Momentum Building for Marcus Theatres;

Continued Strong Performance From Marcus Hotels &

Resorts

The Marcus Corporation (NYSE: MCS) today reported results for

the second quarter fiscal 2024 ended June 27, 2024.

“Marcus Hotels & Resorts continued its strong performance in

the second quarter of fiscal 2024 as group demand continued to

improve, especially midweek, and the summer travel season got

started,” said Gregory S. Marcus, chief executive officer of The

Marcus Corporation. “While last year’s Hollywood strikes continued

to impact Marcus Theatres’ results in April and May, there was a

notable positive shift in June and we ended the quarter with much

stronger momentum. The blockbuster performances of Inside Out 2 and

Deadpool & Wolverine, along with other strong performances from

recent films like Despicable Me 4 and Twisters, continue to affirm

that consumers crave seeing great movies on the big screen. As we

look ahead to the second half of 2024, we are encouraged by

improving trends in both businesses, including continued strong

group bookings in our hotel business and an improving slate of

exciting films anticipated in our theatre business.”

Second Quarter Fiscal 2024

Highlights

- Total revenues for the second quarter of fiscal 2024 were

$176.0 million, a 15.0% decrease from total revenues of $207.0

million for the second quarter of fiscal 2023.

- Operating income was $2.2 million for the second quarter of

fiscal 2024, compared to operating income of $20.8 million for the

prior year quarter.

- Net loss was $20.2 million for the second quarter of fiscal

2024, compared to net income of $13.5 million for the same period

in fiscal 2023. Net loss for the second quarter of fiscal 2024 was

negatively impacted by $15.0 million, or $0.47 per share, of debt

conversion expense and related tax impacts of the previously

announced convertible senior notes repurchases. Excluding the

impacts of the convertible senior notes repurchases, net loss was

$5.2 million for the second quarter of fiscal 2024.

- Net loss per diluted common share was $0.64 for the second

quarter of fiscal 2024, compared to net earnings per diluted common

share of $0.35 for the second quarter of fiscal 2023. Excluding the

impacts of the convertible senior notes repurchases, net loss per

diluted common share was $0.17 for the second quarter of fiscal

2024.

- Adjusted EBITDA was $22.0 million for the second quarter of

fiscal 2024, compared to Adjusted EBITDA of $38.7 million for the

prior year quarter.

First Half Fiscal 2024

Highlights

- Total revenues for the first half of fiscal 2024 were $314.6

million, a 12.4% decrease from total revenues of $359.3 million for

the first half of fiscal 2023.

- Operating loss was $14.4 million for the first half of fiscal

2024, compared to operating income of $11.8 million for the first

half of fiscal 2023.

- Net loss was $32.1 million for the first half of fiscal 2024,

compared to net income of $4.0 million for the for the first half

of fiscal 2023. Net loss for the first half of fiscal 2024 was

negatively impacted by $15.0 million, or $0.47 per share, of debt

conversion expense and related tax impacts of the previously

announced convertible senior notes repurchases. Excluding the

impacts of the convertible senior notes repurchases, net loss was

$17.1 million for the first half of fiscal 2024.

- Net loss per diluted common share was $1.03 for the first half

of fiscal 2024, compared to net earnings per diluted common share

of $0.13 for the first half of fiscal 2023. Excluding the impacts

of the convertible senior notes repurchases, net loss per diluted

common share was $0.56 for the first half of fiscal 2024.

- Adjusted EBITDA was $24.3 million for the first half of fiscal

2024, compared to Adjusted EBITDA of $48.2 million for the first

half of fiscal 2023.

Marcus® Hotels & Resorts

Marcus Hotels & Resorts reported total revenues before cost

reimbursements of $63.8 million in the second quarter of fiscal

2024, a 5.6% increase over the prior year period. Revenue per

available room, or RevPAR, increased 6.5% in the second quarter of

fiscal 2024 compared to the second quarter of fiscal 2023,

resulting in the division outperforming the industry and its

competitive sets by 3.5 and 1.9 percentage points,

respectively.

