Mirant Announces Agreement for Sale of Caribbean Business

April 18 2007 - 9:24AM

PR Newswire (US)

ATLANTA, April 18 /PRNewswire-FirstCall/ -- Mirant Corporation

(NYSE:MIR) announced today that it has entered into a definitive

purchase and sale agreement with a subsidiary of Marubeni

Corporation for the sale of its Caribbean business for $1.082

billion, which includes related debt of approximately $350 million,

power purchase obligations of approximately $153 million and

estimated working capital at closing. The net proceeds to Mirant

from the sale are expected to be approximately $565 million after

payment of transaction costs estimated to be approximately $14

million. Upon completion of the transaction, Mirant expects to

realize a pre-tax gain of approximately $65 million for financial

reporting purposes and a gain for tax reporting purposes of

approximately $150 million. The transaction is expected to close by

mid-2007 after the satisfaction of various conditions to closing.

Mirant's Caribbean business includes controlling interests in two

integrated utilities: Jamaica Public Service Company ("JPS") of

which Mirant owns 80% and Grand Bahama Power Company of which

Mirant owns 55%. Mirant also owns 39% of PowerGen, the owner and

operator of three power plants in Trinidad, 25% of Curacao

Utilities Company which provides electricity and other utility

services and a $40 million convertible preferred equity interest in

Aqualectra, an integrated water and electric company in Curacao.

JPS purchases power under power purchase agreements ("PPAs") with

two independent generation companies. The sole purpose of these

independent companies is to generate power for sale to JPS. Prior

to the third quarter of 2006, Mirant had accounted for the PPAs as

capital leases. During the third quarter of 2006, Mirant

reevaluated these PPAs based on evolving interpretations of the

Financial Accounting Standards Board (FASB) Interpretation No. 46,

"Consolidation of Variable Interest Entities," as amended. As a

result of this reevaluation, beginning with the third quarter of

2006, Mirant now consolidates the assets and liabilities of the two

independent generation companies and, accordingly, does not reflect

the PPAs as capital leases. The PPAs will remain obligations of JPS

after the sale is completed. "We have valued doing business in

Curacao, Grand Bahama, Jamaica and Trinidad," said Edward R.

Muller, Chairman and Chief Executive Officer of Mirant Corporation.

"We wish the people of all four countries and Marubeni Corporation

great success." Mirant was advised in the transaction by J.P.

Morgan Securities Inc., as financial advisor. Mirant is a

competitive energy company that produces and sells electricity in

the United States, the Caribbean, and the Philippines. Mirant owns

or leases approximately 17,300 megawatts of electric generating

capacity globally. The company operates an asset management and

energy marketing organization from its headquarters in Atlanta. For

more information, please visit http://www.mirant.com/. Stockholder

inquiries: 678 579 7777 DATASOURCE: Mirant CONTACT: Felicia

Browder, +1-678-579-3111, , or Investor Relations, Mary Ann Arico,

+1-678-579-7553, , or Sarah Stashak, +1-678-579-6940, , or

Stockholder inquiries, +1-678-579-7777, all of Mirant Web site:

http://www.mirant.com/

Copyright

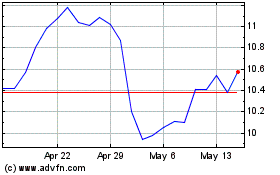

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jul 2023 to Jul 2024