UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

|

☒

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

☐

|

Definitive Additional Materials

|

|

|

☐

|

Soliciting Material Under Rule 14a-12

|

|

MONMOUTH REAL ESTATE INVESTMENT CORPORATION

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

|

LAND & BUILDINGS CAPITAL

GROWTH FUND, LP

LAND & BUILDINGS GP LP

L&B OPPORTUNITY FUND,

LLC

LAND & BUILDINGS INVESTMENT

MANAGEMENT, LLC

JONATHAN LITT

MICHELLE APPLEBAUM

MARK A. FILLER

GREGORY F. HUGHES

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials:

|

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

Persons who are to respond to the collection

of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

PRELIMINARY

COPY SUBJECT TO COMPLETION

DATED MARCH 2, 2021

ANNUAL MEETING

OF SHAREHOLDERS

OF

Monmouth Real Estate Investment Corporation

_________________________

PROXY STATEMENT

OF

Land & buildings capital growth fund, lp

_________________________

PLEASE VOTE ON

THE ENCLOSED GOLD PROXY CARD TODAY

Land & Buildings Capital

Growth Fund, LP (“L&B Capital”), L&B Opportunity Fund, LLC (“L&B Opportunity”), Land &

Buildings GP LP (“L&B GP”), Land & Buildings Investment Management, LLC (“L&B Management”)

and Jonathan Litt (collectively, “Land & Buildings” or “we”) are investors in Monmouth Real Estate

Investment Corporation, a Maryland corporation (“Monmouth” or the “Company”), that beneficially own in

the aggregate 689,530 shares of common stock, par value $0.01 per share (the “Common Stock”), of the Company. We believe

that the Company’s shares are deeply undervalued relative to its robust portfolio of industrial warehouse properties and

the extremely favorable market environment within in which it operates. Although the Company publicly announced a decision to explore

strategic alternatives in January 2021, in our view the Company’s current directors, who bear responsibility for the persistent

underperformance of the Company, are not the right people to objectively evaluate the range of strategic opportunities available

to the Company and chart a new path forward for Monmouth. We believe that change on the Company’s Board of Directors (the

“Board”) is necessary to help unlock value for shareholders.

We have nominated four

exceptionally qualified director candidates who have the deep real estate and capital markets experience needed to help properly

evaluate the best ways to maximize value for all Monmouth shareholders. We are seeking your support at the Annual Meeting of Shareholders

scheduled to be held on ___________, 2021 at _______, Eastern Time, at ________________ (including any adjournments or postponements

thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following:

|

|

1.

|

To elect Land & Buildings’ director nominees, Michelle Applebaum, Mark A. Filler, Gregory

F. Hughes and Jonathan Litt (the “Nominees”), to the Board as Class III directors, each to hold office until the Company’s

2024 annual meeting of shareholders and until his or her successor is duly elected and qualifies;

|

|

|

2.

|

To ratify the appointment of PKF O’Connor Davies, LLP as the Company’s registered public

accounting firm for the fiscal year ending September 30, 2021;

|

|

|

3.

|

To vote on an advisory resolution to approve the compensation of the Company’s executive

officers for the fiscal year ended September 30, 2020 as described in the Company’s proxy statement;

|

|

|

4.

|

To approve Land & Buildings’ non-binding business proposal to request that the Board

take all necessary steps in its power to declassify the Board so that all directors are elected on an annual basis commencing at

the next annual meeting of shareholders after the Annual Meeting (the “Board Declassification Proposal”); and

|

|

|

5.

|

To transact such other business as may properly come before the Annual Meeting or any adjournment

or postponements thereof.

|

According to the

Company’s proxy statement, there are four Class III director seats up for election at the Annual Meeting. This Proxy Statement

is soliciting proxies to elect only our Nominees. Accordingly, the enclosed GOLD proxy card may only be voted for our Nominees

and does not confer voting power with respect to any of the Company’s director nominees. The names, backgrounds and qualifications

of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. Your vote

to elect our Nominees will have the legal effect of replacing four incumbent directors with our Nominees. If elected, our Nominees

will constitute a minority on the Board and there can be no guarantee that our Nominees will be able to implement the actions that

they believe are necessary to unlock shareholder value at Monmouth. However, we believe the election of our Nominees is an important

step in the right direction for reversing the Company’s historical underperformance and charting a new path forward for Monmouth.

The Company has

set the close of business on ___________, 2021 as the record date for determining shareholders entitled to notice of and to vote

at the Annual Meeting (the “Record Date”). Shareholders of record at the close of business on the Record Date will

be entitled to cast one vote for as many individuals as there are directors to be elected at the Annual Meeting and to cast one

vote on each other matter presented at the Annual Meeting for each share of Common Stock owned as of the Record Date. According

to the Company, as of the Record Date, there were ___________ shares of Common Stock outstanding and entitled to vote at the Annual

Meeting. The mailing address of the principal executive offices of the Company is Bell Works, 101 Crawfords Corner Road, Suite

1405, Holmdel, New Jersey 07733.

As of the date hereof, Land & Buildings and the other Participants

(as defined below) collectively own an aggregate of 689,530 shares of Common Stock (the “Land & Buildings Group Shares”).

The Participants intend to vote the Land & Buildings Group Shares “FOR ALL” the Nominees, FOR the

ratification of PKF O’Connor Davies, LLP as the independent registered public accounting firm for the fiscal year ending

September 30, 2021, [FOR/AGAINST/ABSTAIN on] the non-binding advisory resolution on the compensation of the Company’s

named executive officers, and FOR the non-binding proposal to request that the Board declassify the Board, as described

herein. While we currently intend to vote all of the Land & Buildings Group Shares “FOR ALL” the Nominees,

we reserve the right to vote some or all of the Land & Buildings Group Shares for some or all of the Company’s director

nominees, as we see fit, in order to achieve a Board composition that we believe is in the best interest of all shareholders. We

would only intend to vote some or all of the Land & Buildings Group Shares for some or all of the Company’s director

nominees in the event it were to become apparent to us, based on the projected voting results at such time, that less than all

of our Nominees would be elected at the Annual Meeting and that by voting the Land & Buildings Group Shares we could help elect

Monmouth nominees that we believe are the most qualified to serve as directors and thus help achieve a Board composition that we

believe is in the best interest of all shareholders. Shareholders should understand, however, that all shares of Common Stock represented

by the enclosed GOLD proxy card will be voted at the Annual Meeting as marked.

We urge you to carefully

consider the information contained in this Proxy Statement and then support our efforts by voting via the Internet or telephone

by following the instructions on the enclosed GOLD proxy card. Your vote is important, and due to ongoing delays in the

postal system, we are encouraging shareholders to submit their proxies electronically if possible. Alternatively, if you do not

have access to the Internet or a touch-tone telephone, please sign, date and return the enclosed GOLD proxy card by mail

in the postage-paid envelope today. This Proxy Statement and the enclosed GOLD proxy card are first being mailed to shareholders

on or about ___________, 2021.

THIS SOLICITATION

IS BEING MADE BY LAND & BUILDINGS AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY.

LAND & BUILDINGS

URGES YOU TO VOTE “FOR ALL” THE NOMINEES VIA THE INTERNET OR TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON THE

ENCLOSED GOLD PROXY CARD TODAY. IF YOU DO NOT HAVE ACCESS TO THE INTERNET OR A TOUCH-TONE TELEPHONE, PLEASE SIGN, DATE AND

RETURN THE GOLD PROXY CARD VOTING “FOR ALL” THE NOMINEES.