“Total occupancy neared pre-pandemic levels during the second

quarter of fiscal 2024, driven by strong group demand, especially

on weekdays, and the start of the peak travel season,” said Michael

R. Evans, president of Marcus Hotels & Resorts. “Our Milwaukee

properties recently hosted thousands of guests for five sold out

nights during the Republican National Convention, and I

congratulate all our associates on a job exceptionally well done.

Looking ahead, we remain encouraged by positive group booking

trends across our portfolio for the remainder of 2024, 2025 and

beyond. As the summer travel, festival and convention season

continues, we look forward to continuing to showcase our

award-winning properties and world-class hospitality to more

leisure travelers and groups alike.”

Continued improvements in group business drove occupancy growth

of 4.5 percentage points during the second quarter of fiscal 2024.

Group booking pace for the remainder of fiscal 2024 is running

ahead of comparable pace during the same period in fiscal 2023,

even when excluding bookings related to the Republican National

Convention in July 2024. Fiscal 2025 booking pace is also running

significantly ahead compared to the same period last year, with

banquet and catering revenue pace running similarly ahead.

The Pfister Hotel in Milwaukee is in the final phases of its $20

million reinvestment, with finishing touches continuing in the

hotel’s first floor public spaces. The hotel recently completed

renovations of its historic guest rooms, which followed the full

revitalization of The Pfister’s ballrooms and meeting and event

spaces which were completed in September 2023.

Marcus Theatres®

The lingering effects of the nearly four-month long WGA and

SAG-AFTRA labor strikes in 2023 continued to impact results, with

weaker performances from films in April and May, followed by

stronger film product in June. As a result, Marcus Theatres

reported total revenue of $101.5 million in the second quarter of

fiscal 2024, compared to $136.9 million in the second quarter of

fiscal 2023. Division operating income of $2.8 million and Adjusted

EBITDA of $15.1 million were down in the second quarter due to

decreased attendance. Average ticket price decreased 3.1% with an

increase in promotions and a higher percentage of attendance on

Value Tuesday, while average concession revenues per person

increased by 2.3%.

As part of Marcus Theatres’ initiatives to drive attendance and

appeal to value oriented customers, the division launched its

Everyday Matinee program during the second quarter, which offers a

$7 ticket for kids and seniors for all shows starting before 4 p.m.

In addition, Marcus Theatres continued to enhance its Value Tuesday

promotion, bringing back a free complimentary size popcorn for

members of the Magical Movie Rewards loyalty program.

“We are starting to see the impact of the last year’s Hollywood

strikes lessen, with a larger quantity of exciting wide-release

films on the horizon,” said Mark A. Gramz, president of Marcus

Theatres. “Inside Out 2 opened with a huge success in the second

quarter of 2024, and continued its strong run in July to become the

highest grossing animated movie ever. Inside Out 2, Bad Boys: Ride

or Die, and IF performed particularly well in our primarily

Midwestern markets during the second quarter of fiscal 2024. As we

head into the second half of the year, the momentum has continued

with Despicable Me 4 and Twisters off to strong showings in our

markets, and the blockbuster Deadpool & Wolverine opened last

weekend with much excitement from moviegoers. We continue to see an

improving film slate with several highly anticipated new wide

releases this fall such as Beetlejuice Beetlejuice and Joker: Folie

a Deux, along with a number of exciting films slated for the

remainder of the year.”

While schedule changes may occur, new films expected to be

released during the remainder of fiscal 2024 that have the

potential to perform well include Beetlejuice Beetlejuice, Joker:

Folie A Deux, Smile 2, Venom: The Last Dance, Gladiator II, Wicked

Part One, Moana 2, Mufasa: The Lion King, and Sonic the Hedgehog 3,

among others.

Balance Sheet and

Liquidity

The Marcus Corporation’s financial position remains strong with

$208.0 million in cash and revolving credit availability at the end

of the second quarter of fiscal 2024.

