FALSE000183163100018316312024-06-182024-06-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (or date of earliest event reported): June 18, 2024

_____________________

loanDepot, Inc.

(Exact Name of Registrant as Specified in its Charter)

_____________________

| | | | | | | | | | | | | | |

| Delaware | | 001-40003 | | 85-3948939 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

6561 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (888) 337-6888

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.001 Par Value | | LDI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive Agreement.

On June 18, 2024, the previously announced offer to exchange (the “Exchange Offer”) any and all of the outstanding 6.500% Senior Notes due 2025 (the “Old Notes”) issued by LD Holdings Group LLC (the “Issuer”), a subsidiary of loanDepot, Inc. (the “Company”), for newly issued 8.750% Senior Secured Notes due 2027 (the “New Notes”) and cash, expired. In conjunction with the Exchange Offer the Issuer also solicited consents (the “Consent Solicitation”) to eliminate substantially all restrictive covenants and certain of the default provisions, as well as to release the guarantees of the guarantors (“Proposed Amendments”) in the indenture governing the Old Notes. The adoption of the Proposed Amendments required the consents of holders of at least a majority of the outstanding principal amount of the Old Notes (the “Requisite Consents”). As of the Expiration Time, the Issuer had received the Requisite Consents and executed a supplemental indenture (the “Supplemental Indenture”) effecting the Proposed Amendments. The Supplemental Indenture became effective upon execution, and will become operative on the settlement date of the Exchange Offer and the Consent Solicitation.

The foregoing description of the Supplemental Indenture does not purport to be complete and is qualified in its entirety by reference to the full text of the Supplemental Indenture, a copy of which is attached hereto as Exhibit 4.1 and is incorporated herein by reference.

Item 8.01 Other Events.

On June 20, 2024, the Company announced the final tender results in connection with the Exchange Offer. $477,955,000 aggregate principal amount of Old Notes, representing approximately 96.0% of the outstanding Old Notes, were validly tendered and accepted as of the expiration time of the Exchange Offer. The Company will issue $340,646,000 aggregate principal amount of New Notes and, following the settlement date, $19,795,000 aggregate principal amount of Old Notes will remain outstanding. The Company expects the settlement date to occur on or about June 24, 2024. A copy of the press release announcing the final results, which also describes the final results in greater detail, is attached hereto as Exhibit 99.1.

Neither the press release filed herewith nor this Current Report on Form 8-K constitutes an offer to sell or purchase, or a solicitation of an offer to sell or purchase, or the solicitation of tenders or consents with respect to, any security. No offer, solicitation, purchase or sale will be made in any jurisdiction in which such an offer, solicitation or sale would be unlawful.

The Exchange Offer and the issuance of the New Notes have not been and will not be registered with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Securities Act”) or any other applicable securities laws, and, unless so registered, the New Notes may not be offered, sold, pledged or otherwise transferred within the United States or to or for the account of any U.S. person, except pursuant to an exemption from the registration requirements thereof. Accordingly, the New Notes were offered and will be issued only to holders that are (i) “qualified institutional buyers” as defined in Rule 144A under the Securities Act and (ii) persons outside the United States, that are not “U.S. persons” in compliance with Regulation S under the Securities Act and that are not acquiring the New Secured Notes for the account or benefit of a U.S. person. This report does not constitute an offer to sell, or a solicitation of an offer to buy, any security. No offer, solicitation, or sale will be made in any jurisdiction in which such an offer, solicitation, or sale would be unlawful.

Forward Looking Statements

This report contains forward-looking statements that are based on management’s beliefs and assumptions and on information currently available to management. Forward-looking statements include statements that are not historical facts and can be identified by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “will,” “would” or similar expressions and the negatives of those terms.

Forward-looking statements involve known and unknown risks, uncertainties and other factors, such as the satisfaction of the conditions described in the confidential Offering Memorandum and Consent Solicitation Statement (as supplemented), that may cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Given these uncertainties, you should not place undue reliance on forward-looking statements. Also, forward-looking statements represent management’s beliefs and assumptions only as of the date of this report. You should read this report with the understanding that the Company’s actual future results may be materially different from what the Company expects.