IF YOU HAVE ALREADY

SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED

IN THIS PROXY STATEMENT VIA THE INTERNET OR TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON THE ENCLOSED GOLD PROXY CARD, OR

IF YOU DO NOT HAVE ACCESS TO THE INTERNET OR A TOUCH-TONE TELEPHONE, BY SIGNING, DATING AND RETURNING THE ENCLOSED GOLD PROXY

CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT WILL BE COUNTED. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING

BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL

MEETING.

Important Notice Regarding

the Availability of Proxy Materials for the Annual Meeting—

This Proxy Statement and our GOLD proxy card are available at

_______________________.com

IMPORTANT

Your vote is

important, no matter how many or few shares of Common Stock you own. Land & Buildings urges you to vote FOR ALL of the Nominees

and in accordance with Land & Buildings’ recommendations on the other proposals on the agenda for the Annual Meeting

via the Internet or telephone by following the instructions on the enclosed GOLD proxy card today. If you do not have access to

the Internet or a touch-tone telephone, please sign, date and return the enclosed GOLD proxy card today.

|

|

•

|

If your shares of Common Stock are registered in your own name, please

follow the instructions on the enclosed GOLD proxy card to vote via the Internet or telephone today. If you do not have

access to the Internet or a touch-tone telephone, please sign and date the enclosed GOLD proxy card and return it to Land

& Buildings, c/o Innisfree M&A Incorporated (“Innisfree”), in the enclosed postage-paid envelope today.

|

|

|

•

|

If your shares of Common Stock are held in a brokerage account or

bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy materials, together with a GOLD

voting instruction form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker,

trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions.

|

|

|

•

|

Depending upon your broker or custodian, you may be able to vote

either by toll-free telephone or by the Internet. Please refer to the enclosed proxy card or voting instruction form for instructions

on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form.

|

Due to ongoing

delays in the postal system, we are encouraging shareholders to submit their proxies electronically (by Internet or by telephone)

if possible.

Since only your

latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the

management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card

you may have previously sent to us. Remember, you can vote for our Nominees only on our GOLD proxy card. So please make

certain that the latest dated proxy card you return is the GOLD proxy card.

If you have any questions,

require assistance in voting your GOLD proxy card,

or need additional copies

of Land & Buildings’ proxy materials,

please contact Innisfree

at the phone numbers listed below.

Innisfree M&A Incorporated

501 Madison Avenue, 20th

floor

New York, New York 10022

Shareholders may call toll

free: (877) 456-3507

Banks and Brokers may call

collect: (212) 750-5833

Background

to the Solicitation

The following is a chronology of material

events leading up to this proxy solicitation.

|

|

·

|

In December 2020, Land & Buildings began building an investment position in Monmouth based

on its belief that the Company’s shares were deeply undervalued.

|

|

|

·

|

On December 21, 2020, Blackwells Capital LLC (“Blackwells”) publicly announced its

submission to the Company of an offer to purchase the Company for $18.00 per share in cash on December 18, 2020.

|

|

|

·

|

On December 21, 2020, the Company publicly confirmed its receipt of the Blackwells offer, as well

as an earlier offer by Blackwells to purchase the Company for $16.75 per share in cash that was submitted to the Company on December

1, 2020. The Company stated that the Board unanimously determined the original Blackwells offer was not in the best interests of

the Company.

|

|

|

·

|

On December 29, 2020, Land & Buildings privately submitted its notice nominating the Nominees

and submitting the Board Declassification Proposal for consideration by the Company’s shareholders at the Annual Meeting.

|

|

|

·

|

On December 31, 2020, the Company announced that, as of the deadline for the receipt of such notices,

it had received notice from Land & Buildings of the nomination of the Nominees and the submission of the Board Declassification

Proposal, and notice from Blackwells of its nomination of four candidates for election to the Board and the submission of six non-binding

proposals for consideration by the Company’s shareholders at the Annual Meeting.

|

|

|

·

|

On January 4, 2021, Jonathan Litt and Craig Melcher spoke with Michael Landy, the Company’s

Chief Executive Officer, and Kevin Miller, the Company’s Chief Financial Officer. On the call, Mr. Landy and Mr. Miller failed

to collaboratively engage with Land & Buildings on matters including Board structure and refreshment, non-core investments,

balance sheet strategy or the Blackwells offer and referred us to SEC filings and transcripts. Troublingly, Mr. Landy noted that

the Company’s staggered Board has “served us well over time”, despite the Company’s substantial underperformance

relative to its peers.

|

|

|

·

|

On January 14, 2021 the Company publicly announced the Board’s decision to explore strategic

alternatives to maximize shareholder value, including a potential sale or merger of the Company. Notably, the Company did not announce

the formation of a Special Committee of the Board to lead the strategic alternatives process. The Company also announced that the

Board unanimously determined the second Blackwells offer was not in the best interests of the Company.

|

|

|

·

|

On January 26, 2021 Land & Buildings issued a public letter to the Company’s shareholders.

In the letter, Land & Buildings expressed serious concerns regarding the Company’s strategic review process, and stated

that in order for the process to have a legitimate chance of achieving a successful outcome, it should be led by a Special Committee

of the Board comprised of truly independent directors, including the Nominees.

|

|

|

·

|

On February 4, 2021, the Company issued a press release announcing the results for the first quarter

ended December 31, 2020 and a supplemental information package in connection with its earnings conference call for the first quarter

ended December 31, 2020. Land & Buildings noted that the Company had unrealized losses on its non-core securities portfolio

of $107 million as of December 31, 2020.

|

|

|

·

|

As of March 2, 2021, despite attempts by Land & Buildings, the Company had not meaningfully

engaged with Land & Buildings regarding the appointment of the Nominees to the Board and to a Special Committee of the Board

to lead the strategic review process.

|

|

|

·

|

On March 2, 2021, Land & Buildings filed a preliminary proxy statement.

|

REASONS FOR THE

SOLICITATION

Land & Buildings

invested in Monmouth because we believe the Company’s shares are deeply undervalued relative to its robust portfolio of industrial

warehouse properties and the extremely favorable market environment in which it operates. Our belief was, and remains, that improved

oversight – in the form of new independent directors – would help unlock significant value for shareholders. Such refreshment

would also revitalize the Company’s leadership and help address the poor corporate governance policies that are key contributors

to Monmouth’s underperformance. That is why we decided to nominate four exceptionally qualified director candidates to the

Board.

This contest is

a referendum on the Company's historical underperformance and whether the directors in place today are best equipped to reverse

this trend and chart the path forward for Monmouth – including whether they are the right individuals to objectively evaluate

the range of strategic opportunities available to maximize value for all Monmouth stockholders. We believe the answer is a resounding

NO.

Unfortunately, the

Board rebuffed our efforts at constructive dialogue and has elected to run what we believe will likely be a flawed strategic alternatives

process overseen by the same entrenched and conflicted leadership that bears responsibility for the persistent underperformance

of the Company relative to its peers.

We Do Not Believe

Monmouth’s Current Board Can Effectively Evaluate Strategic Alternatives

In the midst of

preparing our nominations, we learned of the offer by Blackwells to acquire the Company for $18.00 per share in cash, which amount

was up from $16.75 in its original bid. In the interest of avoiding a two-way public proxy contest and helping all shareholders

realize the true value of their investment in Monmouth, we submitted our nominations privately and urged the Board to immediately

establish a Special Committee – including our Nominees – to conduct a thorough strategic review process to evaluate

the all strategic alternatives, including the Blackwells offer, and the best path forward for the Company. Critically, such a process

would be unencumbered by the personal and professional conflicts present on the incumbent Board. Now more than ever shareholders

need an objective Board to determine which course of action will maximize value.

