Filed by Nabors Energy Transition Corp.

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Nabors Energy Transition Corp.

Commission File No.: 001-41073

Analyst & Investor Day July 2023

Th e presentation (together with oral statements made in connection herewith, the “Presentation”) is for informational purposes only to assist interested parties in making their own evaluation with respect to the business operations of Vast Solar Pty Ltd, an Australian proprietary company limited by shares (“Vast” or the “Company”) and the proposed business combination between V ast and Nabors Energy Transition Corp. (“NETC”) and the related transactions (the “Business Combination”). The information contained herein does not purport to be all - inclusive and none of NETC, Vast, nor any of their respective subsidiaries, stockholders, shareholders, affiliates, representatives, control persons, partners, directors, officers, employees, advisers or agents make any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting the Presentation, you confirm that you are not relying upon the information contained herein to make any decision. The recipient shall not rely upon any statement, representation or warranty made by any other person, firm or corporation in making its investment or decision to invest in Vast. To the fullest extent permitted by law, in no circumstances will NETC, Vast, or any of their respective subsidiaries, stockholders, shareholders, affiliates, representatives, control persons, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of the Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. In addition, the Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of NETC, Vast, or the Business Combination. Please refer to the business combination agreement and other related transaction documents for the full terms of the Business Combination. The general explanations included in the Presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs. Important Information for NETC Stockholders The Presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or constitute a solicitation of any vote or approval. In connection with the proposed Business Combination , Vast has filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form F - 4 (the “Registration Statement”), which i nclude s (i) a preliminary prospectus of Vast relating to the offer of securities to be issued in connection with the proposed Business Combination and (ii) a preliminary proxy statement of NETC to be distributed to holders of NETC’s capital stock in connection with NETC’s solicitation of proxies for vote by NETC’s shareholders with respect to the proposed Business Combination and other matters described in the Registration Statement. NETC and Vast also plan to file other documents with the SEC regarding the proposed Business Combination . After the Registration Statement has been declared effective by the SEC, a definitive proxy statement/prospectus will be mailed to the stockholders of NETC. INVESTORS AND SECURITY HOLDERS OF NETC AND VAST ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS CONTAINED THEREIN (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND ALL OTHER DOCUMENTS RELATING TO THE PROPOSED BUSINESS COMBINATION THAT HAVE BEEN OR WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION. Investors and security holders will be able to obtain free copies of the proxy statement/prospectus and other documents containing important information about NETC and Vast , through the website maintained by the SEC at http://www.sec.gov . In addition, the documents filed by NETC may be obtained free of charge from NETC’s website at www.nabors - etcorp.com or by written request to NETC at 515 West Greens Road, Suite 1200, Houston, TX 77067. Use of Data Certain information contained in the Presentation, including that which relates to Vast’s industry and markets in which it operates, relates to or is based on third party studies, publications and surveys and the Company’s own internal estimates and research. In some cases, we may not expressly refer to the sources from which this information is derived. In addition, all of the market data included in the Presentation involves a number of assumptions, estimates and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions or estimates; none of the Company, NETC, nor their representatives or affiliates assumes any responsibility for updating the Presentation based on facts learned following its use. Finally, while the Company believes such third - party sources and its internal research are reliable, such sources and research have not been verified by any independent source and none of NETC, the Company, nor any of their respective affiliates nor any of its or their control persons, officers, directors, employees or representatives make any representation or warranty with respect to the accuracy of such information. These and other factors could cause Vast’s future performance and actual market growth, opportunity and size and the like to differ materially from the Company’s assumptions and estimates presented herein. Forward - Looking Statements The information included herein and in any oral statements made in connection herewith include “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included herein, regarding the proposed Business Combination, NETC’s and Vast’s ability to consummate the proposed Business Combination, the benefits of the proposed Business Combination and NETC’s and Vast’s future financial performance following the proposed Business Combination, as well as NETC’s and Vast’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward - looking statements. When used herein, including any oral statements made in connection herewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward - looking statements, although not all forward - looking statements contain such identifying words. These forward - looking statements are based on NETC and Vast management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, NETC and Vast disclaim any duty to update any forward - looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof. NETC and Vast caution you that these forward - looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of NETC and Vast. 2 Disclaimers & Disclosures

Disclaimers & Disclosures ( cont’d) 3 These risks include, but are not limited to, general economic, financial, legal, political and business conditions and changes in domestic and foreign markets; the inability to complete the Business Combination or the convertible debt and equity financings contemplated in connection with the proposed Business Combination (the “Financing”) in a timely manner or at all (including due to the failure to receive required stockholder or shareholder, as applicable, approvals, or the failure of other closing conditions such as the satisfaction of the minimum cash condition following redemptions by NETC’s public stockholders and the receipt of certain governmental and regulatory approvals), which may adversely affect the price of NETC’s securities; the inability of the Business Combination to be completed by NETC’s Business Combination deadline and the potential failure to obtain an extension of the Business Combination deadline if sought by NETC; the occurrence of any event, change or other circumstance that could give rise to the termination of the Business Combination or the Financing; the inability to recognize the anticipated benefits of the proposed Business Combination; the inability to obtain or maintain the listing of Vast’s shares on a national exchange following the consummation of the proposed Business Combination; costs related to the proposed Business Combination; the risk that the proposed Business Combination disrupts current plans and operations of Vast, business relationships of Vast or Vast’s business generally as a result of the announcement and consummation of the proposed Business Combination; Vast’s ability to manage growth; Vast’s ability to execute its business plan, including the completion of the Port Augusta project, at all or in a timely manner and meet its projections; potential disruption in Vast’s employee retention as a result of the proposed Business Combination; potential litigation, governmental or regulatory proceedings, investigations or inquiries involving Vast or NETC, including in relation to the proposed Business Combination; changes in applicable laws or regulations and general economic and market conditions impacting demand for Vast’s products and services. Additional risks are set forth in the section of the Appendix titled "Summary Risk Factors" attached to the Presentation and be set forth in the section titled "Risk Factors" in the proxy statement/prospectus that with the SEC in connection with the proposed Business Combination. Should one or more of the risks or uncertainties described herein and in any oral statements made in connection therewith occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward - looking statements. Additional information concerning these and other factors that may impact NETC’s and Vast’s expectations can be found in the section titled “Risk Factors” in Vast’s Registration Statement on Form S - 4, as amended, filed with the SEC on May 18, 202 3, and NETC’s periodic filings with the SEC, including NETC’s Annual Report on Form 10 - K for the year ended December 31, 2022, filed with the SEC on March 22, 2023, NETC’s Quarterly Report on Form 10 - Q for the quarter ended March 31, 2023, filed with the SEC on May 10, 2023, and any subsequently filed Quarterly Reports on Form 10 - Q or Current Reports on Form 8 - K. NETC’s SEC filings are available publicly on the SEC’s website at www.sec.gov . Participants in the Solicitation NETC, Nabors Industries Ltd. (“Nabors”), Vast and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of NETC in connection with the proposed Business Combination . Information about the directors and executive officers of NETC is set forth in NETC’s Annual Report on Form 10 - K for the year ended December 31, 202 2 , filed with the SEC on March 2 2 , 202 3 . To the extent that holdings of NETC’s securities have changed since the amounts printed in NETC’s Annual Report on Form 10 - K for the year ended December 31, 202 2 , such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the Registration Statement and other relevant materials filed or to be filed with the SEC when they become available. You may obtain free copies of these documents as described in the preceding paragraph . No Offer or Solicitation The Presentation shall not constitute a “solicitation” of a proxy, consent, or authori z ation , as defined in Section 14 of the Securities Exchange Act of 1934, as amended, with respect to any securities or in respect of the proposed Business Combination. The Presentation also does not constitute an offer, or a solicitation of an offer, to buy, sell, or exchange any securities, investment or other specific product, or a solicitation of any vote or approval, nor shall there be any sale of securities, investment or other specific product in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities , will be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act of 1933, as amended, or an exemption therefrom. NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE PRESENTATION OR DETERMINED IF TH E PRESENTATION IS TRUTHFUL OR COMPLETE. In connection with the proposed Business Combniation, Vast has filed with the SEC a registration statement on Form F - 4, which i nclude s a prospectus of Vast and a proxy statement of NETC. NETC and Vast also plan to file other documents with the SEC regarding the proposed Business Combination. After the registration statement has been declared effective by the SEC, a definitive proxy statement/prospectus will be mailed to the stockholders of NETC. INVESTORS AND STOCKHOLDERS OF NETC ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE PROPOSED BUSINESS COMBINATION THAT HAVE BEEN OR WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION. Investors and stockholders will be able to obtain free copies of the proxy statement/prospectus and other documents containing important information about NETC and Vast , through the website maintained by the SEC at http://www.sec.gov . In addition, the documents filed by NETC may be obtained free of charge from NETC’s website at www.nabors - etcorp.com or by written request to NETC at 515 West Greens Road, Suite 1200, Houston, TX 77067. Trademarks and Trade Names Vast, Nabors and NETC own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. Th e Presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in th e Presentation is not intended to, and does not imply, a relationship with the Company, Nabors or NETC, or an endorsement or sponsorship by or of the Company, Nabors or NETC. Solely for convenience, the trademarks, service marks and trade names referred to in th e Presentation may appear with the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that the Company, Nabors or NETC will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. Summary of Contracts Insofar as th e Presentation contains summaries of existing agreements and documents, such summaries are qualified in their entirety by reference to the agreements and documents being summari z ed.

Agenda Vast Demonstration Plant near Forbes, Australia Company Craig Wood, Chief Executive Officer Technology Kurt Drewes, Chief Technology Officer Projects Lachlan Roberts, General Manager IEP NETC & Nabors Guillermo Sierra, VP Energy Transition, Nabors Industries Q&A

Vast Company Overview Craig Wood Chief Executive Officer

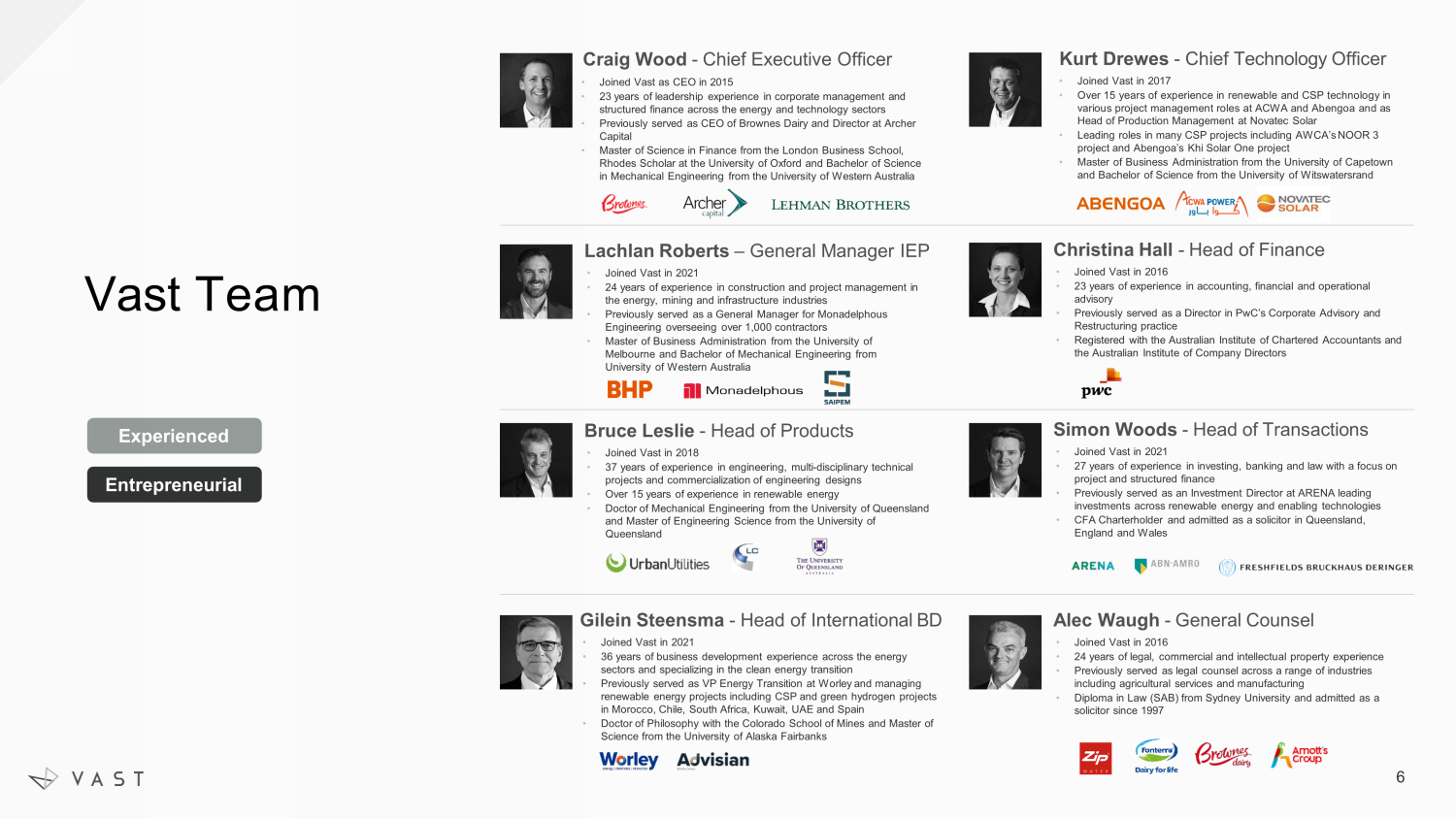

Vast Team Craig Wood - Chief Executive Officer • Joined Vast as CEO in 2015 • 23 years of leadership experience in corporate management and structured finance across the energy and technology sectors • Previously served as CEO of Brownes Dairy and Director at Archer Capital • Master of Science in Finance from the London Business School, Rhodes Scholar at the University of Oxford and Bachelor of Science in Mechanical Engineering from the University of Western Australia Kurt Drewes - Chief Technology Officer • Joined Vast in 2017 • Over 1 5 years of experience in renewable and CSP technology in various project management roles at ACWA and Abengoa and as Head of Production Management at Novatec Solar • Leading roles in many CSP projects including AWCA’s NOOR 3 project and Abengoa’s Khi Solar One project • Master of Business Administration from the University of Capetown and Bachelor of Science from the University of Witswatersrand Lachlan Roberts – General Manager IEP • Joined Vast in 2021 • 24 years of experience in construction and project management in the energy, mining and infrastructure industries • Previously served as a General Manager for Monadelphous Engineering overseeing over 1,000 contractors • Master of Business Administration from the University of Melbourne and Bachelor of Mechanical Engineering from University of Western Australia Christina Hall - Head of Finance • Joined Vast in 2016 • 23 years of experience in accounting, financial and operational advisory • Previously served as a Director in PwC’s Corporate Advisory and Restructuring practice • Registered with the Australian Institute of Chartered Accountants and the Australian Institute of Company Directors Bruce Leslie - Head of Products • Joined Vast in 2018 • 37 years of experience in engineering, multi - disciplinary technical projects and commerciali z ation of engineering designs • Over 15 years of experience in renewable energy • Doctor of Mechanical Engineering from the University of Queensland and Master of Engineering Science from the University of Queensland Simon Woods - Head of Transactions • Joined Vast in 2021 • 27 years of experience in investing, banking and law with a focus on project and structured finance • Previously served as an Investment Director at ARENA leading investments across renewable energy and enabling technologies • CFA Charterholder and admitted as a solicitor in Queensland, England and Wales Gilein Steensma - Head of International BD • Joined Vast in 2021 • 36 years of business development experience across the energy sectors and speciali z ing in the clean energy transition • Previously served as VP Energy Transition at Worley and managing renewable energy projects including CSP and green hydrogen projects in Morocco, Chile, South Africa, Kuwait, UAE and Spain • Doctor of Philosophy with the Colorado School of Mines and Master of Science from the University of Alaska Fairbanks Alec Waugh - General Counsel • Joined Vast in 2016 • 24 years of legal, commercial and intellectual property experience • Previously served as legal counsel across a range of industries including agricultural services and manufacturing • Diploma in Law (SAB) from Sydney University and admitted as a solicitor since 1997 Experienced Entrepreneurial 6

► The IEA forecasts deployment of up to 430 GW of new CSP capacity globally by 2050 for on - grid applications alone 1 ► Vast has a multi - GW global pipeline of potential CSP projects and 230 MW of projects under development as of February 2023 ► Off - grid applications, green fuel production and process heat could reach more than 1 TW by 2050 2 ► Up to AUD215 million of funding committed by the Australian and German governments to Vast projects ► Inflation Reduction Act is expected to materially improve project economics and accelerate US deployment through the 30+% ITC ► Technology proven through 5 years of piloting prototypes ► Technology de - risked through grid - synchroni z ed demonstration plant which operated for nearly 3 years ► Technology supported by multiple non - dilutive government grants supporting technology evolution (Australia, Germany, US) ► Senior and experienced team has a demonstrated track record of successful project development Proven Success ► Vast has developed the next generation of concentrated solar thermal power system (CSP v3.0) ► Modular tower modality and sodium - based heat transfer technology deliver a design that increases geographical applicability, reliability and efficiency , while reducing complexity, cost and construction time ► System provides competitive, dispatchable and carbon - free: ► Power for on - and off - grid applications ► Energy storage ► Process heat ► Green fuels (e.g., solar methanol, e SAF, among others) Next Gen Technology Overview Market Opportunity 1. Based on IEA’s Net Zero Emissions by 2050 forecast 2. As Prepared by a Top Tier International Management Consulting Firm 7

