UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement.

[ ] CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY

RULE 14A-6(E)(2)).

[X] Definitive Proxy Statement.

[ ] Definitive Additional Materials.

[ ] Soliciting Material Pursuant to ss.240.14a-12.

MADISON COVERED CALL & EQUITY STRATEGY FUND

(Names of Registrant As Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

[X] No Fee Required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

MADISON COVERED CALL & EQUITY STRATEGY FUND

550 SCIENCE DRIVE

MADISON, WI 53711

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 25, 2023

Notice is hereby given to shareholders of the Madison Covered Call & Equity Strategy Fund (the “Fund”) that the annual meeting of shareholders of the Fund (the “Annual Meeting”) will be held at the offices of the Fund, 550 Science Drive, Madison, Wisconsin 53711, on Friday, August 25, 2023, at 10:00 a.m. Central time. The Annual Meeting is being held for the following purposes:

1. To elect one Class I Trustee to serve until the Fund’s 2026 annual meeting of shareholders or until his successor shall have been elected and qualified; and

2. To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

THE BOARD OF TRUSTEES OF THE FUND (THE “BOARD”), INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” ELECTION OF THE CLASS I TRUSTEE.

The Board has fixed the close of business on June 22, 2023 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting. We urge you to complete, sign, date and mail the enclosed proxy card in the postage-paid envelope provided so you will be represented at the Annual Meeting.

By order of the Board of Trustees

/s/ Holly S. Baggot

Holly S. Baggot, Secretary

Madison, Wisconsin

July 1, 2023

It is important that your shares be represented at the Annual Meeting in person or by proxy. Whether or not you plan to attend the Annual Meeting, please vote by mail by signing, dating and returning the enclosed proxy card in the accompanying postage-paid envelope. If you wish to attend the Annual Meeting and vote in person, you will be able to do so and your vote at the Annual Meeting will revoke any proxy you may have submitted. Merely attending the Annual Meeting, however, will not revoke any previously submitted proxy. Your vote is extremely important. No matter how many or how few shares you own, please send in your proxy card today.

This page was intentionally left blank.

MADISON COVERED CALL & EQUITY STRATEGY FUND

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 25, 2023

This proxy statement (the “Proxy Statement”) is furnished to shareholders of the Madison Covered Call & Equity Strategy Fund (the “Fund”) in connection with the solicitation by the Board of Trustees of the Fund (the “Board of Trustees” or the “Board”) of proxies to be voted at the annual meeting of shareholders of the Fund to be held on Friday, August 25, 2023 at 10:00 a.m., Central time, and any adjournments or postponements thereof (the “Annual Meeting”). The Annual Meeting will be held at the offices of the Fund, 550 Science Drive, Madison, Wisconsin 53711. One share of the Fund (collectively, the “Shares”) is entitled to one vote on each proposal, and each fractional Share is entitled to a fractional vote thereon. Holders of Shares of the Fund are referred to herein as “shareholders.”

This Proxy Statement gives you the information you need to vote on the matters listed on the accompanying Notice of Annual Meeting of Shareholders. Much of the information in this Proxy Statement is required under rules of the Securities and Exchange Commission (“SEC”). If there is anything you don’t understand, please contact the Fund at our toll-free number, 1-800-767-0300.

The Fund will furnish, without charge, a copy of the Fund’s most recent Annual Report and Semi-Annual Report to shareholders to any shareholder upon request. Requests should be directed to Madison Asset Management, LLC, 550 Science Drive, Madison, Wisconsin 53711, or by calling, toll-free, 1-800-767-0300.

The Notice of Annual Meeting of Shareholders, this Proxy Statement and the enclosed proxy card are first being sent to shareholders on or about July 7, 2023.

Important Notice Regarding the Availability of Proxy Materials:

This Proxy Statement is available at the website listed on your proxy card.

This page was intentionally left blank.

INFORMATION TO HELP YOU UNDERSTAND

AND VOTE ON THE PROPOSAL

While we strongly encourage you to read the full text of this Proxy Statement, we are also providing you the following brief overview of the proposal addressed in this Proxy Statement (the “Proposal”), in a Question and Answer format, to help you understand and vote on the Proposal. Your vote is important. Please vote by completing and returning the enclosed proxy card in the enclosed postage-paid return envelope.

•Why are you sending me this information?

You are receiving these materials because on June 22, 2023 (the “Record Date”), you owned Shares of the Fund and, as a result, have a right to vote on the Proposal. Each Share of the Fund is entitled to one vote on the Proposal, and each fractional Share is entitled to a fractional vote thereon, with no cumulative voting.

•Why is a shareholder meeting being held?

Because the Fund’s Shares are listed on the New York Stock Exchange (the “NYSE”) under the ticker symbol “MCN,” the Fund must hold an annual meeting of shareholders to elect Trustees each fiscal year.

•What proposals will be voted on at the Annual Meeting?

Shareholders of the Fund are being asked to elect one individual as Class I Trustee of the Board (Mr. Richard E. Struthers is the nominee) to serve until the Fund’s 2026 annual meeting of shareholders or until his successor shall have been elected and qualified (the “Proposal”).

•Will your vote make a difference?

YES! Your vote is important and could make a difference in the governance of the Fund, no matter how many Shares you own.

•Who is asking for your vote?

The enclosed proxy is solicited by the Board for use at the Annual Meeting to be held on Friday, August 25, 2023 and, if the Annual Meeting is adjourned or postponed, at any later meetings, for the purposes stated in the Notice of Annual Meeting of Shareholders.

•How does the Board recommend that shareholders vote on the Proposal?

The Board of Trustees, including the Independent Trustees (as defined below), unanimously recommends that you vote “FOR” the Proposal.