Given the relatively

straightforward nature of the Company’s assets, with 55% of Monmouth’s revenue derived from assets leased to FedEx

Corporation,1 we believe

a full and fair sales process should generate significant interest in the Company’s industrial warehouse assets, and should

take no more than 30 to 60 days to arrive at an outcome. We would interpret any delay beyond the 60 days as an indication that

this process is merely a smoke screen being used by an entrenched Board and management to remain in control beyond the vote for

new directors at the Annual Meeting.

We are Concerned

by Monmouth’s Historical Underperformance

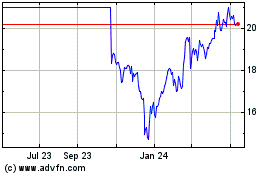

Monmouth has consistently

and persistently underperformed its industrial REIT peers over the trailing 10-, 5-, 3- and 1-year periods by 135%, 67%, 123% and

8%, respectively. Troublingly, the Board has not held the management accountable for capital allocation errors that have led to

substantially inferior earnings growth. Monmouth’s FFO per share growth has trailed its industrial peers by 69%, 22%, 24%

and 18% over the trailing 10-, 5-, 3- and 1-year periods. 2

1 Source: Supplemental Information on Form 8-K for the quarter ended December 31, 2020.

2 Peer group comprised of members of the Bloomberg REIT Industrial/Warehouse Index: Americold Realty Trust (NYSE: COLD), Duke Realty Corporation (NYSE: DRE), EastGroup Properties, Inc. (NYSE: EGP), First Industrial Realty Trust, Inc. (NYSE: FR), Innovative Industrial Properties, Inc. (NYSE: IIPR), Industrial Logistics Properties Trust (Nasdaq: ILPT), Prologis, Inc. (NYSE: PLD), Plymouth Industrial REIT, Inc. (NYSE: PLYM), PS Business Parks, Inc. (NYSE: PSB), Rexford Industrial Realty, Inc. (NYSE: REXR), STAG Industrial, Inc. (NYSE: STAG) and Terreno Realty Corporation (NYSE: TRNO). Total shareholder returns reported through December 1, 2020, the unaffected share price before the initial Blackwells offer. FFO growth sourced from Bloomberg based on actual results reported by the respective peer companies or, where actual results have not yet been reported, 2020 consensus FFO estimates as of March 2, 2021.

A clear example

of poor capital allocation is the Company’s investments in other REITs in troubled businesses far from the Company’s

core business. The Company incurred $127 million of losses on Monmouth’s stakes in public securities of real estate companies,

including regional mall owners CBL & Associates Properties, Inc. (formerly NYSE: CBL) and Pennsylvania Real Estate Investment

Trust (NYSE: PEI), where the Company has lost 98% and 93%, respectively, on their investments as of September 30, 2020.3

Monmouth’s Total Shareholder

Returns Have Significantly Underperformed Industrial Peers

|

Total Shareholder Returns

|

Trailing

10 Years

|

Trailing

5 Years

|

Trailing

3 Years

|

Trailing

1 Year

|

|

Monmouth Real Estate Investment Corporation

|

215%

|

79%

|

-5%

|

1%

|

|

Industrial REITs

|

350%

|

146%

|

118%

|

9%

|

|

|

|

|

|

|

|

MNR Underperformance vs. Industrial REITs

|

-135%

|

-67%

|

-123%

|

-8%

|

Monmouth’s FFO Growth Has

Significantly Trailed Industrial Peers

|

FFO Growth

|

Trailing

10 Years

|

Trailing

5 Years

|

Trailing

3 Years

|

Trailing

1 Year

|

|

Monmouth Real Estate Investment Corporation

|

27%

|

33%

|

1%

|

-8%

|

|

Industrial REITs

|

96%

|

55%

|

25%

|

10%

|

|

|

|

|

|

|

|

MNR Underperformance vs. Industrial REITs

|

-69%

|

-22%

|

-24%

|

-18%

|

We are Concerned

by Monmouth’s Abysmal Corporate Governance

Monmouth’s

corporate governance is a relic of the past, increasing the likelihood that directors’ allegiances lay with management rather

than the best interest of all shareholders. Consider the following:

|

|

·

|

Glass Lewis and/or ISS recommending to

withhold support on at least one MNR director in each of the past 5 years due to various governance concerns;

|

|

|

·

|

ISS Quality Score of 9 on a scale of 1

to 10, with 10 indicating the highest governance risk;

|

3 Source: Annual Report on Form 10-K for the year ended September 30, 2020 as full disclosure not available for quarter ended December 31, 2020.

|

|

·

|

The

Company maintains a staggered Board;

|

|

|

·

|

Three Landy immediate family members serve

as directors and occupy the roles of Chairman, President and Chief Executive Officer;

|

|

|

·

|

Additional MNR directors either serving

as a director alongside the Landys at UMH Properties Inc., a related company in which the Landy family has separate interests or

having received brokerage commissions from UMH;

|

|

|

·

|

The average director tenure of 17 years

far exceeds good corporate governance practices; and

|

|

|

·

|

Eight of 13 directors have a tenure of

more than a dozen years, including one director with a 50+ year tenure and two additional directors with 30+ year tenures.

|

Land &

Buildings’ Nominees Would Bring Much-Needed Change to the Board

It is time for

Monmouth’s Board to be refreshed and to begin the process of the Company reversing consistent and persistent underperformance.

Land & Buildings’ director candidates for election to the Board at the Annual Meeting have the deep real estate and

capital markets experience needed to help properly evaluate the best ways to maximize value for all Monmouth stockholders. Our

highly-qualified nominees to the Board at the Annual Meeting are as follows:

|

|

·

|

Gregory F. Hughes, who brings significant

experience in public and private real estate markets, including as Chief Operating Officer and Chief Financial Officer of SL Green

Realty Corp. (NYSE: SLG) and Chief Financial Officer of Fortress Investment Group LLC.

|

|

|

·

|

Mark A. Filler, who has extensive

executive experience in the real estate industry including as Chief Executive Officer of Prospect Mortgage Company and Apex National

Real Estate LLC, and as Co-Founder of Prism Financial. While at Prospect, the Company originated approximately $10 billion annually

and had a servicing portfolio in excess of $15 billion.

|

|

|

·

|

Michelle Applebaum, who previously

served as a director of Northwest Pipe Company (NASDAQ: NWPX) and whose deep capital markets expertise includes building one of

the first “independent” equity research and corporate advisory boutiques and repeated top ratings from Institutional

Investor Magazine.

|

|

|

·

|

Jonathan Litt, an advocate of shareholder

rights with decades of experience investing in the REIT industry and extensive expertise in developing strategies to maximize long-term

shareholder value in the sector – both as an investor and as a public company director.

|

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Company currently

has a classified Board, which is divided into three classes. There are four Class III director seats up for election at the Annual

Meeting. Your vote to elect our Nominees will have the legal effect of replacing four incumbent directors with the Nominees. If

elected, our Nominees will constitute a minority on the Board and there can be no guarantee that our Nominees will be able to implement

the actions that they believe are necessary to unlock shareholder value at Monmouth. There is no assurance that any incumbent director

will serve as a director if our Nominees are elected to the Board. You should refer to the Company's proxy statement for the names,

background, qualifications and other information concerning the Company's nominees.