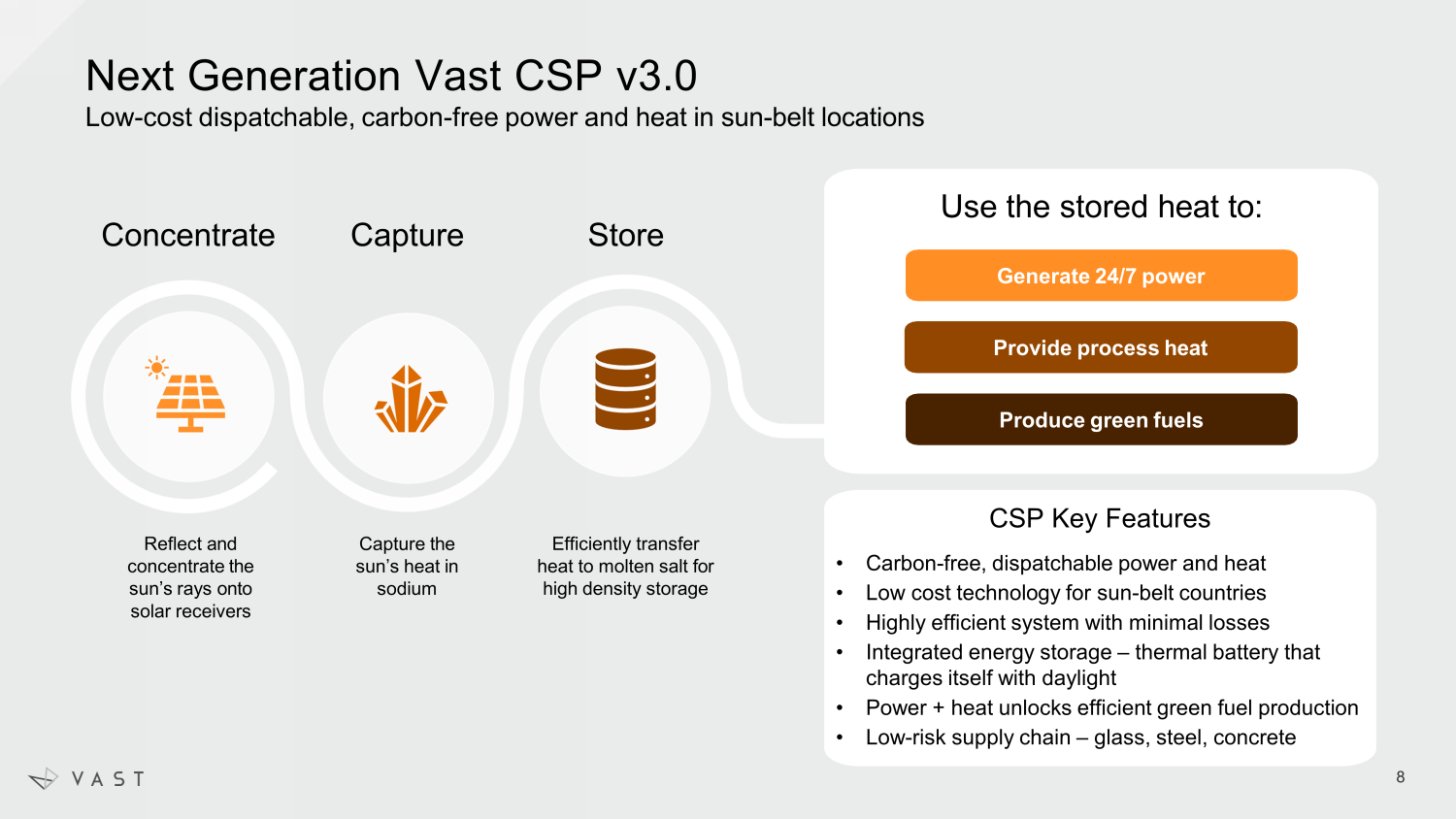

Next Generation Vast CSP v3.0 Low - cost dispatchable, carbon - free power and heat in sun - belt locations Reflect and concentrate the sun’s rays onto solar receivers Capture the sun’s heat in sodium Use the stored heat to: Concentrate Capture Store Efficiently transfer heat to molten salt for high density storage Generate 24/7 power Provide process heat Produce green fuels CSP Key Features • Carbon - free, dispatchable power and heat • Low cost technology for sun - belt countries • Highly efficient system with minimal losses • Integrated energy storage – thermal battery that charges itself with daylight • Power + heat unlocks efficient green fuel production • Low - risk supply chain – glass, steel, concrete 8

CSP Solves Problems that Wind and Solar Photovoltaics (PV) Can’t It Can Generate Process Heat ► Decarboni z ing manufacturing is challenging because many industrial processes require heat that can only be efficiently generated by burning fossil fuels ► CSP can generate process heat equivalent to burning fossil fuels, allowing manufacturers to decarbonize ► Expands addressable market beyond power generation to heat for industrial purposes, or a mix of power and heat for production of green fuels such as hydrogen, methanol, sustainable aviation fuels and ammonia, among others It’s Dispatchable ► Wind and Solar PV are intermittent generators ► Adding battery storage allows wind and solar PV to be dispatched, but only with limited duration (i.e., 2 - 4 hours), at a high cost and with significant trade - offs ► CSP provides efficient long - duration storage (i.e., 8 - 16 hours) which makes it comparable to traditional fossil generation 9

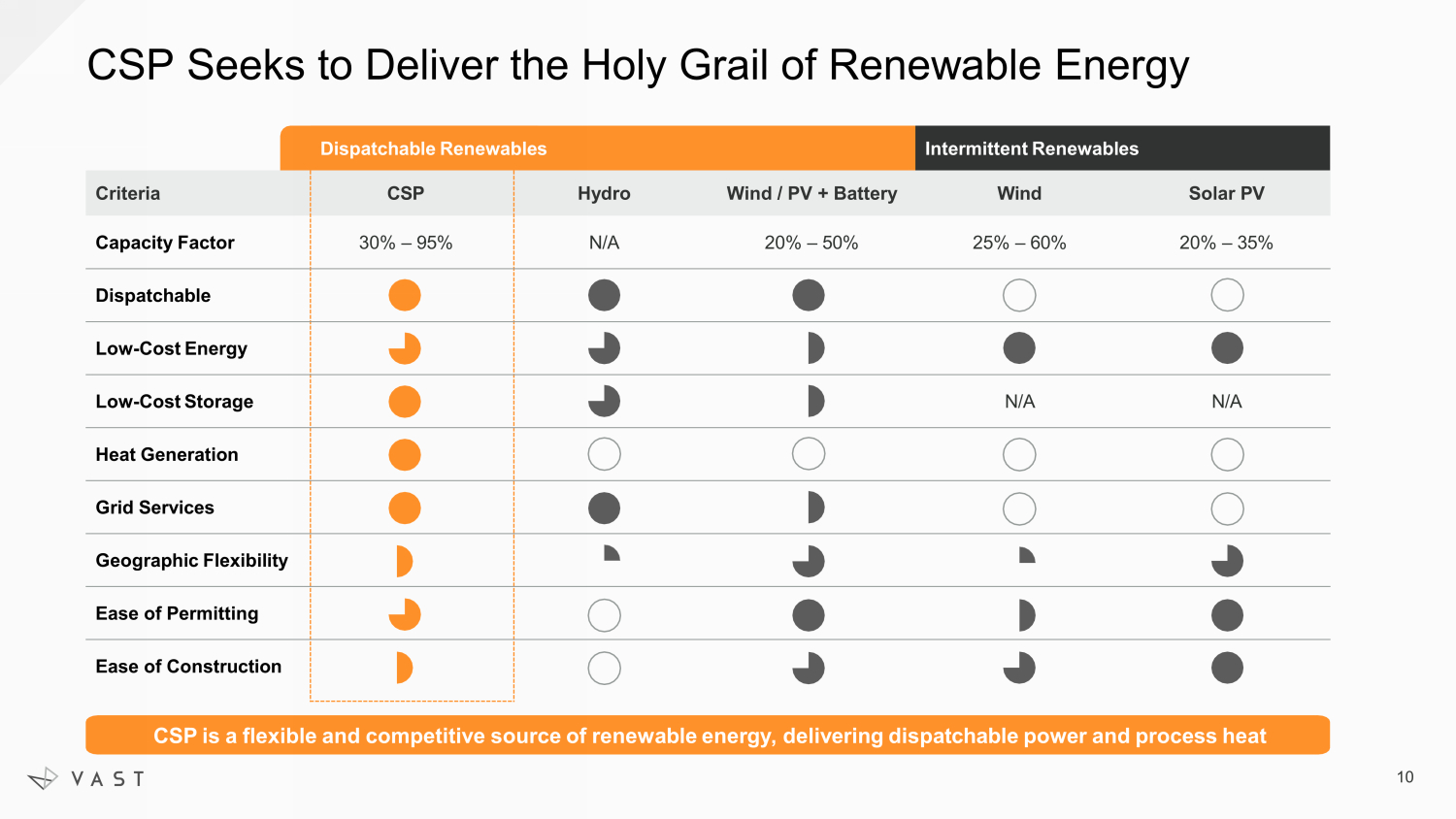

CSP is a flexible and competitive source of renewable energy, delivering dispatchable power and process heat CSP Seeks to Deliver the Holy Grail of Renewable Energy Dispatchable Renewables Intermittent Renewables Criteria CSP Hydro Wind / PV + Battery Wind Solar PV Capacity Factor 30% – 95% N/A 20% – 50% 25% – 60% 20% – 35% Dispatchable Low - Cost Energy Low - Cost Storage N/A N/A Heat Generation Grid Services Geographic Flexibility Ease of Permitting Ease of Construction 10

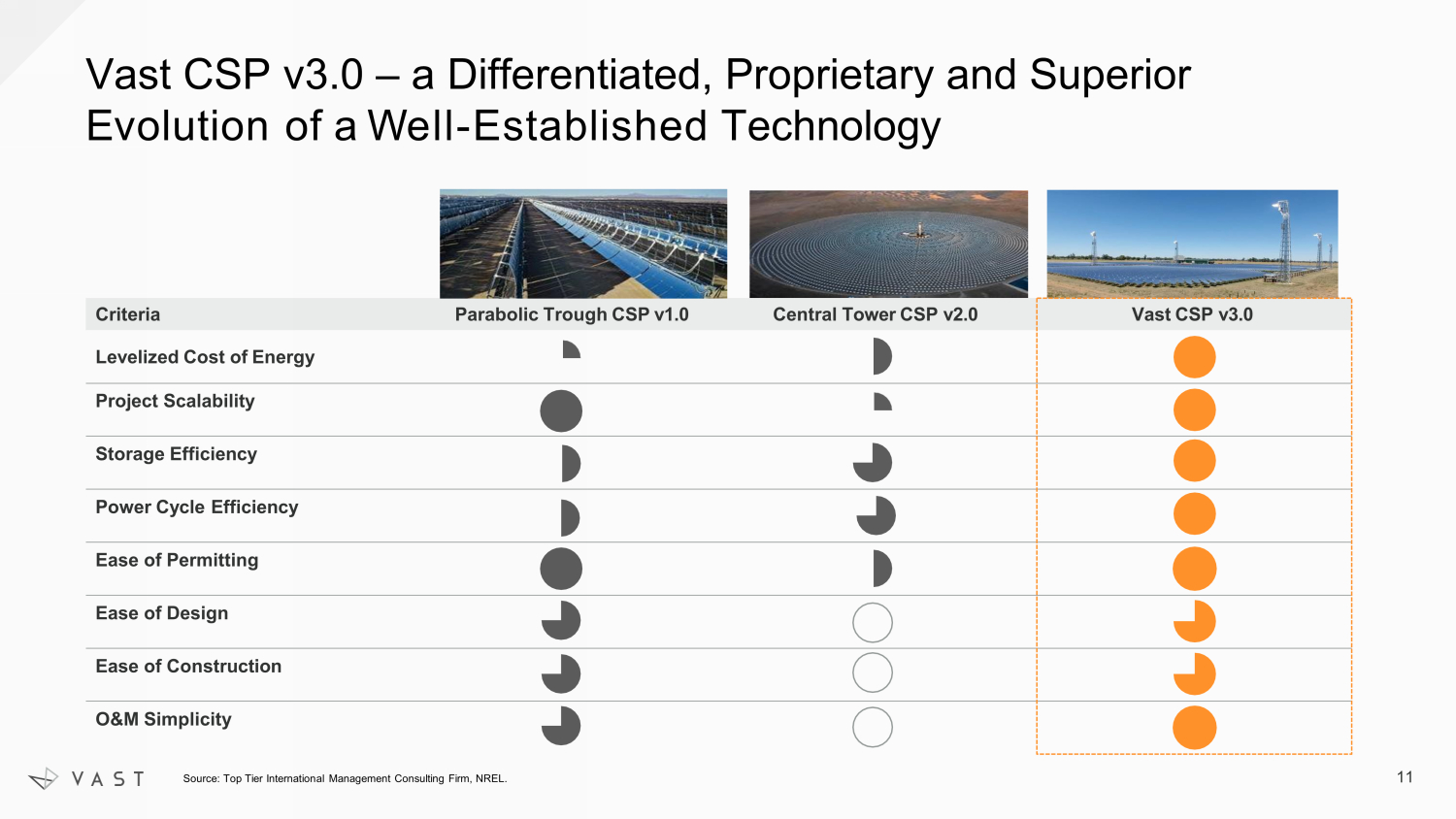

Criteria Parabolic Trough CSP v1.0 Central Tower CSP v2.0 Vast CSP v3.0 Leveli z ed Cost of Energy Project Scalability Storage Efficiency Power Cycle Efficiency Ease of Permitting Ease of Design Ease of Construction O&M Simplicity Vast CSP v3.0 – a Differentiated, Proprietary and Superior E volution of a W ell - Established Technology Source: Top Tier International Management Consulting Firm, NREL. 11

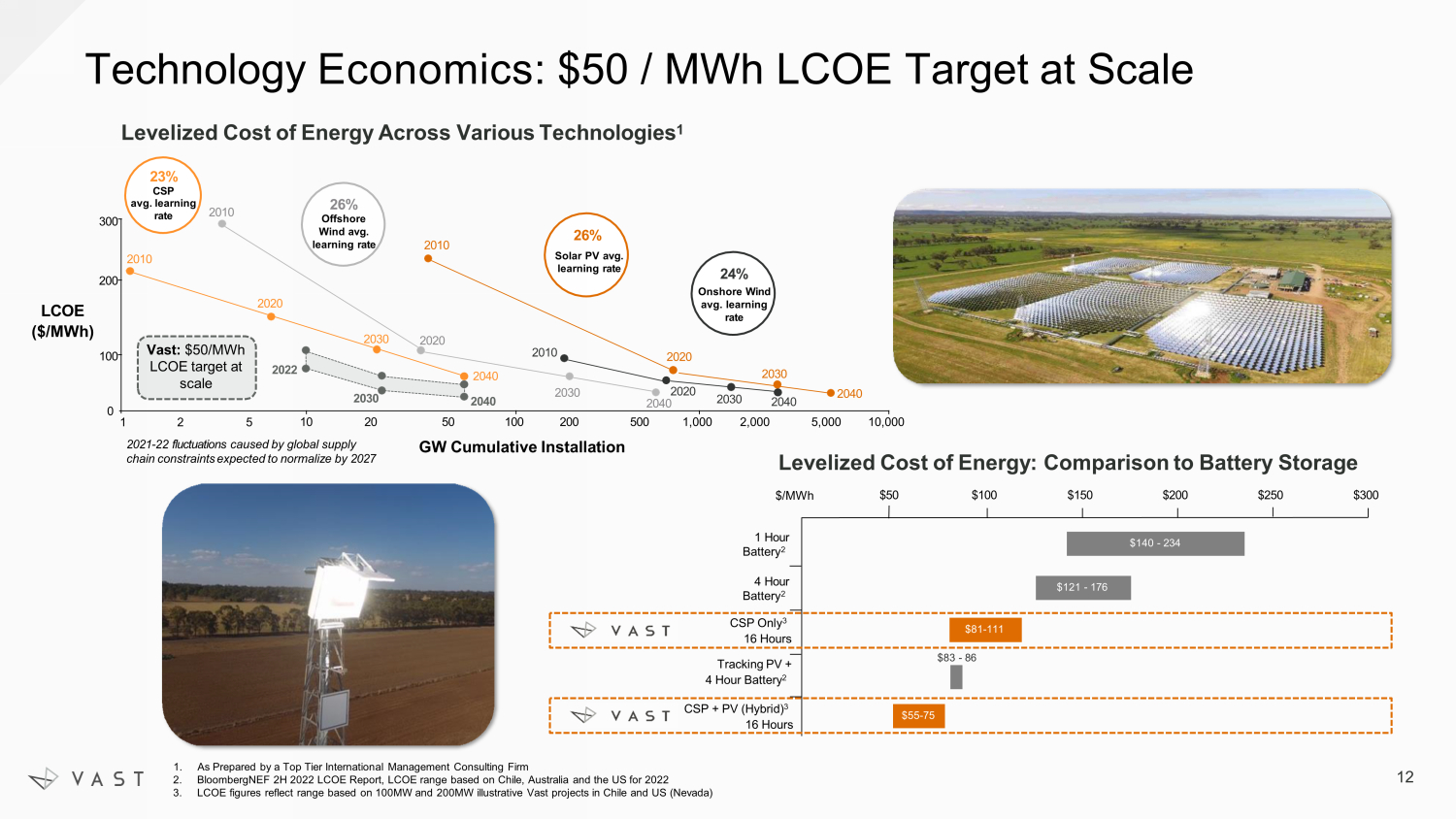

1. As Prepared by a Top Tier International Management Consulting Firm 2. BloombergNEF 2H 2022 LCOE Report, LCOE range based on Chile, Australia and the US for 2022 3. LCOE figures reflect range based on 100MW and 200MW illustrative Vast projects in Chile and US (Nevada) Technology Economics: $50 / MWh LCOE Target at S cale 23% CSP avg. learning rate 26% Offshore Wind avg. learning rate 26% Solar PV avg. learning rate 24% Onshore Wind avg. learning rate 2010 2010 2010 2010 2020 2030 2020 2030 2020 2030 2040 2020 2040 2030 2040 0 200 300 10 20 50 100 200 GW Cumulative Installation 500 1,000 2,000 5,000 10,000 100 LCOE ($/MWh) Vast: $50/MWh LCOE target at scale 1 2 5 2022 2030 2040 2040 1 Hour Battery 2 4 Hour Battery 2 CSP + PV (Hybrid) 3 16 Hours $140 - 234 $121 - 176 $55 - 75 2021 - 22 fluctuations caused by global supply chain constraints expected to normalize by 2027 Levelized Cost of Energy Across Various Technologies 1 Levelized Cost of Energy: Comparison to Battery Storage $/MWh $50 $100 $150 $200 $250 $300 $81 - 111 CSP Only 3 16 Hours Tracking PV + 4 Hour Battery 2 $83 - 86 12

