability Company Agreement of the General Partner to give effect to the terms of the Board Rights Agreement.

The description of the Voting Agreement is qualified in its entirety by reference to the full text of the Voting Agreement, which is filed as Exhibit 10.3 hereto, and is incorporated into this Item 1.01 by reference.

Amendment to Mesquite Acquisition Agreement

On July 2, 2019, the parties to that certain Asset Purchase and Sale Agreement, dated as of May 13, 2019 (the “

Mesquite Acquisition Agreement

”), by and among a wholly owned subsidiary of the Partnership, Mesquite Disposals Unlimited, LLC (“

Mesquite

”) and Mesquite SWD, Inc., entered into a letter agreement (the “

Letter Agreement Amendment

”) to amend the terms of the Mesquite Acquisition

3

Agreement (as amended by the Letter Agreement Amendment, the “

Amended Mesquite Acquisition Agreement

”). Under the Letter Agreement Amendment, the cash portion of the purchase price due at closing was amended to $592,500,000. In addition, the Partnership agreed to pay Mesquite up to $200,000,000 in cash to be paid in two installments contingent on certain performance metrics of the assets being acquired by the Partnership pursuant to the Amended Mesquite Acquisition Agreement.

The description of the Letter Agreement Amendment is qualified in its entirety by reference to the full text of the Letter Agreement Amendment, which is filed as Exhibit 10.4 hereto, and is incorporated into this Item 1.01 by reference.

Term Credit Agreement

On July 2, 2019, the Partnership and its wholly owned subsidiary, NGL Energy Operating LLC, a Delaware limited liability company (the “

Borrower

”), entered into a Term Credit Agreement (the “

Term Credit Agreement

”) with Toronto Dominion (Texas) LLC, as administrative agent, and the financial institutions party thereto as lenders, that provides for a $250,000,000 term loan facility. Toronto Dominion (Texas) LLC and certain of its affiliates are also lenders under the Borrower’s revolving credit facility. The term loans will mature on July 2, 2024 and will be subject to customary mandatory prepayment events, including with the proceeds of certain asset sales, equity issuances and debt incurrences.

The obligations of Borrower under the Term Credit Agreement are guaranteed by the Partnership and certain of the Borrower’s wholly owned subsidiaries. The term loans will be secured by substantially all of the assets of the Borrower, the Partnership and the other subsidiary guarantors subject to certain customary exclusions.

All borrowings under the Term Credit Agreement bear interest, at the Borrower’s option, at (a) an alternate base rate plus (i) during the first three-month period after the closing date, margin equal to the applicable margin for alternate base rate loans calculated under the Borrower’s existing revolving credit facility, (ii) 2.00% per annum for the second three-month period after the Closing Date, (iii) 2.25% per annum for the third three-month period after the Closing Date, (iv) 2.50% per annum for the fourth three-month period after the Closing Date, and (v) thereafter, such rate per annum such that the alternate base rate equals to a rate of interest agreed to among the Borrower and the administrative agent, or (b) an adjusted LIBOR rate plus (i) during the first three-month period after the closing date, margin equal to the applicable margin for LIBOR rate loans calculated under the Borrower’s existing revolving credit facility, (ii) 3.00% per annum for the second three-month period after the Closing Date, (iii) 3.25% per annum for the third three-month period after the Closing Date, (iv) 3.50% per annum for the fourth three-month period after the Closing Date, and (v) thereafter, such rate per annum such that the adjusted LIBOR rate equals to a rate of interest agreed to among the Borrower and the administrative agent.

The Term Credit Agreement contains various customary representations, warranties and covenants by the Partnership and its subsidiaries, including, without limitation, (i) commencing September 30, 2019, the Partnership, the Borrower and the subsidiary guarantors will be subject to financial covenants limiting leverage, including senior leverage, secured leverage and total leverage, and requiring a minimum interest coverage, (ii) negative covenants limiting indebtedness, liens, equity distributions and fundamental changes involving the Partnership or its subsidiaries and (iii) affirmative covenants requiring, among other things, reporting of financial information and material events and covenants to maintain existence and pay taxes, in each case substantially consistent with the Borrower’s existing revolving credit facility.

Substantially consistent with the Borrower’s existing revolving facility, the Partnership’s and its subsidiaries’ obligations under the Term Credit Agreement may be accelerated following certain events of default (subject to applicable cure periods), including, without limitation, (i) the failure to pay principal or interest when due, (ii) a breach by the Partnership or its subsidiaries of any material representation or warranty or any covenant made in the Term Credit Agreement or (iii) certain events of bankruptcy or insolvency.