THE

Land & Buildings NOMINEES

Set forth below

are the name, age, business address, present principal occupation, and employment and material occupations, positions, offices,

or employments for the past five years of each of the Nominees. This information has been furnished to us by the Nominees. The

nominations were made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments.

The specific experience, qualifications, attributes and skills that led us to conclude that the Nominees should serve as directors

of the Company are set forth above in the section entitled “Reasons for the Solicitation” and below.

Michelle Applebaum,

age 63, has served as Senior Adviser at Ziba Capital Management, a hedge-fund, since May 2020, and as President of Corp Research

Inc., a consulting firm focusing mainly on private steel companies and private equity clients, since she founded the company in

November 2016. Previously, Ms. Applebaum served as a Senior Advisor to Republic Partners, a middle-market investment bank focusing

on clients in the industrial and logistics sectors, from September 2016 until October 2018. Prior to that, Ms. Applebaum built

one of the first “independent” equity research and corporate advisory boutiques, Michelle Applebaum Research Inc. (“MARI”),

and also published an industry newsletter and did industry consulting under the dba, Steel Market Intelligence (“SMI”),

serving as Managing Partner, President and CEO of MARI/SMI from 2003 until November 2016. Prior to establishing MARI/SMI, she was

an equity analyst and Managing Director with Salomon Brothers (later Citigroup) and became ranked number one in steel equity analysis

in 1988 and retained that standing for most of the remainder of her career with the firm. Ms. Applebaum also was a part of the

Management Oversight Committee for the firm’s top-rated equity research division, and sat on the Credit Committee for all

steel business and on the firm’s Diversity Committee. Ms. Applebaum’s steel equity research has won many accolades

and awards, including repeated top ratings from Institutional Investor Magazine and Greenwich Research Associates. Previously,

Ms. Applebaum served as a director of Northwest Pipe Company (NASDAQ: NWPX), the largest manufacturer of engineered steel pipe

water systems in North America, from September 2014 to June 2020. Ms. Applebaum was also previously employed by Lake Forest College

as Adjunct Faculty from 2010 until 2014 and became trustee of the college in 2015. She has also been a frequent contributor to

Bloomberg, WSJ, CNBC, Washington Post and other financial news outlets. Ms. Applebaum has been a National Association of Corporate

Directors Board Leadership Fellow, has been profiled in Boardroom Insider magazine and is a frequent speaker at conferences regarding

shareholder engagement, disclosure and other matters relevant to public companies. Ms. Applebaum holds a Bachelor of Arts degree

in Economics from Northwestern University and an MBA in finance/accounting from the Kellogg School of Management at Northwestern

University.

Land & Buildings

believes that Ms. Applebaum’s 30+ years’ experience and expertise working in capital markets and advising CEOs, as

well as her significant leadership experience working at a senior level in a large multinational company, makes her well-qualified

to serve on the Board.

Mark A. Filler,

age 60, currently serves as Chief Executive Officer of Apex National Real Estate LLC, a real estate company that buys, rehabs,

and sells small residential properties, since he founded the company in June 2017. Previously, Mr. Filler served as Managing Director

at Guaranteed Rate Inc., a residential mortgage company, from October 2019 to November 2020, as a consultant to Towne Mortgage

Company, a residential mortgage company, from June 2018 to October 2019, and as Chief Executive Officer of Jordan Capital Finance,

LLC (f/k/a Hilco Real Estate Finance, LLC), a lender to residential rehab investors, from when he founded the company in 2012 until

its sale to a portfolio company of The Blackstone Group in January 2017, and he served as its President from January 2017 to February

2017. Prior to that, Mr. Filler served as President and Chief Executive Officer of Prospect Mortgage Company, a retail mortgage

company, from when he founded the company in 2006 to 2012, as Executive Vice President, Mergers and Acquisitions at American Home

Mortgage Corp. (formerly NYSE: AHM), a retail mortgage lender, from 2002 to 2006, as Co-Founder of Oasis Legal Finance, LLC, a

legal funding company, from 2002 to 2003, and as Co-Founder, Chief Executive Officer and President of Prism Financial Corporation

(formerly NASDAQ: PRFN), a financial services company, from 1994 to 2001, including through its initial public offering and its

sale to Royal Bank of Canada. Mr. Filler served on the boards of directors of Towne Mortgage Company from June 2018 to October

2019, Prospect Mortgage Company from 2006 to 2012, and Prism Financial Corporation, a financial services company, from 1994 to

2001. Mr. Filler received a Bachelor of Arts in Political Science from the University of Michigan and a Juris Doctorate from Harvard

Law School.

Land & Buildings

believes Mr. Filler’s extensive executive experience in the real estate industry and his prior board service would make him

a valuable addition to the Board.

Gregory F. Hughes,

age 57, has served as Principal of Roscommon Capital Limited Partnership, a financial advisory and investment firm, since he founded

it in 2011. Previously, Mr. Hughes served as an instructor at the NYU Schack Institute of Real Estate, a school for continuing

education, during 2013. Prior to that, Mr. Hughes served as Chief Operating Officer of SL Green Realty Corp (NYSE: SLG), a real

estate investment trust, from 2007 to 2010, and as its Chief Financial Officer from 2004 to 2010, as Chief Credit Officer of Gramercy

Property Trust Inc. (formerly NYSE: GPT) (“GPT”), a global investor and asset manager of commercial real estate, from

2004 to 2008, and as Chief Financial Officer and Managing Director of the private equity real estate group at JP Morgan Partners,

a private equity division of JPMorgan Chase & Co. (NYSE: JPM), from 2002 to 2003. Earlier in his career, Mr. Hughes served

as Partner and Chief Financial Officer of Fortress Investment Group LLC, an investment and asset management firm, from 1999 to

2002, and as Chief Financial Officer of Wellsford Residential Property Trust (formerly NYSE: WRP) and Wellsford Real Properties,

Inc. (formerly AMEX: WRP), a real estate merchant banking firm, from 1992 to 1999. Mr. Hughes served on the board of trustees of

Gramercy Property Trust, a real estate investment trust, from December 2015 to October 2018. Mr. Hughes served on the boards of

directors of New York REIT, Inc. (formerly NYSE: NYRT), a real estate investment trust, from October 2016 to January 2017, and

GPT, from December 2012 to December 2015, prior to its merger with Chambers Street Properties (formerly NYSE: CSG) when it became

Gramercy Property Trust. Mr. Hughes received a Bachelor of Science in Accounting from the University of Maryland. Mr. Hughes is

a Certified Public Accountant.

Land & Buildings

believes Mr. Hughes’ deep expertise in real estate investment and accounting, and his public board experience, well qualify

him to serve on the Board.

Jonathan Litt,

age 57, is the Founder and Chief Investment Officer of L&B Management, a registered investment advisor specializing in publicly

traded real estate and real estate related securities, which he founded in 2008. Prior to founding L&B Management, Mr. Litt

was Managing Director and Senior Global Real Estate Analyst at Citigroup, where he was responsible for Global Property Investment

Strategy, coordinating a 44-person team of research analysts located across 16 countries. Mr. Litt previously served on the Board

of Directors of Taubman Centers, Inc. (NYSE: TCO), an S&P MidCap 400 Real Estate Investment Trust engaged in the ownership,

management and/or leasing of regional, super-regional and outlet shopping centers in the U.S. and Asia, from May 2018 to May 2019.

