Current Report Filing (8-k)

December 17 2020 - 8:30AM

Edgar (US Regulatory)

0000356309

false

NEW JERSEY RESOURCES CORP

0000356309

2020-12-15

2020-12-16

0000356309

2020-11-29

2020-11-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 16, 2020

NEW JERSEY RESOURCES CORPORATION

(Exact Name of registrant as specified in its charter)

|

New Jersey

|

|

001-08359

|

|

22-2376465

|

|

(State or Other

|

|

(Commission

|

|

(IRS Employer

|

|

Jurisdiction

|

|

File Number)

|

|

Identification No.)

|

|

of Incorporation)

|

|

|

|

|

|

|

|

|

|

|

|

1415 Wyckoff Road

|

|

|

|

Wall, New Jersey

|

|

07719

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(732) 938-1480

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

[ ]

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

[ ]

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

[ ]

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

[ ]

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on

which registered

|

|

Common Stock - $2.50 par value

|

|

NJR

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 8.01 Other Events.

On December 16, 2020, NJR Energy Services Company (“NJRES”), a wholly-owned subsidiary of New Jersey Resources Corporation (“NJR”), entered into a series of Asset Management Agreements (the “Transactions”) with an investment grade public utility (the “Utility”), under which the Utility will provide certain asset management services and NJRES may deliver natural gas to the Utility totaling up to 88,968 MMBtu/day from November 1 to March 31 each year during the term of the Transactions, for fees payable to NJRES totaling approximately $500 million, and payable through November 1, 2030. The Transactions include a series of recallable and permanent releases commencing on November 1, 2021. Upon completion of the Transactions on October 31, 2031, the transportation capacity will be permanently retained by the Utility.

NJR also published an investor fact sheet entitled, “Q&A on the Asset Management Agreement with an Investment Grade Public Utility” (the “Investor Fact Sheet”). The Investor Fact Sheet is furnished herewith as Exhibit 99.1, and is incorporated by reference into this Item 8.01 of this Current Report on Form 8-K.

Cautionary Statements Regarding Forward-Looking Statements

This filing contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. NJR cautions readers that the assumptions forming the basis for forward-looking statements include many factors that are beyond NJR’s ability to control or estimate precisely, such as estimates of future market conditions and the behavior of other market participants. Words such as “anticipates,” “estimates,” “expects,” “will,” “projects,” “intends,” “plans,” “believes,” “may,” “should” and similar expressions may identify forward-looking information and such forward-looking statements are made based upon management’s current expectations and beliefs as of this date concerning future developments and their potential effect upon NJR. There can be no assurance that future developments will be in accordance with management’s expectations or that the effect of future developments on NJR will be those anticipated by management. Forward-looking information in this filing includes, but is not limited to, certain statements regarding the arrangement with an investment grade public utility to release natural gas transportation capacity and related fees.

Additional information and factors that could cause actual results to differ materially from NJR’s expectations are contained in NJR’s filings with the U.S. Securities and Exchange Commission (“SEC”), including NJR’s Annual Reports on Form 10-K and subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other SEC filings, which are available at the SEC’s web site, http:.//www.sec.gov. Information included in this filing is representative as of today only and while NJR periodically reassesses material trends and uncertainties affecting NJR’s results of operations and financial condition in connection with its preparation of management’s discussion and analysis of results of operations and financial condition contained in its Quarterly and Annual Reports filed with the SEC, NJR does not, by including this statement, assume any obligation to review or revise any particular forward-looking statement referenced herein in light of future events.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NEW JERSEY RESOURCES CORPORATION

|

|

|

|

|

|

Date: December 17, 2020

|

By:

|

/s/ Patrick J. Migliaccio

|

|

|

|

|

Patrick J. Migliaccio

|

|

|

|

Senior Vice President and Chief Financial

|

|

|

|

Officer

|

|

|

|

|

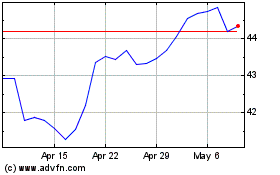

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From Mar 2024 to Apr 2024

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From Apr 2023 to Apr 2024