Important factors that could cause actual results to differ materially from the Company’s expectations are included in the section entitled “Risk Factors” set forth in the confidential Offering Memorandum and Consent Solicitation Statement and under the caption “Risk Factors” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in the Company’s filings. The Company’s expressly disclaims any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| 4.1 | Supplemental Indenture, dated as of June 18, 2024, by and among LD Holdings Group LLC, the guarantors party thereto and Wilmington Trust, National Association, as trustee, to the Indenture, dated as of October 27, 2020, by and among LD Holdings Group LLC, the guarantors party thereto and Wilmington Trust, National Association, as trustee, related to LD Holdings Group LLC’s 6.500% unsecured senior notes due 2025. |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

loanDepot, Inc. |

| |

By: | /s/ David Hayes | |

Name: David Hayes |

Title: Chief Financial Officer |

Date: June 20, 2024

FIRST SUPPLEMENTAL INDENTURE

FIRST SUPPLEMENTAL INDENTURE dated as of June 18, 2024 (this “Supplemental Indenture”), among LD Holdings Group LLC, a Delaware limited liability company (the “Company”), the guarantors named on the signature pages hereto (the “Guarantors”) and Wilmington Trust, National Association, as trustee (the “Trustee”) under the Indenture referred to below.

W I T N E S S E T H

WHEREAS, each of the Company, the Guarantors and the Trustee have executed and delivered the Indenture, dated as of October 27, 2020 (the “Indenture”), providing for the issuance of an aggregate principal amount of $500,000,000 of 6.500% Senior Notes due 2025 of the Company (the “Notes”) and the guarantee of such Notes issued under the Indenture by the Guarantors (the “Guarantees”);

WHEREAS, Section 9.2 of the Indenture provides that, subject to certain conditions, the Company, the Guarantors and the Trustee may amend, supplement or otherwise modify the Indenture, the Notes or the Guarantees with the consent of the Holders of at least a majority in aggregate principal amount of all the outstanding Notes issued under the Indenture (including consents obtained in connection with a purchase of, tender offer or exchange offer for, the Notes) (such consents, the “Required Consents”);

WHEREAS, the Company has offered to exchange (the “Exchange Offer”) for a combination of up to $423 million aggregate principal amount of the Company’s 8.250% Senior Secured Notes due 2027 and cash, any and all of the outstanding Notes, upon the terms and subject to the conditions set forth in the confidential offering memorandum and consent solicitation statement relating to the Exchange Offer, dated as of May 20, 2024 (as supplemented from time to time, the “Offering Memorandum”);

WHEREAS, in connection with the Exchange Offer, the Company has also solicited the Required Consents (such solicitation, the “Consent Solicitation”) to certain proposed amendments to the Indenture set forth in Articles II and III of this First Supplemental Indenture;

WHEREAS, at or prior to 5:00 p.m., New York City time, on June 18, 2024, the Company received the Required Consents pursuant to the Consent Solicitation;

WHEREAS, the Company has satisfied all conditions precedent provided under the Indenture to enable the Company, the Guarantors and the Trustee to enter into this First Supplemental Indenture, the execution and delivery of this First Supplemental Indenture is authorized or permitted by the Indenture and all other conditions and requirements necessary to make this First Supplemental Indenture, when duly executed and delivered, a valid, binding and enforceable agreement against the Company and the Guarantors in accordance with its terms have been performed and fulfilled, all as certified by an Officer’s Certificate delivered to the Trustee simultaneously with the execution and delivery of this First Supplemental Indenture as contemplated by Sections 9.5 and 12.2 of the Indenture, and (2) the Company has delivered to the Trustee simultaneously with the execution and delivery of this First Supplemental Indenture an Officer’s Certificate and an Opinion of Counsel relating to this First Supplemental Indenture as contemplated by Sections 9.5 and 12.2 of the Indenture;

WHEREAS, the Indenture provides pursuant to Section 9.2 that the Trustee will join the Company and the Guarantors in the execution of any amended or supplemental indenture authorized pursuant to Section 9.2 of the Indenture if the amendment or supplement does not adversely affect the rights, duties, liabilities or immunities of the Trustee under the Indenture or otherwise; and

WHEREAS, the board of directors of the Company and each Guarantor have authorized and approved the execution and delivery of this First Supplemental Indenture.

