New MoneyLion Financial Literacy Report Sheds Light on the 2024 Financial Landscape for U.S. Hispanics

September 16 2024 - 9:00AM

Business Wire

The MoneyLion Understanding U.S. Hispanic

Financial Literacy & Empowerment 2024 Report explores financial

literacy and attitudes toward personal finance within the U.S.

Hispanic community

MoneyLion (“MoneyLion”) (NYSE: ML), a digital ecosystem for

consumer finance that empowers everyone to make their best

financial decisions, today shared findings from a new Understanding

U.S. Hispanic Financial Literacy & Empowerment 2024 Report1.

Coinciding with the start of Hispanic Heritage Month on September

15, this report, conducted by The Harris Poll and commissioned by

MoneyLion, offers a comprehensive exploration of financial literacy

and personal finance attitudes of the U.S. Hispanic community.

The report showcases crucial insights into how Hispanics in the

U.S. perceive their access to financial resources, their preferred

methods for learning about money, and the broader political

implications of their financial literacy. With detailed comparisons

between Hispanic and Non-Hispanic populations in the U.S., the

report highlights key disparities in financial education, time

constraints, and familiarity with financial products, offering

valuable recommendations for improving financial literacy and

access to resources within this rapidly growing community.

Key Findings from the Report:

- Preference for Social Media: 24% of U.S. Hispanics turn

to social media for financial guidance, compared to just 17% of

Non-Hispanics, indicating a strong preference for non-traditional

financial information sources.

- Strong Interest in Financial Education: 45% of U.S.

Hispanics want to learn more about saving money (vs. 33% of

Non-Hispanics) if they had time to do so, and 36% are interested in

budgeting (vs. 27% of Non-Hispanics).

- Time Constraints: A notable 68% of U.S. Hispanics report

not having enough time to access financial tools and resources that

can help them learn about money and personal finance topics,

compared to 51% of Non-Hispanics, underscoring the need for quick,

accessible financial education.

- Financial Literacy Disparity: The survey revealed

significant disparities in financial literacy between U.S.

Hispanics and Non-Hispanics. The U.S. Hispanic financial literacy

rate of 54% was significantly lower than the 69% of

Non-Hispanics.

- Gaps in Financial Planning: 53% of U.S. Hispanics have

an emergency fund, compared to 67% of Non-Hispanics. Furthermore,

only 24% of U.S. Hispanics contributed to a retirement account in

the past 12 months, compared to 49% of Non-Hispanics.

- Political Engagement: 74% of U.S. Hispanics are more

likely to support a presidential candidate who prioritizes

financial literacy as one of their main issues.

“Our latest financial literacy survey highlights the strong

desire within the U.S. Hispanic community to learn and improve

their financial well-being,” said Yuka Yoneda, Vice President of

Content Marketing at MoneyLion. “It also shows the barriers this

group faces when it comes to learning about money, such as limited

time, and a preference for modern formats like short videos for

financial education. This data is exciting for MoneyLion as it

highlights the impact of our ongoing initiatives to foster

financial empowerment and literacy. We’re committed to providing

the right mix of tools and support necessary to help Hispanics in

the United States - and all Americans - achieve financial success

and empower them to make their best financial decisions.”

“The U.S. Hispanic community is one of the most important in the

country,” said David Krane, Senior Consultant at The Harris Poll.

“As this community continues to grow and exert influence in U.S.

society, it’s clear from MoneyLion’s research that providing the

right resources to improve financial literacy is essential. Helping

U.S. Hispanics build greater confidence in managing their finances

is a highly desirable outcome.”

In addition to the report, MoneyLion also launched the latest

season of its “No Stupid Questions” content series, hosted by

social media finfluencer and award-winning financial educator Lea

Landaverde. Designed to fit the needs of busy, everyday Americans

interested in up-leveling their financial lives, the show answers

some of the most common money questions (crowd-sourced from real

users on the MoneyLion app) in simple terms that anyone can

understand - and in under 2 minutes per episode.

For more information on the Understanding U.S. Hispanic

Financial Literacy & Empowerment 2024 Report, visit MoneyLion’s

website here.

About MoneyLion

MoneyLion is a leader in financial technology powering the next

generation of personalized products, content, and marketplace

technology, with a top consumer finance super app, a premier

embedded finance platform for enterprise businesses and a

world-class media arm. MoneyLion’s mission is to give everyone the

power to make their best financial decisions. We pride ourselves on

serving the many, not the few; providing confidence through

guidance, choice, and personalization; and shortening the distance

to an informed action. In our go-to money app for consumers, we

deliver curated content on finance and related topics, through a

tailored feed that engages people to learn and share. People take

control of their finances with our innovative financial products

and marketplace - including our full-fledged suite of features to

save, borrow, spend, and invest - seamlessly bringing together the

best offers and content from MoneyLion and our 1,200+ Enterprise

Partner network, together in one experience.

MoneyLion’s enterprise technology provides the definitive search

engine and marketplace for financial products, enabling any company

to add embedded finance to their business, with advanced AI-backed

data and tools through our platform and API. Established in 2013,

MoneyLion connects millions of people with the financial products

and content they need, when and where they need it.

For more information about MoneyLion, please visit

www.moneylion.com. For information about Engine by MoneyLion for

enterprise businesses, please visit www.engine.tech. For investor

information and updates, visit investors.moneylion.com and follow

@MoneyLionIR on X.

_____________________________ 1 The insights featured in this

report were compiled using data collected from an online survey

conducted in the United States by The Harris Poll on behalf of

MoneyLion from 8/9/2024-8/14/2024 among 1,009 U.S. residents (half

of whom were Hispanic (n=506) and the other half Non-Hispanic

(n=503)), provides a detailed comparison between these two groups

over the ages of 18 and older).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240915342863/en/

MoneyLion Communications pr@moneylion.com

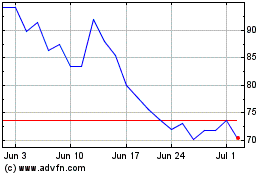

MoneyLion (NYSE:ML)

Historical Stock Chart

From Dec 2024 to Jan 2025

MoneyLion (NYSE:ML)

Historical Stock Chart

From Jan 2024 to Jan 2025