•Who is eligible to vote?

Shareholders of record of the Fund at the close of business on the Record Date are entitled to be present and to vote at the Annual Meeting or any adjournment or postponement thereof.

•How do you vote your Shares?

Whether or not you plan to attend the Annual Meeting, we urge you to complete, sign, date, and return the enclosed proxy card in the postage-paid envelope provided so your Shares will be represented at the Annual Meeting. If you wish to attend the Annual Meeting and vote in person, you will be able to do so. You may contact the Fund at 1-800-767-0300 to obtain directions to the site of the Annual Meeting. Shares represented by duly executed proxies received prior to the Annual Meeting will be voted in accordance with your instructions. If you sign the proxy, but do not fill in a vote, your Shares will be voted in accordance with the Board’s recommendation. If any other business is brought before the Annual Meeting, your Shares will be voted at the proxyholders’ discretion.

Shareholders who execute proxies may revoke them at any time before they are voted by filing with the Secretary of the Fund a written notice of revocation, by delivering a duly executed proxy bearing a later date or by attending the Annual Meeting and voting in person. Merely attending the Annual Meeting, however, will not revoke any previously submitted proxy.

Broker-dealer firms holding Shares in “street name” for the benefit of their customers and clients will request the instructions of such customers and clients on how to vote their Shares on the Proposal. A signed proxy card or other authorization by a beneficial owner of Shares that does not specify how the beneficial owner’s Shares are to be voted on the Proposal will be deemed to be an instruction to vote such Shares in favor of such Proposal. If any other business is brought before the Annual Meeting, your Shares will be voted at the proxyholders’ discretion.

•What vote is required to approve the Proposal?

The nominee for Class I Trustee must be approved by the affirmative vote of a majority of the Shares present in person at the Annual Meeting or represented by proxy and entitled to vote on the subject matter so long as a quorum is present. Votes withheld and abstentions will have the same effect as votes against this Proposal, but “broker non-votes” will have no effect on the outcome of the vote on this Proposal.

•How many Shares of the Fund were outstanding as of the Record Date?

At the close of business on the Record Date, the Fund had 21,025,679 Shares outstanding.

PROPOSAL: ELECTION OF TRUSTEES

The Fund’s Shares are listed on the NYSE, which requires the Fund to hold an annual meeting of shareholders to elect Trustees each fiscal year. Shareholders of the Fund are being asked to elect one individual as the sole Class I Trustee of the Board (Mr. Richard E. Struthers is the nominee) to serve until the Fund’s 2026 annual meeting of shareholders or until his successor shall have been elected and qualified.

Composition of the Board of Trustees. The Board of Trustees is classified into three classes of Trustees: Class I Trustees, Class II Trustees and Class III Trustees. Assuming the Class I nominee is elected at the Annual Meeting, the Board will be constituted as follows:

Class I Trustee. Mr. Richard E. Struthers is the sole Class I Trustee. If elected, the term of the Class I Trustee will continue until the Fund's 2026 annual meeting of shareholders, or until his successor shall have been elected and qualified.

Class II Trustees. Mr. Scott C. Jones and Mr. Paul A. Lefurgey are currently the Class II Trustees. It is currently anticipated that the Class II Trustees will next stand for reelection at the Fund's 2024 annual meeting of shareholders.

Class III Trustee. Mr. Steven P. Riege is the sole Class III Trustee. It is currently anticipated that the Class III Trustee will next stand for reelection at the Fund's 2025 annual meeting of shareholders.

Generally, the Trustees of only one class are elected at each annual meeting, so that the regular term of only one class of Trustees will expire annually and any particular Trustee stands for election only once in each three year period. If elected at the Annual Meeting, the Class I nominee will hold office until the Fund’s 2026 annual meeting of shareholders or until his successor shall have been elected and qualified. The other Trustees of the Fund will continue to serve under their current term as described above.

The Class I Trustee nominee nominated by the Board has indicated he consents to serve as a Trustee if elected at the Annual Meeting. The Fund knows of no reason why the nominee would be unable or unwilling to serve if elected. If a designated nominee declines or otherwise becomes unavailable for election, however, the proxy confers discretionary power on the persons named therein to vote in favor of a substitute nominee or nominees.

Unless authority is withheld, it is the intention of the persons named in the proxy to vote the proxy “FOR” the election of the Class I Trustee nominee named above.

Trustees. Certain information concerning the current Trustees, Trustee nominees, and officers of the Fund is set forth in the tables below. The Trustees who are “interested persons” (as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”)) are indicated below. Independent Trustees are those Trustees who are not interested persons of the Fund, the Fund’s investment adviser, Madison Asset Management, LLC (“MAM”), or MAM’s parent company, Madison Investment Holdings, Inc.

(“MIH”) (MAM and MIH are collectively referred to herein as “Madison”) and qualify as "independent" under the definition of that term as set forth in Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Independent Trustees”).

The Fund is part of a fund complex (referred to herein as the “Fund Complex”) currently comprised of the Madison Funds (15 open-end funds), and the Ultra Series Fund (14 open-end funds), for a total of 29 open-end funds (each a "portfolio") and one closed-end fund, (i.e. the Fund). Unless otherwise indicated, the business address of each Trustee and officer of the Fund is c/o Madison Asset Management, LLC, 550 Science Drive, Madison, Wisconsin 53711.