As previously announced, during the second quarter of fiscal

2024 the Company entered into agreements for $86.4 million

aggregate principal amount of privately negotiated cash repurchases

effected over two separate repurchase tranches (the “Repurchases”)

of the Company’s 5.00% Convertible Senior Notes due 2025 (the

“Convertible Senior Notes”). The first repurchase transaction

retired $40 million aggregate principal amount of Convertible

Senior Notes and closed during the second quarter of fiscal 2024 on

June 14, 2024. The second repurchase transaction retired $46.4

million aggregate principal amount of Convertible Senior Notes and

closed during the third quarter of fiscal 2024 on July 16, 2024. In

connection with the Repurchases, the Company entered into unwind

agreements with certain financial institutions to terminate a

portion of the existing capped call transactions in a notional

amount equal to the aggregate principal amount of the

Repurchases.

The final cash cost of the $86.4 million aggregate principal

amount of Convertible Senior Notes repurchases, net of the cash

received from the unwind of the capped call transactions, was $87.9

million. Following the completion of the Repurchases, $13.6 million

aggregate principal amount of the Convertible Senior Notes remains

outstanding.

In connection with the Repurchases, the required accounting for

the transactions resulted in the Company recognizing $13.9 million

of debt conversion expense during the second quarter of fiscal

2024, while the unwind of the capped call transactions resulted in

a $12.9 million increase in shareholders equity during the second

quarter of fiscal 2024. In addition, income tax expense (benefit)

during the second quarter of fiscal 2024 was negatively impacted by

$1.1 million for the related noncash tax impacts of the capped call

unwind.

In addition, on July 9, 2024, the Company completed a private

placement offering of $100 million aggregate principal amount of

senior notes in two tranches: $60 million aggregate principal

amount of 6.89% senior notes due 2031 and $40 million aggregate

principal amount of 7.02% senior notes due 2034. The net proceeds

of the offering were used to refinance the Repurchases and for

general corporate purposes. These refinancing transactions extended

debt maturities and mark a significant step in simplifying the

Company’s capital structure.

Conference Call and

Webcast

The Marcus Corporation management will hold a conference call

today, Thursday, August 1, 2024, at 10:00 a.m. Central/11:00 a.m.

Eastern time. Interested parties may listen to the call live on the

internet through the investor relations section of the company's

website: investors.marcuscorp.com, or by dialing 1-404-975-4839 and

entering the passcode 979410. Listeners should dial in to the call

at least 5-10 minutes prior to the start of the call or should go

to the website at least 15 minutes prior to the call to download

and install any necessary audio software.

A telephone replay of the conference call will be available

through Thursday, August 8, 2024, by dialing 1-866-813-9403 and

entering passcode 848375. The webcast will be archived on the

company’s website until its next earnings release.

Non-GAAP Financial

Measure

Adjusted EBITDA has been presented in this press release as a

supplemental measure of financial performance that is not required

by, or presented in accordance with, GAAP. The company defines

Adjusted EBITDA as net earnings (loss) attributable to The Marcus

Corporation before investment income or loss, interest expense,

other expense, gain or loss on disposition of property, equipment

and other assets, equity earnings or losses from unconsolidated

joint ventures, net earnings or losses attributable to

noncontrolling interests, income taxes, depreciation and

amortization and non-cash share-based compensation expense,

adjusted to eliminate the impact of certain items that the company

does not consider indicative of its core operating performance. A

reconciliation of this measure to the equivalent measure under

GAAP, along with reconciliations of this measure for each of our

operating segments, are set forth in the attached table.