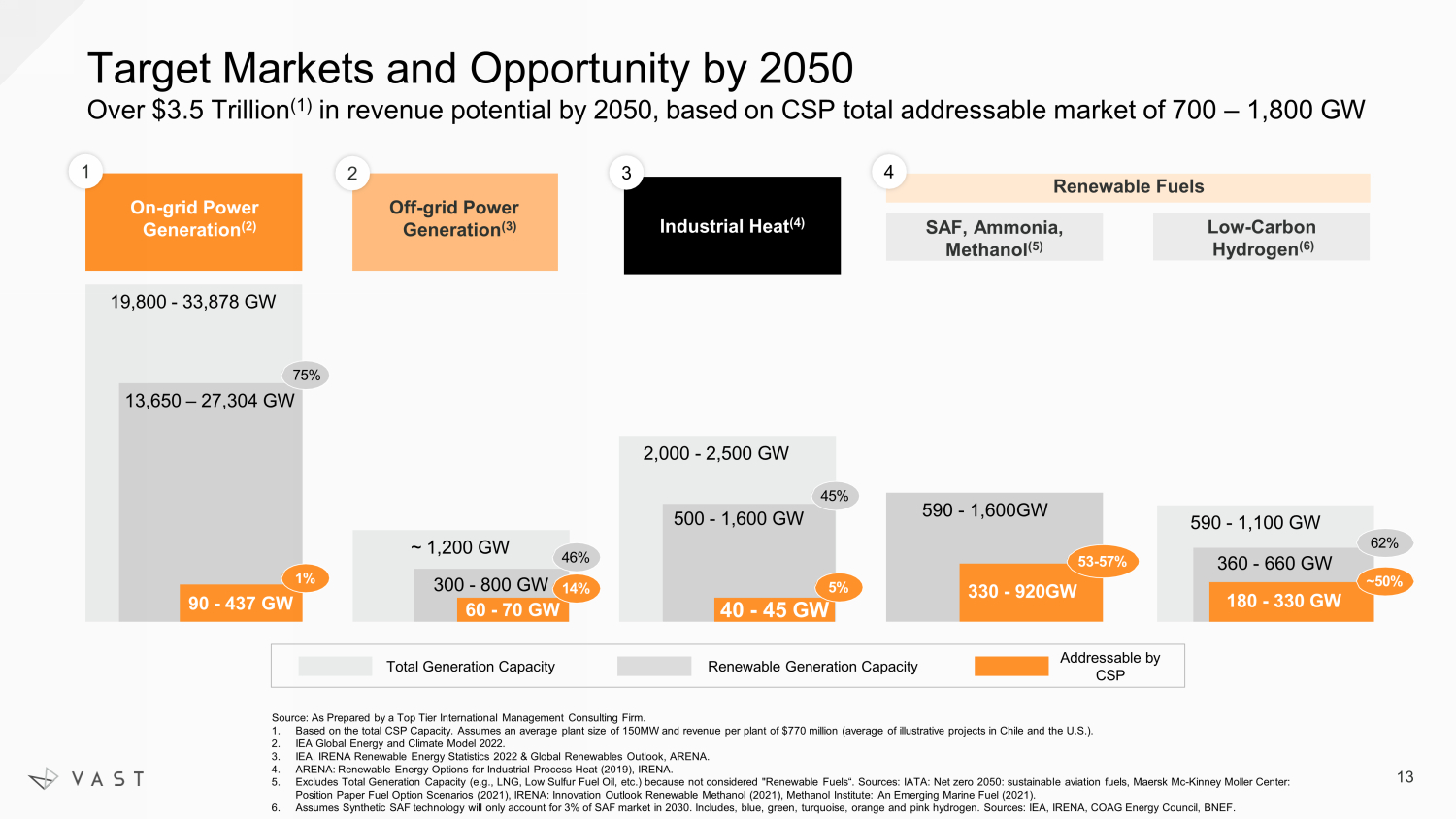

Industrial Heat (4) Target Markets and Opportunity by 2050 Over $3.5 Trillion (1) in revenue potential by 2050, based on CSP total addressable market of 700 – 1,800 GW Source: As Prepared by a Top Tier International Management Consulting Firm. 1. Based on the total CSP Capacity. Assumes an average plant size of 150MW and revenue per plant of $770 million (average of illustrative projects in Chile and the U.S.). 2. IEA Global Energy and Climate Model 2022. 3. IEA, IRENA Renewable Energy Statistics 2022 & Global Renewables Outlook, ARENA. 4. ARENA: Renewable Energy Options for Industrial Process Heat (2019), IRENA. 5. Excludes Total Generation Capacity (e.g., LNG, Low Sulfur Fuel Oil, etc.) because not considered "Renewable Fuels“. Sources: IATA: Net zero 2050: sustainable aviation fuels, Maersk Mc - Kinney Moller Center: Position Paper Fuel Option Scenarios (2021), IRENA: Innovation Outlook Renewable Methanol (2021), Methanol Institute: An Emerging Marine Fuel (2021). 6. Assumes Synthetic SAF technology will only account for 3% of SAF market in 2030. Includes, blue, green, turquoise, orange and pink hydrogen. Sources: IEA, IRENA, COAG Energy Council, BNEF. On - grid Power Generation ( 2 ) Off - grid Power Generation ( 3 ) 2 1 ~ 1,200 GW 300 - 800 GW 60 - 70 GW 19,800 - 33,878 GW 90 - 437 GW 75% 13,650 – 27,304 GW 1% 46% 14% 2,000 - 2,500 GW 500 - 1,600 GW 40 - 45 GW 45% 5% Renewable Fuels SAF, Ammonia, Methanol ( 5 ) Low - Carbon Hydrogen ( 6 ) 590 - 1,600GW 330 - 920GW 53 - 57% 590 - 1,100 GW 360 - 660 GW 180 - 330 GW 62% ~50% Total Generation Capacity Renewable Generation Capacity Addressable by CSP 3 4 13

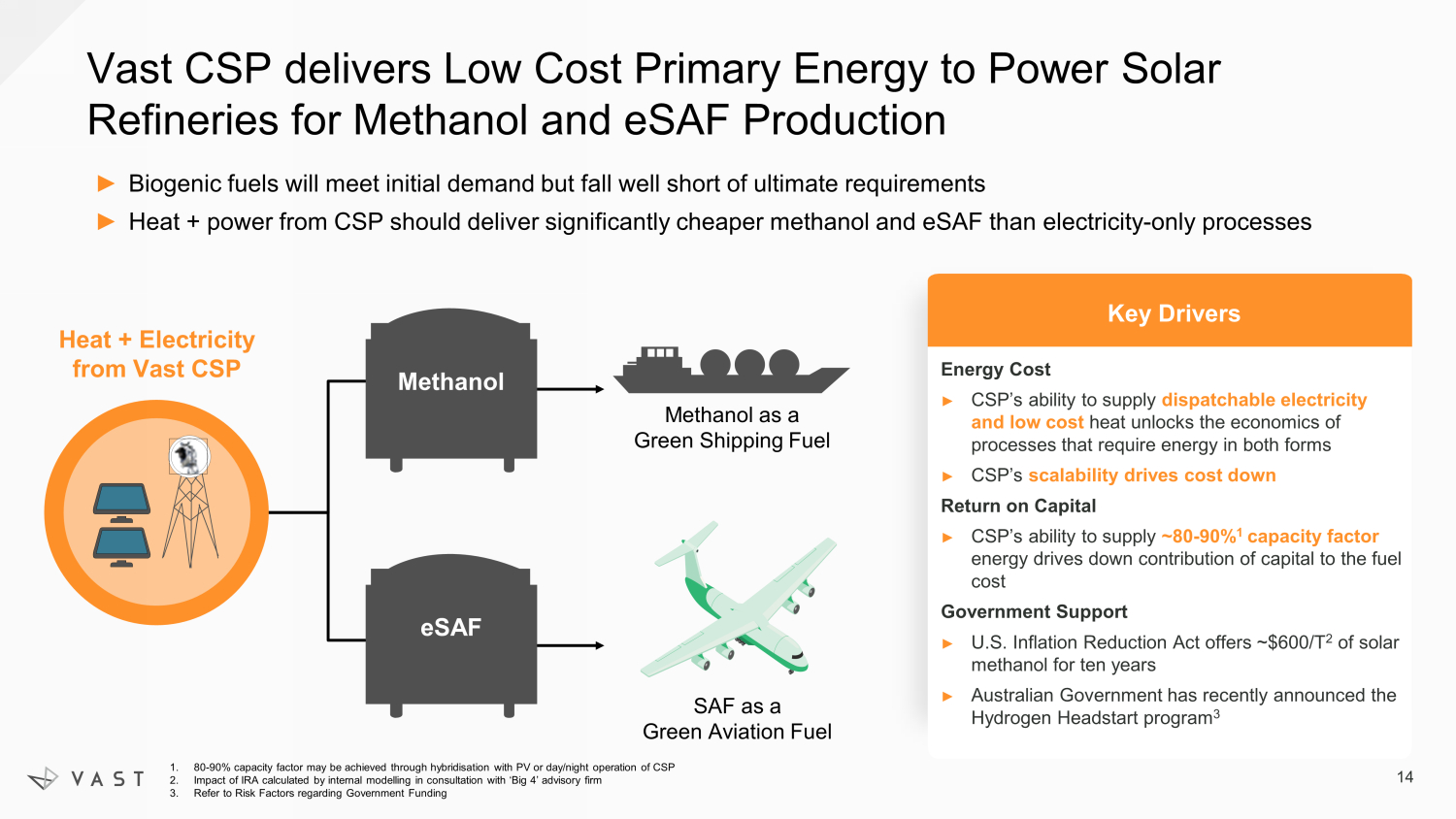

Methanol as a Green Shipping Fuel SAF as a Green Aviation Fuel Heat + Electricity from Vast CSP ► Biogenic fuels will meet initial demand but fall well short of ultimate requirements ► Heat + power from CSP should deliver significantly cheaper methanol and eSAF than electricity - only processes Vast CSP delivers Low Cost Primary Energy to Power Solar Refineries for Methanol and eSAF Production eSAF Methanol Key Drivers Energy Cost ► CSP’s ability to supply dispatchable electricity and low cost heat unlocks the economics of processes that require energy in both forms ► CSP’s scalability drives cost down Return on Capital ► CSP’s ability to supply ~80 - 90% 1 capacity factor energy drives down contribution of capital to the fuel cost Government Support ► U.S. Inflation Reduction Act offers ~$600/T 2 of solar methanol for ten years ► Australian Government has recently announced the Hydrogen Headstart program 3 14 1. 80 - 90% capacity factor may be achieved through hybridisation with PV or day/night operation of CSP 2. Impact of IRA calculated by internal modelling in consultation with ‘Big 4’ advisory firm 3. Refer to Risk Factors regarding Government Funding

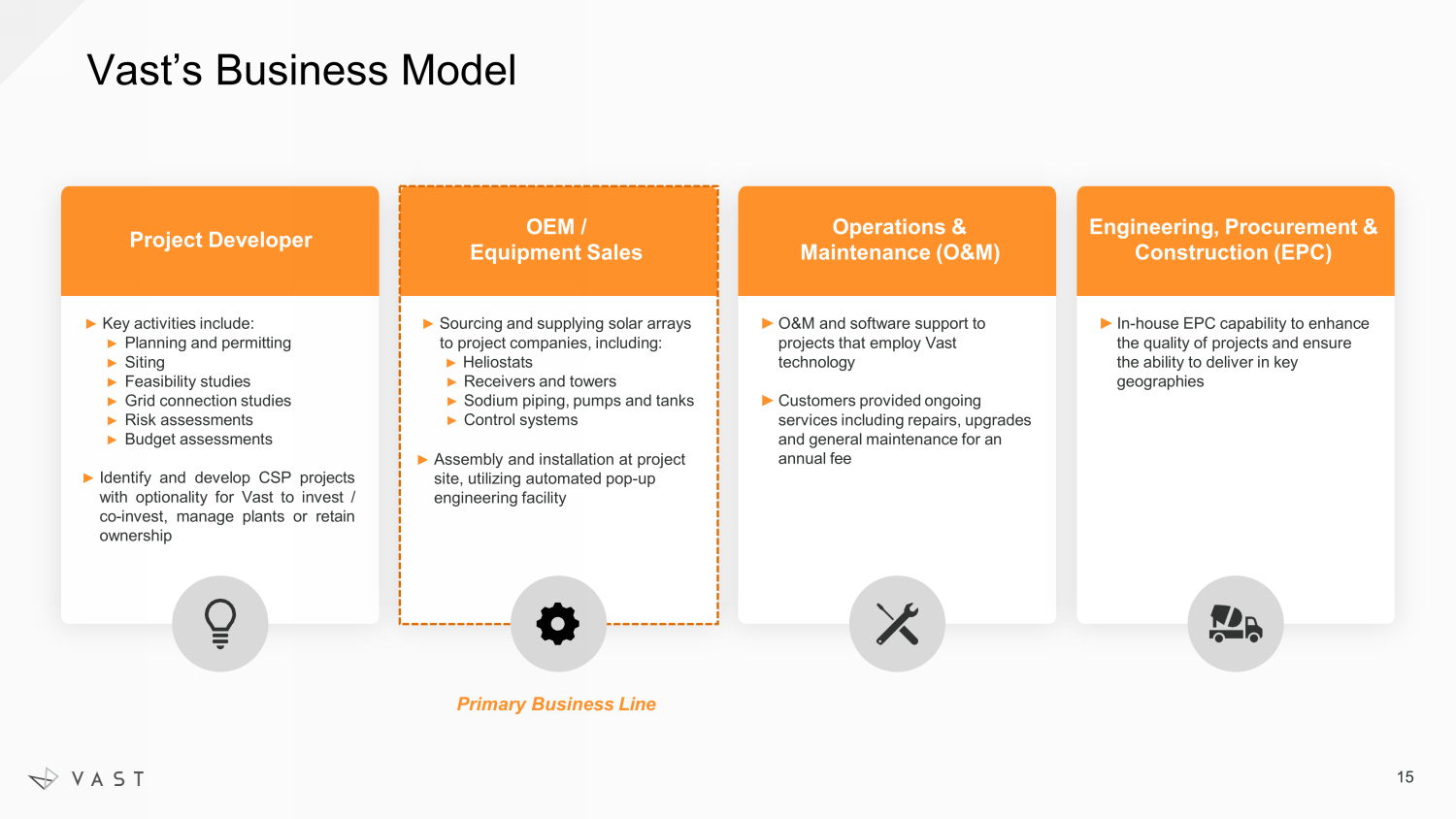

Vast’s Business Model ► Key activities include: ► Planning and permitting ► Siting ► Feasibility studies ► Grid connection studies ► Risk assessments ► Budget assessments ► Identify and develop CSP projects with optionality for Vast to invest / co - invest, manage plants or retain ownership Project Developer OEM / Equipment Sales ► O&M and software support to projects that employ Vast technology ► Customers provided ongoing services including repairs, upgrades and general maintenance for an annual fee Operations & Maintenance (O&M) ► In - house EPC capability to enhance the quality of projects and ensure the ability to deliver in key geographies Engineering, Procurement & Construction (EPC) Primary Business Line ► Sourcing and supplying solar arrays to project companies, including: ► Heliostats ► Receivers and towers ► Sodium piping, pumps and tanks ► Control systems ► Assembly and installation at project site, utilizing automated pop - up engineering facility 15

Illustrative Unit Economics: Sample 150 MW Projects Chile 150 MW 1 US (Nevada) 150 MW 1 Average Typical Project 150 MW 2 T - 1 T - 2 COD T+1 30 - Year Life of Plant T - 1 T - 2 COD T+1 30 - Year Life of Plant T - 1 T - 2 COD T+1 30 - Year Life of Plant Developer Fee (FID) $14 - - - $14 $17 - - - $17 $16 - - - $16 OEM (During Construction) $158 $158 - - $316 $201 $201 - - $402 $180 $180 - - $360 O&M (Annual After COD) 3 - - $9 $9 $347 - - $9 $9 $359 - - $9 $9 $353 Software Support Fee (Annual After COD) 3 - - $1 $1 $41 - - $1 $1 $41 - - $1 $1 $41 Total Revenue $173 $158 $10 $10 $718 $218 $201 $10 $10 $818 $196 $180 $10 $10 $770 Developer Fee (FID) $9 - - - $9 $11 - - - $11 $10 - - - $10 % Net Margin 65% - - - 65% 65% - - - 65% 65% - - - 65% OEM Margin $32 $32 - - $63 $40 $40 - - $80 $36 $36 - - $72 % Net Margin 20% 20% - - 20% 20% 20% - - 20% 20% 20% - - 20% O&M Margin - - $2 $2 $87 - - $2 $2 $90 - - $2 $2 $88 % Net Margin - - 25% 25% 25% - - 25% 25% 25% - - 25% 25% 25% Software Support Fee - - $1 $1 $41 - - $1 $1 $41 - - $1 $1 $41 % Net Margin - - 100% 100% 100% - - 100% 100% 100% - - 100% 100% 100% Total Net Margin $41 $32 $3 $3 $200 $51 $40 $3 $3 $222 $46 $36 $3 $3 $211 % Margin 24% 20% 33% 33% 28% 23% 20% 33% 33% 27% 24% 20% 33% 33% 27% Note: COD = Commercial Operation Date. T = Years from COD 1. Illustrative 150 MW Vast project economics are based on the average of a 100 MW and 200 MW illustrative project in the same geographic location 2. Illustrative Average Typical 150MW Vast Project economics are based on the average of the 150 MW illustrative projects in Chile and the U.S. (Nevada) 3. Annual O&M Revenue and Software Support Fees are escalated by assumed inflation of 2.0% annually over the 30 - year operating life of the plant and added as a simple sum 16