Trustees | | | | | | | | | | | | | | | | | |

| Name and Age | Position Held with Fund | Term of Office and Length of Time Served¹ | Principal Occupation(s) During Past Five Years | Number of Portfolios in Fund Complex Overseen | Other Directorships Held |

| Independent Trustees |

Scott C. Jones 60 | Class II Trustee | Since 2021;

to serve until 2024 | Managing Director, Carne Global Financial Services (US) LLC (a provider of independent governance and distribution support for the asset management industry),

2013 - Present

Managing Director, Park Agency, Inc.,

2020 - Present | 16 | Madison Funds (15), 2019 - Present XAI Octagon Floating Rate & Alternative Income Term Trust, 2017 - Present; Manager Directed Portfolios (open-end fund family, 9 portfolios), 2016 - Present and Lead Independent Trustee since 2017; Guestlogix Inc. (a provider of ancillary focused technology to the travel industry), 2015 - 2016 |

1 A Trustee must retire at the end of the calendar year in which the first of the following two events occurs: (1) they attain the age of 76, or (2) they have served on the Board for a total of 15 years, subject in the latter case to extension by unanimous vote of the remaining Trustees on an annual basis. The 15 year term limitation shall commence on the later of April 19, 2013 or the date of the Trustee's initial election or appointment as a trustee. Board terms end on December 31 of the year noted.

| | | | | | | | | | | | | | | | | |

| Name and Age | Position Held with Fund | Term of Office and Length of Time Served¹ | Principal Occupation(s) During Past Five Years | Number of Portfolios in Fund Complex Overseen | Other Directorships Held |

| Independent Trustees |

Steven P. Riege

68 | Class III Trustee | Since 2015;

to serve until 2025 | Ovation Leadership (management consulting), Milwaukee, WI, Owner/President, 2001 – Present Robert W. Baird & Company (financial services), Milwaukee, WI, Senior Vice President- Marketing and Vice President- Human Resources, 1986 – 2001 | 30 | Madison Funds (15) and

Ultra Series Fund (14),

2015 - Present |

Richard E. Struthers2 70 | Class I Trustee | Since 2017;

Nominee to serve until 2026, if elected | Clearwater Capital Management (investment advisory firm), Naples, FL, Chair and Chief Executive Officer, 1998 – Present Park Nicollet Health Services, Minneapolis, MN, Chairman, Finance and Investment Committee, 2006 – 2012 | 30 | Madison Funds (15) and Ultra Series Fund (14), 2004 - Present |

1 A Trustee must retire at the end of the calendar year in which the first of the following two events occurs: (1) they attain the age of 76, or (2) they have served on the Board for a total of 15 years, subject in the latter case to extension by unanimous vote of the remaining Trustees on an annual basis. The 15 year term limitation shall commence on the later of April 19, 2013 or the date of the Trustee's initial election or appointment as a trustee. Board terms end on December 31 of the year noted.

2 Nominee for election as a Class I Trustee at the Annual Meeting.

| | | | | | | | | | | | | | | | | |

| Name and Age | Position Held with Fund | Term of Office and Length of Time Served¹ | Principal Occupation(s) During Past Five Years | Number of Portfolios in Fund Complex Overseen | Other Directorships Held |

| Interested Trustees |

Paul A. Lefurgey3 58 | Class II Trustee

Vice President | Since 2021;

to serve until 2024

Indefinite Term since 2012 | Madison and Madison Investment Advisors, LLC ("MIA"), Co-Head of Investments, 2022 - Present; CEO, 2017 - 2021; Co-Head of Fixed Income, 2019 - 2021; Director of Fixed Income Investments, 2016 - 2019; Executive Director and Head of Fixed Income Investments, 2013 - 2016; Chairman - Executive Committee, 2015 – 2017

Madison Funds (15) and Ultra Series Fund (14), Vice President, 2009 - Present;

Madison Strategic Sector Premium Fund, Vice President, 2010 - 2018 | 30 | Madison Funds (15), 2020 - Present

and

Ultra Series Fund (14), 2022 - Present |

1 ATrustee must retire at the end of the calendar year in which the first of the following two events occurs: (1) they attain the age of 76, or (2) they have served on the Board for a total of 15 years, subject in the latter case to extension by unanimous vote of the remaining Trustees on an annual basis. The 15 year term limitation shall commence on the later of April 19, 2013 or the date of the Trustee's initial election or appointment as a trustee. Board terms end on December 31 of the year noted. .

3 Mr. Lefurgey serves as an officer of MAM. Since MAM is the investment adviser to the Fund, Mr. Lefurgey is considered an “interested person” of the Fund as the term is defined in the 1940 Act.

Officers. The following information relates to the executive officers of the Fund who are not Trustees. The officers of the Fund are appointed by the Board and serve until their respective successors are chosen and qualified. The Fund’s officers receive no compensation from the Fund, but may also be officers or employees of Madison or affiliates of Madison and may receive compensation in such capacities.

| | | | | | | | | | | |

| Name and Age | Position(s) Held with Fund | Term of Office and Length of Time Served | Principal Occupation(s) During Past Five Years |

Patrick F. Ryan 43

| President | Indefinite Term since March 2020 | Madison and MIA, Head of Multi-Asset Solutions and Portfolio Manager, 2018 – Present; Co-Head of Multi-Asset Solutions and Portfolio Manager, 2016 - 2017 Madison Funds (15) and Ultra Series Fund (14), President, March 2020 - Present |

Steve J. Fredricks 52 | Chief Compliance Officer and Assistant Secretary | Indefinite Term since 2018 | Madison and MIA, Chief Legal Officer, March 2020 - Present; Chief Compliance Officer, 2018 - Present Madison Funds (15) and Ultra Series Fund (14), Chief Compliance Officer and Assistant Secretary, 2018 - Present Madison Strategic Sector Premium Fund, Chief Compliance Officer, 2018 Jackson National Asset Management, LLC, Senior Vice President and Chief Compliance Officer, 2005 - 2018 |