Adjusted EBITDA is a key measure used by management and the

company’s board of directors to assess the company’s financial

performance and enterprise value. The company believes that

Adjusted EBITDA is a useful measure, as it eliminates certain

expenses and gains that are not indicative of the company’s core

operating performance and facilitates a comparison of the company’s

core operating performance on a consistent basis from period to

period. The company also uses Adjusted EBITDA as a basis to

determine certain annual cash bonuses and long-term incentive

awards, to supplement GAAP measures of performance to evaluate the

effectiveness of its business strategies, to make budgeting

decisions, and to compare its performance against that of other

peer companies using similar measures. Adjusted EBITDA is also used

by analysts, investors and other interested parties as a

performance measure to evaluate industry competitors.

Adjusted EBITDA is a non-GAAP measure of the company’s financial

performance and should not be considered as an alternative to net

earnings (loss) as a measure of financial performance, or any other

performance measure derived in accordance with GAAP and it should

not be construed as an inference that the company’s future results

will be unaffected by unusual or non-recurring items. Additionally,

Adjusted EBITDA is not intended to be a measure of liquidity or

free cash flow for management’s discretionary use. In addition,

this non-GAAP measure excludes certain non-recurring and other

charges and has its limitations as an analytical tool. You should

not consider Adjusted EBITDA in isolation or as a substitute for

analysis of the company’s results as reported under GAAP. In

evaluating Adjusted EBITDA, you should be aware that in the future

the company will incur expenses that are the same as or similar to

some of the items eliminated in the adjustments made to determine

Adjusted EBITDA, such as acquisition expenses, preopening expenses,

accelerated depreciation, impairment charges and other adjustments.

The company’s presentation of Adjusted EBITDA should not be

construed to imply that the company’s future results will be

unaffected by any such adjustments. Definitions and calculations of

Adjusted EBITDA differ among companies in our industries, and

therefore Adjusted EBITDA disclosed by the company may not be

comparable to the measures disclosed by other companies.

About The Marcus

Corporation

Headquartered in Milwaukee, The Marcus Corporation is a leader

in the lodging and entertainment industries, with significant

company-owned real estate assets. The Marcus Corporation’s theatre

division, Marcus Theatres®, is the fourth largest theatre circuit

in the U.S. and currently owns or operates 995 screens at 79

locations in 17 states under the Marcus Theatres, Movie Tavern® by

Marcus and BistroPlex® brands. The company’s lodging division,

Marcus® Hotels & Resorts, owns and/or manages 16 hotels,

resorts and other properties in eight states. For more information,

please visit the company’s website at www.marcuscorp.com.

Certain matters discussed in this press release are

“forward-looking statements” intended to qualify for the safe

harbors from liability established by the Private Securities

Litigation Reform Act of 1995. These forward-looking statements may

generally be identified as such because the context of such

statements include words such as we “believe,” “anticipate,”

“expect” or words of similar import. Similarly, statements that

describe our future plans, objectives or goals are also

forward-looking statements. Such forward-looking statements are

subject to certain risks and uncertainties which may cause results

to differ materially from those expected, including, but not

limited to, the following: (1) the adverse effects future pandemics

may have on our theatre and hotels and resorts businesses, results

of operations, liquidity, cash flows, financial condition, access

to credit markets and ability to service our existing and future

indebtedness; (2) the availability, in terms of both quantity and

audience appeal, of motion pictures for our theatre division

(including disruptions in the production of films due to events

such as a strike by actors, writers or directors or future

pandemics); (3) the effects of theatre industry dynamics such as

the maintenance of a suitable window between the date such motion

pictures are released in theatres and the date they are released to

other distribution channels; (4) the effects of adverse economic

conditions in our markets; (5) the effects of adverse economic

conditions on our ability to obtain financing on reasonable and

acceptable terms, if at all; (6) the effects on our occupancy and

room rates caused by the relative industry supply of available

rooms at comparable lodging facilities in our markets; (7) the

effects of competitive conditions in our markets; (8) our ability

to achieve expected benefits and performance from our strategic

initiatives and acquisitions; (9) the effects of increasing

depreciation expenses, reduced operating profits during major

property renovations, impairment losses, and preopening and

start-up costs due to the capital intensive nature of our business;

