UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

| | | |

| ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

| | | |

| ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission file number 001-38048

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

Kinetik 401(k) Plan

B. Name of issuer of the securities held pursuant to the plan and the address of this principal executive office:

KINETIK HOLDINGS INC.

2700 Post Oak Boulevard, Suite 300

Houston, Texas 77056-4400

TABLE OF CONTENTS

| | | | | | | | |

| Item | | Page |

| | |

| | |

| Report of Independent Registered Public Accounting Firm | |

| | |

| Financial Statements | |

| Statement of Net Assets Available for Benefits | |

| Statement of Changes in Net Assets Available for Benefits | |

| Notes to Financial Statements | |

| | |

| Supplementary Information | |

| | |

| Schedule H, Line 4i – Schedule of Assets (Held at End of Year) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Report of Independent Registered Public Accounting Firm

To the Plan Participants and the Plan Administrator of the

Kinetik 401(k) Plan

Houston, Texas

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Kinetik 401(k) Plan (the “Plan”) as of December 31, 2022 and 2021, and the related statement of changes in net assets available for benefits for the year ended December 31, 2022, and the related notes and schedule (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2022 and 2021, and the changes in net assets available for benefits for the year ended December 31, 2022, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As a part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for purposes of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The accompanying supplemental schedule of assets (held at end of year) as of December 31, 2022 has been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Calvetti Ferguson

We have served as the Plan's auditor since 2023.

Houston, Texas

June 28, 2023

| | | | | | | | | | | | | | |

Kinetik 401(k) Plan Statements of Net Assets Available for Benefits For the Years ended December 31, 2022 and 2021 (In thousands) |

| | | 2022 | | 2021 |

| | | | |

| ASSETS | | | | |

| | | | |

| Investments, at fair value | | $ | 10,634 | | | $ | 9,381 | |

| | | | |

| Receivables | | | | |

| Employer’s contributions | | 241 | | | — | |

| Participants’ contributions | | 59 | | | — | |

| Notes receivable from participants | | 270 | | | 270 | |

| Total receivables | | 570 | | | 270 | |

| | | | |

| NET ASSETS AVAILABLE FOR BENEFITS | | $ | 11,204 | | | $ | 9,651 | |

See Notes to Financial Statements.

| | | | | | | | | | |

Kinetik 401(k) Plan Statement of Changes in Net Assets Available for Benefits For the Year Ended December 31, 2022 (In thousands)

| | |

| | | 2022 | | |

| | | | |

| | | | |

| ADDITIONS | | | | |

| Investment income | | | | |

| Net depreciation in fair value of investments | | $ | (2,051) | | | |

| Interest and dividends | | 360 | | | |

| Net investment loss | | (1,691) | | | |

| | | | |

| CONTRIBUTIONS | | | | |

| Employer | | 1,888 | | | |

| Participants | | 2,176 | | | |

| Rollovers | | 155 | | | |

| Total contributions | | 4,219 | | | |

| | | | |

| Interest income on notes receivable from participants | | 11 | | | |

| | | | |

| Total additions | | 2,539 | | | |

| | | | |

| DEDUCTIONS | | | | |

| Benefits paid directly to participants | | 978 | | | |

| Administrative expenses | | 8 | | | |

| Total deductions | | 986 | | | |

| | | | |

| Net increase | | 1,553 | | | |

| | | | |

| NET ASSETS AVAILABLE FOR BENEFITS, beginning of year | | 9,651 | | | |

| | | | |

| NET ASSETS AVAILABLE FOR BENEFITS, end of year | | $ | 11,204 | | | |

See Notes to Financial Statements.

KINETIK 401 (K) PLAN

NOTES TO FINANCIAL STATEMENTS

Note 1. Description of the Plan

The following description of the Kinetik 401(k) Plan (the Plan), formerly EagleClaw Midstream 401(k) Plan, provides only general information. Participants should refer to the Plan document for a more complete description of the Plan’s provisions, which is available from Plan management.