He has served as a director of the Children with Dyslexia Scholarship Fund since 1998 and Land & Buildings Offshore Fund, Ltd.

since 2008. Mr. Litt previously served as a director of Mack-Cali Realty Corporation (NYSE: CLI), a leading owner, manager, and

developer of office and class A residential real estate throughout the Northeast, from March 2014 to August 2016. Mr. Litt holds

a Bachelor of Arts degree in Economics from Columbia University and a Master of Finance degree from New York University's Stern

School of Business.

Land & Buildings

believes that Mr. Litt is well-qualified to serve as a director of the Company given his extensive experience as a director, his

lengthy history in the real estate investment industry, and his expertise gained as Founder and Chief Investment Officer of L&B

Management.

Each Nominee is

a citizen of the United States of America.

The principal business

address of Ms. Applebaum is 1525 Lake Cook Road, #312, Deerfield, Illinois 60015. The principal business address of Mr. Filler

is 226 Prospect Ave., Highland Park, Illinois 60035. The principal business address of Mr. Hughes is 2000 South Ocean Blvd., #504,

Delray Beach, Florida 33483. The principal business address of Mr. Litt is c/o Land & Buildings Investment Management, LLC,

1 Landmark Square, 11th Floor, Stamford, Connecticut 06901.

As of the date hereof,

Mr. Litt does not directly own any securities of the Company and has not entered into any transactions in securities of the Company

during the past two years. Mr. Litt, as the Managing Principal of L&B Management, which is the investment manager of L&B

Capital and L&B Opportunity, and is the investment advisor of certain accounts managed by L&B Management (the “Managed

Accounts”), may be deemed to beneficially own the (i) 178,668 shares of Common Stock beneficially owned directly by L&B

Capital, (ii) 30,113 shares of Common Stock beneficially owned directly by L&B Opportunity and (iii) 480,749 shares of Common

Stock held in the Managed Accounts. For information regarding transactions in securities of the Company during the past two years

by L&B Capital, L&B Opportunity and L&B Management through the Managed Accounts, please see Schedule I.

As of the date hereof,

none of the Nominees other than Mr. Litt beneficially owns any securities of the Company and no such Nominee has entered into any

transactions in the securities of the Company during the past two years. Each Nominee may be deemed to be a member of a “group”

with the other Participants for the purposes of Section 13(d)(3) of the Exchange Act, and such group may be deemed to beneficially

own the 689,530 shares of Common Stock beneficially owned in the aggregate by all of the Participants. Each Nominee disclaims beneficial

ownership of the shares of Common Stock that he or she does not directly own.

Land & Buildings

believes that each Nominee presently is, and if elected as a director of the Company, each Nominee would qualify as, an “independent

director” within the meaning of (i) applicable New York Stock Exchange (“NYSE”) listing standards applicable

to board composition, including NYSE Listed Company Manual Section 303.A, and (ii) Section 301 of the Sarbanes-Oxley Act of 2002.

Notwithstanding the foregoing, Land & Buildings acknowledges that no director of a NYSE listed company qualifies as “independent”

under the NYSE listing standards unless the board of directors affirmatively determines that such director is independent under

such standards. Accordingly, Land & Buildings acknowledges that if any Nominee is elected, the determination of the Nominee’s

independence under the NYSE listing standards ultimately rests with the judgment and discretion of the Board. No Nominee is a member

of the Company’s compensation, nominating or audit committee that is not independent under any such committee’s applicable

independence standards.

L&B Management

entered into a letter agreement with each of the Nominees other than Mr. Litt, pursuant to which it has agreed to indemnify such

Nominees against claims arising from the solicitation of proxies from the Company’s shareholders in connection with the Annual

Meeting and any related transactions. For the avoidance of doubt, such indemnification does not apply to any claims made against

a Nominee in his or her capacity as a director of the Company, if so elected.

Other than as stated

herein, and except for compensation received by Mr. Litt as an employee of Land & Buildings, there are no arrangements or understandings

between members of Land & Buildings and any of the Nominees or any other person or persons pursuant to which the nomination

of the Nominees described herein is to be made, other than the consent by each of the Nominees to be named in this Proxy Statement

and to serve as a director of the Company if elected as such at the Annual Meeting. None of the Nominees is a party adverse to

the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material

pending legal proceedings.

We do not expect

that the Nominees will be unable to stand for election, but, in the event any Nominee is unable to serve or for good cause will

not serve, the shares of Common Stock represented by the enclosed GOLD proxy card will be voted for substitute nominee(s),

to the extent this is not prohibited under the Bylaws and applicable law. In addition, we reserve the right to nominate substitute

person(s) if the Company makes or announces any changes to the Bylaws or takes or announces any other action that has, or if consummated

would have, the effect of disqualifying any Nominee, to the extent this is not prohibited under the Bylaws and applicable law.

In any such case, we would identify and properly nominate such substitute nominee(s) in accordance with the Bylaws and shares of

Common Stock represented by the enclosed GOLD proxy card will be voted for such substitute nominee(s). We reserve the right

to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases

the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional

nominations made pursuant to the preceding sentence are without prejudice to the position of Land & Buildings that any attempt

to increase the size of the current Board or to reconstitute or reconfigure the classes on which the current directors serve, constitutes

an unlawful manipulation of the Company’s corporate machinery.

While we currently intend to vote all of the Land & Buildings

Group Shares “FOR ALL” our Nominees, we reserve the right to vote some or all of the Land & Buildings Group

Shares for some or all of the Company’s director nominees, as we see fit, in order to achieve a Board composition that we

believe is in the best interest of all shareholders. We would only intend to vote some or all of the Land & Buildings Group

Shares for some or all of the Company’s director nominees in the event it were to become apparent to us, based on the projected

voting results at such time, that less than all of our Nominees would be elected at the Annual Meeting and that by voting the Land

& Buildings Group Shares we could help elect Monmouth nominees that we believe are the most qualified to serve as directors

and thus help achieve a Board composition that we believe is in the best interest of all shareholders. Shareholders should understand,

however, that all shares of Common Stock represented by the enclosed GOLD proxy card will be voted at the Annual Meeting

as marked.

WE STRONGLY URGE

YOU TO VOTE “FOR ALL” THE NOMINEES USING THE ENCLOSED GOLD PROXY CARD.

PROPOSAL NO. 2

RATIFICATION

OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2021

As discussed in

further detail in the Company’s proxy statement, the Company has proposed that the shareholders ratify the Audit Committee’s

appointment of PKF O’Connor Davies, LLP as the Company’s independent registered public accounting firm for the fiscal

year ending September 30, 2021. Additional information regarding this proposal is contained in the Company’s proxy statement.

WE MAKE NO RECOMMENATION

WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

PROPOSAL NO. 3

ADVISORY

VOTE ON NAMED EXECUTIVE OFFICERS’ COMPENSATION

As discussed in

further detail in the Company’s proxy statement, the Company is providing shareholders with the opportunity to cast a non-binding,

advisory vote on the compensation that was paid to the Company’s Named Executive Officers in fiscal 2019 as described in

the “Compensation Discussion and Analysis” set forth in the Company’s proxy statement, including the compensation

tables and the narrative disclosures that accompany those tables. Accordingly, the Company is asking shareholders to vote for the

following resolution:

“RESOLVED,

that the shareholders approve, on an advisory basis, the compensation of the Corporation’s Named Executive Officers, as set

forth in the Company’s proxy statement.”