(10) the effects of changes in the availability of and cost of

labor and other supplies essential to the operation of our

business; (11) the effects of weather conditions, particularly

during the winter in the Midwest and in our other markets; (12) our

ability to identify properties to acquire, develop and/or manage

and the continuing availability of funds for such development; (13)

the adverse impact on business and consumer spending on travel,

leisure and entertainment resulting from terrorist attacks in the

United States, other incidents of violence in public venues such as

hotels and movie theatres or epidemics; and (14) a disruption in

our business and reputational and economic risks associated with

civil securities claims brought by shareholders. These statements

are not guarantees of future performance and are subject to risks,

uncertainties and other factors, some of which are beyond our

control and difficult to predict and could cause actual results to

differ materially from those expressed or forecasted in the

forward-looking statements. Our forward-looking statements are

based upon our assumptions, which are based upon currently

available information. Shareholders, potential investors and other

readers are urged to consider these factors carefully in evaluating

the forward-looking statements and are cautioned not to place undue

reliance on such forward-looking statements. The forward-looking

statements made herein are made only as of the date of this press

release and we undertake no obligation to publicly update such

forward-looking statements to reflect subsequent events or

circumstances.

THE MARCUS CORPORATION

Consolidated Statements of

Earnings (Loss)

(Unaudited)

(in thousands, except per share

data)

13 Weeks Ended

26 Weeks Ended

June 27, 2024

June 29, 2023

June 27, 2024

June 29, 2023

Revenues:

Theatre admissions

$

48,580

$

68,987

$

89,176

$

116,622

Rooms

30,496

28,646

48,709

46,503

Theatre concessions

44,417

59,707

79,112

102,082

Food and beverage

19,272

18,573

35,435

33,766

Other revenues

22,534

21,428

42,236

41,116

165,299

197,341

294,668

340,089

Cost reimbursements

10,733

9,666

19,911

19,194

Total revenues

176,032

207,007

314,579

359,283

Costs and expenses:

Theatre operations

52,118

66,905

97,103

117,974

Rooms

11,164

10,360

20,575

19,638

Theatre concessions

18,515

22,601

33,401

38,331

Food and beverage

15,080

14,451

28,943

28,019

Advertising and marketing

6,502

5,613

11,803

10,678

Administrative

22,630

19,466

44,032

39,317

Depreciation and amortization

16,699

15,994

32,714

31,870

Rent

6,496

6,594

12,843

13,087

Property taxes

3,688

4,532

7,619

9,289

Other operating expenses

9,741

9,636

19,611

19,287

(Gain) Loss on disposition of property,

equipment and other assets

(43

)

379

(20

)

777

Impairment charges

472

—

472

—

Reimbursed costs

10,733

9,666

19,911

19,194

Total costs and expenses

173,795

186,197

329,007

347,461

Operating income (loss)

2,237

20,810

(14,428

)

11,822

Other income (expense):

Investment income

173

359

865

619

Interest expense

(2,564

)

(3,093

)

(5,098

)

(6,101

)

Other income (expense)

(390

)

(477

)

(731

)

(878

)

Debt conversion expense

(13,908

)

—

(13,908

)

—

Equity losses from unconsolidated joint

ventures

(50

)

(31

)

(437

)

(202

)

(16,739

)

(3,242

)

(19,309

)

(6,562

)

Earnings (Loss) before income

taxes

(14,502

)

17,568

(33,737

)

5,260

Income tax expense (benefit)

5,719

4,102

(1,650

)

1,260

Net Earnings (Loss)

$

(20,221

)

$

13,466

(32,087

)

4,000

Net earnings (loss) per common share -

diluted

$

(0.64

)

$

0.35

$

(1.03

)

$

0.13

Weighted average shares outstanding -

diluted

32,161

40,935

32,027

31,674

THE MARCUS CORPORATION

Condensed Consolidated Balance

Sheets

(Unaudited)

(In thousands)

June 27, 2024

December 28,

2023

Assets:

Cash and cash equivalents

$

32,810

$

55,589

Restricted cash

4,975

4,249

Accounts receivable

28,046

19,703

Other current assets

24,882

22,175

Property and equipment, net

685,864

682,262

Operating lease right-of-use assets

171,193

179,788

Other assets

104,328

101,337

Total Assets

$

1,052,098

$

1,065,103

Liabilities and Shareholders'

Equity:

Accounts payable

$

47,804

$

37,384

Taxes other than income taxes

18,635

18,585

Other current liabilities

85,325

80,283

Current portion of finance lease

obligations

2,512

2,579

Current portion of operating lease

obligations

14,077

15,290

Current maturities of long-term debt

10,815

10,303

Finance lease obligations

11,578

12,753

Operating lease obligations

170,638

178,582

Long-term debt

164,862

159,548

Deferred income taxes

30,150

32,235

Other long-term obligations

46,276

46,389

Equity

449,426

471,172

Total Liabilities and Shareholders'

Equity

$

1,052,098

$

1,065,103

THE MARCUS CORPORATION

Business Segment

Information

(Unaudited)

(In thousands)

Theatres

Hotels/

Resorts

Corporate

Items

Total

13 Weeks Ended June 27, 2024

Revenues

$

101,452

$

74,497

$

83

$

176,032

Operating income (loss)

2,781

6,117

(6,661

)

2,237

Depreciation and amortization

11,520

5,048

131

16,699

Adjusted EBITDA

15,069

11,426

(4,535

)

21,960

13 Weeks Ended June 29, 2023

Revenues

$

136,850

$

70,066

$

91

$

207,007

Operating income (loss)

19,811

6,105

(5,106

)

20,810

Depreciation and amortization

11,317

4,588

89

15,994

Adjusted EBITDA

31,251

11,336

(3,889

)

38,698

26 Weeks Ended June 27, 2024

Revenues

$

182,722

$

131,694

$

163

$

314,579

Operating income (loss)

(2,958

)

955

(12,425

)

(14,428

)

Depreciation and amortization

22,553

9,912

249

32,714

Adjusted EBITDA

21,225

11,415

(8,389

)

24,251

26 Weeks Ended June 29, 2023

Revenues

$

233,226

$

125,877

$

180

$

359,283

Operating income (loss)

21,330

1,073

(10,581

)

11,822

Depreciation and amortization

22,805

8,889

176

31,870

Adjusted EBITDA

45,054

10,926

(7,824

)

48,156

Corporate items include amounts not

allocable to the business segments. Corporate revenues consist

principally of rent and the corporate operating loss includes

general corporate expenses. Corporate information technology costs

and accounting shared services costs are allocated to the business

segments based upon several factors, including actual usage and

segment revenues.

Supplemental Data

(Unaudited)

(In thousands)

13 Weeks Ended

26 Weeks Ended

Consolidated

June 27, 2024

June 29, 2023

June 27, 2024

June 29, 2023

Net cash flow provided by (used in)

operating activities

$

35,975

$

55,060

$

20,877

$

47,326

Net cash flow provided by (used in)

investing activities

(19,882

)

(7,111

)

(40,640

)

(16,642

)

Net cash flow provided by (used in)

financing activities

1,139

(11,911

)

(2,290

)

(6,336

)

Capital expenditures

(19,843

)

(6,975

)

(35,283

)

(15,896

)

THE MARCUS CORPORATION

Reconciliation of Net Earnings

(Loss) to Adjusted EBITDA

(Unaudited)

(In thousands)

13 Weeks Ended

26 Weeks Ended

June 27, 2024

June 29, 2023

June 27, 2024

June 29, 2023

Net earnings (loss)

$

(20,221

)

$

13,466

$

(32,087

)

$

4,000

Add (deduct):

Investment income

(173

)

(359

)

(865

)

(619

)

Interest expense

2,564

3,093

5,098

6,101

Other expense (income)