General

The Plan is a defined contribution plan covering all full-time employees of Kinetik Holdings, Inc. and its wholly owned subsidiaries (collectively, the Company). BCP Raptor Midco, LLC, a wholly owned subsidiary of Holdco, is the Plan Sponsor. On April 1, 2022, the Plan changed its investment custodian and record keeper from Reliance Trust Company (Reliance) and ADP Retirement to Fidelity Management Trust Company (Fidelity) at the discretion of Plan management. As a result of the change in custodian, the assets of the Plan transferred from Reliance to Fidelity (collectively, the “Custodians”). During 2021 and through March 31, 2022, Reliance served as the sole trustee of the Plan and on April 1, 2022, Fidelity was appointed as the new trustee. The plan was amended and restated and effective April 1, 2022, the employer name was changed to BCP Management Services, and the plan name changed from EagleClaw Midstream, LLC 401(k) Plan to Kinetik 401(k) Plan. The Investment committee is responsible for oversight of the Plan and determining the appropriateness of the Plan's investment offerings and monitoring investment performance. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA).

Contributions

Each year, participants may contribute up to 75 percent of pretax annual compensation, as defined in the Plan. Participants who have attained age 50 before the end of the plan year are eligible to make catch-up contributions. Participants may also designate some of their contributions as after-tax contributions to a Roth 401(k) option. Participants may also contribute amounts representing distributions from other qualified defined benefit or defined contribution plans (rollover). Participants direct the investment of their contributions into various investment options offered by the Plan. The Plan includes an auto-enrollment provision whereby all newly eligible employees are automatically enrolled in the Plan unless they affirmatively elect not to participate in the Plan. Automatically enrolled participants have their deferral rate set at 3 percent of eligible compensation and their contributions invested in a designated balanced fund until changed by the participant.

The Company made non-elective Safe Harbor matching contributions to the Plan in an amount equal to 3 percent of eligible compensation. This contribution is intended to satisfy a safe harbor contribution formula permitted by Internal Revenue Service (IRS) regulations. By making the safe harbor matching contribution, the Plan will automatically satisfy the nondiscrimination requirements that otherwise would apply to 401(k) contributions made by the Plan. In 2022, the Company elected to make a discretionary matching contribution of 2 percent of eligible compensation to eligible participants. The Company contributions are invested as directed by the participant.

Additional profit-sharing amounts may be contributed at the option of the Company. During the year ended December 31, 2022, the Company did not make a profit-sharing contribution to the Plan. Contributions are subject to certain limitations.

Participant Accounts

Each participant’s account is credited with the participant’s contributions and the Company’s contributions, as well as allocations of Plan earnings. Participant accounts may be charged with an allocation of administrative expenses. Allocations are based on participant earnings, account balances, or specific participant transactions, as defined. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Company Stock

Effective April 1, 2022, the Plan permits participants to invest in common stock of the Company. The Plan limits the amount a participant can invest in Company stock, to encourage diversification of participants’ accounts. Participants may direct up to a maximum of 20% of their contributions to Company stock. In addition, a participant may not transfer amounts from other investment funds into Company stock to the extent the transfer would result in more than 20% of the participant’s total account balance being invested in Company stock.

Vesting

Participants are vested immediately in their contributions and employer contributions plus actual earnings thereon. Participants are also fully vested in dividends paid on the portion of their employer matching contributions invested in the Company Stock.

Notes Receivable from Participants

The Plan includes a loan provision that allows for participant loans after satisfying certain conditions. Participants may borrow from their fund accounts a minimum of $500 up to a maximum equal to the lesser of $50,000 or 50% percent of their vested account balance. The loans are secured by the balance in the participant’s account and bear interest at rates commensurate with local prevailing rates as determined by Plan management. Principal and interest is paid ratably through monthly payroll deductions.

Pursuant to the Coronavirus Aid, Relief, and Economic Security Act (the CARES Act) that was signed into law on March 27, 2020, Plan participants could request a delay of note repayments for repayments that occurred between March 27, 2020 and December 31, 2021. The participant’s note was reamortized and included any interest accrued during the period of delay. The ability to request a delay in note repayments under the CARES Act ceased as of December 31, 2021.

Payment of Benefits

Upon separation of service due to death, disability, retirement or termination of employment, a participant may elect to receive either a lump sum amount equal to the value of the participant’s vested interest in his or her account, or installments.