As discussed in the Company’s proxy

statement, the results of this advisory vote are not binding on the Compensation Committee of the Board, the Company or the Board,

but the Board values input from our shareholders and will consider carefully the results of this vote when making future decisions

concerning executive compensation.

[WE MAKE NO RECOMMENDATION

WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES [“FOR”/”AGAINST”/“ASBSTAIN” ON]

THIS PROPOSAL.]

PROPOSAL NO. 4

ADVISORY

VOTE ON THE DECLASSIFICATION OF THE BOARD

On December 29,

2020, Land & Buildings submitted a non-binding business proposal to the Company for approval by shareholders at the Annual

Meeting to request the Board to take all necessary steps in its power to declassify the Board so that all directors are elected

on an annual basis commencing at the next annual meeting of shareholders after the Annual Meeting.

Currently, the Board

is divided into three classes, with directors serving staggered three-year terms. Land & Buildings believes that the election

of directors is the most powerful way that shareholders can influence the strategic direction of a public company, and the annual

election of all directors is critical to maintaining director and management accountability to shareholders and to good corporate

governance in line with generally accepted best practices. Land & Buildings is submitting the Board Declassification Proposal

because it believes that the classification of the Board is not in the best interests of the Company and its shareholders, and

that the annual election of directors would serve to increase director and management accountability and improve overall corporate

governance at the Company, which will in turn help incentivize the creation and protection of shareholder value at the Company.

Accordingly, we are asking shareholders to vote in favor of the following resolution:

“RESOLVED,

that the shareholders of Monmouth Real Estate Investment Corporation (the “Company”) request that the Board of Directors

of the Company (the “Board”) take all necessary steps in its power to declassify the Board so that all directors are

elected on an annual basis commencing at the next annual meeting of shareholders. Such declassification shall be completed in a

manner that does not affect the unexpired terms of the previously elected directors.”

This proposal is

non-binding on the Company. If shareholders vote to approve this proposal at the Annual Meeting, however, we would expect the Company

to seriously consider the views of its shareholders in determining whether to implement this proposal.

WE

RECOMMEND YOU VOTE “FOR” this PROPOSAL using the enclosed gold proxy card.

VOTING AND PROXY

PROCEDURES

Shareholders are

entitled to one vote for each share of Common Stock held of record on the Record Date with respect to each matter to be acted on

at Annual Meeting. Only shareholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting.

Shareholders who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record

Date) may not vote such shares of Common Stock. Shareholders of record on the Record Date will retain their voting rights in connection

with the Annual Meeting even if they sell such shares of Common Stock after the Record Date. Based on publicly available information,

Land & Buildings believes that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting

is the Common Stock.

Shares of Common

Stock represented by properly executed GOLD proxy cards will be voted at the Annual Meeting as marked and, in the absence

of specific instructions, will be voted FOR ALL the Nominees, FOR the ratification of PKF O’Connor Davies,

LLP as the Company’s registered public accounting firm for the fiscal year ending September 30, 2021, [FOR/AGAINST/ABSTAIN]

on the approval of the non-binding advisory resolution on the compensation of the Company’s executive officers for the fiscal

year ended September 30, 2020, and FOR the non-binding proposal to request that the Board declassify the Board, as described

herein, and in the discretion of the persons named as proxies on all other matters as may properly come before the Annual Meeting,

as described herein.

According to the

Company’s proxy statement for the Annual Meeting, the current Board intends to nominate four candidates for election as directors

at the Annual Meeting. This Proxy Statement is soliciting proxies to elect only our Nominees. Accordingly, the enclosed GOLD

proxy card may only be voted for our Nominees and does not confer voting power with respect to the Company’s nominees.

QUORUM; BROKER NON-VOTES; DISCRETIONARY

VOTING

A quorum is the

minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally

conduct business at the meeting. For the Annual Meeting, shareholders entitled to cast a majority of all the votes entitled to

be cast at the Annual Meeting, present in person or by proxy, shall constitute a quorum.

Abstentions and

broker “non-votes” will be counted as present and entitled to vote for purposes of determining a quorum. A broker “non-vote”

results when a bank, broker or other nominee who holds shares for another person has not received voting instructions from the

owner of the shares and, under the applicable rules, does not have discretionary authority to vote on a matter.

If you are a

stockholder of record, you must vote by Internet or vote by telephone, deliver your vote by mail, or attend the Annual

Meeting in person and vote in order to be counted in the determination of a quorum.

If your shares of

Common Stock are held in the name of your broker, a bank or other nominee, that party will give you instructions for voting your

shares. If you do not give instructions to your bank or brokerage firm, it will not be allowed to vote your shares of Common Stock

with respect to any of the proposals to be presented at the Annual Meeting. In the absence of voting instructions, shares of Common

Stock subject to such so-called broker non-votes will not be counted as voted on those proposals and so will have no effect on

the vote. Accordingly, we encourage you to vote promptly, even if you plan to attend the Annual Meeting.

VOTES REQUIRED FOR APPROVAL

Election of Directors

─ The Company has adopted a plurality vote standard for director elections. The four directors receiving the highest number

of affirmative votes will be elected as directors of the Company. “Withhold” votes and broker non-votes are not considered

votes cast for the foregoing purpose, and will have no effect on the election of the Nominees.

Ratification

of Appointment of Independent Registered Public Accounting Firm ─ According to the Company’s proxy statement, a

majority of the votes cast in person or by proxy at the Annual Meeting, assuming a quorum is present, is required to ratify the

appointment of PKF O’Connor Davies, LLP as the Company’s independent registered public accounting firm for the fiscal

year ending September 30, 2021. Abstentions and broker non-votes are not considered votes cast, and will have no effect on the

vote for this proposal.

Advisory Resolution

to Approve Executive Compensation ─ According to the Company’s proxy statement, the affirmative vote of a majority

of the votes cast on this proposal at the Annual Meeting will be required to approve the advisory resolution on executive compensation.

Abstentions and broker non-votes are not considered votes cast, and will have no effect on the vote for this proposal.

Non-Binding Proposal

to Declassify the Board ─ Although the vote is non-binding, assuming that a quorum is present, the affirmative vote of

a majority of the votes cast on this proposal at the Annual Meeting will be required to approve the Board Declassification Proposal.

Abstentions and broker non-votes are not considered votes cast, and will have no effect on the vote for this proposal.

Under applicable

Maryland law, none of the holders of Common Stock is entitled to appraisal rights in connection with any matter to be acted on

at the Annual Meeting. If you sign and submit your GOLD proxy card without specifying how you would like your shares voted,

your shares will be voted in accordance with Land & Buildings’ recommendations specified herein and in accordance with

the discretion of the persons named on the GOLD proxy card with respect to any other matters that may be voted upon at the

Annual Meeting.

REVOCATION OF PROXIES

You may change your

vote or revoke your proxy at any time prior to its exercise by attending the Annual Meeting and voting in person (although attendance

at the Annual Meeting will not in and of itself constitute revocation of a proxy), by voting again by telephone or through the

Internet, by delivering a written notice of revocation, or by signing and delivering a subsequently dated proxy which is properly

completed. A written notice of revocation may be delivered either to Land & Buildings in care of Innisfree at the address set

forth on the back cover of this Proxy Statement or to the Company at Bell Works, 101 Crawfords Corner Road, Suite 1405, Holmdel,

New Jersey 07733 or any other address provided by the Company. Although a revocation is effective if delivered to the Company,

we request that either the original or photostatic copies of all revocations be mailed to Land & Buildings in care of Innisfree

at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately

determine if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding

shares of Common Stock. Additionally, Innisfree may use this information to contact shareholders who have revoked their proxies

in order to solicit later dated proxies for the election of the Nominees.