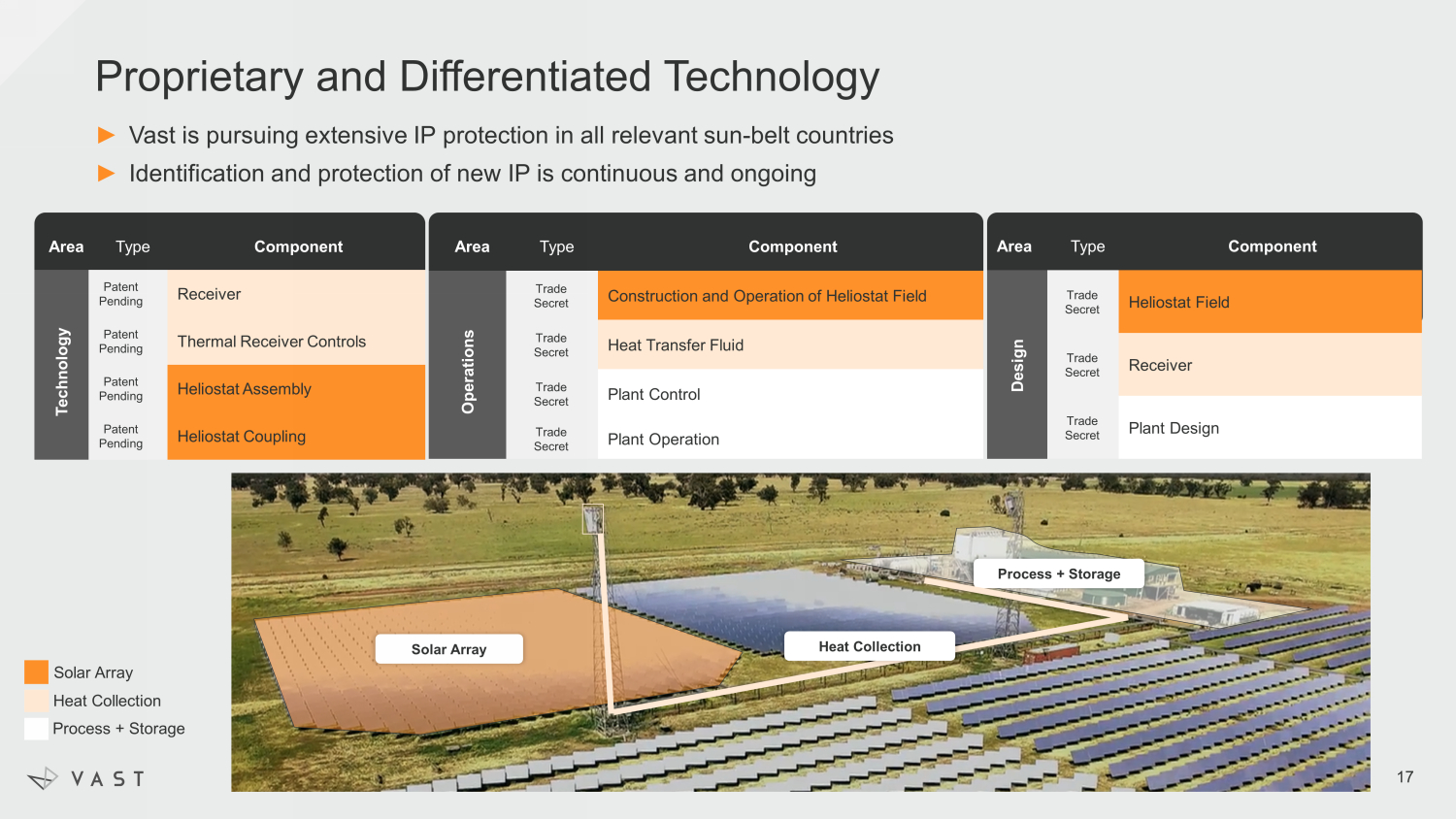

Proprietary and Differentiated Technology Area Type Component Technology Patent Pending Receiver Patent Pending Thermal Receiver Controls Patent Pending Heliostat Assembly Patent Pending Heliostat Coupling Area Type Component Operations Trade Secret Construction and Operation of Heliostat Field Trade Secret Heat Transfer Fluid Trade Secret Plant Control Trade Secret Plant Operation Area Type Component Design Trade Secret Heliostat Field Trade Secret Receiver Trade Secret Plant Design Solar Array Process + Storage Heat Collection Solar Array Heat Collection Process + Storage ► Vast is pursuing extensive IP protection in all relevant sun - belt countries ► Identification and protection of new IP is continuous and ongoing 17

Vast Technology Overview Kurt Drewes Chief Technology Officer

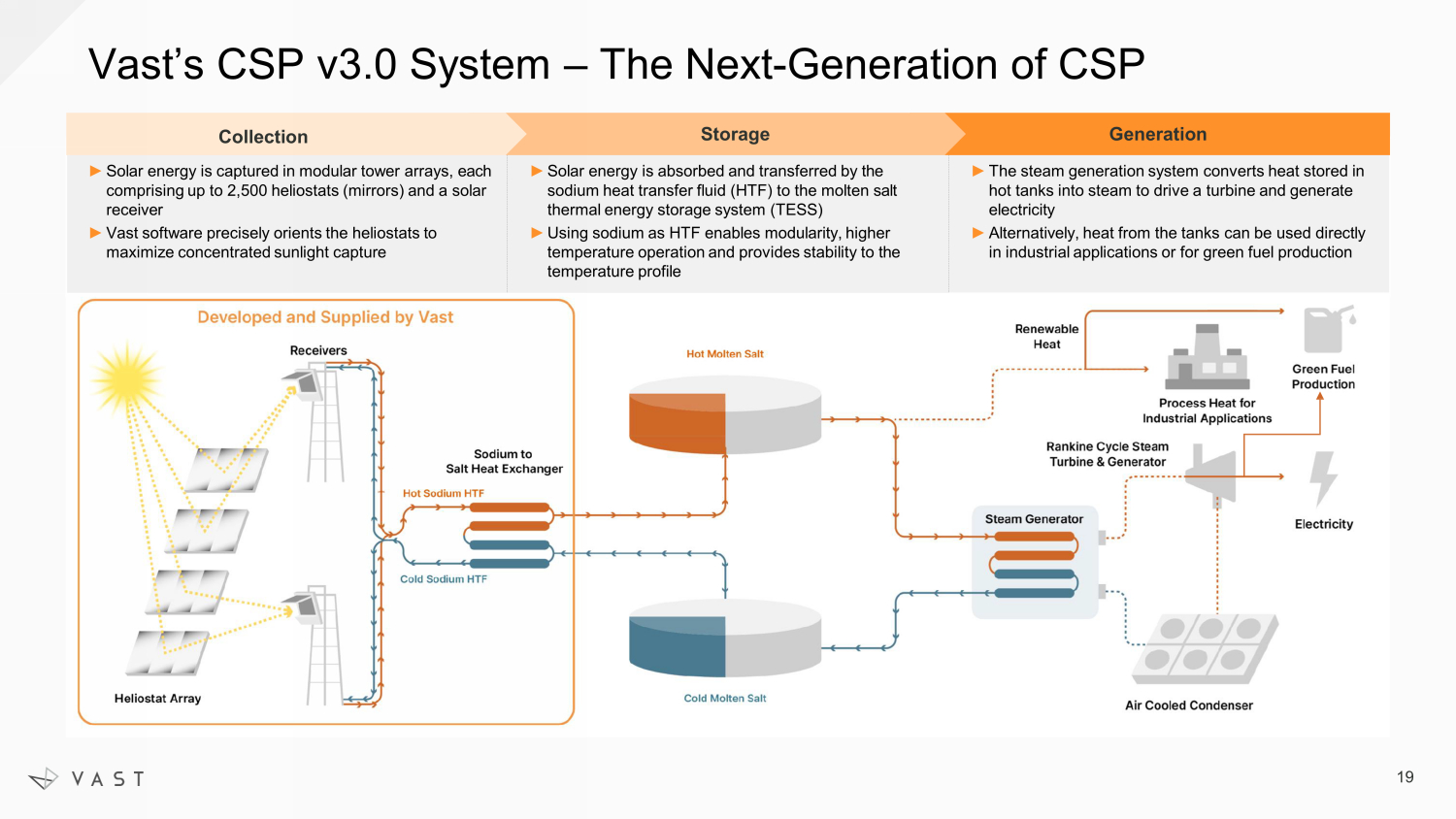

► Solar energy is captured in modular tower arrays, each comprising up to 2,500 heliostats (mirrors) and a solar receiver ► Vast software precisely orients the heliostats to maximize concentrated sunlight capture ► Solar energy is absorbed and transferred by the sodium heat transfer fluid (HTF) to the molten salt thermal energy storage system (TESS) ► Using sodium as HTF enables modularity, higher temperature operation and provides stability to the temperature profile ► The steam generation system converts heat stored in hot tanks into steam to drive a turbine and generate electricity ► Alternatively, heat from the tanks can be used directly in industrial applications or for green fuel production Generation Vast’s CSP v3.0 System – The Next - Generation of CSP Storage Collection 19

Vast’s Technology is Proven Heliostat Prototyping and Testing Modular Array Prototyping and Testing Solar Receiver Prototyping and Testing Utility Scale Project Development 2009 - 2010 2010 - 2011 2011 - 2014 2018 - 2019 1.1MW Sun - to - Grid Demonstration Plant Located Near Forbes, Australia 2014 - 2020 Heliostats Solar Array Tower Solar Receiver Substation Sodium Storage Air Cooled Condenser 1MW Turbine Control Room HTF Piping Marulan 1 ▪ First heliostat generations ▪ Exploratory manufacturing techniques ▪ Optical refinement Marulan 2 ▪ Next generations of heliostats ▪ Optimal heliostat layouts ▪ Field comms and operations Back Station ▪ Water receivers ▪ Sodium receivers to unlock modularity ▪ Sodium operations Technology proven through long duration field testing at multiple sites Received International Energy Agency’s SolarPACES 2019 Technical Innovation Award Project Sold Objectives Met 50MW Solar PV ▪ Development, permitting and grid connection secured ▪ Sold shovel - ready to Genex Limited ▪ Plant now built and generating ▪ Approximately 3,500 heliostats configured into 5 modular tower arrays ▪ Co - funded with ARENA ▪ Final - form plant first synchronized with Australian national grid January 2018 ▪ Technology demonstrated, refined and validated ▪ Operability confirmed via operation for 32 months ▪ Technology scalability confirmed 5 years of prototyping and testing components leading to a successful grid - synchronized demonstration plant 20

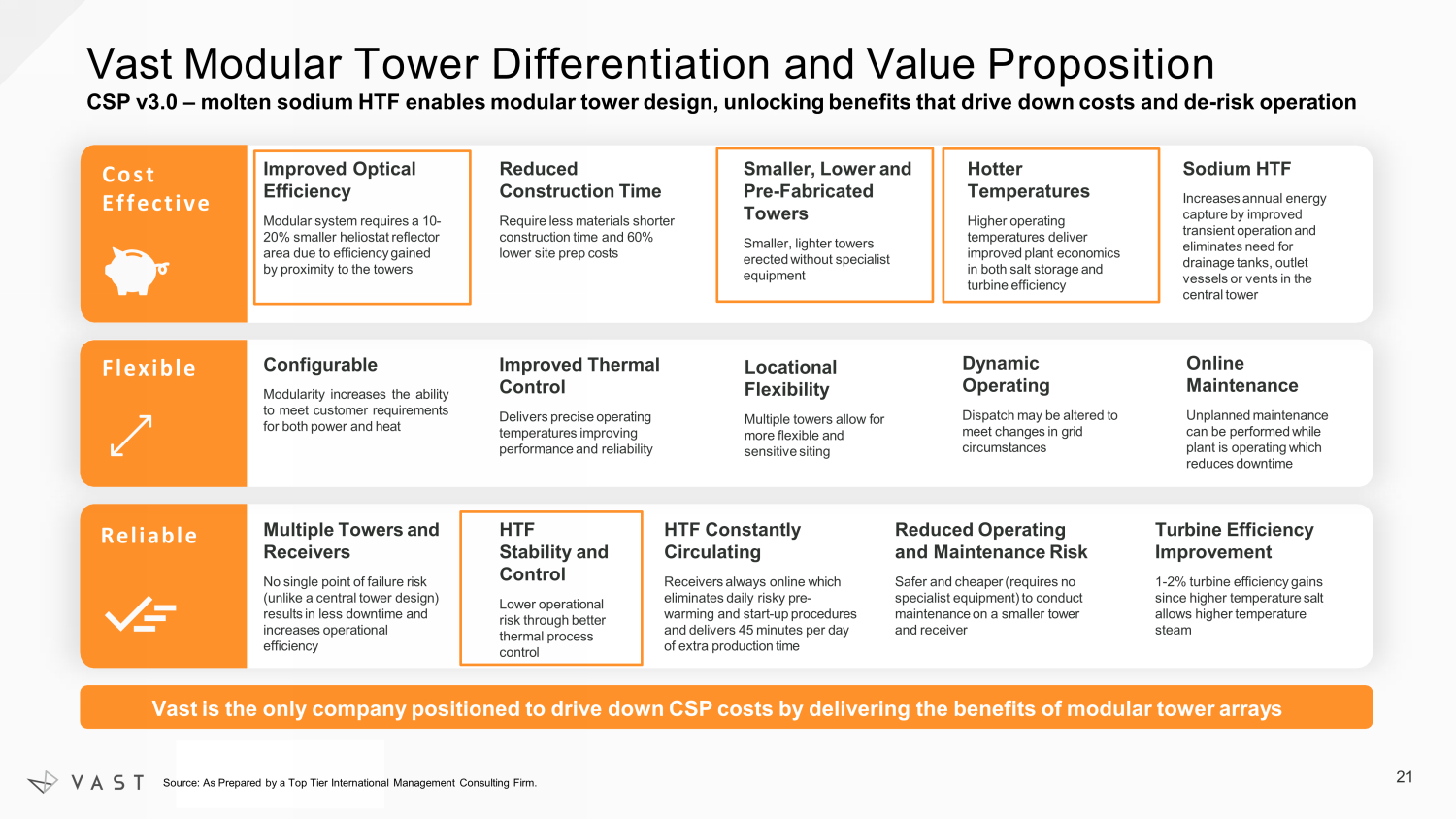

Vast Modular Tower Differentiation and Value Proposition CSP v3.0 – molten sodium HTF enables modular tower design, unlocking benefits that drive down costs and de - risk operation Multiple Towers and Receivers No single point of failure risk (unlike a central tower design) results in less downtime and increases operational efficiency HTF Stability and Control Lower operational risk through better thermal process control HTF Constantly Circulating Receivers always online which eliminates daily risky pre - warming and start - up procedures and delivers 45 minutes per day of extra production time Reduced Operating and Maintenance Risk Safer and cheaper (requires no specialist equipment) to conduct maintenance on a smaller tower and receiver Turbine Efficiency Improvement 1 - 2% turbine efficiency gains since higher temperature salt allows higher temperature steam Improved Thermal Control Delivers precise operating temperatures improving performance and reliability Configurable Modularity increases the ability to meet customer requirements for both power and heat Dynamic Operating Dispatch may be altered to meet changes in grid circumstances Online Maintenance Unplanned maintenance can be performed while plant is operating which reduces downtime Locational Flexibility Multiple towers allow for more flexible and sensitive siting Vast is the only company positioned to drive down CSP costs by delivering the benefits of modular tower arrays Cost Effective Flexible Reliable Improved Optical Efficiency Modular system requires a 10 - 20% smaller heliostat reflector area due to efficiency gained by proximity to the towers Reduced Construction Time Require less materials shorter construction time and 60% lower site prep costs Smaller, Lower and Pre - Fabricated Towers Smaller, lighter towers erected without specialist equipment Hotter Temperatures Higher operating temperatures deliver improved plant economics in both salt storage and turbine efficiency Sodium HTF Increases annual energy capture by improved transient operation and eliminates need for drainage tanks, outlet vessels or vents in the central tower 21 Source: As Prepared by a Top Tier International Management Consulting Firm.