Pursuant to the CARES Act, participants who were currently receiving required minimum distributions were offered the option to waive their 2021 payment and participants who were due to receive the first required distribution in 2021 had their distribution automatically waived. The ability to request special waivers with respect to required minimum distributions under the CARES Act ceased as of December 31, 2021. In addition, the Plan also permits participants to request up to $100,000 in coronavirus-related distributions, with repayment terms of up to three years, in accordance with the CARES Act. The ability to request coronavirus-related distributions under the CARES Act ceased as of December 30, 2021.

Forfeited Accounts

On December 31, 2022 and 2021, there were no forfeited nonvested accounts.

Note 2. Summary of Significant Accounting Policies

Basis of Accounting

The financial statements of the Plan are prepared using the accrual basis of accounting.

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America (US GAAP) requires Plan management to make estimates and assumptions that affect the reported

amounts of assets, liabilities and changes therein, and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

Investment Valuation and Income Recognition

Investments are reported at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Plan’s Administrative Committee determines the Plan’s valuation policies utilizing information provided by the investment advisers, custodians, and insurance company. See Note 3 for discussion of fair value measurements.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded at the ex-dividend date. Net depreciation includes the Plan’s gains and losses on investments bought and sold as well as held during the year.

Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued, but unpaid interest. Interest income is recorded on the accrual basis. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of December 31, 2022 and 2021, respectively.

Payment of Benefits

Benefits are recorded when paid.

Expenses

Certain expenses of maintaining the Plan are paid by the Plan, unless otherwise paid by the Company. Expenses that are paid by the Company are excluded from these financial statements. Investment related expenses are included in net depreciation of fair value of investments.

Plan Management’s Review of Subsequent Events

The Plan has evaluated subsequent events through June 28, 2023, the date the financial statements were available to be issued.

Note 3. Fair Value Measurements

Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 820, Fair Value Measurements and Disclosures, provides the framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy under FASB ASC 820 are described as follows:

| | | | | |

| Level 1 | Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access. |

| |

| Level 2 | Inputs to the valuation methodology include: |

| ◦Quoted prices for similar assets or liabilities in active markets; ◦Quoted prices for identical or similar assets or liabilities in inactive markets; ◦Inputs other than quoted prices that are observable for the asset or liability; and ◦Inputs that are derived principally from or corroborated by observable market data by correlation or other means. |

| |

| If the asset or liability has a specified (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability. |

| |

| Level 3 | Inputs to the valuation methodology are unobservable and significant to the fair value measurement. |

The asset or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

Following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used on December 31, 2022 and 2021.

Mutual funds: Valued at the daily closing price as reported by the fund. Mutual funds held by the Plan are open-end mutual funds that are registered with the Securities and Exchange Commission. These funds are required to publish their daily net asset value (NAV) and to transact at that price. The mutual funds held by the Plan are deemed to be actively traded.

Common Stocks: Valued at the closing price reported on the active market on which the individual securities are traded.

Collective trust fund: Valued at the NAV of units of a collective trust. The NAV, as provided by the trustee, is used as a practical expedient to estimate fair value. Participant transactions (purchases and sales) may occur daily. If the Plan initiates a full redemption of the collective trust, the investment adviser reserves the right to temporarily delay withdrawal from the trust in order to ensure that security liquidations will be carried out in an orderly business manner.

The following table sets forth by level, within the fair value hierarchy, the Plan’s investments at fair value as of

| | | | | | | | | | | | | |

| 2022 | | 2021 | | |

| (In thousands) | | |

| Level 1: | | | | | |

| Mutual funds | $ | 10,286 | | | $ | 9,193 | | | |

| Kinetik Holdings Inc. Common Stock | 75 | | — | | | |

| Total assets in fair value hierarchy | 10,361 | | | 9,193 | | | |

| Investments measured at net asset value: | | | | | |

| Collective trust fund | 273 | | 188 | | |

| | | | | |

| Investments at fair value | $ | 10,634 | | | $ | 9,381 | | | |

Fair Value of Investments in Entities that Use NAV

The following table summarizes investments measured at fair value based on NAV per share as of December 31, 2022 and 2021:

| | | | | | | | | | | |

| 2022 | | 2021 |

| Collective trust fund | | | |

| Fair value (in thousands) | $ | 273 | | | $ | 188 | |

| Unfunded commitment | None | | None |

| Redemption frequency | Immediate | | Immediate |

| Other redemption restrictions | None | | None |

| Redemption notice period | None | | None |

Note 4. Related Party Transactions and Party in Interest Transactions

Certain Plan investments are shares of mutual funds and a collective trust fund held by the Custodians, the trustees for the Plan and, therefore, these transactions qualify as party in interest transactions. The Plan also invests in shares of the Company's common stock. Because the Company is the plan sponsor, transactions involving the Company’s common stock qualify as party-in-interest transactions. All investment fund earnings or losses posted to each Plan participant’s account are net of investment management fees charged by each investment fund under the Plan.