IF YOU WISH TO

VOTE FOR ALL OF THE NOMINEES, PLEASE FOLLOW THE INSTRUCTIONS TO VOTE BY INTERNET OR BY TELEPHONE ON THE ENCLOSED GOLD PROXY CARD.

ALTERNATIVELY, IF YOU DO NOT HAVE ACCESS TO THE INTERNET OR A TOUCH-TONE TELEPHONE, PLEASE SIGN, DATE AND RETURN THE ENCLOSED GOLD

PROXY CARD TODAY IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION OF

PROXIES

The solicitation

of proxies pursuant to this Proxy Statement is being made by Land & Buildings. Proxies may be solicited by mail, facsimile,

telephone, telegraph, electronic mail, in person and by advertisements. Solicitations may also be made by certain of the respective

directors, officers, members and employees of Land & Buildings, none of whom will, except as described elsewhere in this Proxy

Statement, receive additional compensation for such solicitation. The Nominees may make solicitations of proxies but, except as

described herein, will not receive compensation for acting as director nominees.

Members of Land

& Buildings have entered into an agreement with Innisfree for solicitation and advisory services in connection with this solicitation,

for which Innisfree will receive a fee not to exceed $_______, together with reimbursement for its reasonable out-of-pocket expenses,

and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws.

Innisfree will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. Land & Buildings

has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the

beneficial owners of the shares of Common Stock they hold of record. Land & Buildings will reimburse these record holders for

their reasonable out-of-pocket expenses in so doing. It is anticipated that Innisfree will employ approximately ___ persons to

solicit shareholders for the Annual Meeting.

The entire expense

of soliciting proxies is being borne by Land & Buildings. Land & Buildings estimates that through the date hereof its expenses

in furtherance of, or in connection with, this solicitation are approximately $_____. Costs of this solicitation of proxies are

currently estimated to be up to $_______ (including, but not limited to, fees for attorneys, solicitors and other advisors, and

other costs incidental to the solicitation). The actual amount could be higher or lower depending on the facts and circumstances

arising in connection with the solicitation. Land & Buildings intends to seek reimbursement from the Company of all expenses

it incurs in connection with this solicitation. Land & Buildings does not intend to submit the question of such reimbursement

to a vote of security holders of the Company.

ADDITIONAL PARTICIPANT

INFORMATION

The participants in the

solicitation are anticipated to be L&B Capital, a Delaware limited partnership, L&B Opportunity, a Delaware limited liability

company, L&B GP, a Delaware limited partnership, L&B Management, a Delaware limited liability company, Mr. Litt and the

other Nominees (each, a “Participant” and collectively, the “Participants”).

The address of the

principal office of L&B Capital, L&B Opportunity, L&B GP, L&B Management and Mr. Litt is 1 Landmark Square, 7th

Floor, Stamford, Connecticut 06901.

The principal business

of each of L&B Capital and L&B Opportunity is serving as a private investment fund. The principal business of L&B GP

is serving as the general partner of L&B Capital. The principal business of L&B Management is serving as the investment

manager of each of L&B Capital and L&B Opportunity and as the investment advisor of the Managed Accounts. The principal

occupation of Mr. Litt is serving as the Managing Principal of L&B Management.

As of the date hereof,

L&B Capital directly owns 178,668 shares of Common Stock. As of the date hereof, L&B Opportunity directly owns 30,113 shares

of Common Stock. As of the date hereof, 480,749 shares of Common Stock were held in the Managed Accounts. L&B GP, as the general

partner of L&B Capital, may be deemed the beneficial owner of an aggregate of 178,668 shares of Common Stock owned by L&B

Capital. L&B Management, as the investment manager of each of L&B Capital and L&B Opportunity, and as the investment

advisor of the Managed Accounts, may be deemed the beneficial owner of an aggregate of 689,530 shares of Common Stock owned by

L&B Capital and L&B Opportunity and held in the Managed Accounts. Mr. Litt, as the managing principal of L&B Management,

which is the investment manager of each of L&B Capital and L&B Opportunity, and the investment advisor of the Managed Accounts,

may be deemed the beneficial owner of an aggregate of 689,530 shares of Common Stock owned by L&B Capital and L&B Opportunity

and held in the Managed Accounts.

The shares of Common

Stock owned directly by L&B Capital and L&B Opportunity and held in the Managed Accounts were purchased with working capital

(which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business).

For information

regarding purchases and sales of securities of the Company during the past two years by each of the Participants, see Schedule

I.

As disclosed elsewhere

herein, each Participant may be deemed to be a member of a “group” with the other Participants for the purposes of

Section 13(d)(3) of the Exchange Act, and such group may be deemed to beneficially own the 689,530 shares of Common Stock beneficially

owned in the aggregate by all of the Participants. Each Participant disclaims beneficial ownership of the shares of Common Stock

that he, she or it does not directly own.

L&B Management,

as the investment manager of L&B Capital and L&B Opportunity and the investment advisor of the Managed Accounts, is entitled

to receive certain management fees and performance-related fees with respect to the shares of Common Stock owned by each of L&B

Capital and L&B Opportunity and held in the Managed Accounts. Mr. Litt, as the Managing Principal of L&B Management, is

entitled to receive certain management fees and performance-related fees paid to L&B Management with respect to the shares

of Common Stock owned by each of L&B Capital and L&B Opportunity and held in the Managed Accounts.

Except as otherwise

set forth in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no Participant has been convicted

in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no Participant directly or indirectly beneficially

owns any securities of the Company; (iii) no Participant owns any securities of the Company which are owned of record but not beneficially;

(iv) no Participant has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase

price or market value of the securities of the Company owned by any Participant is represented by funds borrowed or otherwise obtained

for the purpose of acquiring or holding such securities; (vi) no Participant is, or within the past year was, a party to any contract,

arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint

ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits,

or the giving or withholding of proxies; (vii) no associate of any Participant owns beneficially, directly or indirectly, any securities

of the Company; (viii) no Participant owns beneficially, directly or indirectly, any securities of any parent or subsidiary of

the Company; (ix) no Participant or any of his, her or its associates was a party to any transaction, or series of similar transactions,

since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of

similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds

$120,000; (x) no Participant or any of his, her or its associates has any arrangement or understanding with any person with respect

to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any

of its affiliates will or may be a party; (xi) no Participant has a substantial interest, direct or indirect, by securities holdings

or otherwise in any matter to be acted on at the Annual Meeting; (xii) no Participant holds any positions or offices with the Company;

(xiii) no Participant has a family relationship with any director, executive officer, or person nominated or chosen by the Company

to become a director or executive officer; and (xiv) no companies or organizations, with which any of the Participants has been

employed in the past five years, is a parent, subsidiary or other affiliate of the Company. There are no material proceedings to

which any Participant or any of his, her or its associates is a party adverse to the Company or any of its subsidiaries or has

a material interest adverse to the Company or any of its subsidiaries. With respect to each of the Participants, none of the events

enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past 10 years.

CERTAIN OTHER MATTERS

Land & Buildings

is unaware of any other matters to be considered at the Annual Meeting. However, should other matters, which Land & Buildings

is not aware of a reasonable time before this solicitation, be brought before the Annual Meeting, the persons named as proxies

on the enclosed GOLD proxy card will vote on such matters in their discretion.