Technology Development Supply Chain Strong Customers and Partners 22 Long - term relationships with an extensive network of partners that help deliver globally competitive products and technology

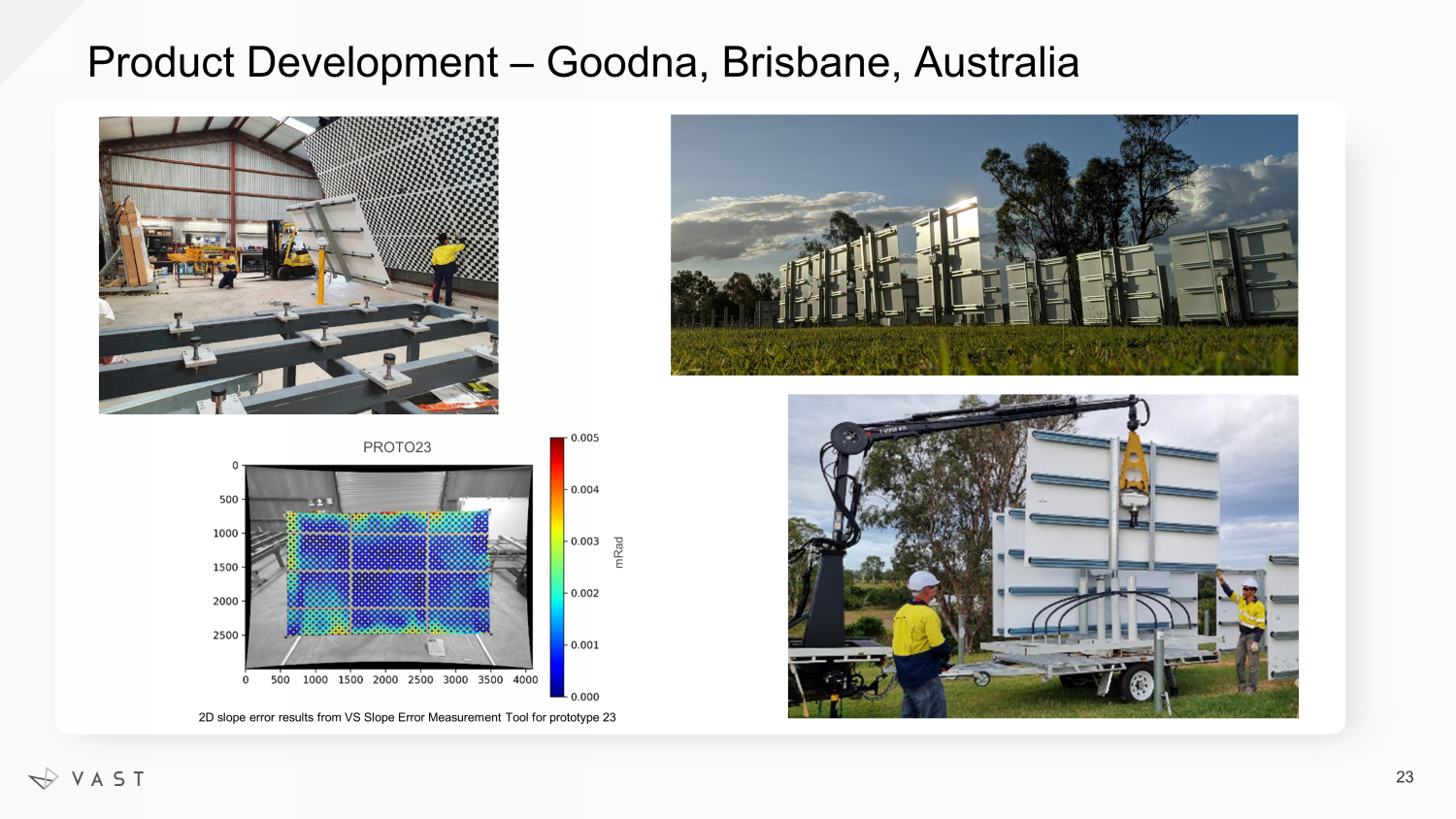

Product Development – Goodna, Brisbane, Australia 23 2D slope error results from VS Slope Error Measurement Tool for prototype 23 mRad PROTO23

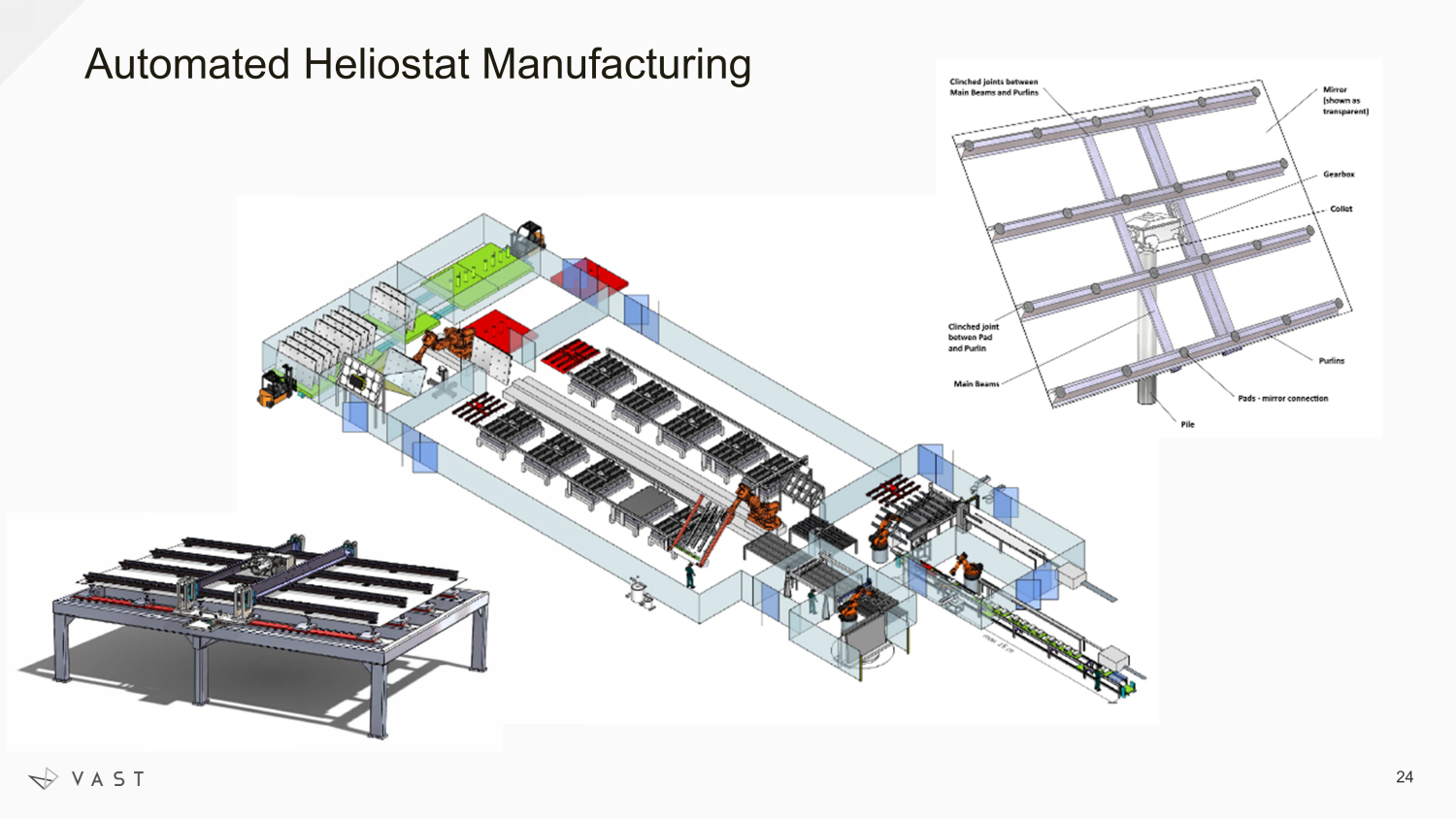

Automated Heliostat Manufacturing 24

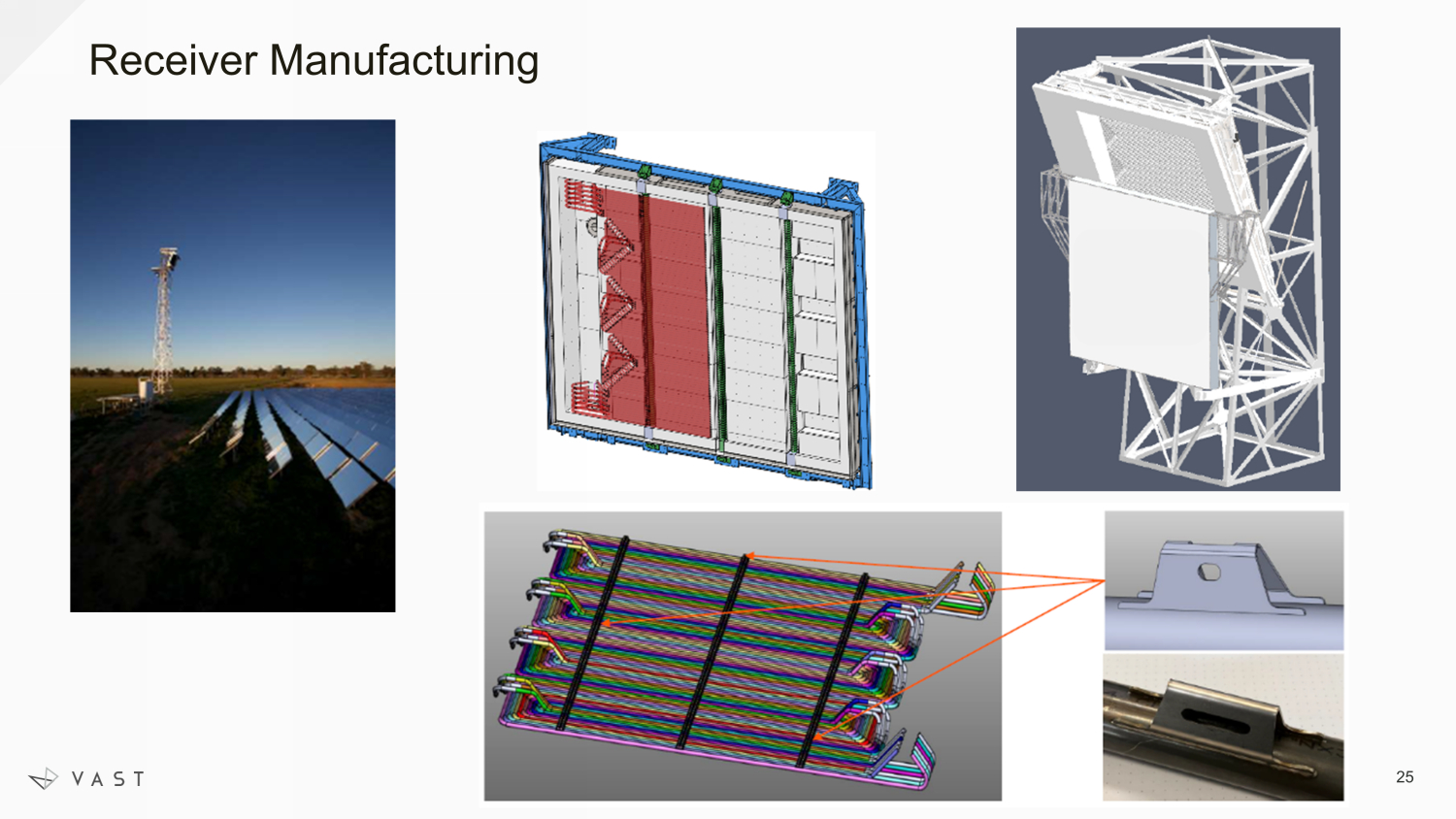

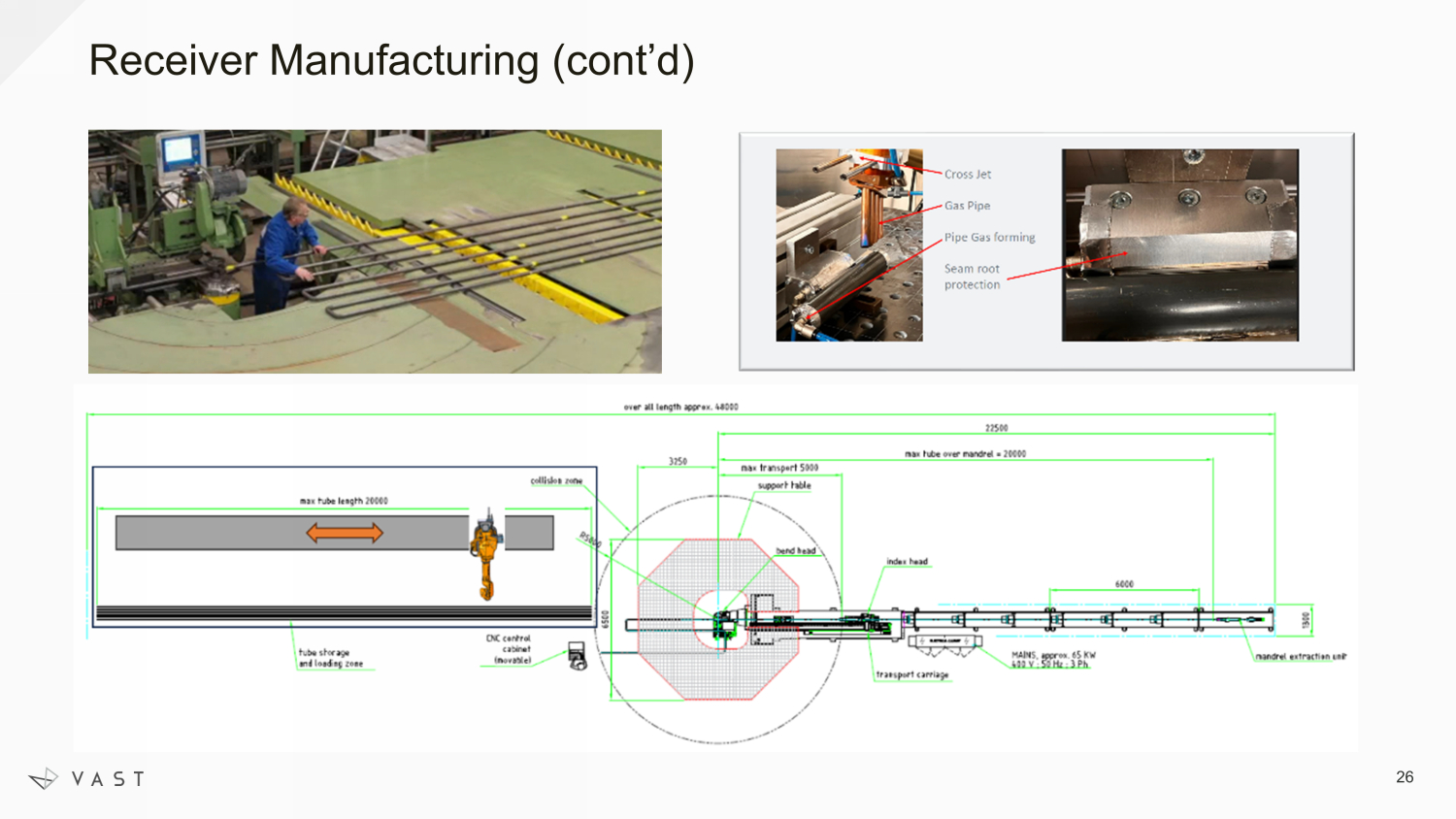

Receiver Manufacturing 25

Receiver Manufacturing (cont’d) 26

Technology Summary 27 Process Technology ► Modular Network Topology ► Higher Temperatures ► Superior Dynamic Controls Enabling Technologies ► Modulization and Standardisation ► Investment in deep long - term relationships ► Investment in leading Manufacturing Technology

Projects Overview Lachlan Roberts General Manager IEP

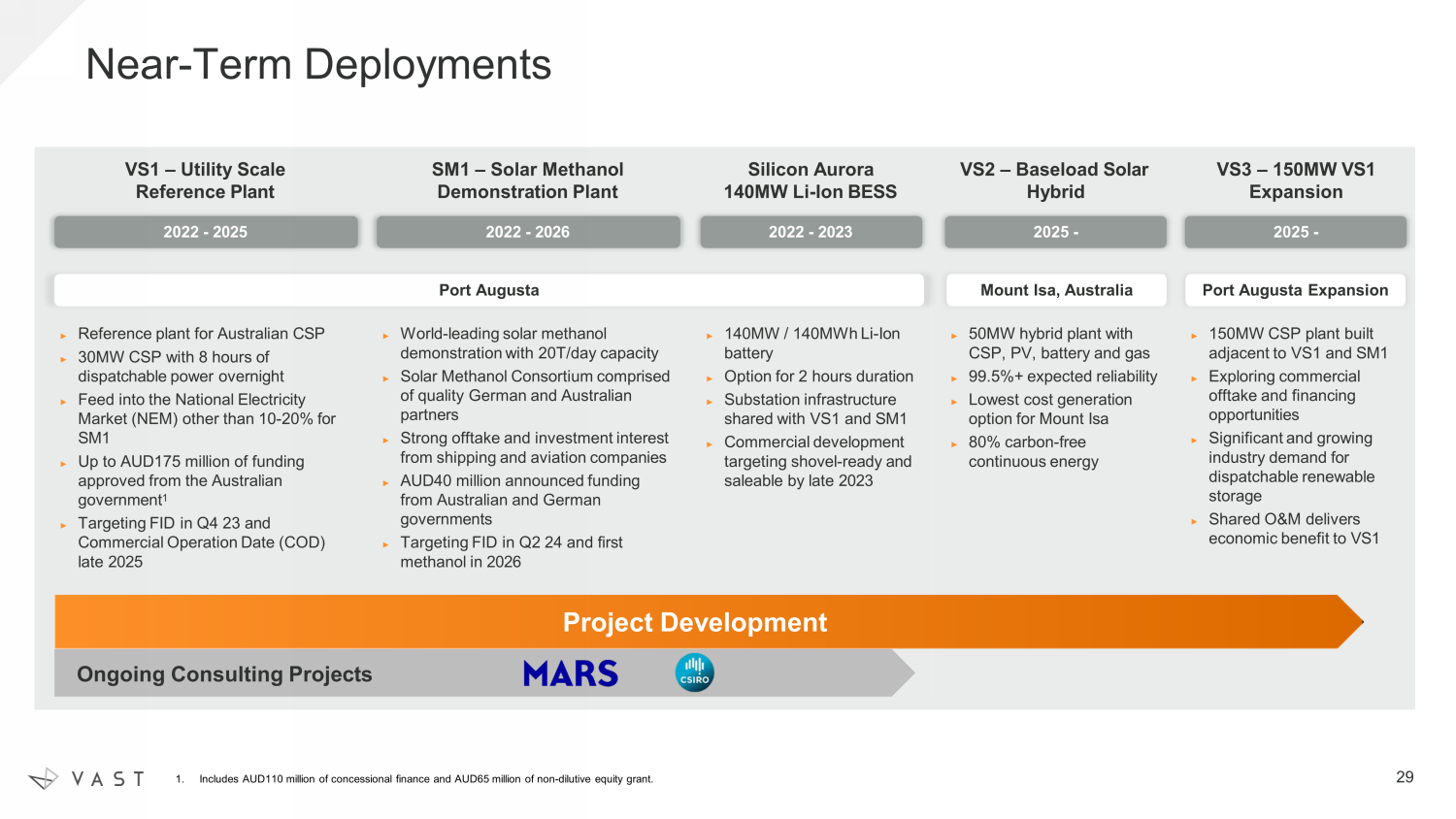

2025 - VS3 – 150MW VS1 Expansion ► 150MW CSP plant built adjacent to VS1 and SM1 ► Exploring commercial offtake and financing opportunities ► Significant and growing industry demand for dispatchable renewable storage ► Shared O&M delivers economic benefit to VS1 2025 - VS2 – Baseload Solar Hybrid ► 50MW hybrid plant with CSP, PV, battery and gas ► 99.5%+ expected reliability ► Lowest cost generation option for Mount Isa ► 80% carbon - free continuous energy 2022 - 2023 Silicon Aurora 140MW Li - Ion BESS ► 140MW / 140MWh Li - Ion battery ► Option for 2 hours duration ► Substation infrastructure shared with VS1 and SM1 ► Commercial development targeting shovel - ready and saleable by late 2023 2022 - 2026 SM1 – Solar Methanol Demonstration Plant 2022 - 2025 VS1 – Utility Scale Reference Plant Ongoing Consulting Projects Near - Term Deployments Project Development ► World - leading solar methanol demonstration with 20T/day capacity ► Solar Methanol Consortium comprised of quality German and Australian partners ► Strong offtake and investment interest from shipping and aviation companies ► AUD40 million announced funding from Australian and German governments ► Targeting FID in Q2 24 and first methanol in 2026 ► Reference plant for Australian CSP ► 30MW CSP with 8 hours of dispatchable power overnight ► Feed into the National Electricity Market (NEM) other than 10 - 20% for SM1 ► Up to AUD175 million of funding approved from the Australian government 1 ► Targeting FID in Q4 23 and Commercial Operation Date (COD) late 2025 Port Augusta Mount Isa, Australia Port Augusta Expansion 1. Includes AUD110 million of concessional finance and AUD65 million of non - dilutive equity grant. 29