Note 5. Plan Termination

Although it has not expressed any intent to do so, the Employer has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA.

Note 6. Tax Status

Effective April 1, 2022, the Plan adopted a non-standardized, pre-approved defined contribution profit sharing plan sponsored by FMR, LLC with Internal Revenue Code Section 401(k) Cash or Deferred Arrangement (CODA) which received a favorable opinion letter from the IRS dated June 30, 2020. The Plan has been amended since the date of the last amendment covered by the above-mentioned determination letter. However, Plan management believes that the Plan is currently designed and being operated in compliance with the applicable requirements of the Internal Revenue Code. Prior to April 1, 2022, the Plan operated under an adoption agreement in connection with a non-standardized prototype defined contribution profit sharing plan sponsored ADP, LLC.

US GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

Note 7. Risks and Uncertainties

The Plan invests in various investment securities that are exposed to various risks such as interest rates, market and credit risks. Market values of investments may decline for a number of reasons, including changes in prevailing market and interest rates, increases in defaults and credit rating downgrades. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in values of investment securities will occur in the near term and that some changes could materially affect participant account balances and the amounts reported in the statement of net assets available for benefits.

Note 8. Reconciliation of Financial Statements to Form 5500

The following is a reconciliation of net assets available for benefits per the financial statements at December 31, 2022 and 2021 to Form 5500:

| | | | | | | | | | | |

| 2022 | | 2021 |

| (In thousands) |

| Net assets available for benefits per the financial statements | $ | 11,204 | | | $ | 9,651 | |

| Employer’s contributions receivable | (241) | | | — | |

| Participants’ contributions receivable | (59) | | | — | |

| Total receivable | (300) | | | — | |

| Net assets available for benefits per Form 5500 | $ | 10,904 | | | $ | 9,651 | |

The following is a reconciliation of the changes in net assets available for benefits per the financial statements for the years ended December 31, 2022 to Form 5500:

| | | | | | | |

| 2022 | | |

| | | |

| (In thousands) | | |

| Net increase in net assets available for benefits per the financial statements | $ | 1,553 | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Employer contributions receivable at December 31, 2022 | (241) | | | |

| Participant contributions receivable at December 31, 2022 | (59) | | | |

| Net income per Form 5500 | $ | 1,253 | | | |

Note 9. Subsequent Events

The Plan has evaluated subsequent events through June 28, 2023, the date the Plan’s financial statements were available to be issued.

| | | | | | | | | | | | | | | | | | | | | | | |

| Kinetik 401(k) Plan |

| Schedule H, Line 4i - Schedule of Assets (Held at End of Year) |

| |

| December 31, 2022 |

| (a) | (b) | | (c) | | (d) | | (e) |

| Identity of issue, borrower, lessor or similar party | | Description of investment including maturity date, rate of interest, collateral, par or maturity value | | Cost** | | Current value |

