Jacobs Reaches 52-Week High - Analyst Blog

March 18 2013 - 9:10AM

Zacks

Jacobs Engineering Group

Inc. (JEC), a construction services provider, hit a

52-week high of $53.80 on Mar 15, 2013, as it gained momentum from

a continued flow of contracts from well-known companies that

followed modest fiscal first quarter 2013 results. Jacobs has

generated a return of approximately 26.2% year-to-date.

This Zacks Rank #2 (Buy) company’s

long-term estimated earnings per share growth rate is 13.5%.

Average volume of shares traded over the last three months came in

at approximately 1.0 million.

Galore of

Contracts

Jacobs has been successfully

achieving a large number of projects and has also implemented them

with equal success. In March, Jacobs received a contract from

Jiangsu Sailboat Petrochemical Co., based in China, for designing a

sulfuric acid plant for an undisclosed amount. Around the same

time, Jacobs also inked an agreement with Shell Company of

Australia Ltd., for Shell’s Clyde Terminal Project based in Sydney,

Australia.

Also, in February, Jacobs signed

another contract with NASA for its Johnson Space Centre. This

contract is not the first, but rather among many other contracts

that Jacobs has entered into with NASA in various regions. The

company is also expanding its operations beyond the US, to regions

like China, Australia, Singapore, and Saudi Arabia, to name only a

few.

In late January, Jacobs reported

modest results for its fiscal first quarter 2013, with earnings per

share of 76 cents, in line with the Zacks Consensus Estimate.

Revenue increased 4.6% year over year to $2.6 billion in 2012.

Estimates have also been increasing

consistently over the past 60 days, after the announcement of the

results. The Zacks Consensus Estimate for fiscal 2013 rose almost

1.5% to $3.35 while that for fiscal 2014 increased 4.2% to $3.74 in

the past 60 days.

Other Stocks to

Consider

Other stocks worth a look in the

services industry are AECOM Technology Corporation

(ACM), Tyco International (TYC) and

Mistras Group Inc. (MG); each of these holds a

Zacks Rank #2 (Buy).

AECOM TECH CORP (ACM): Free Stock Analysis Report

JACOBS ENGIN GR (JEC): Free Stock Analysis Report

MISTRAS GROUP (MG): Free Stock Analysis Report

TYCO INTL LTD (TYC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

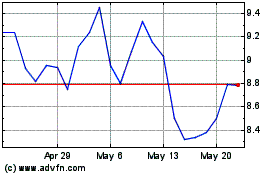

Mistras (NYSE:MG)

Historical Stock Chart

From Jun 2024 to Jul 2024

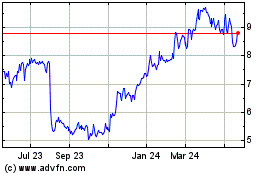

Mistras (NYSE:MG)

Historical Stock Chart

From Jul 2023 to Jul 2024