390

477

731

878

(Gain) Loss on disposition of property,

equipment and other assets

(43

)

379

(20

)

777

Equity losses from unconsolidated joint

ventures

50

31

437

202

Income tax expense (benefit)

5,719

4,102

(1,650

)

1,260

Depreciation and amortization

16,699

15,994

32,714

31,870

Share-based compensation (a)

2,418

1,515

4,932

3,687

Impairment charges (b)

472

—

472

—

Theatre exit costs (c)

136

—

136

—

Insured losses (d)

41

—

445

—

Debt conversion expense (e)

13,908

—

13,908

—

Adjusted EBITDA

$

21,960

$

38,698

$

24,251

$

48,156

Reconciliation of Operating

income (loss) to Adjusted EBITDA by Reportable Segment

(Unaudited)

(In thousands)

13 Weeks Ended June 27,

2024

26 Weeks Ended June 27,

2024

Theatres

Hotels & Resorts

Corp. Items

Total

Theatres

Hotels & Resorts

Corp. Items

Total

Operating income (loss)

$

2,781

$

6,117

$

(6,661

)

$

2,237

$

(2,958

)

$

955

$

(12,425

)

$

(14,428

)

Depreciation and amortization

11,520

5,048

131

16,699

22,553

9,912

249

32,714

(Gain) loss on disposition of property,

equipment and other assets

(45

)

2

—

(43

)

(27

)

7

—

(20

)

Share-based compensation (a)

164

259

1,995

2,418

604

541

3,787

4,932

Impairment charges (b)

472

—

—

472

472

—

—

472

Theatre exit costs (c)

136

—

—

136

136

—

—

136

Insured losses (d)

41

—

—

41

445

—

—

445

Adjusted EBITDA

$

15,069

$

11,426

$

(4,535

)

$

21,960

$

21,225

$

11,415

$

(8,389

)

$

24,251

13 Weeks Ended June 29,

2023

26 Weeks Ended June 29,

2023

Theatres

Hotels & Resorts

Corp. Items

Total

Theatres

Hotels & Resorts

Corp. Items

Total

Operating income (loss)

$

19,811

$

6,105

$

(5,106

)

$

20,810

$

21,330

$

1,073

$

(10,581

)

$

11,822

Depreciation and amortization

11,317

4,588

89

15,994

22,805

8,889

176

31,870

(Gain) loss on disposition of property,

equipment and other assets

(19

)

398

—

379

304

473

—

777

Share-based compensation (a)

142

245

1,128

1,515

615

491

2,581

3,687

Adjusted EBITDA

$

31,251

$

11,336

$

(3,889

)

$

38,698

$

45,054

$

10,926

$

(7,824

)

$

48,156

(a)

Non-cash expense related to share-based

compensation programs.

(b)

Non-cash impairment charges related to one

permanently closed theatre location in the second quarter of fiscal

2024.

(c)

Non-recurring costs related to the closure

and exit of one theatre location in the second quarter of fiscal

2024.

(d)

Repair costs that are non-operating in

nature related to insured property damage at one theatre

location.

(e)

Loss on extinguishment of $86.4 million

aggregate principal amount of Convertible Notes. See Convertible

Senior Notes Repurchases in the “Liquidity and Capital Resources”

section of MD&A included in the fiscal 2024 second quarter 10Q

for further discussion.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731602301/en/

Chad Paris (414) 905-1100 investors@marcuscorp.com

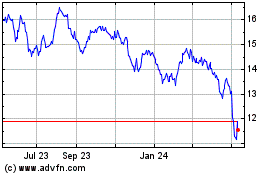

Marcus (NYSE:MCS)

Historical Stock Chart

From Dec 2024 to Jan 2025

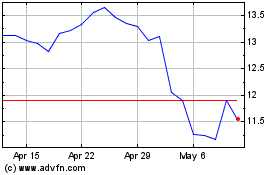

Marcus (NYSE:MCS)

Historical Stock Chart

From Jan 2024 to Jan 2025