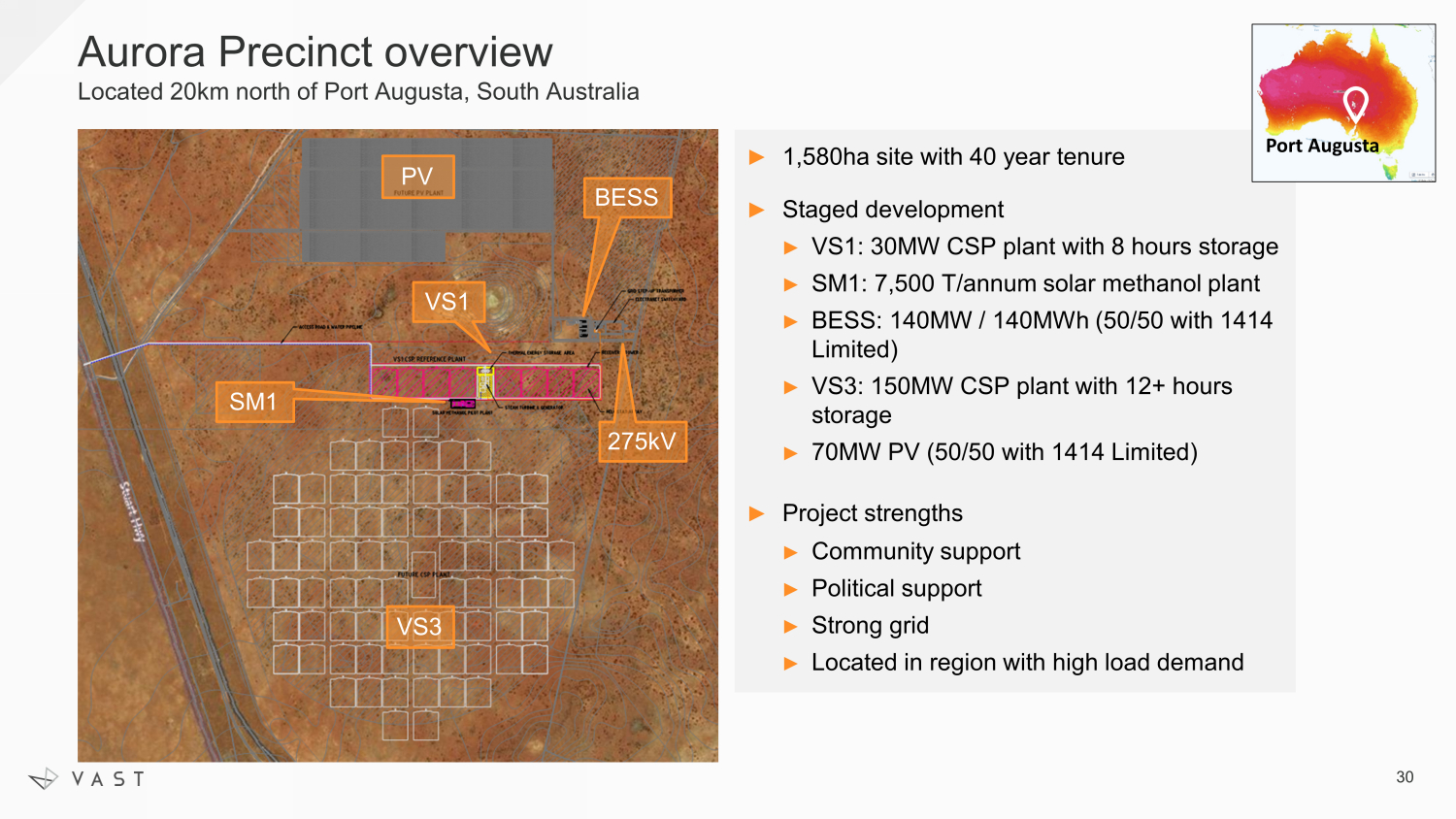

Aurora Precinct overview Located 20km north of Port Augusta, South Australia PV VS3 SM1 BESS 275kV ► 1,580ha site with 40 year tenure ► Staged development ► VS1: 30MW CSP plant with 8 hours storage ► SM1: 7,500 T/annum solar methanol plant ► BESS: 140MW / 140MWh (50/50 with 1414 Limited) ► VS3: 150MW CSP plant with 12+ hours storage ► 70 MW PV ( 50 / 50 with 1414 Limited) ► Project strengths ► Community support ► Political support ► Strong grid ► Located in region with high load demand Port Augusta 30 VS1

VS1 – 30MW Port Augusta CSP Dispatchable renewable energy on demand ► Configuration ► 8 solar fields, each with approximately 2,400 heliostats ► 8 hours of thermal storage ► 30 MW steam turbine ► Clutched generator => synchronous condenser functionality ► Target schedule ► FID Q 4 2023 ► First Energy Q 4 2025 31 Port Augusta Rendered image for illustrative purposes

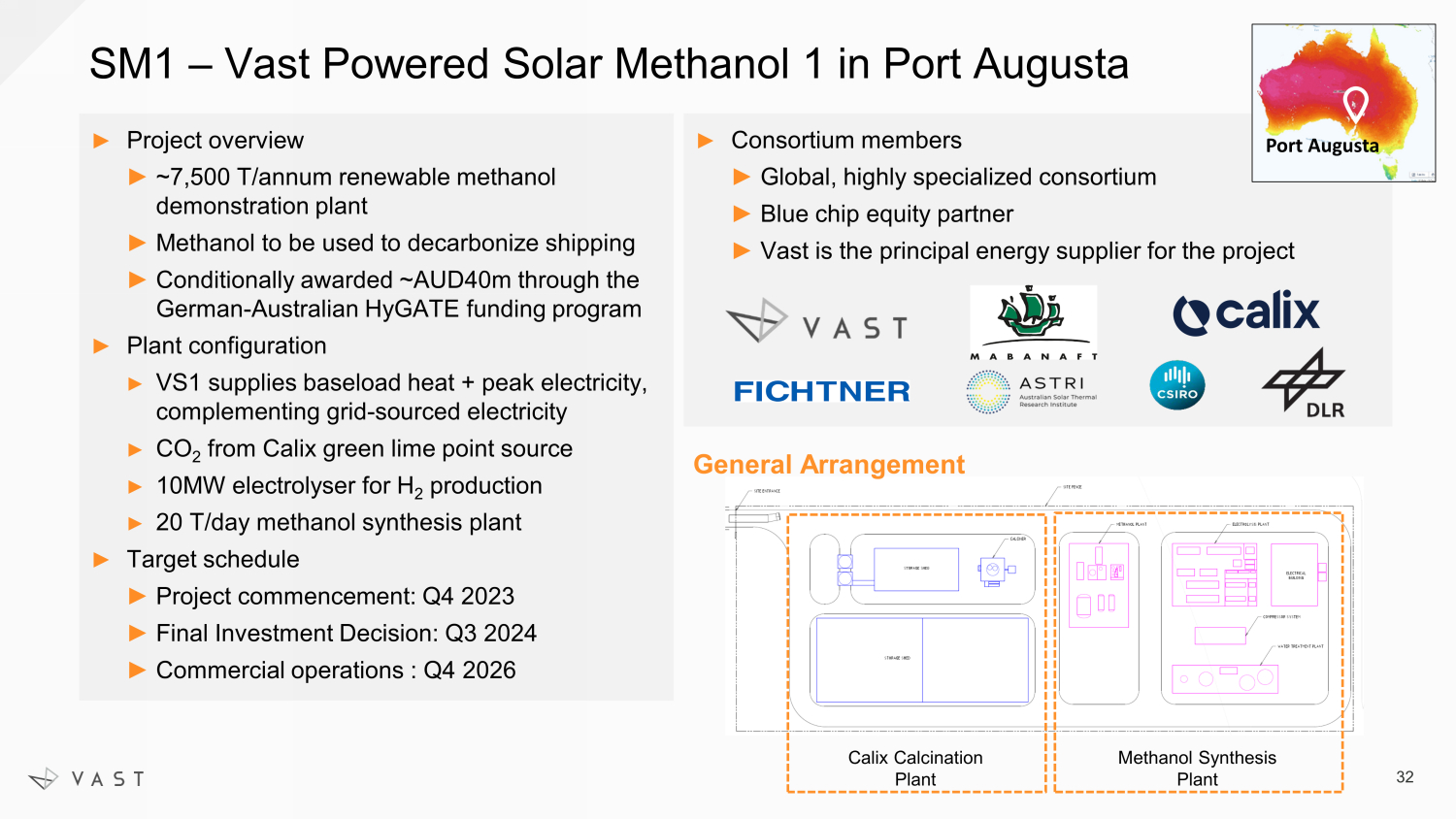

► Project overview ► ~7,500 T/annum renewable methanol demonstration plant ► Methanol to be used to decarbonize shipping ► Conditionally awarded ~AUD40m through the German - Australian HyGATE funding program ► Plant configuration ► VS1 supplies baseload heat + peak electricity, complementing grid - sourced electricity ► CO 2 from Calix green lime point source ► 10 MW electrolyser for H 2 production ► 20 T/day methanol synthesis plant ► Target schedule ► Project commencement : Q 4 2023 ► Final Investment Decision : Q 3 2024 ► Commercial operations : Q 4 2026 SM1 – Vast Powered Solar Methanol 1 in Port Augusta Calix Calcination Plant Methanol Synthesis Plant General Arrangement ► Consortium members ► Global, highly specialized consortium ► Blue chip equity partner ► Vast is the principal energy supplier for the project 32 Port Augusta

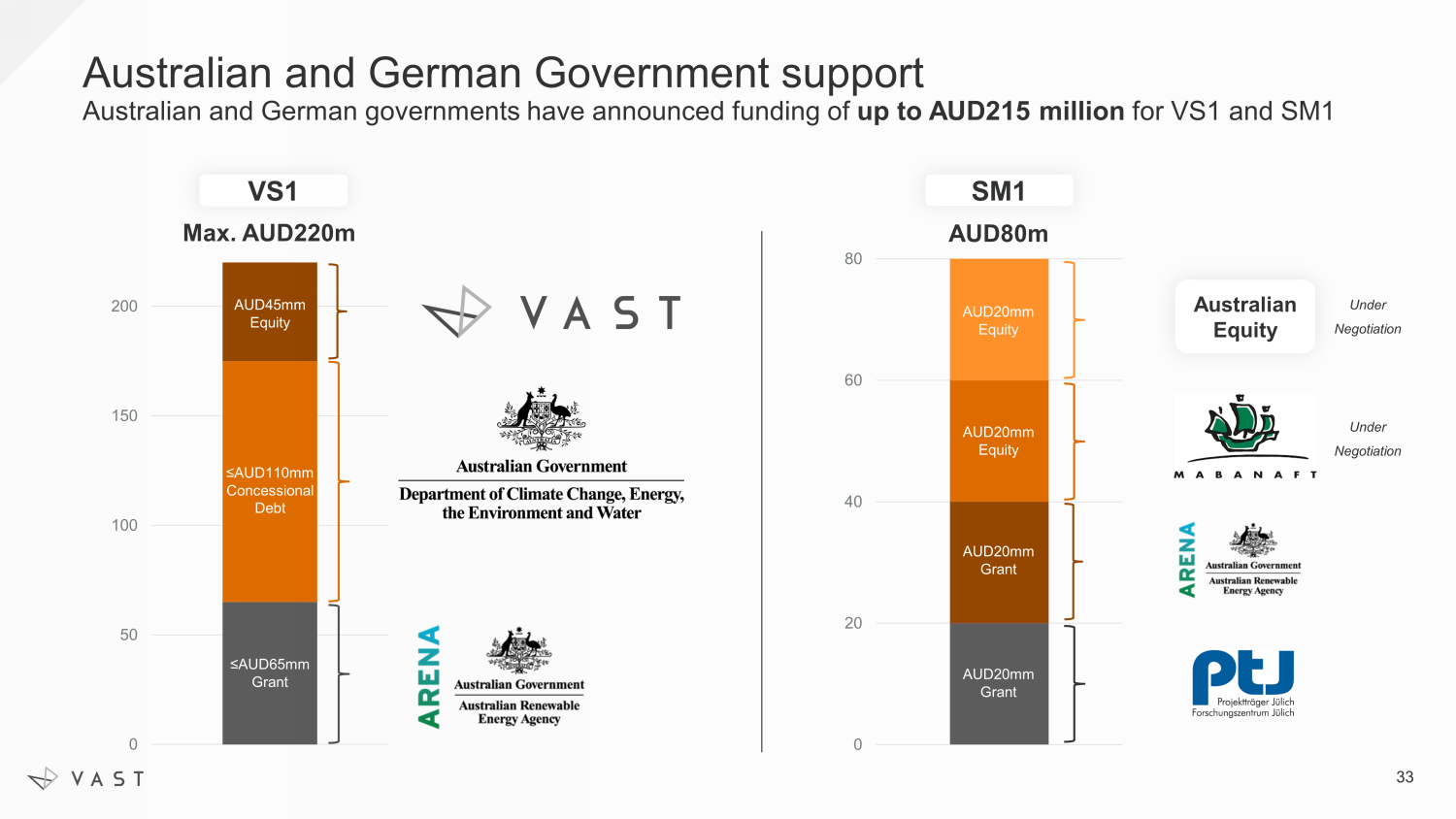

Australian and German Government support Australian and German governments have announced funding of up to AUD215 million for VS1 and SM1 0 20 40 60 80 0 50 100 150 200 250 AUD45mm Equity ≤AUD110mm Concessional Debt ≤AUD65mm Grant AUD80m AUD20mm Equity AUD20mm Grant AUD20mm Grant Max. AUD220m Australian Equity VS1 SM1 AUD20mm Equity 33 Under Negotiation Under Negotiation

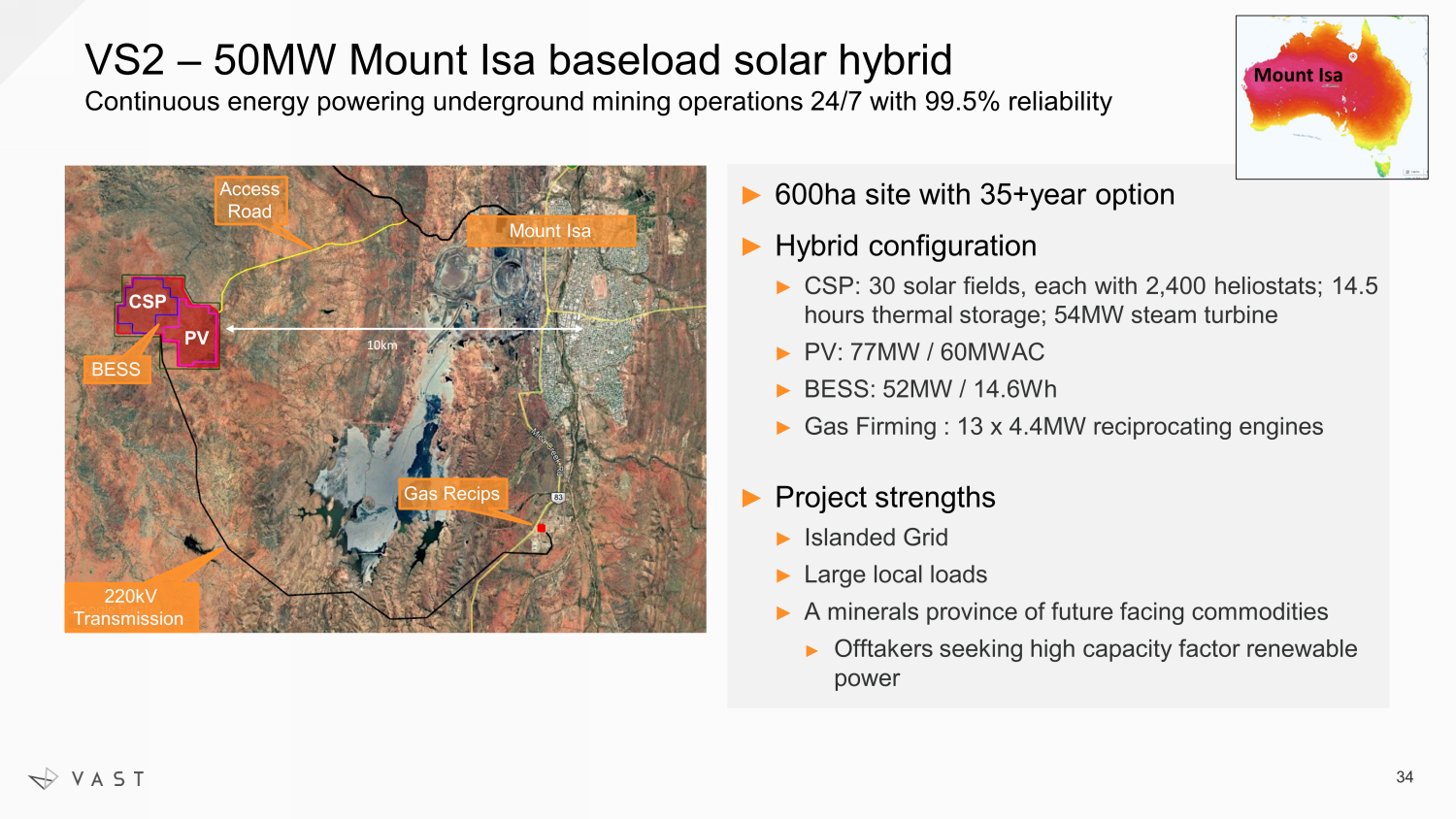

VS2 – 50MW Mount Isa baseload solar hybrid Continuous energy powering underground mining operations 24/7 with 99.5% reliability PV BESS ► 600ha site with 35+year option ► Hybrid configuration ► CSP : 30 solar fields, each with 2 , 400 heliostats ; 14 . 5 hours thermal storage ; 54 MW steam turbine ► PV : 77 MW / 60 MWAC ► BESS : 52 MW / 14 . 6 Wh ► Gas Firming : 13 x 4.4MW reciprocating engines ► Project strengths ► Islanded Grid ► Large local loads ► A minerals province of future facing commodities ► Offtakers seeking high capacity factor renewable power PV CSP Mount Isa 10km BESS Gas Recips 220kV Transmission Access Road Mount Isa 34