Greg D. Hoppe 53 | Vice President

Chief Financial Officer | Indefinite Term since March 2020 Indefinite Term since 2019 | MIH and MIA, Vice President, 1999 - Present; MAM, Vice President, 2009 - Present Madison Funds (15) and Ultra Series Fund (14), Chief Financial Officer, 2019 - Present; Treasurer, 2009 - 2019 Madison Strategic Sector Premium Fund, Treasurer, 2009 - 2018 |

| | | | | | | | | | | |

| Name and Age | Position(s) Held with Fund | Term of Office and Length of Time Served | Principal Occupation(s) During Past Five Years |

Holly S. Baggot 62 | Secretary and Assistant Treasurer

Anti-Money Laundering Officer | Indefinite Term since 2012

Indefinite Term since 2022 | MIH and MIA, Vice President, 2010 - Present MAM, Vice President, 2009 - Present MFD Distributor, LLC (“MFD”) (an affiliated brokerage firm of Madison), Vice President, 2012 - Present Madison Funds (15) and Ultra Series Fund (14), Secretary, 1999 - Present and Assistant Treasurer, 2009 - Present, and Anti-Money Laundering Officer, 2019 - 2020 and 2022 - Present Madison Strategic Sector Premium Fund, Secretary and Assistant Treasurer, 2010 - 2018 |

Terri Wilhelm

54 | Assistant Secretary | Indefinite Term since 2022 | MIH, MIA and Madison, Senior Compliance Analyst, September 2022 – Present Madison Funds (15), Ultra Series Fund (14), 2022 – Present State of Wisconsin Investment Board, Senior Paralegal, 2017 – 2022 |

Board Qualifications. The members of the Board of Trustees each have experience which led Fund management to the conclusion that the person should serve as a member of the Board, both at the time of the person’s appointment to the Board and continuing as of the date of this Proxy Statement. All four of the Trustees have substantial experience operating and overseeing a business, whether it be the investment management business (Messrs. Jones, Lefurgey and Struthers) or the management consulting business (Mr. Riege).

Mr. Jones has over 25 years of experience in the asset management industry as an independent director, attorney, and executive, holding various roles including Chief Operating Officer, Chief Financial Officer and Chief Administrative Officer, with asset class experience ranging from municipal bonds to hedge funds. He has served as an Independent Trustee of the Fund since 2021, and of Madison Funds, an open-end fund complex managed by MAM, since 2019.

Mr. Riege has spent over 30 years in the financial services industry finding and developing high performing individuals to lead highly successful organizations. His corporate career culminated at R.W. Baird where he held several leadership positions including Chief Human Resources Officer and Director of Wealth Management. Mr. Riege’s passion for leadership then

drove him to build his own management consulting firm, Ovation Leadership, which he has successfully led for 20 years. As President of Ovation, he is active in visioning, conflict resolution, strategic planning, transition planning, organizational change and team dynamics. He has served as an Independent Trustee of the Fund since 2015, and of Madison Funds and Ultra Series Fund, each an open-end fund complex managed by MAM, from 2005 to present.

Mr. Struthers worked directly in the mutual fund industry at Investment Advisers, Inc. for over 20 years. At this billion dollar, global investment management firm, he served as Executive Vice President of IAI, President of the IAI Mutual Funds and President of IAI Securities, Inc. After IAI, Mr. Struthers formed his own investment management firm specializing in equities, which he has successfully lead and managed for 20 years. He has served as an Independent Trustee of the Fund since 2017, and of Madison Funds and Ultra Series Fund, each an open-end fund complex managed by MAM, from 2004 to present.

Mr. Lefurgey serves as Co-Head of Investments with a focus on the firm's fixed income and multi-asset solutions teams. He is on the firm's Executive Committee and a member of the Investment Risk Oversight Committee. He has over 30 years of experience in the investment management business and also serves on the Board of Trustees of Madison Funds and Ultra Series Fund, each an open-end fund complex managed by MAM, since March 2020 and November 2022, respectively. Mr. Lefurgey is considered an “interested person” of the Fund under the 1940 Act.

As a result of the expertise described above, each Trustee has unique perspectives regarding the operation and management of the Fund and the Board’s oversight of the Fund’s operations and management. They use this collective experience to serve the Fund for the benefit of Fund shareholders.

Board Committees. The Trustees have determined that the efficient conduct of the Trustees’ affairs makes it desirable to delegate responsibility for certain specific matters to committees of the Board. The committees meet as often as necessary, either in conjunction with regular meetings of the Trustees or otherwise. The Board currently has two standing committees: the Audit Committee and the Nominating and Governance Committee.

Audit Committee. The Board has an Audit Committee, composed of Richard E. Struthers (Chair), Steven P. Riege and Scott C. Jones. In addition to being Independent Trustees as defined above, each of these Trustees also meets the additional independence requirements for audit committee members as defined by the NYSE. The Audit Committee is charged with selecting an independent registered public accounting firm for the Fund and reviewing accounting matters with the Fund’s independent registered public accounting firm.

The Audit Committee presents the following report:

The Audit Committee: (i) reviewed and discussed with management of the Fund the audited financial statements of the Fund for the fiscal year ended December 31, 2022; (ii) discussed with the Fund’s independent registered public accounting firm the matters required to be discussed

under Public Company Accounting Oversight Board ("PCAOB") Auditing Standard No. 16, Communications with Audit Committee and all other communications required by other PCAOB Standards or Rules; and (iii) received the written disclosures and the letter from the Fund’s independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning the independence of the Fund’s independent registered public accounting firm. Based on these reviews and discussions, the Audit Committee recommended to the Board of Trustees of the Fund that the financial statements be included in the Fund’s Annual Report for the past fiscal period and filed with the SEC.