| | | | | |

| Investments: | | | | | | |

| * | KINETIK HOLDINGS INC | | Common Stock | | $ | — | | | $ | 74,443 | |

| PUTNAM STABLE VALUE | | Common Collective Trust | | — | | | 273,331 | |

| JP MORGAN SMALL CAP GROWTH R6 | | Mutual Fund | | — | | | 304,992 | |

| MASSMUTUAL SEL MID CAP GR I | | Mutual Fund | | — | | | 223,552 | |

| VANGUARD EXT MKT IDX - ADMIRAL | | Mutual Fund | | — | | | 253,886 | |

| JOHN HANCOCK DISC VALUE MC R6 | | Mutual Fund | | — | | | 287,185 | |

| MFS INTL DIVERSIFICATION R4 | | Mutual Fund | | — | | | 106,460 | |

| PUTNAM LARGE CAP VALUE R6 | | Mutual Fund | | — | | | 183,977 | |

| VANGUARD TOT BND MKT IND-ADM | | Mutual Fund | | — | | | 393,521 | |

| PIONEER BOND FUND – K | | Mutual Fund | | — | | | 32,871 | |

| MFS GROWTH FUND R6 | | Mutual Fund | | — | | | 335,716 | |

| VANGUARD INSTITUTIONAL TARGET RETIREMENT 2020 I | | Mutual Fund | | — | | | 303,917 | |

| VANGUARD INSTITUTIONAL TARGET RETIREMENT 2055 I | | Mutual Fund | | — | | | 1,095,872 | |

| VANGUARD INSTITUTIONAL TARGET RETIREMENT 2050 I | | Mutual Fund | | — | | | 1,155,532 | |

| VANGUARD INSTITUTIONAL TARGET RETIREMENT 2035 I | | Mutual Fund | | — | | | 573,298 | |

| VANGUARD 500 INDEX FUND – ADMIRAL | | Mutual Fund | | — | | | 796,591 | |

| VANGUARD INSTITUTIONAL TARGET RETIREMENT 2040 I | | Mutual Fund | | — | | | 523,715 | |

| PIMCO INCOME FUND INSTITUTIONAL | | Mutual Fund | | — | | | 538,204 | |

| UNDISCOVERED MANAGERS BEHAVIORAL VALUE FUND R6 | | Mutual Fund | | — | | | 85,116 | |

| VANGUARD INSTITUTIONAL TARGET RETIREMENT 2025 I | | Mutual Fund | | — | | | 403,724 | |

| VANGUARD INSTITUTIONAL TARGET RETIREMENT 2065 I | | Mutual Fund | | — | | | 152,293 | |

| VANG TOT INTL STK IND ADM | | Mutual Fund | | — | | | 278,304 | |

| VANGUARD INSTITUTIONAL TARGET RETIREMENT 2030 I | | Mutual Fund | | — | | | 919,091 | |

| VANGUARD INSTITUTIONAL TARGET RETIREMENT 2045 I | | Mutual Fund | | — | | | 906,880 | |

| VANGUARD INSTITUTIONAL TARGET RETIREMENT 2060 I | | Mutual Fund | | — | | | 414,607 | |

| * | FIDELITY GOVT MMKT K6

| | Mutual Fund | | — | | | 144 | |

| VANGUARD INSTITUTIONAL TARGET INC I | | Mutual Fund | | — | | | 16604 |

| | | | | | | |

| | | | | $ | — | | | $ | 10,633,826 | |

| | | | | | | |

| * | Notes receivable from participants | | Varying maturity dates and interest rates ranging from 4.25% - 8.00% | | — | | | 270,094 | |

| | | | | | | |

| | | | | $ | — | | | $ | 10,903,920 | |

| (*) | Party-in-interest | | | | | | |

| (**) | Cost is not required for participant directed funds | | | | | | |

| | | | | | | |

EXHIBIT INDEX

| | | | | |

| Exhibit Number | Description |

| |

| 23.1 | |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Kinetik Holdings, Inc.’s Fiduciary Committee has duly caused this annual report to be signed by the undersigned hereunto duly authorized.

KINETIK 401(K) PLAN

By: /s/ Steven Stellato

Kinetik Holdings, Inc. Investment Committee Member

Date: June 28, 2023

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

Kinetik 401(k) Plan

Houston, Texas

We consent to the incorporation by reference in Registration Statement Nos. 333-262043 and 333-266106 on Form S-3, Registration Statement No. 333-264117 on Form S-3D and Registration Statement No. 333-234475 on Form S-8 of our report dated June 28, 2023, appearing in this Annual Report on Form 11-K of the Kinetik 401(k) Plan for the year ended December 31, 2022.

/s/ Calvetti Ferguson

Houston, Texas

June 28, 2023

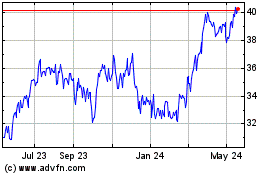

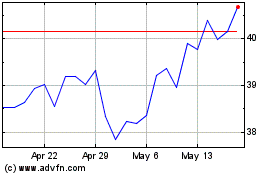

Kinetik (NYSE:KNTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kinetik (NYSE:KNTK)

Historical Stock Chart

From Apr 2023 to Apr 2024