VS2 – 50MW Mount Isa baseload solar hybrid Continuous energy powering underground mining operations 24/7 with 99.5% reliability B aseload solar energy: an ex ample three - day period in January 1 Projected annualized performance optimized for lowest LCOE 1. P50 TMY at 1 minute resolution Mount Isa Proportion of Supply Purpose ► Primary Daytime Supply ► Short - Term Boost ► Primary Night - time Supply ► Firming Support Battery (BESS) Gas Assets CSP Plant 30 Solar Arrays 14.5hrs Thermal Storage Steam Turbine Charging 35 36% 44% 20% Disc harging PV Plant

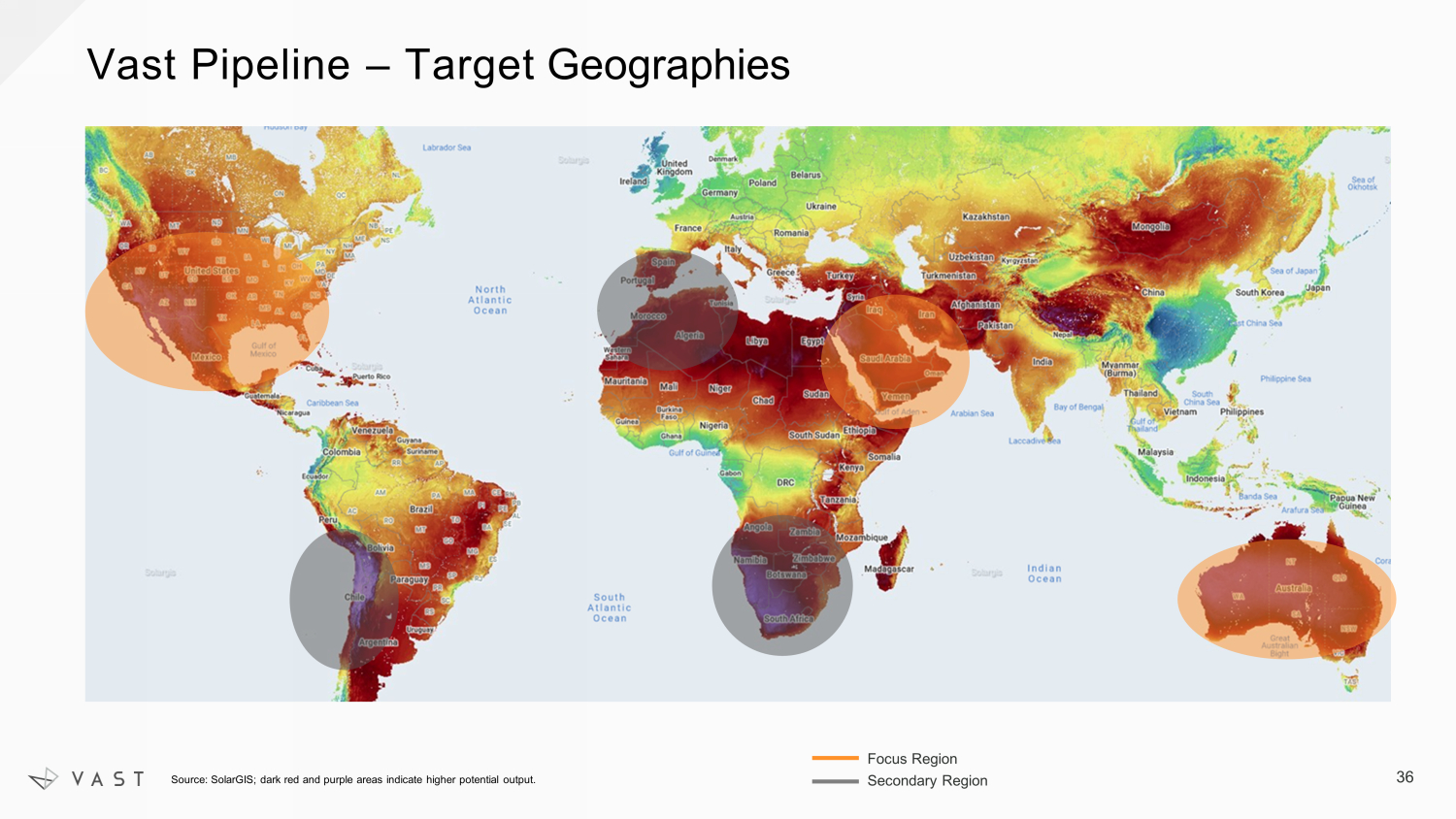

Vast Pipeline – Target Geographies Source: SolarGIS; dark red and purple areas indicate higher potential output. Focus Region Secondary Region 36

NETC & Nabors Guillermo Sierra VP - Energy Transition, Nabors Industries

Active in markets comprising 70%+ of global oil and gas production Located in 15+ countries, with a diversified customer base 300+ Global service assets Partnering with Nabors provides Vast with access to global relationships, reach and manufacturing and supply chain capabilities : a Unique Sponsor Leading international franchise with significant growth opportunities 38

Leveraging Nabors’ Capabilities to Accelerate Vast’s Global Deployment Nabors’ Capability Vast Applicability Strategic Automation & Robotics ▪ Mirror cleaning ▪ Automated pop - up manufacturing Manufacturing & Facilities ▪ Global supply chain ▪ Global field and technical support Controls, Software & AI ▪ Mirror array controls ▪ Remote operations ▪ Fluid control systems Nabors Technology ▪ Material sciences ▪ Hydrogen Nabors Ventures ▪ Revolutionary battery tech (Natron) ▪ Baseload energy enhancer (Sage ) Scaling Commercial ▪ Global relationships in key markets: U.S., Middle East and Latin America Technology Development ▪ Engineering capabilities ▪ IP procedures Maintenance Operations ▪ Remote control centers ▪ Continuous monitoring of field hardware Public Readiness Accounting HR IP Management Multi - Jurisdictional Experience Processes & Procedures Agreements With Nabors ► In connection with the transaction, NETC and Vast entered into several agreements with Nabors: ► Joint Development and Licensing Agreement to jointly develop technology to improve Vast’s CSP systems by leveraging Nabors expertise in automation, robotics, remote operations, material science, among others ► Shared Services Agreement with respect to various support functions ► In addition to the transaction, in December 2022 Vast entered into arrangements with companies within Nabors’ venture platform: ► Memorandum of Understanding b etween Vast and Sage Geosystems Inc. to evaluate opportunities to collaborate on future solar projects incorporating the Sage geothermal battery + storage technology, which allows for both storage and generation of energy from the earth’s heat ► Letter of intent between Vast and Natron Energy, Inc., a provider of sodium - ion battery products, to use revolutionary Natron batteries in projects using Vast’s CSP technology ► Additional opportunities for partnership and collaboration include leveraging Nabors’ global supply chain and operational footprint as well as its advanced engineering and engineering expertise, infrastructure resources, market knowledge, technology innovation / competencies and customer / vendor relationships Nabors’ Capability Vast Applicability 39

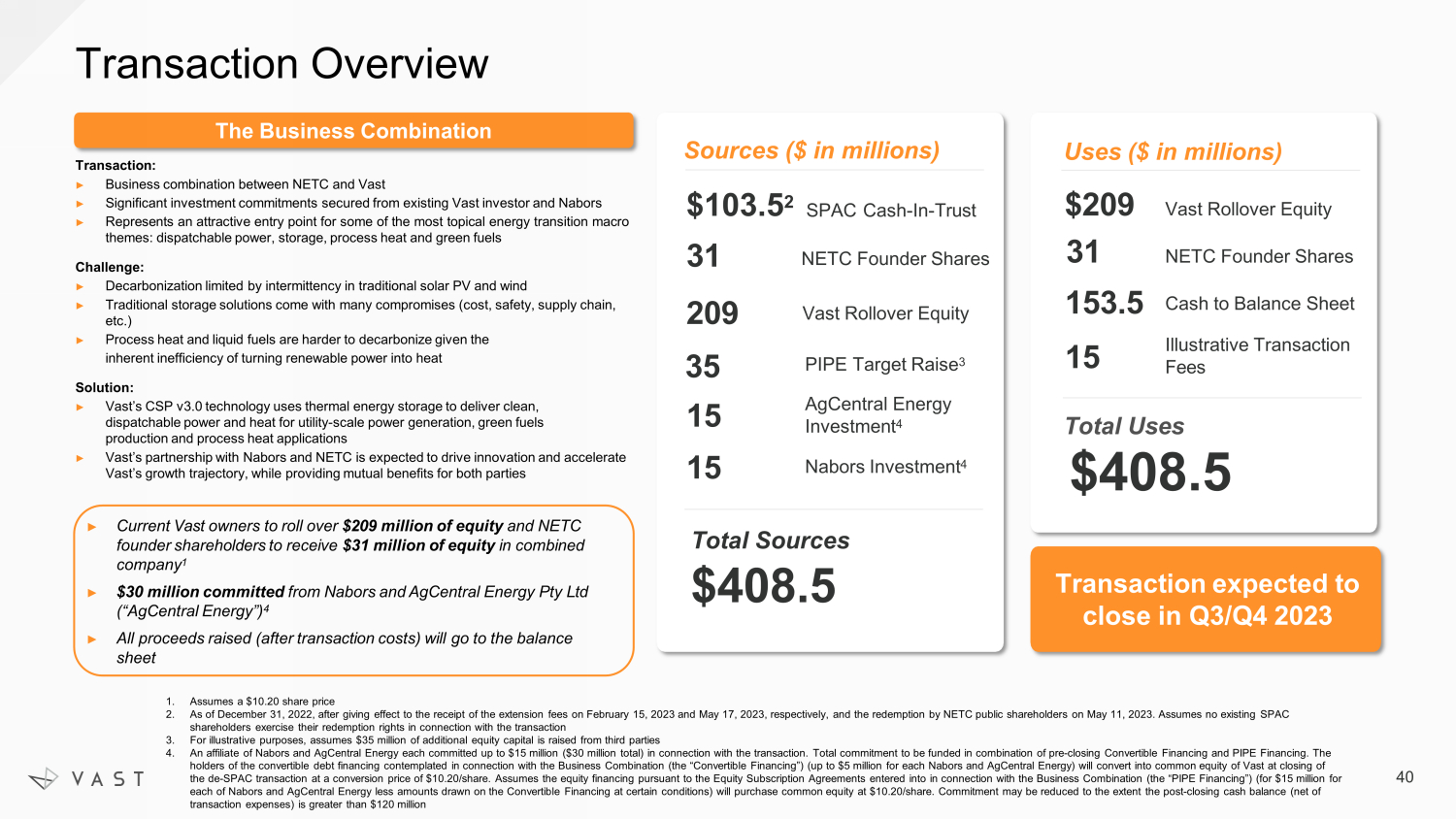

Transaction Overview Cash to Balance Sheet Illustrative Transaction Fees Total Uses $ 408.5 Uses ($ in millions) Total Sources $ 408.5 Sources ($ in millions) Transaction expected to close in Q 3 /Q 4 2023 Vast Rollover Equity $209 31 153.5 15 NETC Founder Shares SPAC Cash - In - Trust PIPE Target Raise 3 Vast Rollover Equity AgCentral Energy Investment 4 Nabors Investment 4 $ 103.5 2 31 209 35 15 15 NETC Founder Shares 1. Assumes a $10.20 share price 2. As of December 31, 2022, after giving effect to the receipt of the extension fees on February 15, 2023 and May 17, 2023, resp ect ively, and the redemption by NETC public shareholders on May 11, 2023. Assumes no existing SPAC shareholders exercise their redemption rights in connection with the transaction 3. For illustrative purposes, assumes $35 million of additional equity capital is raised from third parties 4. An affiliate of Nabors and AgCentral Energy each committed up to $15 million ($30 million total) in connection with the trans act ion. Total commitment to be funded in combination of pre - closing Convertible Financing and PIPE Financing . The holders of the convertible debt financing contemplated in connection with the Business Combination (the “Convertible Financin g”) (up to $5 million f or each Nabors and AgCentral Energy) will convert into common equity of Vast at closing of the de - SPAC transaction at a conversion price of $10.20/share. Assumes the equity financing pursuant to the Equity Subscription Agreements entered into in connection with the Bu siness Combination (the “PIPE Financing”) (for $15 million for each of Nabors and AgCentral Energy less amounts drawn on the Convertible Financing at certain conditions) will purchase comm on equity at $10.20/share. Commitment may be reduced to the extent the post - closing cash balance (net of transaction expenses) is greater than $120 million ► Current Vast owners to roll over $209 million of equity and NETC founder shareholders to receive $31 million of equity in combined company 1 ► $30 million committed from Nabors and AgCentral Energy Pty Ltd (“AgCentral Energy”) 4 ► All proceeds raised (after transaction costs) will go to the balance sheet The Business Combination Transaction: ► Business combination between NETC and Vast ► Significant investment commitments secured from existing Vast investor and Nabors ► Represents an attractive entry point for some of the most topical energy transition macro themes : dispatchable power, storage, process heat and green fuels Challenge: ► Decarboni z ation limited by intermittency in traditional solar PV and wind ► Traditional storage solutions come with many compromises (cost, safety, supply chain, etc.) ► Process heat and liquid fuels are harder to decarboni z e given the inherent inefficiency of turning renewable power into heat Solution: ► Vast’s CSP v3.0 technology uses thermal energy storage to deliver clean, dispatchable power and heat for utility - scale power generation, green fuels production and process heat applications ► Vast’s partnership with Nabors and NETC is expected to drive innovation and accelerate Vast’s growth trajectory, while providing mutual benefits for both parties 40

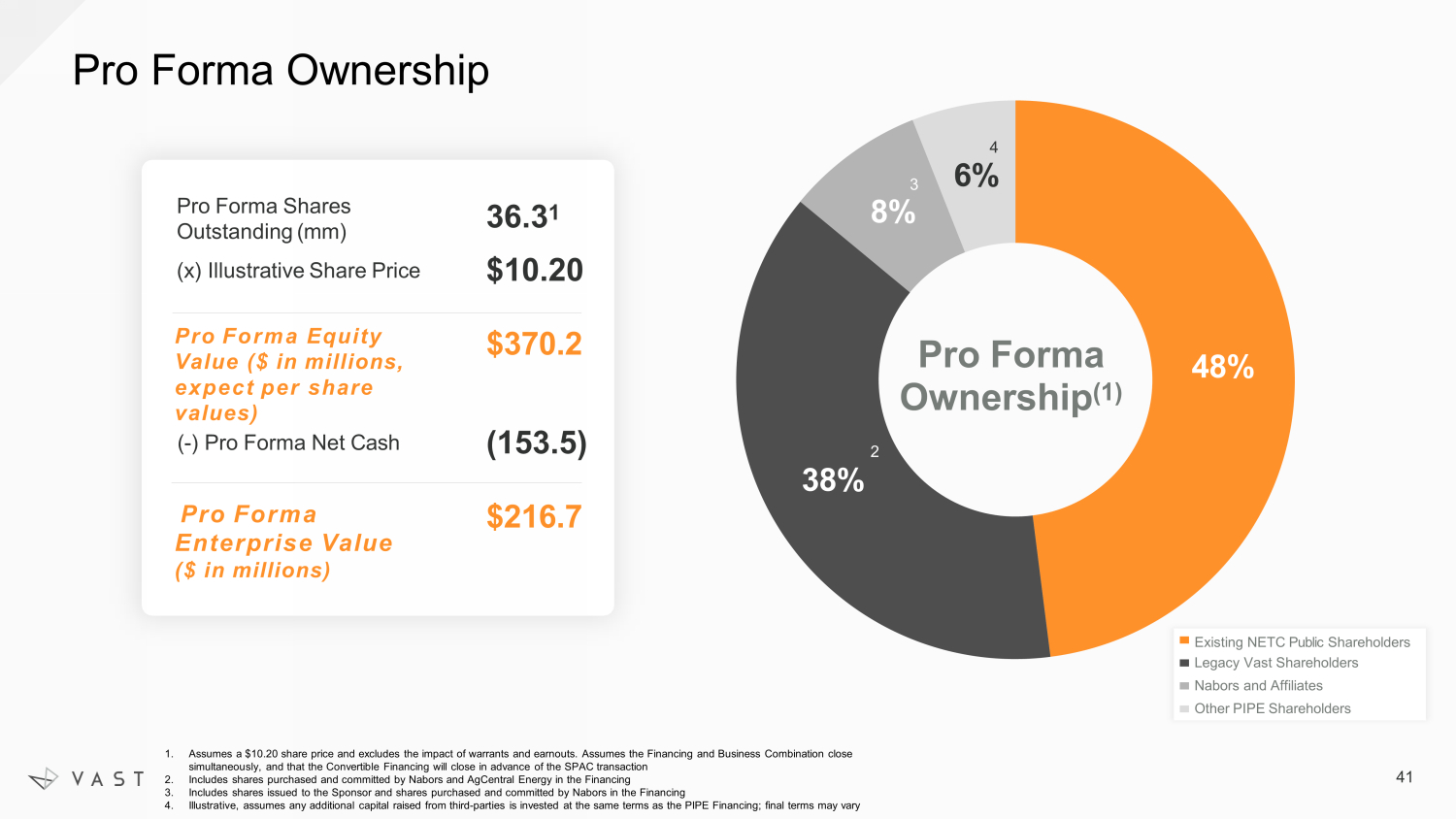

Pro Forma Ownership 48% 6% Pro Forma Ownership (1) Existing NETC Public Shareholders Legacy Vast Shareholders Nabors and Affiliates Other PIPE Shareholders 1. Assumes a $10.20 share price and excludes the impact of warrants and earnouts. Assumes the Financing and Business Combination close simultaneously , and that the Convertible Financing will close in advance of the SPAC transaction 2. Includes shares purchased and committed by Nabors and AgCentral Energy in the Financing 3. Includes shares issued to the Sponsor and shares purchased and committed by Nabors in the Financing 4. Illustrative, assumes any additional capital raised from third - parties is invested at the same terms as the PIPE Financing; fina l terms may vary 2 38% 3 8% 4 36.3 1 $10.20 $ 370.2 Pro Forma Shares Outstanding (mm) (x) Illustrative Share Price Pro Forma Equity Value ($ in millions, expect per share values) $ 216.7 ( - ) Pro Forma Net Cash Pro Forma Enterprise Value ($ in millions) ( 153.5 ) 41

Key Investment Highlights ► Potential to deliver low - cost, dispatchable renewable energy – the holy grail of clean energy ► Proprietary technology that addresses CSP’s historical reliability and manufacturability issues ► Targets large addressable market ► Attractive entry point provides for potential asymmetric risk / reward profile ► Partnership with Nabors should accelerate deployment 42

Reliable, Controllable, Stored Energy.