The Audit Committee is governed by a written charter, the most recent version of which was approved by the Board on May 24, 2023 (the “Audit Committee Charter”). In accordance with proxy rules promulgated by the SEC, the Fund's Audit Committee Charter is required to be filed at least once every three years as an exhibit to the Funds proxy statement, and was last filed in 2022 as Attachment A to the Fund's proxy statement. It is also available on the Fund's website at www.madisonfunds.com. You may request a hard copy of the Audit Committee Charter to be mailed to you by calling the Fund toll-free at 1-800-767-0300.

Nominating and Governance Committee. The Board has a Nominating and Governance Committee, which is composed of Steven P. Riege (Chair), Richard E. Struthers and Scott C. Jones each of whom is an Independent Trustee and is “independent” as defined by NYSE listing standards.

The Nominating and Governance Committee is governed by a written charter, the most recent version of which was approved by the Board on May 24, 2023 (the “Nominating and Governance Committee Charter”). In accordance with proxy rules promulgated by the SEC, the Fund's Nominating and Governance Committee Charter is required to be filed at least once every three years as an exhibit to the Fund’s proxy statement, and was last filed in 2022 as Attachment B to the Fund’s proxy statement. It is also available on the Fund’s website at www.madisonfunds.com. You may request a hard copy of the Nominating and Governance Committee Charter to be mailed to you by calling the Fund toll-free at 1-800-767-0300.

As part of its duties, the Nominating and Governance Committee makes recommendations to the full Board with respect to candidates for the Board. The Nominating and Governance Committee will consider Trustee candidates recommended by shareholders. In considering candidates submitted by shareholders, the Nominating and Governance Committee will take into consideration the needs of the Board and the qualifications of the candidate. To have a candidate considered by the Nominating and Governance Committee, a shareholder must submit the recommendation in writing and must include the information required by the Procedures for Shareholders to Submit Nominee Candidates, which are set forth in Appendix A to the Nominating and Governance Committee Charter. The shareholder

recommendation must be sent to the Fund’s Secretary, c/o Madison Asset Management, LLC, 550 Science Drive, Madison, Wisconsin 53711.

Mr. Struthers, who is a nominee for election at the Annual Meeting, currently serves as a Trustee of the Fund and was unanimously nominated by the Board and the Nominating and Governance Committee.

Leadership Structure of the Board. The Board is relatively small and operates in a collegial atmosphere. Although no member is formally charged with acting as Chair, Mr. Ryan, the President of the Trust, generally acts as the Chairperson during meetings All Board members are expected to provide their input into establishing the Board’s meeting agenda. Likewise, each Board meeting contains a standing agenda item for any Board member to raise new or additional items he or she believes are important in connection with the Fund's governance. The Board has charged Mr. Riege with acting as the Lead Independent Trustee for purposes of communicating with MAM, the Chief Compliance Officer of the Fund (the “CCO”), counsel to the Independent Trustees and fund counsel on matters relating to the Board as a whole. The Independent Trustees often meet in executive session without representatives of MAM present (including meetings with counsel, the CCO and the independent registered public accounting firm).

The Board’s Role in Risk Oversight. MAM is responsible for the overall risk management of the Fund, which includes supervising its affiliated and third-party service providers and identifying and mitigating possible events that could adversely impact the Fund’s business, operations or performance. Risks to the Fund include investment, legal, compliance and regulatory risks, as well as the risk of operational failure or lack of business continuity. The Board oversees risk management of the Fund’s investment programs through the Audit Committee and through oversight by the Board itself. The CCO of the Fund, who reports directly to the Independent Trustees, provides the Board with quarterly updates and a comprehensive annual report regarding the processes and controls in place to address regulatory, compliance, legal and operational risk. The Board exercises its oversight in conjunction with MAM, the CCO, fund counsel and counsel to the Independent Trustees by requesting reports and presentations at regular intervals throughout the year. Additionally, the Audit Committee receives periodic reports from the Fund’s independent accountants. The Board’s committee structure requires an Independent Trustee to serve as chairman of the Nominating and Governance Committee and the Audit Committee.

The Board receives regular written reports describing and analyzing the investment performance of the Fund. In addition, the portfolio managers of the Fund meet with the Board periodically to discuss portfolio performance and answer the Board’s questions with respect to portfolio strategies and risks.

The Board also receives regular written reports from the Fund’s Chief Financial Officer that enable the Board to monitor the number of fair valued securities in the Fund’s portfolio, the reasons for the fair valuation and the methodology used to arrive at the fair value. Such reports also include information concerning illiquid securities within the Fund’s portfolio. The Board and/or the Audit Committee may also review valuation procedures and

pricing results with the Fund's independent auditors in connection with the review of the results of the audit of the Fund's year-end financial statements.

The Board also receives regular compliance reports prepared by the compliance staff of MAM, and meets regularly with the CCO to discuss compliance issues, including compliance risks. As required under applicable rules, the Independent Trustees meet regularly in executive session with the CCO, and the CCO prepares and presents an annual written compliance report to the Board. The CCO, as well as the compliance staff of MAM, provides the Board with reports on their examinations of functions and processes within MAM that affect the Fund. The Board also adopts compliance policies and procedures for the Fund and approves such procedures as appropriate for certain of the Fund’s service providers. The compliance policies and procedures are specifically designed to detect and prevent violations of the federal securities laws.

In its annual review of the Fund's Investment Advisory Agreement, the Board reviews information provided by MAM relating to its operational capabilities, financial conditions and resources. The Board may also discuss particular risks that are not addressed in its regular reports and processes.