NOW THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt of which is hereby acknowledged, the Company, the Guarantors and the Trustee mutually covenant and agree for the equal and ratable benefit of the Holders as follows:

ARTICLE I

DEFINITIONS

Section 1.1 Defined Terms. As used in this First Supplemental Indenture, terms defined in the Indenture or in the preamble or recitals hereto are used herein as therein defined. The words “herein,” “hereof” and “hereby” and other words of similar import used in this First Supplemental Indenture refer to this First Supplemental Indenture as a whole and not to any particular Section hereof.

ARTICLE II

CONSENTED AMENDMENTS

Section 2.1 Amendments to Certain Provisions of the Indenture.

(a) The Indenture is hereby amended to delete Section 3.2 (Limitations on Indebtedness), Section 3.3 (Limitation on Restricted Payments), Section 3.4 (Limitation on Restrictions on Distributions from Restricted Subsidiaries), Section 3.5 (Limitation on Sales of Assets and Subsidiary Stock), Section 3.6 (Limitation on Liens), Section 3.7 (Limitation on Guarantees), Section 3.8 (Limitation on Affiliate Transactions), Section 3.9 (Change of Control), Section 3.10 (Reports), paragraphs (a)(2), (a)(3), (c), (d) and (e) of Section 4.1 (Merger and Consolidation), Article X (Guarantee) and Exhibit B (Form of Supplemental Indenture), and all references thereto contained in the Indenture, in their entirety, with such Sections and references having no further force or effect.

(b) The Indenture is hereby amended to delete Sections 6.1(a)(4), 6.1(a)(5), and 6.1(a)(6) (Events of Default), and all references thereto contained in Section 6.1 and elsewhere in the Indenture, in their entirety, and the occurrence of the events described in Sections 6.1(a)(4), 6.1(a)(5), and 6.1(a)(6) shall no longer constitute Events of Default.

(c) The failure to comply with the terms of any of the Sections of the Indenture set forth in clause (a) above shall no longer constitute a Default or an Event of Default under the Indenture and shall no longer have any other consequence under the Indenture.

(d) All definitions set forth in Section 1.1 (Definitions) of the Indenture that relate to defined terms used solely in the Sections deleted by this First Supplemental Indenture are hereby deleted in their entirety.

(e) All references to Sections of the Indenture amended by this First Supplemental Indenture shall be to such Sections as amended by this First Supplemental Indenture.

Section 2.2 Release of Guarantees.

(a) Each of the Guarantors shall be fully and unconditionally released from its Guarantee and all references thereto, including through the terms: Guarantors, Guaranteed Obligations,

Other Guarantee and Note Guarantees, contained in the Indenture, in their entirety, shall have no further force or effect.

ARTICLE III

AMENDMENTS TO THE NOTES

Section 3.1 Amendments to Notes. The Notes are hereby amended to delete all provisions inconsistent with the amendments to the Indenture effected by this First Supplemental Indenture.

Section 3.2 Endorsement and Change of Form of Notes. Any Notes authenticated and delivered after the close of business on the date that this First Supplemental Indenture becomes effective may, at the sole discretion of the Company, be affixed to, stamped, imprinted or otherwise legended, with a notation as follows:

“The restrictive covenants of the Company and certain of the Events of Default and other provisions have been eliminated, as provided in the First Supplemental Indenture, dated as of June 18, 2024. Reference is hereby made to said First Supplemental Indenture, copies of which are on file with the Trustee, for a description of the amendments made therein.”