Some banks, brokers

and other nominee record holders may be participating in the practice of “householding” proxy statements and annual

reports. This means that only one copy of this Proxy Statement may have been sent to multiple shareholders in your household. We

will promptly deliver a separate copy of the document to you if you contact our proxy solicitor, Innisfree, at the following address

or phone number: 501 Madison Avenue, 20th Floor, New York, New York 10022 or call toll free at (877) 456-3507. If you want to receive

separate copies of our proxy materials in the future, or if you are receiving multiple copies and would like to receive only one

copy for your household, you should contact your bank, broker or other nominee record holder, or you may contact our proxy solicitor

at the above address or phone number.

The information

concerning the Company and the proposals in the Company’s proxy statement contained in this Proxy Statement has been taken

from, or is based upon, publicly available documents on file with the SEC and other publicly available information. Although we

have no knowledge that would indicate that statements relating to the Company contained in this Proxy Statement, in reliance upon

publicly available information, are inaccurate or incomplete, to date we have not had access to the books and records of the Company,

were not involved in the preparation of such information and statements and are not in a position to verify such information and

statements. All information relating to any person other than the Participants is given only to the knowledge of Land & Buildings.

This Proxy Statement

is dated ___________, 2021. You should not assume that the information contained in this Proxy Statement is accurate as of any

date other than such date, and the mailing of this Proxy Statement to shareholders shall not create any implication to the contrary.

SHAREHOLDER

PROPOSALS

According to the

Company’s proxy statement, shareholders interested in presenting a proposal for inclusion in the Company’s proxy statement

for the 2022 annual meeting of shareholders may do so by following the procedures in Rule 14a-8 under the Exchange Act. To be eligible

for inclusion in the Company’s proxy statement, shareholder proposals must be received at the Company’s principal executive

offices by ___________.

According to the

Company’s proxy statement, nominations of individuals for election to the Board and the proposal of other business to be

considered by shareholders at the Company’s 2022 annual meeting of shareholders, but not included in the Company’s

proxy statement, may be made by a person who is a shareholder of record at the time of giving notice and at the time of the Meeting,

who delivers notice along with the additional information and materials required by the Company’s current Bylaws to the Company’s

Secretary at the Company’s principal executive offices not earlier than ___________ and not later than ___________. However,

in the event that the 2022 annual meeting of shareholders is advanced more than 30 days or delayed by more than 60 days from the

first anniversary of the date of the Annual Meeting, notice by the shareholder to be timely must be received no earlier than the

120th day prior to the date of the mailing of the notice for such annual meeting and not later than the close of business on the

later of the 90th day prior to the date of the mailing of the notice for such annual meeting or the 10th day following the day

on which public announcement of the date of the mailing of the notice of such meeting is first made.

The information

set forth above regarding the procedures for submitting shareholder proposals for consideration at the 2022 annual meeting of shareholders

is based on information contained in the Company’s proxy statement. The incorporation of this information in this proxy statement

should not be construed as an admission by Land & Buildings that such procedures are legal, valid or binding.

ADDITIONAL

INFORMATION

WE HAVE OMITTED FROM

THIS PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS EXPECTED TO BE INCLUDED IN THE COMPANY’S PROXY

STATEMENT RELATING TO THE ANNUAL MEETING BASED ON RELIANCE ON RULE 14A-5(C). THIS DISCLOSURE IS EXPECTED TO INCLUDE, AMONG OTHER

THINGS, CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY’S DIRECTORS, INFORMATION CONCERNING EXECUTIVE COMPENSATION, SECTION

16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE OF THE COMPANY’S DIRECTORS, RELATED PERSON TRANSACTIONS AND GENERAL INFORMATION

CONCERNING THE COMPANY’S ADMINISTRATION AND INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. SEE SCHEDULE II FOR INFORMATION

REGARDING PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF THE SHARES AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND MANAGEMENT

OF THE COMPANY.

LAND & BUILDINGS CAPITAL GROWTH

FUND, LP

Dated: ___________, 2021

SCHEDULE I

TRANSACTIONS IN

SECURITIES OF the Company

DURING THE PAST TWO YEARS

|

Nature of the Transaction

|

Amount of Securities Purchased/(Sold)

|

Date of Purchase/Sale

|

LAND & BUILDINGS

CAPITAL GROWTH FUND, LP

|

Purchase of Common Stock

|

4,050

|

12/14/2020

|

|

Purchase of Common Stock

|

11,080

|

12/14/2020

|

|

Purchase of Common Stock

|

43,179

|

12/15/2020

|

|

Purchase of Common Stock

|

24,057

|

12/16/2020

|

|

Purchase of Common Stock

|

8,474

|

12/17/2020

|

|

Purchase of Common Stock

|

31,508

|

12/18/2020

|

|

Short Sale of Common Stock

|

(35,917)

|

12/21/2020

|

|

Purchase of Common Stock

|

46,152

|

12/23/2020

|

|

Purchase of Common Stock

|

18,348

|

12/24/2020

|

|

Sale of Common Stock

|

(8,180)

|

12/31/2020

|

LAND & BUILDINGS

REAL ESTATE OPPORTUNITY FUND, LP 4

|

Purchase of Common Stock

|

5,471

|

12/14/2020

|

|

Purchase of Common Stock

|

14,968

|

12/14/2020

|

|

Short Sale of Common Stock

|

(5,986)

|

12/21/2020

|

|

Short Sale of Common Stock

|

(14,453)

|

12/21/2020

|

L&B OPPORTUNITY

FUND, LLC

|

Purchase of Common Stock

|

626

|

12/14/2020

|

|

Purchase of Common Stock

|

1,713

|

12/14/2020

|

|

Purchase of Common Stock

|

6,675

|

12/15/2020

|

|

Purchase of Common Stock

|

3,719

|

12/16/2020

|

|

Purchase of Common Stock

|

1,310

|

12/17/2020

|

|

Purchase of Common Stock

|

4,870

|

12/18/2020

|

|

Short Sale of Common Stock

|

(5,550)

|

12/21/2020

|

|

Purchase of Common Stock

|

7,098

|

12/23/2020

|

|

Purchase of Common Stock

|

2,822

|

12/24/2020

|

|

Purchase of Common Stock

|

1,280

|

12/31/2020

|

LAND & BUILDINGS INVESTMENT

MANAGEMENT, LLC

(Through the Managed

Accounts)

|

Purchase of Common Stock

|

10,418

|

12/14/2020

|

|

Purchase of Common Stock

|

28,504

|

12/14/2020

|

|

Purchase of Common Stock

|

111,083

|

12/15/2020

|

|

Purchase of Common Stock

|

61,889

|

12/16/2020

|

|

Purchase of Common Stock

|

21,801

|

12/17/2020

|

|

Purchase of Common Stock

|

81,054

|

12/18/2020

|

|

Short Sale of Common Stock

|

(92,365)

|

12/21/2020

|

|

Purchase of Common Stock

|

118,780

|

12/23/2020

|

|

Purchase of Common Stock

|

47,220

|

12/24/2020

|

4 Position held

was subsequently netted on December 31, 2020, in connection with the wind down of the entity.

SCHEDULE II

The following

table is reprinted from the Company’s proxy statement filed with

the Securities and Exchange Commission on _________, 2021.

IMPORTANT

Tell your Board

what you think! Your vote is important. No matter how many shares of Common Stock you own, please give Land & Buildings your