MFS Announces Closed-End Fund Distributions

March 01 2022 - 4:20PM

Business Wire

MFS Investment Management® (MFS®) announced today monthly

distributions of the following closed-end funds, all with

declaration dates of March 1, 2022, ex-dividend dates of March 15,

2022, record dates of March 16, 2022, and payable dates of March

31, 2022:

Fund (ticker)

Income/ Share

Other Sources/ Share*

Total Amount/ Share

MFS® Charter Income Trust (NYSE: MCR)^

$0.0000

$0.052860

$0.052860

MFS® Government Markets Income Trust

(NYSE: MGF)^

$0.0000

$0.025050

$0.025050

MFS® High Income Municipal Trust (NYSE:

CXE)

$0.01850

$0.0000

$0.01850

MFS® High Yield Municipal Trust (NYSE:

CMU)

$0.015250

$0.0000

$0.015250

MFS® Intermediate High Income Fund (NYSE:

CIF)^

$0.0000

$0.017530

$0.017530

MFS® Intermediate Income Trust (NYSE:

MIN)^

$0.0000

$0.024550

$0.024550

MFS® Investment Grade Municipal Trust

(NYSE: CXH)

$0.0310

$0.0000

$0.0310

MFS® Multimarket Income Trust (NYSE:

MMT)^

$0.0000

$0.038210

$0.038210

MFS® Municipal Income Trust (NYSE:

MFM)

$0.02250

$0.0000

$0.02250

MFS® Special Value Trust (NYSE: MFV)^

$0.0000

$0.042990

$0.042990

^The fund has adopted a managed distribution plan. Under a

managed distribution plan, to the extent that sufficient investment

income is not available on a monthly basis, the fund will

distribute long-term capital gains and/or return of capital in

order to maintain its managed distribution level. You should not

draw any conclusions about the fund’s investment performance from

the amount of the fund’s distributions or from the terms of the

fund’s managed distribution plan. The Board of the fund may amend

the terms of the plan or terminate the plan at any time without

prior notice to the fund's shareholders. The amendment or

termination of a plan could have an adverse effect on the market

price of the fund’s common shares. The plan will be subject to

periodic review by the Board. With each distribution that does not

consist solely of net investment income, the fund will issue a

notice to shareholders and an accompanying press release which will

provide detailed information regarding the amount and composition

of the distribution and other related information. The amounts and

sources of distributions reported in the notice to shareholders are

only estimates and are not being provided for tax reporting

purposes. The actual amounts and sources of the amounts for tax

reporting purposes will depend upon the fund’s investment

experience during its full fiscal year and may be subject to

changes based on tax regulations. The fund will send shareholders a

Form 1099-DIV for the calendar year that will tell them how to

report these distributions for federal income tax purposes. The

fund may at times distribute more than its net investment income

and net realized capital gains; therefore, a portion of the

distribution may result in a return of capital. A return of capital

may occur, for example, when some or all of the money that

shareholders invested in the fund is paid back to them. A return of

capital does not necessarily reflect a fund’s investment

performance and should not be confused with ‘yield’ or ‘income’.

Any such returns of capital will decrease the fund's total assets

and, therefore, could have the effect of increasing the fund's

expense ratio. In addition, in order to make the level of

distributions called for under its plan, the fund may have to sell

portfolio securities at a less than opportune time. For estimated

source information for distributions paid in prior periods, please

see MFS.com and click on the following links: Products &

Strategies, Closed-End Funds, Dividend Source Information.

*Distribution from "Other Sources" may contain sources of income

other than ordinary income, such as short term capital gains, long

term capital gains, or return of capital, which can not be

determined until the close of the fund's fiscal year end.

Distributions that are treated for federal income tax purposes as a

return of capital will reduce a shareholder's tax basis in his or

her shares and, to the extent the distribution exceeds a

shareholder's adjusted tax basis, will be treated as a gain to the

shareholder from a sale of shares. Please see the fund's most

recent dividend source information available from payable date at

MFS.com for the breakdown of the distribution.

Investors who want to make changes to their accounts should

contact their financial advisor, brokerage firm, or other nominee

with whom the shares are registered. If shares are registered with

the funds’ transfer agent, Computershare, the transfer agent may be

contacted directly at 800-637-2304, or www.computershare.com.

About MFS Investment

Management

In 1924, MFS launched the first US open-end mutual fund, opening

the door to the markets for millions of everyday investors. Today,

as a full-service global investment manager serving financial

advisors, intermediaries and institutional clients, MFS still

serves a single purpose: to create long-term value for clients by

allocating capital responsibly. That takes our powerful investment

approach combining collective expertise, thoughtful risk management

and long-term discipline. Supported by our culture of shared values

and collaboration, our teams of diverse thinkers actively debate

ideas and assess material risks to uncover what we believe are the

best investment opportunities in the market. As of January 31,

2022, MFS manages US$657.1 billion in assets on behalf of

individual and institutional investors worldwide. Please visit

mfs.com for more information.

The funds are closed-end investment products. Common shares

of the funds are only available for purchase/sale on the NYSE at

the current market price. Shares may trade at a discount to

NAV.

MFS Investment Management 111 Huntington

Ave, Boston, MA 02199

15812.161

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220301006108/en/

MFS Shareholders or Advisors (investment product

information): Jeffrey Schwarz, 800-343-2829, ext. 55872

Media Only: Dan Flaherty, 617-954-4256

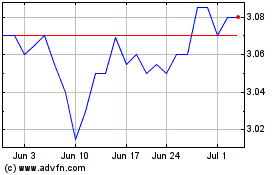

MFS Government Markets I... (NYSE:MGF)

Historical Stock Chart

From Oct 2024 to Nov 2024

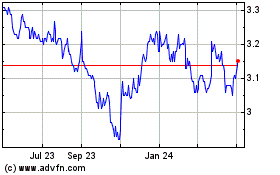

MFS Government Markets I... (NYSE:MGF)

Historical Stock Chart

From Nov 2023 to Nov 2024