The description of the Term Credit Agreement is qualified in its entirety by reference to the full text of the Term Credit Agreement, which is filed as Exhibit 10.5 hereto and is incorporated into this Item 1.01 by reference.

Item 2.01

Completion of Acquisition or Disposition of Assets

On July 2, 2019, pursuant to the Amended Mesquite Acquisition Agreement, the Partnership completed the previously announced acquisition of all of the assets of Mesquite for a total purchase price of $892,500,000. The purchase price was comprised of (i) $592,500,000 in cash, (ii) an issuance by the Partnership of $100,000,000 (based on market value) of 9.00% Class B Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units of the Partnership (the “

Class B Preferred Units

”) to Precious Lady Holdings, L.L.C. (“

Precious Lady

”), and (iii) up to $200,000,000 in cash to be paid in two deferred installments contingent on certain performance metrics of the assets being acquired.

The material terms of the Mesquite Acquisition Agreement were previously reported in Item 1.01 of the Partnership’s

Current Report on Form 8-K filed with the SEC on May 15, 2019

and are incorporated herein by reference. The description of the Mesquite Acquisition Agreement included or incorporated by reference in this Current Report on Form 8-K is qualified in its entirety by reference to the full text of the Mesquite Acquisition Agreement, which is filed as Exhibit 2.1 hereto, and is incorporated into this Item 2.01 by reference. The description of the Letter Agreement Amendment is qualified in its entirety by reference to the full text of the Letter Agreement Amendment, which is filed as Exhibit 10.4 hereto, and is incorporated into this Item 2.01 by reference.

Item 2.03

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information included in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03 of this Current Report on Form 8-K.

4

Item 3.02

Unregistered Sales of Equity Securities

Preferred Units and Warrants

On July 2, 2019, the Partnership completed the Private Placement with the issuance and sale of an aggregate of 400,000 Preferred Units and Warrants exercisable to purchase an aggregate of 17,000,000 Common Units for an aggregate purchase price of $400,000,000. The Private Placement resulted in aggregate net proceeds to the Partnership of approximately $385 million, after deducting a closing fee of $8,000,000 payable to affiliates of the Purchasers and certain expenses and expense reimbursements.

The Private Placement was made in reliance upon an exemption from the registration requirements of the Securities Act of 1933, as amended (the “

Securities Act

”), pursuant to Section 4(a)(2) thereof, as a transaction by an issuer not involving any public offering. The terms of the Preferred Units and the Common Units issuable upon exercise of the Warrants are set forth in the Amended and Restated Partnership Agreement (as defined in Item 5.03 hereof).

The Warrants issued in the Private Placement are exercisable for, in the aggregate, 17,000,000 Common Units. Warrants to purchase 10,000,000 Common Units were issued with an exercise price of $17.45 per Common Unit (subject to customary adjustments) (the “

Premium Warrants

”), and the remaining Warrants to purchase 7,000,0000 Common Units were issued with an exercise price of $14.54 per Common Unit (subject to customary adjustments) (the “

Par Warrants

”). The Warrants may be exercised from and after the first anniversary of the Closing Date, subject to certain terms and conditions set forth in the Warrants. Notwithstanding the foregoing, upon the occurrence of a Class D Change of Control (as defined in the Amended and Restated Partnership Agreement), all unvested Warrants shall immediately vest and be exercisable in full. Unexercised Warrants will expire on the tenth anniversary of the Closing Date. The Warrants will not participate in cash distributions by the Partnership.

The description of the Warrants is qualified in its entirety by reference to each of the full text of the Form of Par Warrant and the Form of Premium Warrant, which are filed as Exhibits 10.6 and 10.7, respectively, hereto and are incorporated into this Item 3.02 by reference.

The information regarding the Preferred Units set forth in Item 5.03 of this Current Report is incorporated by reference into this Item 3.02.

On July, 2, 2019, the Partnership issued 4,185,642 Class B Preferred Units to Precious Lady pursuant to the terms of the Amended Mesquite Acquisition Agreement.

The issuance of the Class B Preferred Units was made in reliance upon an exemption from the registration requirements of the Securities Act, pursuant to Section 4(a)(2) thereof, as a transaction by an issuer not involving any public offering. The terms of the Class B Preferred Units are set forth in the Amended and Restated Partnership Agreement (as defined in Item 5.03 hereof).