ARTICLE IV

MISCELLANEOUS

Section 4.1 Effectiveness. The provisions of Article II and III of this First Supplemental Indenture shall become effective immediately but shall not become operative until both (i) the Company pays the Total Consideration or the Tender Consideration (each as defined in the Offering Memorandum), as applicable, to Holders who have validly tendered (and not validly withdrawn) Notes (along with the related consents) in accordance with the terms of the Offering Memorandum and (ii) the Company informs the Trustee in writing (which may be by e-mail) that the payment in clause (i) has been made.

Section 4.2 Ratification of Indenture; First Supplemental Indenture Part of Indenture. Except as expressly amended and supplemented hereby, the Indenture is in all respects ratified and confirmed and all the terms, conditions and provisions thereof shall remain in full force and effect. This First Supplemental Indenture shall form a part of the Indenture for all purposes, and every Holder of Notes heretofore or hereafter authenticated and delivered shall be bound hereby.

Section 4.3 Governing Law. THIS FIRST SUPPLEMENTAL INDENTURE SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK, WITHOUT REGARD TO PRINCIPLES OF CONFLICTS OF LAW. EACH OF THE COMPANY, THE GUARANTORS AND THE TRUSTEE HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATING TO THIS FIRST SUPPLEMENTAL INDENTURE, THE INDENTURE, THE NOTES OR THE TRANSACTION CONTEMPLATED HEREBY.

Section 4.4 Severability. In case any provision in this First Supplemental Indenture shall be invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining

provisions shall not in any way be affected or impaired thereby and such provision shall be ineffective only to the extent of such invalidity, illegality or unenforceability.

Section 4.5 Trustee Makes No Representation. The Trustee makes no representation as to the validity or sufficiency of this First Supplemental Indenture or for the recitals contained herein.

Section 4.6 The Trustee. The Trustee shall not be responsible in any manner whatsoever for or in respect of the validity or sufficiency of this First Supplemental Indenture or for or in respect of the recitals contained herein, all of which recitals are made solely by the Company and the Guarantors and the rights, protections and indemnities afforded the Trustee under the Indenture shall apply to any action (or inaction) of the Trustee hereunder or in connection herewith. The Trustee is executing this First Supplemental Indenture and performing hereunder solely in conclusive reliance on (i) the consents and direction of the consenting Holders who together constitute the Required Consents, (ii) the statements and representations of the Company hereunder and in the Officer’s Certificate and (iii) the Opinion of Counsel being delivered in connection herewith.

Section 4.7 Parties. Nothing expressed or mentioned herein is intended or shall be construed to give any Person, firm or corporation, other than the Holders and the Trustee, any legal or equitable right, remedy or claim under or in respect of this First Supplemental Indenture or the Indenture or any provision herein or therein contained.

Section 4.8 Further Assurances. The parties hereto will execute and deliver such further instruments and do such further acts and things as may be reasonably required to carry out the intent and purpose of this First Supplemental Indenture and the Indenture.

Section 4.9 Counterparts.

(a) The parties hereto may sign any number of copies of this First Supplemental Indenture. Each signed copy shall be an original, but all of them together represent the same agreement. The exchange of copies of this First Supplemental Indenture and of signature pages by facsimile or PDF transmission shall constitute effective execution and delivery of this First Supplemental Indenture as to the parties hereto and may be used in lieu of the original First Supplemental Indenture for all purposes. Signatures of the parties hereto transmitted by facsimile or PDF shall be deemed to be their original signatures for all purposes.

(b) The words “execution,” “signed,” “signature,” and words of like import in this First Supplemental Indenture shall include images of manually executed signatures transmitted by facsimile, email or other electronic format (including, without limitation, “pdf,” “tif” or “jpg”) and other electronic signatures (including, without limitation, DocuSign and AdobeSign). The use of electronic signatures and electronic records (including, without limitation, any contract or other record created, generated, sent, communicated, received or stored by electronic means) shall be of the same legal effect, validity and enforceability as a manually executed signature or use of a paper-based record-keeping system to the fullest extent permitted by applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act and any other applicable law, including, without limitation, any state law based on the Uniform Electronic Transactions Act or the Uniform Commercial Code; provided that, notwithstanding anything herein to the contrary, the Trustee is not under any obligation to agree to accept electronic signatures in any form or in any format unless expressly agreed to by the Trustee pursuant to procedures approved by the Trustee.

