Mirant Reports Results for Second Quarter 2007 and Completion of Divestiture Program

August 09 2007 - 8:30AM

PR Newswire (US)

* Net income of $1.256 billion versus net income of $99 million for

the second quarter of 2006 ATLANTA, Aug. 9 /PRNewswire-FirstCall/

-- Mirant Corporation (NYSE:MIR) today reported net income of

$1.256 billion for the quarter ended June 30, 2007, compared to net

income of $99 million for the same period in 2006. Results for 2007

include an after-tax gain of $1.3 billion on the sale of the

Philippine business. Diluted earnings per share for the second

quarter of 2007 were $4.91 per share, compared to $0.32 per diluted

share for the same period in 2006. Mirant reported adjusted net

income from continuing operations of $162 million for the second

quarter of 2007, or diluted earnings per share of $0.57, compared

to a loss of $1 million for the same period in 2006. Adjusted net

income excludes unrealized mark-to-market gains and losses and

other non- recurring items, including a $175 million impairment in

2007 related to the Lovett generation facility. Adjusted EBITDA

from continuing operations, which also excludes unrealized

mark-to-market gains and losses, a $175 million impairment in 2007

related to the Lovett generation facility and other non-recurring

items, was $230 million for the second quarter of 2007, compared to

$83 million for the same period in 2006. Both the second quarter of

2007 and the second quarter of 2006 benefited from incremental

realized value from hedging. The period over period increase for

the quarter was principally due to higher realized gross margin in

the Mid-Atlantic and favorable fuel oil management activities. Net

cash provided by operating activities during the second quarter of

2007 was $286 million excluding bankruptcy payments of $22 million.

Net cash provided by operating activities for the first six months

of 2007 was $543 million excluding bankruptcy payments of $28

million. Year-to-Date Net income for the first six months of 2007

was $1.204 billion compared to $566 million for the same period in

2006. Results for 2007 include an after- tax gain of $1.3 billion

on the sale of the Philippine business. Diluted earnings per share

for the first six months of 2007 were $4.70 per share, compared to

$1.84 per diluted share for the same period in 2006. Mirant

reported adjusted net income from continuing operations of $291

million for the first six months of 2007, or diluted earnings per

share of $1.03, compared to adjusted net income of $88 million for

the same period in 2006, or $0.28 earnings per diluted share.

Adjusted net income excludes unrealized mark-to-market gains and

losses and other non-recurring items including a $175 million

impairment in 2007 related to the Lovett generation facility.

Adjusted EBITDA from continuing operations, which also excludes

unrealized mark-to-market gains and losses, a $175 million

impairment in 2007 related to the Lovett generation facility and

other non-recurring items, was $451 million for the first six

months of 2007, compared to $264 million for the same period in

2006. Both the first six months of 2007 and first six months of

2006 benefited from incremental realized value from hedging. The

period over period increase was principally due to higher realized

gross margin in the Mid-Atlantic and favorable fuel oil management

activities. As of June 30, 2007, the company's continuing

operations had cash and cash equivalents of $5.673 billion, total

available liquidity of $6.386 billion and total outstanding debt of

$3.139 billion. Completion of Divestiture Program Mirant announced

that it has closed the previously announced sale of its Caribbean

business to a subsidiary of the Marubeni Corporation. The net

proceeds to Mirant after transaction costs are $553 million. "This

completes the divestiture program that we announced approximately a

year ago with total net proceeds of $5.076 billion," said Edward R.

Muller, chairman and chief executive officer. "Mirant's operations

are now exclusively in the United States." Earnings Call Mirant is

hosting an earnings call today to discuss its second quarter 2007

financial results and outline business priorities. The call will be

held from 10:00 a.m. to 11:00 a.m. New York City time. The

conference call can be accessed via the investor relations section

of the company's website at http://www.mirant.com/ or analysts are

invited to listen to the call by dialing 866 293 8970

(International 913 312 1230) and entering pass code 4738382.

Presentation slides for the analyst call have been posted to the

company's website. The presentation may include certain non-GAAP

financial measures as defined under SEC rules. In such event, a

reconciliation of those measures to the most directly comparable

GAAP measures will also be available via the investor relations

section of the company's website at http://www.mirant.com/. A

recording of the event will be available for playback on the

company's website beginning today at 12:00 p.m. New York City time.

A replay also will be available by dialing 888 203 1112

(International 719 457 0820) and entering the pass code 4738382.