Item 3.03

Material Modification to Rights of Security Holders

Pursuant to the Purchase Agreement, on the Closing Date, the Partnership issued and sold to the Purchasers the Preferred Units and the Warrants. The terms of the Preferred Units and the Common Units issuable upon exercise of the Warrants are set forth in the Amended and Restated Partnership Agreement. As described in the Amended and Restated Partnership Agreement, the Preferred Units entitle the holders of the Preferred Units (each, a “

Preferred Unitholder

”) to certain rights that are senior to the rights of the holders of Common Units, such as rights to certain distributions and rights upon liquidation of the Partnership.

5

If the Partnership fails to pay the redemption price in full in cash on the applicable payment due date, then the Partnership shall not, without the consent of a representative of the Preferred Unitholders, declare or make any distributions in respect of any Class D Junior Securities (as defined in the Amended and Restated Partnership Agreement), including Common Units. In addition, if any accumulated and unpaid distributions are past due and outstanding, the Partnership shall not, without the consent of a representative of the Preferred Unitholders, redeem or repurchase any Class D Junior Securities or Class D Parity Securities (each as defined in the Amended and Restated Partnership Agreement). Upon liquidation of the Partnership, each holder of Preferred Units shall be entitled to receive, in respect of each Preferred Unit then-owned, a liquidation preference equal to the greater of the applicable redemption price and the Class D Stated Value (as defined in the Amended and Restated Partnership Agreement) of such Preferred Unit on such date.

The information regarding the Preferred Units set forth in Items 1.01, 3.02 and 5.03 hereof is incorporated by reference into this Item 3.03.

Item 5.02

Departure of Directors or Certain Officers; Election of Directors, Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Pursuant to the Board Rights Agreement and the Voting Agreement, on July 2, 2019, Brian Boland was appointed to the board of directors of the General Partner, effective immediately.

Prior to the signing of the Purchase Agreement, there had been no transactions since the beginning of the Partnership’s last fiscal year in which the Partnership was a participant involving amounts exceeding $120,000 and in which Mr. Boland had a direct or indirect material interest.

Item 5.03

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

Amended and Restated Partnership Agreement

On July 2, 2019, NGL Energy Holdings LLC, a Delaware limited liability company and the general partner of the Partnership (the “

General Partner

”), executed the Sixth Amended and Restated Agreement of Limited Partnership of the Partnership (the “

Amended and Restated Partnership Agreement

”) for the purpose of defining preferences, rights, powers and duties of the Preferred Unitholders and making such additional amendments thereto as the board of directors of the General Partner determined to be necessary and appropriate. The preferences, rights, powers and duties of the Preferred Unitholders are defined in the Amended and Restated Partnership Agreement.

The Preferred Units rank senior to the Common Units and

pari passu

with the Partnership’s Class B Preferred Units and Class C Preferred Units (as defined in the Amended and Restated Partnership Agreement), with respect to the payment of distributions and distribution of assets upon liquidation, dissolution and winding up of the Partnership. The Preferred Units have no stated maturity and will remain outstanding indefinitely, unless redeemed by the Partnership at the election of the Partnership (at any time) or the Preferred Unitholders (after eight and one-half years from the Closing Date) or in connection with a Change of Control (as defined in the Amended and Restated Partnership Agreement), in each case, subject to certain limitations as described therein.

Each Preferred Unitholder will be entitled to receive a cumulative, quarterly distribution in arrears on each Preferred Unit then held by such Preferred Unitholder at an annual rate of (i) 9.00% per annum for all periods during which the Preferred Units are outstanding beginning on the Closing Date and ending on the date and including the last day of the eleventh full quarter following the Closing Date, (ii) 10.00% per annum for all periods during which the Preferred Units are outstanding beginning on and

6

including the first day of the twelfth full quarter following the Closing Date and ending on the last day of the nineteenth full quarter following the Closing Date, and (iii) thereafter, 10.00% per annum or, at the Purchasers’ election from time to time, a floating rate equal to the applicable three-month LIBOR, plus 7.00% per annum.