Risk Factors

Summary of Risk Factors For additional risks associated with an investment in Vast, please see the section titled "Risk Factors" in Vast's Registrati on Statement on Form F - 4, as amended, filed with the SEC on May 18, 2023 Risks Relating to Vast’s Business • If the demand for Vast’s CST and CSP technology does not grow as anticipated, it will negatively impact Vast’s revenue and harm the overall performance of the company. • If Vast is not successful in securing new contracts and / or developing the projects in its pipeline, it could negatively impact Vast’s business operations and financial performance. • Vast expects to invest in growth for the foreseeable future, and there is a risk that Vast may fail to manage that growth effectively. • If Vast is not able to appropriately manage its growth strategy, its business operations and financial results could be adversely affected. • A material reduction in the retail price of traditional utility - generated electricity or electricity from other sources could harm its business, financial condition, results of operations and prospects. • Vast will likely require a significant amount of capital to achieve its growth plans but obtaining it may be uncertain as Vast may not be able to secure additional financing on favorable terms, or at all. • Vast may invest large amounts of resources in its project development and construction activities, in particular its IEP business line, without first securing project financing, which could raise its expenses and make it harder to recoup its investments. • Vast may not be able to successfully finish or operate its projects in a way that makes a profit and / or meets its customers' requirements. • Vast is a growth - stage company with a history of operating losses, and it will likely incur substantial additional expenses and operating losses in the future. • Vast’s revenue, expenses, and related financials may fluctuate significantly. • An increase in the cost of materials and commodities used as inputs or otherwise in Vast’s business could adversely affect its business. • The failure of Vast’s suppliers to continue to deliver necessary raw materials or other components required for Vast’s projects in a timely manner or at all, or Vast’s inability to obtain substitute sources of these components on a timely basis or on terms acceptable to us, could adversely affect Vast’s business. • Vast requires certain specialty materials and components that may be subject to supply chain disruptions and the inability to obtain such materials and components on a timely basis or on terms acceptable to us, could adversely affect Vast’s business. • Certain estimates of market opportunity and forecasts of market growth may prove to be inaccurate. • Expanding Vast’s operations beyond Australia is a planned avenue for growth, but this strategy comes with additional risks that it may not encounter domestically. These risks could have a material adverse effect on its business and financial performance. • Vast operates in a highly competitive industry, where its present or future competitors may be able to compete more effectively than Vast does, which could have a material adverse effect on Vast’s business, revenues, growth rates, and market share. • Should it seek to dispatch during daylight hours, CSP faces competition from both rooftop and utility scale PV electricity generation in the Australian Electricity Market. The success of PV generating during daylight hours in the Australian Electricity Market depresses the price at which a CSP plant can sell electricity during the day. • CSP faces competition from existing coal - fired and other power plants that over their longer periods of operation have already amortized their fixed project costs and now offer energy at marginal costs that are difficult for newly - built plants to match. • Securing government support such as grant funding and concessional debt financing may result in increased government oversight and regulation for Vast. • The green hydrogen and downstream derivative production industry is an emerging market , and it may not receive widespread market acceptance. • Debt financing typically required for large and utility - scale projects such as VS1 and the other projects in Vast’s pipeline requires, for example, a third - party energy assessment and a third - party engineering report in form and substance satisfactory to the lenders. Failure to obtain such assessments and reports could result in delays, increased expenses or project cancellation. • Vast’s business is subject to risks associated with construction, utility interconnection, cost overruns and delays, including those related to obtaining government permits and other contingencies that may arise in the course of completing installations. • CSP v3.0 construction is complex and engineering, procurement and construction of VS1 and other Vast projects may require Vast to negotiate, engage and oversee multiple construction companies on split EPC contracts which may result in delay and cost overruns. • A portion of Vast’s activities are conducted through variable interest entities, and changes to accounting guidance, policies or interpretations thereof could cause Vast to materially change the presentation of its financial statements. • Vast has a history of operating losses and will likely incur substantial additional expenses and operating losses in the futu re. Vast’s management has concluded that there is, and the report of Vast’s independent registered public accounting firm contains an explanatory paragraph that expresses, substantial doubt about Vast’s ability to continue as a “go ing concern”. 45

Summary of Risk Factors (cont’d) Risks Relating to Vast’s Business (cont’d) • VS1 is critically important to the future of the business. The project may be delayed due to factors such as a complex grid connection process, permitting delays, updated legislation forcing permits to be re - acquired, failure to attract the required financing, construction delays, cost overruns, loss / theft of a key piece of equipment, longer than expected commissioning process and a slower than expected ramp - up of production post commissioning. A delay / failure in the delivery of VS1 could materially impact Vast’s overall growth strategy and substantially reduce the potential to commercialize Vast’s product offering. • VS1 involves an approximately 30X scale up relative to the JSS Pilot Plant which exposes Vast to significant risk associated with factors such as technology readiness, organizational capability to deliver and production ramp up. • Vast is only a 50% owner of SiliconAurora whose support is critical to ensure the success of VS1 and other projects in the pipeline. Should Vast lose control of this entity / fail to appropriately manage this business with its co - investors, 1414 Degrees Pty. Ltd, it may significantly delay Vast’s projects and have material adverse outcomes for the overall prospects of the business. • Elevated interest rates could adversely affect Vast’s business, its results of operations and its financial condition. • Construction of Vast’s projects requires it to rely on the experience and resources of designers, general contractors and subcontractors, who may experience financial or other problems during the design or construction process and their failures may delay or prevent completion of its projects which may materially adversely affect its business, financial condition and results of operations. • Delays in the construction of Vast’s projects or significant cost overruns could present significant risks to its business and could have a material adverse effect on its business, financial condition and results of operations. • A work interruption, strike or other union activities by the employees of Vast’s suppliers, contractors or subcontractors could have a material adverse effect on its business, financial condition and results of operations. • It is difficult, if not impossible, to forecast Vast’s future results, and Vast has limited insight into trends that may emerge and affect Vast’s business. • Vast may be unable to execute on its business model or develop its technology, which would have a material adverse effect on Vast’s operating results and business, would harm Vast’s reputation and could result in substantial liabilities that exceed its resources. • Vast may be unable to raise the necessary capital to implement its business plan and strategy, and Vast may not be able to satisfy the conditions precedent to funding of the DOE, ARENA and the German government grants. • If Vast needs to raise additional funds, there is a risk that these funds may not be available on terms favorable to Vast or Vast’s shareholders, or at all when needed. • Vast faces significant competition and that its competitors may develop competing technologies that are more efficient or effective than Vast’s. • There is a risk that Vast may not be able to attain the supplies and products for its projects. • If Vast is unable to enter into commercial agreements with its current suppliers or its replacement suppliers on favorable terms, or if these suppliers experience difficulties meeting Vast’s requirements, the development and commercial progression of Vast’s projects may be delayed. Risks Related to Vast’s Technology • CST and CSP plants developed using Vast’s technology may not generate the levels of output estimated by Vast’s production models. • Vast may be unable to adapt its technologies and products to meet shifting customer preferences or industry regulations, and Vast’s rivals could create products that reduce the need and / or demand for its offerings. • The development and delivery of Vast’s modular CSP v3.0 plants will require substantial funding. Vast’s projects may rely on outside sources to finance this, and such financing may not be available on favorable terms or at all. • Commercial deployment of new power generation technology, such as CSP v3.0 is difficult. • Vast may experience issues with scaling up Vast’s technology to the size required for VS1 and other large and utility - scale projects, which may have a material adverse effect on Vast’s business in the form of higher costs, reduced demand and delayed growth. • Vast’s business may be harmed if it fails to properly protect its intellectual property, and Vast may also be required to defend against claims or indemnify others against claims if its intellectual property infringes on the intellectual property rights of third parties. There is also a risk that Vast may not have adequate intellectual property rights to carry out its business, may need to defend itself against patent, copyright, trademark, trade secret or other intellectual property infringement or misappropriation claims, and may need to enforce its intellectual property rights from unauthorized use by third parties. • Vast’s business and growth strategy relies on having continued access to sodium metal used as the primary HTF. There are a limited number of suppliers of this product and any issues that impede of remove these suppliers from the market could have an outsized impact on the overall prospects of the business. 46

Summary of Risk Factors (cont’d) Risks Related to Vast’s Technology (cont’d) • Vast will have to share information with suppliers and construction partners which may result in unauthorized disclosure or unintended transmission of trade secrets or know - how resulting in a loss of its competitive advantage. • The successful delivery of a plant utilizing Vast technology requires the integration of a number of small and large packages of components, technologies and processes. Failure to integrate these appropriately could result in significant underperformance of the plant, which would result in a loss of reputation in the market and a material adverse impact on the business. • Due to the relatively nascent nature of Vast’s technology and lack of familiarity of the technology with existing contractors, there is a risk that the contractors Vast engages fail to follow CSP engineering best practices, which may result in poor performance, breakdowns, cost and schedule overruns which could materially impact the commercial viability of projects using its technology. • Vast intends to manufacture products that it has designed / co - designed and refined over many years that are yet to be produced in commercial quantities. This includes, but is not limited to, heliostats, sodium receivers, sodium / salt heat exchangers, and / or control system software. There is a risk that the quality of Vast’s manufactured products is inadequate, the ramp up of manufacturing takes longer than expected and / or costs significantly more than expected, any of which may result in poor performance of its plants, a loss of confidence in the technology and failure to deliver on its growth strategy. • Vast has not yet integrated a molten salt TESS into its overall technology offering. Molten salt TES is a key driver of the overall economics of Vast’s technology and failure to integrate it appropriately at VS1 and other future projects could have a material adverse effect on the attractiveness of its technology to future investors and customers which could significantly impede its growth strategy. Risks Relating to Legal Matters and Regulations • Vast’s business, financial condition, results of operations and prospects may be materially adversely affected by the extensive regulation of its business. • Any reductions or modifications to, or the elimination of, governmental incentives or policies that support renewable energy in general, and CSP / CST in particular, could have a material adverse effect on Vast’s business, financial condition, results of operations and prospects. • Existing electric utility industry regulations, and changes to regulations, may present technical, regulatory and economic barriers to the purchase and use of solar energy offerings that may significantly reduce demand for Vast’s solar energy offerings. Risks Related to Vast’s Operations • Vast’s business will depend on experienced and skilled personnel and substantial specialty subcontractor resources with emphasis on key offshore personnel that may be required (e.g., turbine suppliers) to verify the installation, and if Vast loses key personnel or if it is unable to attract and integrate additional skilled personnel, it will be more difficult for Vast to manage its business and complete projects. • Vast Solar uses sodium, a material that is highly reactive and can be dangerous when inappropriately handled, as an HTF. • Hydrogen and methanol are flammable fuels that are inherently dangerous substance. • Security and privacy breaches, loss of proprietary information, and service interruptions caused by computer malware, viruses, ransomware, hacking, phishing attacks, and other network disruptions could have a negative impact on Vast’s business. • Adverse weather conditions and natural disasters may have a negative impact on Vast’s operations. This includes, but is not limited to, short term phenomena such as volcanic eruptions and long term deviations to the weather resource relative to historical periods. • The operation and maintenance of Vast’s facilities are subject to many operational risks, the consequences of which could have a material adverse effect on Vast’s business, financial condition, results of operations and prospects. • CSP v3.0 requires the use of a number of complex components, equipment and interconnections, some of which have been custom designed by or for Vast and have not been used in commercial projects in the past. Any failure of such components, equipment or interconnections could result in delays, impaired performance, increased costs and damage to Vast’s reputation. • The performance of Vast’s technology may be affected by field conditions and other factors outside of its control, which could result in harm to its business and financial results. • The equipment Vast procures and manufacture may have shorter lifetime and / or degrade faster than expected resulting in the loss of a competitive advantage, which could result in harm to its projects, reputation in the market and financial results. • Plants using Vast technology are large industrial facilities that may attract negative attention from protestors and / or local communities around the presence of an industrial asset, which could result in a loss of its social license to operate and lawsuits which could have an adverse impact on Vast’s financials. • Vast may fail to secure the Major Hazard Facility licenses and other relevant licenses for VS1 and other projects from relevant federal, state and local regulators resulting in its plants being forced to remain shut down for extended periods of time resulting in a materially adverse impact to the overall production of the plant. • A major safety incident which occurs on one or more of Vast’s projects during construction, commissioning and / or operations could result in harm to personnel, environment and property, which could further result in the creation of material liabilities, shutdown of site for extended time periods, severely tarnish the reputation of its technology and substantially reduce likelihood of winning future projects. 47

Summary of Risk Factors (cont’d) Risks Related to Vast’s Operations (cont’d) • The VS1 reference project is important to the future of the business and requires a substantial scale up relative to the Jema lon g Solar Station (“JSS Demonstration Plant”) and carries significant risk associated with factors such as technology readiness, organizational capability to deliver and production ramp up. • The energy transition process broadly is a future multi - trillion dollar investment thesis and a number of companies will be competing for exceptional talent thus resulting in risks associated with talent acquisition. • As a pre - revenue company, Vast will be competing with much larger and well capitalized companies which may make it difficult to attract and retain necessary to develop and expand its business. • As a company intending to operate internationally, changes in future tax legislation in the countries in which Vast plans to operate can have a material negative impact on Vast. • As an early, developmental stage publicly - traded company, Vast will be subject to unique risks. Risks Related to Australia • It may be difficult to enforce a judgment in the United States against Vast and its officers and directors, assert U . S . securities laws claims in Australia or serve process on Vast’s officers and directors . • As a foreign private issuer, Vast will be exempt from a number of rules under the Securities and Exchange Act of 1934 , Vast will be permitted to file less information with the SEC than domestic companies and permitted to follow home country practice in lieu of the listing requirements of NYSE, subject to certain exceptions . Accordingly, there may be less publicly available information concerning Vast than there is for issuers that are not foreign private issuers . • Australian takeovers laws will apply to the Company and any party seeking to make a proposal to acquire the company will need to comply with those laws. They prescribe processes, disclosures and requirements which may differ from those under equivalent US laws and therefore may impact the terms on which parties may be willing to make such an acquisition proposal or to acquire large numbers of Vast’s ordinary shares. • Vast’s Constitution and other Australian laws and regulations will apply to any corporate and other actions which the company may seek to take in the interests of its shareholders. The terms on which such actions can be taken may be impacted by the constitution and those Australian laws and regulations. • Expanding Vast’s operations beyond Australia is a planned avenue for growth, but this strategy comes with additional risks that it may not encounter domestically. These risks could have a material adverse effect on its business and financial performance. Risks Related to the Business Combination • There is a risk that the potential benefits of the Business Combination may not be fully achieved or may not be achieved within the expected timeframe . • There is a risk that a significant number of NETC stockholders elect to redeem their shares prior to the consummation of the Business Combination pursuant to the NETC Charter, which would potentially make the Business Combination more difficult to complete by reducing the amount of cash available to the combined company to execute its business plan following the Closing, causing the minimum cash condition not to be satisfied . • There are risks and potential costs to NETC if the Business Combination is not completed, including the risk of diverting management’s focus and resources from other business combination opportunities, which could result in NETC being unable to effect a business combination in the requisite time frame and force NETC to liquidate. • There are risks in the fact that the Business Combination Agreement includes an exclusivity provision that prohibits NETC from soliciting other business combination proposals, which restricts NETC’s ability, so long as the Business Combination Agreement is in effect, to consider other potential business combinations. • There is a risk that NETC’s stockholders may fail to provide the votes necessary to effect the Business Combination. • There is a possibility of litigation challenging the Business Combination or that an adverse judgment granting permanent injunctive relief could indefinitely enjoin consummation of the Business Combination. • There is a risk that the Closing might not occur in a timely manner or that the Closing might not occur at all, despite NETC’s efforts. • Completion of the Business Combination is conditioned on the satisfaction of certain Closing conditions that are not within NETC’s control. • There are risks of incurring significant fees and expenses associated with completing the Business Combination and the substantial time and effort of management required to complete the Business Combination. • The existence of financial and personal interests of NETC’s directors and management may result in conflicts of interests between what they may believe is in the best interests of NETC and its shareholders and what they may believe is best for themselves. In addition, NETC directors and management have interests in the Business Combination that may conflict with the interests of shareholders. • The NETC Board did not obtain a third - party valuation or fairness opinion in determining whether or not to proceed with the Busi ness Combination. Risks Related to the CST / CSP Industry • Demand for Vast's CST and CSP technology may not grow as anticipated. • Should it seek to dispatch during daylight hours, CSP faces competition from both rooftop and utility scale PV electricity generation in the Australian Electricity Market. The success of PV generating during daylight hours in the Australian Electricity Market depresses the price at which a CSP plant can sell electricity during the day. • Any reductions or modifications to, or the elimination of, governmental incentives or policies that support renewable energy in general, and CSP / CST in particular, could have a material adverse effect on Vast’s business, financial condition, results of operations and prospects. 48

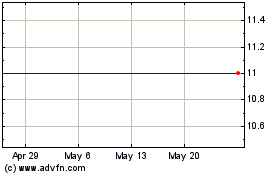

Nabors Energy Transition (NYSE:NETC)

Historical Stock Chart

From Apr 2024 to May 2024

Nabors Energy Transition (NYSE:NETC)

Historical Stock Chart

From May 2023 to May 2024