Mirant is a competitive energy company that produces and sells

electricity in the United States. Mirant owns or leases

approximately 10,300 megawatts of electric generating capacity. The

company operates an asset management and energy marketing

organization from its headquarters in Atlanta. For more

information, please visit http://www.mirant.com/. Regulation G

Reconciliations Adjusted Net Income and Adjusted EBITDA Quarter

Ending June 30, 2007

--------------------------------------------------------------------------

(in millions) EPS(1) -------- Net income $1,256 $4.91 Income from

discontinued operations 1,339 5.23 -------- -------- Loss from

continuing operations (83) (0.32) Adjustment to GAAP EPS for

dilution 0.03 -------- Diluted EPS (0.29) Mark-to-market loss 91

0.32 Gain on sales of assets, net (21) (0.07) Impairment loss 175

0.61 Bankruptcy charges and legal contingencies 16 0.06 Bonus plan

for dispositions 6 0.02 Benefit for income taxes (valuation

allowance adjustment) (22) (0.08) -------- -------- Adjusted net

income $162 $0.57 ======== Provision for income taxes 7 Interest,

net 29 Depreciation and amortization 32 -------- Adjusted EBITDA

$230 ========

--------------------------------------------------------------------------

1 Total diluted shares: 286 million Adjusted net income and

adjusted EBITDA are non-GAAP financial measures. Management and

some members of the investment community utilize adjusted net

income and adjusted EBITDA to measure financial performance on an

ongoing basis. These measures are not recognized in accordance with

GAAP and should not be viewed as an alternative to GAAP measures of

performance. In evaluating these adjusted measures, the reader

should be aware that in the future Mirant may incur expenses

similar to the adjustments set forth above. Adjusted Net Income and

Adjusted EBITDA Year to Date June 30, 2007

--------------------------------------------------------------------------

(in millions) EPS(1) -------- Net income $1,204 $4.70 Income from

discontinued operations 1,420 5.54 -------- -------- Loss from

continuing operations (216) (0.84) Adjustment to GAAP EPS for

dilution 0.08 -------- Diluted EPS (0.76) Mark-to-market loss 396

1.40 Gain on sales of assets, net (23) (0.08) Impairment loss 175

0.62 Bankruptcy charges and legal contingencies 26 0.09 Bonus plan

for dispositions 14 0.05 Postretirement benefit curtailment (32)

(0.12) Benefit for income taxes (valuation allowance adjustment)

(49) (0.17) -------- -------- Adjusted net income $291 $1.03

======== Provision for income taxes 19 Interest, net 77

Depreciation and amortization 64 -------- Adjusted EBITDA $451

========

--------------------------------------------------------------------------

1 Total diluted shares: 283 million Adjusted net income and

adjusted EBITDA are non-GAAP financial measures. Management and

some members of the investment community utilize adjusted net

income and adjusted EBITDA to measure financial performance on an

ongoing basis. These measures are not recognized in accordance with

GAAP and should not be viewed as an alternative to GAAP measures of

performance. In evaluating these adjusted measures, the reader

should be aware that in the future Mirant may incur expenses

similar to the adjustments set forth above. Adjusted Net Income and

Adjusted EBITDA Quarter Ending June 30, 2006

--------------------------------------------------------------------------

(in millions) EPS(1) -------- Net income $99 $0.32 Loss from

discontinued operations (8) (0.03) -------- -------- Income from

continuing operations 107 0.35 Mark-to-market gain (110) (0.36)

Gain on sales of assets, net (6) (0.02) Gain on sales of

investments, net (3) (0.01) Bankruptcy charges and legal

contingencies 11 0.04 -------- -------- Adjusted net loss $(1) $ -

======== Provision for income taxes 1 Interest, net 48 Depreciation

and amortization 35 -------- Adjusted EBITDA $83 ========

--------------------------------------------------------------------------

1 Total diluted shares: 308 million Adjusted net income and

adjusted EBITDA are non-GAAP financial measures. Management and

some members of the investment community utilize adjusted net

income and adjusted EBITDA to measure financial performance on an

ongoing basis. These measures are not recognized in accordance with

GAAP and should not be viewed as an alternative to GAAP measures of

performance. In evaluating these adjusted measures, the reader

should be aware that in the future Mirant may incur expenses

similar to the adjustments set forth above. Adjusted Net Income and

Adjusted EBITDA Year to Date June 30, 2006 (in millions)

--------------------------------------------------------------------------

EPS(1) -------- Net income $566 $1.84 Income from discontinued

operations 36 0.12 -------- -------- Income from continuing

operations 530 1.72 Mark-to-market gain (410) (1.33) Gain on sales

of assets, net (46) (0.15) Gain on sales of investments, net (3)