At any time after the Closing Date, the Partnership shall have the right to redeem all of the outstanding Preferred Units at a price per Preferred Unit equal to the sum of the then-unpaid accumulations with respect to such Preferred Unit and the greater of either the applicable multiple on invested capital or the applicable redemption price based on an applicable internal rate of return, as more fully described in the Amended and Restated Partnership Agreement. At any time on or after the eighth anniversary of the Closing Date, each Preferred Unitholder will have the right to require the Partnership to redeem on a date not prior to the 180th day after such anniversary all or a portion of the Preferred Units then held by such Preferred Unitholder for the then-applicable redemption price, which may be paid in cash or, at the Partnership’s election, a combination of cash and a number of Common Units not to exceed one-half of the aggregate then-applicable redemption price, as more fully described in the Amended and Restated Partnership Agreement. Upon a Class D Change of Control (as defined in the Partnership Agreement), each Preferred Unitholder will have the right require the Partnership to redeem the Preferred Units then held by such Preferred Unitholder at a price per Preferred Unit equal to applicable redemption price. The Preferred Units generally will not have any voting rights, except with respect to certain matters which require the vote of the Preferred Units. The Preferred Units generally do not have any voting rights, except that the Preferred Units shall be entitled to vote as a separate class on any matter on which unitholders are entitled to vote that adversely affects the rights, powers, privileges or preferences of the Preferred Units in relation to other classes of Partnership Interests (as defined in the Amended and Restated Partnership Agreement) or as required by law. The consent of a majority of the then-outstanding Preferred Units, with one vote per Preferred Unit, shall be required to approve any matter for which the Preferred Unitholders are entitled to vote as a separate class or the consent of the representative of the Preferred Unitholders, as applicable.

The description of the Amended and Restated Partnership Agreement contained in this Item 5.03 is qualified in its entirety by reference to the full text of the Amended and Restated Partnership Agreement, which is filed as Exhibit 3.1 hereto and is incorporated by reference herein.

The information regarding the Preferred Units set forth in Items 3.02 and 3.03 hereof is incorporated by reference into this Item 5.03.

7

Item 9.01

Financial Statements and Exhibits

(d)

Exhibits

|

Exhibit No.

|

|

Description

|

|

2.1

|

|

Asset Purchase and Sale Agreement, dated May 13, 2019, by and among NGL Energy Partners LP, Mesquite Disposals Unlimited, LLC and Mesquite SWD, Inc.*

|

|

3.1

|

|

Sixth Amended and Restated Agreement of Limited Partnership of NGL Energy Partners LP, dated as of July 2, 2019

|

|

4.1

|

|

Registration Rights Agreement, dated July 2, 2019, by and among NGL Energy Partners LP, EIG Neptune Equity Aggregator, L.P. and FS Energy and Power Fund

|

|

10.1

|

|

Class D Preferred Unit and Warrant Purchase Agreement, dated July 2, 2019, by and among the NGL Energy Partners LP , EIG Neptune Equity Aggregator, L.P. and FS Energy and Power Fund

|

|

10.2

|

|

Board Representation Rights Agreement, dated July 2, 2019, by and among NGL Energy Partners LP, NGL Energy Holdings LLC and certain affiliates of EIG Neptune Equity Aggregator, L.P. and FS Energy and Power Fund

|

|

10.3

|

|

Voting Agreement, dated July 2, 2019, by and among the members of the NGL Energy Holdings LLC named therein

|

|

10.4

|

|

Letter Agreement, dated July 2, 2019, by and among NGL Energy Partners LP, Mesquite Disposals Unlimited, LLC and Mesquite SWD, Inc.

|

|

10.5

|

|

Term Credit Agreement, dated July 2, 2019, by and among NGL Energy Operating LLC, as Borrower, NGL Energy Partners LP, the lenders thereto and TD Dominion (Texas LLC), as the administrative agent

|

|

10.6

|

|

Form of Par Warrant

|

|

10.7

|

|

Form of Premium Warrant

|

* Exhibits and Schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Partnership agrees to furnish a supplemental copy of any such omitted Exhibit or Schedule to the United States Securities and Exchange Commission upon request.

8

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NGL ENERGY PARTNERS LP

|

|

|

|

|

|

By:

|

NGL Energy Holdings LLC,

|

|

|

|

its general partner

|

|

|

|

|

|

|

|

Date: July 8, 2019

|

By:

|

/s/ H. Michael Krimbill

|

|

|

|

H. Michael Krimbill

|

|

|

|

Chief Executive Officer

|

9

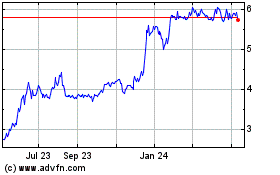

NGL Energy Partners (NYSE:NGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

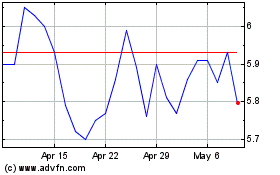

NGL Energy Partners (NYSE:NGL)

Historical Stock Chart

From Apr 2023 to Apr 2024