Section 4.10 Effect of Headings. The headings of the Articles and the Sections in this First Supplemental Indenture are for convenience of reference only and shall not be deemed to alter or affect the meaning or interpretation of any provisions hereof.

Section 4.11 Successors. All agreements of the Company and the Guarantors, as applicable, in this First Supplemental Indenture shall bind its successors. All agreements of the Trustee in the Indenture shall bind its successors.

[Signature page follows]

IN WITNESS WHEREOF, the parties hereto have caused this First Supplemental Indenture to be duly executed as of the date and year first above written.

| | | | | |

| LD HOLDINGS GROUP LLC |

| By: | /s/ Sheila Mayes |

| Name: | Sheila Mayes |

| Title: | Executive Vice President and Treasurer |

GUARANTORS:

| | | | | |

| LOANDEPOT.COM, LLC |

| By: | /s/ Sheila Mayes |

| Name: | Sheila Mayes |

| Title: | Treasurer |

| | | | | |

LD SETTLEMENT SERVICES, LLC By: LD Holdings Group LLC, its sole Member |

| By: | /s/ Sheila Mayes |

| Name: | Sheila Mayes |

| Title: | Executive Vice President and Treasurer |

| | | | | |

| ARTEMIS MANAGEMENT LLC |

| By: | /s/ Sheila Mayes |

| Name: | Sheila Mayes |

| Title: | Treasurer |

| | | | | |

| MELLO HOLDINGS, LLC |

| By: | /s/ Sheila Mayes |

| Name: | Sheila Mayes |

| Title: | Treasurer |

[Signature Page to First Supplemental Indenture]

TRUSTEE:

| | | | | |

| WILMINGTON TRUST, NATIONAL ASSOCIATION, as Trustee |

| By: | /s/ Barry D. Somrock |

| Name: | Barry D. Somrock |

| Title: | Vice President |

[Signature Page to First Supplemental Indenture]

loanDepot Announces Final Results of Exchange Offer

Transaction will Refinance and Extend the Maturity of $477,955,000 of its Senior Notes due 2025

IRVINE, California, June 20, 2024 — (BUSINESS WIRE)—loanDepot, Inc. (NYSE: LDI) (“loanDepot”) announced today the final results of the previously announced offer by its subsidiary LD Holdings Group LLC (the “Issuer”) to exchange any and all of its outstanding 6.500% Senior Notes due 2025 (the “Old Notes”) for newly issued 8.750% Senior Secured Notes due 2027 (“New Notes”).

As of the expiration time of the exchange offer, approximately 96.0% of the Old Notes were tendered and accepted. As a result, the Issuer will pay cash totaling approximately $185 million and issue New Notes in an aggregate principal amount of $340,646,000 in exchange for the tendered Old Notes.

“The successful completion of our exchange offer is an important positive milestone achieved in our Vision 2025 Strategic Plan,” said President and Chief Executive Officer Frank Martell. “Moving forward, we have de-levered our balance sheet and significantly extended our debt maturity profile. At the same time, investments under Vision 2025 in our platforms, products and people position the company for accelerating growth and returning to profitability as the market returns to a healthier state.”

| | | | | | | | | | | | | | |

| Notes to be Exchanged | CUSIP Number | Total Principal Amount Tendered and Accepted | Percent of Old Notes Tendered and Accepted | Tender Consideration(1) |

| 6.500% Senior Notes due 2025 | 521088AA2 (144A) U5140UAA8 (Reg S) | $477,955,000 | 96.0% | $712.94 principal amount of New Notes and $387.06 in cash |

(1) For each $1,000 principal amount of Old Notes. All consideration amounts are approximate amounts and do not reflect the impact of rounding in accordance with the terms described in the Offering Memorandum.