The Board recognizes that it is not possible to identify all of the risks that may affect the Fund or to develop processes and controls to eliminate or mitigate their occurrence or effects. The Board periodically reviews the effectiveness of its oversight of the Fund and the processes and controls in place to limit identified risks. The Board may, at any time and in its discretion, change the manner in which it conducts its risk oversight role.

As noted, the Board has established a Nominating and Governance Committee and an Audit Committee to assist the Board in the oversight and direction of the business and affairs of the Fund. From time to time, the Board may establish informal working groups to review and address the policies and practices of the Fund with respect to certain specified matters.

Given the small size of the Board, its committee structure, the openness of Board meetings to active input by all Board members, its utilization of executive sessions, the role of the Lead Independent Trustee and the Board’s quarterly focus on compliance and risk management, the Board has determined that its current leadership structure is appropriate for the protection of Fund investors.

Shareholder Communications with the Board. Shareholders and other interested parties may contact the Board or any member of the Board by mail. To communicate with the Board or any member of the Board, correspondence should be addressed to the Board of Trustees or the Board members with whom you wish to communicate by either name or title. All such correspondence should be sent c/o the Fund’s Secretary, c/o Madison Asset Management, LLC, 550 Science Drive, Madison, Wisconsin 53711.

Beneficial Ownership of Securities. As of the Record Date, each Trustee beneficially owned equity securities of the Fund and other funds in the Fund Complex overseen by the Trustee as specified below:

| | | | | | | | |

| Trustee | Dollar Range of Equity Securities in the Fund | Aggregate Dollar Range of Equity Securities Overseen by Trustees in the Fund Complex |

| Scott C. Jones | None | None |

Paul A. Lefurgey | None | Over $100,000 |

| Steven P. Riege | None | $10,001 - $50,000 |

Richard E. Struthers (Nominee) | $0 - $10,000 | $50,001 - $100,000 |

As of the Record Date, no individual Trustee owns more than 1% of the outstanding Shares of the Fund and the Trustees and officers of the Fund as a group owned less than 1% of the outstanding Shares of the Fund.

Board Meetings. During the Fund’s fiscal year ended December 31, 2022, each of the Board, the Audit Committee and the Nominating and Governance Committee held four meetings. Each Trustee attended all (100%) of the meetings of the Board (and any committee thereof on which he serves) held during the Fund’s fiscal year ended December 31, 2022. It is the Fund’s policy to encourage Trustees to attend annual meetings of shareholders.

Trustee Compensation. The Fund pays an annual retainer and fee per meeting attended to each Trustee who is not affiliated with Madison or its affiliates, and an additional fee for serving as the Lead Independent Trustee. The following table provides information regarding the compensation of the Fund’s Trustees for its most recently completed fiscal year. The Fund does not accrue or pay retirement or pension benefits to Trustees as of the date of this Proxy Statement.

The Fund’s Trustees were compensated as follows for the fiscal year ended December 31, 2022:

| | | | | | | | |

| Trustee | Aggregate Compensation from the Fund | Total Compensation from the Fund and Fund Complex |

Scott C. Jones | $12,000 | $74,000 |

| Paul A. Lefurgey | None | None |

| Steven P. Riege | $13,000 | $108,000 |

Richard E. Struthers (Nominee) | $12,000 | $100,000 |

Shareholder Approval. The affirmative vote of a majority of the Shares present in person or represented by proxy and entitled to vote on the matter at the Annual Meeting at which a quorum (i.e., the holders of a majority of the Shares entitled to vote on the Proposal present in person or by proxy) is present is necessary to approve the Proposal. The holders of Shares have equal voting rights (i.e., one vote per Share and a fractional vote with respect to fractional Shares). Votes withheld and abstentions will have the same effect as votes against the Proposal, and “broker non-votes” (i.e., Shares held by brokers or nominees as to which (i) instructions have not been received from the beneficial owner or the persons entitled to vote and (ii) the broker does not have discretionary voting power on a particular matter) will have no effect on the outcome of the vote on the Proposal.

Board Recommendation. THE BOARD OF THE FUND, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" THE ELECTION OF THE CLASS I TRUSTEE NOMINEE.

ADDITIONAL INFORMATION

Expenses of Proxy Solicitation. The cost of soliciting proxies will be borne by the Fund. In addition, certain officers of the Fund and/or employees of Madison may solicit proxies by telephone or mail (none of whom will receive additional compensation for doing so). Brokerage houses, banks and other fiduciaries may be requested to forward solicitation material to their principals to obtain authorization for the execution of proxies and will be reimbursed by the Fund for such out-of-pocket expenses.

Further Information About Voting and the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we urge you to complete, sign, date, and return the enclosed proxy card in the postage-paid envelope provided so your Shares will be represented at the Annual Meeting. If you wish to attend the Annual Meeting and vote in person, you will be able to do so. You may contact the Fund toll-free at 1-800-767-0300 to obtain directions to the site of the Annual Meeting.

The Agreement and Declaration of Trust of the Fund requires the presence of a quorum for each matter to be acted upon at the Annual Meeting. The holders of a majority of the Shares entitled to vote on the Proposal must be present in person or by proxy to have a quorum to conduct business at the Annual Meeting. Votes withheld, abstentions and "broker non-votes" will be counted as present for purposes of establishing a quorum.

All properly executed proxies received prior to the date of the Annual Meeting will be voted at the Annual Meeting in accordance with the instructions marked thereon or otherwise as provided therein. If no specification is made on a properly executed proxy card, it will be voted “FOR” the Proposal specified on the proxy card. Shareholders who execute proxies may revoke them at any time before they are voted by filing with the Secretary of the Fund a written notice of revocation, by delivering a duly executed proxy bearing a later date or by attending the Annual Meeting and voting in person. Merely attending the Annual Meeting, however, will not revoke any previously submitted proxy.