(0.01) Bankruptcy charges and legal contingencies 17 0.05 --------

-------- Adjusted net income $88 $0.28 ======== Provision for

income taxes 2 Interest, net 106 Depreciation and amortization 68

-------- Adjusted EBITDA $264 ========

--------------------------------------------------------------------------

1 Total diluted shares: 308 million Adjusted net income and

adjusted EBITDA are non-GAAP financial measures. Management and

some members of the investment community utilize adjusted net

income and adjusted EBITDA to measure financial performance on an

ongoing basis. These measures are not recognized in accordance with

GAAP and should not be viewed as an alternative to GAAP measures of

performance. In evaluating these adjusted measures, the reader

should be aware that in the future Mirant may incur expenses

similar to the adjustments set forth above. Cautionary Language

Regarding Forward-Looking Statements Some of the statements

included herein involve forward-looking information. Mirant

cautions that these statements involve known and unknown risks and

that there can be no assurance that such results will occur. There

are various important factors that could cause actual results to

differ materially from those indicated in the forward-looking

statements, such as, but not limited to, legislative and regulatory

initiatives regarding deregulation, regulation or restructuring of

the industry of generating, transmitting and distributing

electricity; changes in state, federal and other regulations

(including rate and other regulations); changes in, or changes in

the application of, environmental and other laws and regulations to

which Mirant and its subsidiaries and affiliates are or could

become subject; the failure of Mirant's assets to perform as

expected, including outages for unscheduled maintenance or repair;

changes in market conditions, including developments in the supply,

demand, volume and pricing of electricity and other commodities in

the energy markets, or the extent and timing of the entry of

additional competition in Mirant's markets or those of its

subsidiaries and affiliates; increased margin requirements, market

volatility or other market conditions that could increase Mirant's

obligations to post collateral beyond amounts which are expected;

Mirant's inability to access effectively the over-the-counter and

exchange-based commodity markets or changes in commodity market

liquidity or other commodity market conditions, which may affect

Mirant's ability to engage in asset management and proprietary

trading activities as expected, or result in material extraordinary

gains or losses from open positions in fuel oil or other

commodities; deterioration in the financial condition of our

counterparties and the resulting failure to pay amounts owed to

Mirant or to perform obligations due to Mirant beyond collateral

posted; hazards customary to the power generation industry and the

possibility that Mirant may not have adequate insurance to cover

losses as a result of such hazards; price mitigation strategies

employed by ISOs or RTOs that reduce Mirant's revenue and may

result in a failure to compensate Mirant's generation units

adequately for all their costs; changes in the rules used to

calculate capacity and energy payments in the markets in which

Mirant operates; volatility in Mirant's gross margin as a result of

Mirant's accounting for derivative financial instruments used in

its asset management activities and volatility in its cash flow

from operations resulting from working capital requirements,

including collateral, to support its asset management and

proprietary trading activities; Mirant's inability to enter into

intermediate and long-term contracts to sell power and procure

fuel, including its transportation, on terms and prices acceptable

to it; the inability of Mirant's operating subsidiaries to generate

sufficient cash flow to support its operations; Mirant's ability to

borrow additional funds and access capital markets; strikes, union

activity or labor unrest; weather and other natural phenomena,

including hurricanes and earthquakes; the cost and availability of

emissions allowances; Mirant's ability to obtain adequate supply

and delivery of fuel for its facilities; curtailment of operations

due to transmission constraints; environmental regulations that

restrict Mirant's ability or render it uneconomic to operate its

business, including regulations related to the emission of carbon

dioxide and other greenhouse gases; Mirant's inability to complete

construction of emissions reduction equipment by January 2010 to

meet the requirements of the Maryland Healthy Air Act, which may

result in reduced unit operations and reduced cash flows and

revenues from operations; war, terrorist activities or the

occurrence of a catastrophic loss; the fact that the Mirant Lovett

facility remains in bankruptcy; Mirant's substantial consolidated

indebtedness and the possibility that Mirant or its subsidiaries

may incur additional indebtedness in the future; restrictions on

the ability of Mirant's subsidiaries to pay dividends, make

distributions or otherwise transfer funds to Mirant, including

restrictions on Mirant North America contained in its financing

agreements and restrictions on Mirant Mid- Atlantic contained in

its leveraged lease documents, which may affect Mirant's ability to

access the cash flow of those subsidiaries to make debt service and

other payments; and, the disposition of the pending litigation

described in Mirant's Form 10-Q for the quarter ended June 30,

2007, filed with the Securities and Exchange Commission. Mirant

undertakes no obligation to update publicly or revise any forward-

looking statements to reflect events or circumstances that may

arise. The foregoing review of factors that could cause Mirant's

actual results to differ materially from those contemplated in the

forward-looking statements included in this news release should be

considered in connection with information regarding risks and

uncertainties that may affect Mirant's future results included in

Mirant's filings with the Securities and Exchange Commission at

http://www.sec.gov/. Stockholder inquiries: 678 579 7777

DATASOURCE: Mirant Corporation CONTACT: Media, Felicia Browder,

+1-678-579-3111, , or Investor Relations, Mary Ann Arico,

+1-678-579-7553, , both of Mirant Corporation Web site:

http://www.mirant.com/

Copyright

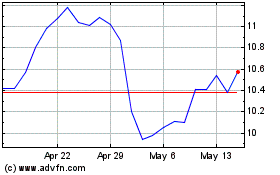

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jul 2023 to Jul 2024