The settlement date for the exchange offer is expected to be June 24, 2024. Following the settlement date, $19,795,000 aggregate principal amount of Old Notes will remain outstanding.

The New Notes will not be registered under the Securities Act of 1933 (“Securities Act”), or any other applicable securities laws and, unless so registered, the New Notes may not be offered, sold, pledged or otherwise transferred within the United States or to or for the account of any U.S. person, except pursuant to an exemption from the registration requirements thereof. Accordingly, the New Notes are being offered and issued only (i) to persons reasonably believed

to be “qualified institutional buyers” (as defined in Rule 144A under the Securities Act) and (ii)

to non-“U.S. persons” who are outside the United States (as defined in Regulation S under the

Securities Act).

The complete terms and conditions of the exchange offer and a related consent solicitation were set forth in the confidential Offering Memorandum and Consent Solicitation Statement dated May 20, 2024, as supplemented by Supplement No.1 to the Offering Memorandum and Consent Solicitation Statement dated June 4, 2024 (together, the “Offering Memorandum”).

This press release is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell the New Notes or any other securities or of consents. The exchange offer and consent solicitation were only made pursuant to the Offering Memorandum. The exchange offer was not made to holders in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction. The New Notes will not be approved or disapproved by any regulatory authority, nor will any such authority pass upon the accuracy or adequacy of the Offering Memorandum.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements that are based on management’s beliefs and assumptions and on information currently available to management. Forward-looking statements include statements that are not historical facts and can be identified by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “will,” “would” or similar expressions and the negatives of those terms.

Forward-looking statements involve known and unknown risks, uncertainties and other factors, such as the satisfaction of the conditions described in the Offering Memorandum, that may cause loanDepot’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Given these uncertainties, you should not place undue reliance on forward-looking statements. Also, forward-looking statements represent management’s beliefs and assumptions only as of the date of this press release. You should read this press release with the understanding that loanDepot’s actual future results may be materially different from what loanDepot expects.

Important factors that could cause actual results to differ materially from loanDepot’s expectations are included in the section entitled “Risk Factors” set forth in the Offering Memorandum and under the caption “Risk Factors” included in loanDepot’s Annual Report on Form 10-K for the year ended December 31, 2023, incorporated by reference into the Offering Memorandum. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in loanDepot’s filings. loanDepot expressly disclaims any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

About loanDepot

loanDepot (NYSE: LDI) is a leading provider of lending solutions that make the American dream of homeownership more accessible and achievable for all, especially the increasingly

diverse communities of first-time homebuyers, through a broad suite of lending and real estate services that simplify one of life’s most complex transactions. Since its launch in 2010, the company has been recognized as an innovator, using its industry-leading technology to deliver a superior customer experience. Our digital-first approach makes it easier, faster and less stressful to purchase or refinance a home. Today, as one of the largest non-bank lenders in the country, loanDepot and its mellohome operating unit offer an integrated platform of lending, loan servicing, real estate and home services that support customers along their entire homeownership journey. Headquartered in Southern California and with hundreds of local market offices nationwide, loanDepot’s passionate team is dedicated to making a positive difference in the lives of their customers every day.

Investor Relations Contact:

Gerhard Erdelji

Senior Vice President, Investor Relations

(949) 822-4074

gerdelji@loandepot.com

Media Contact:

Rebecca Anderson

Senior Vice President, Communications & Public Relations

(949) 822-4024

rebeccaanderson@loandepot.com

Source: loanDepot, Inc.

LDI-IR

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

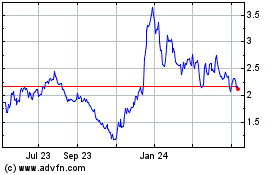

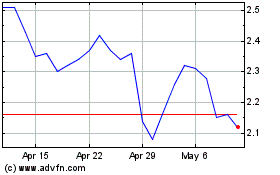

loanDepot (NYSE:LDI)

Historical Stock Chart

From May 2024 to Jun 2024

loanDepot (NYSE:LDI)

Historical Stock Chart

From Jun 2023 to Jun 2024