The Board has fixed the close of business on June 22, 2023 as the Record Date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting. Shareholders as of the close of business on the Record Date will be entitled to one vote on each matter to be voted on for each Share of the Fund held and a fractional vote with respect to fractional Shares, with no cumulative voting rights. There were 21,025,679 Shares of the Fund outstanding as of the Record Date.

Investment Adviser. MAM, a subsidiary of Madison Investment Holdings, Inc., is the Fund’s investment adviser and is responsible for making investment decisions with respect to the investment of the Fund’s assets. MAM is located at 550 Science Drive, Madison, Wisconsin 53711. MAM and its affiliated entities act as investment adviser for individuals, corporations, pension funds, endowments, insurance companies, mutual funds and closed-end investment companies.

Administrator. MAM also serves as administrator to the Fund. State Street Bank & Trust Company serves as sub-administrator to the Fund. State Street Bank & Trust Company is located at One Congress Street, Suite 1, Boston, MA 02114-2016.

Independent Registered Public Accounting Firm. For the fiscal years ended December 31, 2021 and December 31, 2022, and the current fiscal year ending December 31, 2023, Deloitte & Touche LLP (“D&T”) has been selected as the Fund’s independent registered public accounting firm by the Audit Committee of the Fund to audit the accounts of the Fund. The Fund does not know of any direct or indirect financial interest of D&T in the Fund. Representatives of D&T will not be in attendance at the Annual Meeting.

Audit Fees. The aggregate fees billed to the Fund by D&T for professional services rendered for the audit of the Fund’s annual financial statements for the Fund’s fiscal years ended December 31, 2021 and December 31, 2022 were approximately $22,000 and $23,950, respectively.

Audit-Related Fees. The aggregate fees billed by D&T and approved by the Audit Committee of the Fund for the Fund’s fiscal years ended December 31, 2021 and December 31, 2022 for assurance and related services reasonably related to the performance of the audit of the Fund’s annual financial statements were $0 and $0, respectively. D&T did not perform any other assurance and related services that were required to be approved by the Fund’s Audit Committee for such periods.

Tax Fees. The aggregate fees billed by D&T and approved by the Audit Committee of the Fund for the Fund’s fiscal years ended December 31, 2021 and December 31, 2022 for professional services rendered for tax compliance, tax advice, and tax planning were approximately $4,442 and $4,652, respectively (such fees relate to tax services provided by D&T in connection with the review of the Fund’s tax returns). D&T did not perform any other tax compliance or tax planning services or render any tax advice that was required to be approved by the Fund’s Audit Committee for such periods.

All Other Fees. Other than those services described above, D&T did not perform any other services on behalf of the Fund for the Fund’s fiscal years ended December 31, 2021 and December 31, 2022.

Audit Committee’s Pre-Approval Policies and Procedures. As noted above, the Audit Committee is governed by the Audit Committee Charter, which includes Pre-Approval Policies and Procedures. The Audit Committee of the Fund has (i) pre-approved all audit and non-audit services provided by D&T to the Fund, and (ii) all non-audit services provided by D&T to MAM, or any entity controlling, controlled by, or under common control with MAM that provides ongoing services to the Fund which are related to the operations of the Fund (of which there were none), for the fiscal years ended December 31, 2021 and December 31, 2022. None of the services described above for the Fund’s fiscal years ended December 31, 2021 and December 31, 2022 were approved by the Audit Committee pursuant to the pre-approval exception under Rule 2-01(c)(7)(i)(c) of Regulation S-X promulgated by the SEC.

Principal Shareholders. As of the record date, listed below are entities that have made filings with the Securities and Exchange Commission (“SEC”) disclosing ownership of record of 5% or more of the outstanding Shares of the Fund:

| | | | | | | | |

| Name and Address | Number of Shares Owned | Percentage Owned |

Morgan Stanley Smith Barney LLC

1585 Broadway

New York, NY 10036 | 1,050,950 | 5.0% |

Information in this table is based on filings made on or before May 30, 2023. To the knowledge of the Fund, no other person owned 5% or more of the outstanding Shares of the Fund as of such date.

“Section 16(a)” Beneficial Ownership Reporting Compliance. Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 30(h) of the 1940 Act require the Fund’s officers and Trustees, certain officers of the Fund’s investment adviser, affiliated persons of the investment adviser, and persons who beneficially own more than ten percent of the Fund’s shares to file certain reports of ownership (“Section 16 filings”) with the SEC and the NYSE. Based upon the Fund’s review of the copies of such forms effecting the Section 16 filings received by it, the Fund believes that for Fund’s fiscal year ended December 31, 2022, all filings applicable to such persons were completed and filed in a timely manner.

Privacy Policy of the Fund. The Fund is committed to maintaining the privacy of shareholders and to safeguarding their non-public personal information. The following information is provided to help you understand what personal information the Fund collects, how the Fund protects that information and why, in certain cases, the Fund may share information with select other parties:

Generally, the Fund does not receive any non-public personal information relating to its shareholders, although certain non-public personal information of its shareholders may become available to the Fund. The Fund does not disclose any non-public personal information about its shareholders or former shareholders to anyone, except as permitted by law or as is necessary in order to service shareholder accounts (for example, to a transfer agent or third party administrator). The Fund restricts access to non-public personal information about the shareholders to employees of Madison (and its affiliates) with a legitimate business need for the information. The Fund maintains physical, electronic and procedural safeguards designed to protect the non-public personal information of its shareholders.

Deadline for Shareholder Proposals. Shareholder proposals intended for inclusion in the Fund's proxy statement in connection with the Fund’s 2024 Annual Meeting of shareholders pursuant to Rule 14a-8 under the Exchange Act, must be received by the Fund at its principal executive offices by March 3, 2024. In order for the proposals made outside of Rule 14a-8 under the Exchange Act, as amended, to be considered “timely” within the meaning of Rule 14a-4(c) under the Exchange Act, such proposals much be received by the Fund at its principal executives offices not later than the close of business on May 27, 2024, nor earlier than the close of business on April 27, 2024.

Important Notice Regarding the Availability of Proxy Materials. This Proxy Statement is available at the website listed on your proxy card.

Other Matters. Fund management knows of no other matters which are to be brought before the Annual Meeting. However, if any other matters not now known properly come before the Annual Meeting, it is the intention of the persons named in the enclosed form of proxy to vote such proxy in accordance with their judgment on such matters.

Failure of a quorum to be present at the Annual Meeting will necessitate adjournment of the Annual Meeting. In the event that a quorum is present at the Annual Meeting but sufficient votes to approve the Proposal are not received, proxies may vote Shares (including abstentions and broker non-votes) in favor of one or more adjournments of the Annual Meeting with respect to the Proposal to permit further solicitation of proxies, provided they determine that such an adjournment and additional solicitation is reasonable and in the interest of shareholders based on a consideration of all relevant factors, including the nature of the proposal, the percentage of votes then cast, the percentage of negative votes then cast, the nature of the proposed solicitation activities and the nature of the reasons for such further solicitation.

One Proxy Statement may be delivered to two or more shareholders who share an address, unless the Fund has received instructions to the contrary. To request a separate copy of the Proxy Statement, which will be delivered promptly upon written or oral request, or for instructions as to how to request a single copy if multiple copies are received, shareholders should contact the Fund at 550 Science Drive, Madison, Wisconsin 53711, or toll-free at 1-800-767-0300.

WE URGE YOU TO VOTE PROMPTLY BY COMPLETING, SIGNING, DATING AND MAILING THE ENCLOSED PROXY IN THE POSTAGE-PAID ENVELOPE PROVIDED SO YOU WILL BE REPRESENTED AT THE ANNUAL MEETING.

Very truly yours,

By order of the Board of Trustees

/s/ Holly S. Baggot

Holly S. Baggot, Secretary

July 1, 2023

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

VOTING OPTION:

VOTE BY MAIL

Vote, sign and date this Proxy

Card and return in the

postage-paid envelope

Please detach at perforation before mailing.

PROXY

MADISON COVERED CALL & EQUITY STRATEGY FUND

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON AUGUST 25, 2023

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF TRUSTEES. Holly S. Baggot and Greg D. Hoppe (the “Proxyholders”), or any of them, each with the power of substitution, are hereby authorized to represent and vote the shares of the undersigned, with all the powers which the undersigned would possess if personally present, at the annual meeting of shareholders of the Madison Covered Call & Equity Strategy Fund (the "Fund"), to be held on Friday, August 25, 2023 at 10:00 a.m., Central time at the offices of the Fund, 550 Science Drive, Madison, Wisconsin 53711, and any adjournments or postponements thereof.

Shares represented by this proxy card when properly executed will be voted in the manner directed herein by the shareholder, and in the discretion of such proxies, upon any and all other matters as may properly come before the Annual Meeting or any adjournment or postponement thereof. If no direction is made, on a properly executed card, this proxy will be voted "FOR" the election of the named Trustee nominee. If the Trustee nominee for any reason is unable or unwilling to serve, the Proxyholders will vote for the election of such other person as they may consider qualified. The shareholder hereby acknowledges receipt of this Notice of Annual Meeting and Proxy Statement for the Annual Meeting to be held on August 25, 2023.

MCC_33378_050823

PLEASE MARK, SIGN, AND DATE ON THE REVERSE SIDE AND RETURN THE PROXY CARD USING THE ENCLOSED ENVELOPE.

xxxxxxxxxxxxxx code

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting to Be Held on August 25, 2023

The Proxy Statement for this meeting is available at:

https://www.madisonfunds.com/MCNproxy

Please detach at perforation before mailing.

TO VOTE, MARK BOXES BELOW IN BLUE OR BLACK AS SHOWN IN THIS EXAMPLE: x

A. Proposals. THE BOARD OF TRUSTEES RECOMMENDS THAT YOU VOTE FOR THE NOMINEE LISTED BELOW:

1. Election of Trustee:

FOR WITHHOLD

01. Richard E. Struthers* o o

*Class I Trustee of the Madison Covered Call & Equity Strategy Fund to serve until the Fund's 2026 annual meeting

of shareholders and until his successor shall have been elected and qualified.

2. Other Business - To transact such other business as may properly come before the Annual Meeting and any adjournment or

postponement thereof.

B. Authorized Signatures - This section must be completed for your vote to be counted.─ Sign and Date Below:

Note: Please sign exactly as your name(s) appear(s) on this proxy card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature.

| | | | | | | | | | | | | | |

| Date (mm/dd/yyyy) ─ Please print date below | | Signature 1 ─ Please keep signature within the box | | Signature 2 ─ Please keep signature within the box |

| | | | |

xxxxxxxxxxxxxx MCC 33378 xxxxxxxx

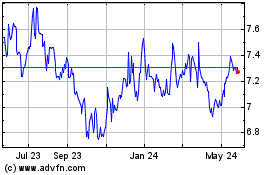

Madison Covered Call and... (NYSE:MCN)

Historical Stock Chart

From Apr 2024 to May 2024

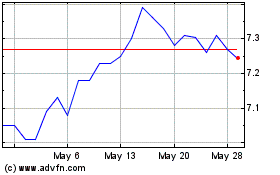

Madison Covered Call and... (NYSE:MCN)

Historical Stock Chart

From May 2023 to May 2024