Traditional Snack Bars Face Nutty Conundrum -- WSJ

October 07 2019 - 3:02AM

Dow Jones News

By Annie Gasparro

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 7, 2019).

As Americans grab for more snack bars, the biggest brands are

getting overlooked.

Sales are falling for General Mills Inc.'s Nature Valley bars

and Kellogg Co.'s Special-K bars, while snack-bar sales are rising

overall. The divergence is the latest example of longstanding

packaged-food makers missing a wave of sales growth for products

much like their own.

Danone SA started losing market share to Chobani a decade ago

when Greek yogurt gained popularity. Kraft Heinz Co.'s Boca veggie

burgers haven't benefited from the sales boom for patties from

Beyond Meat Inc. and Impossible Foods Inc.

Now a trend toward snack bars that are higher in protein and low

in sugar is leaving older brands behind.

Caitlin Long, who works at a tech company in Chicago, said she

is buying more Kind bars because their high fruit-and-nut content

seems healthier than the milled oats and sugar in Nature Valley and

Kellogg's Nutri-Grain bars.

"Kind bars pretty much kept me alive since my baby was born"

four months ago, she said.

Americans are eating more snack bars and more snacks in general.

Snack-bar sales in the U.S. -- including nutrition and performance

bars -- rose 3.2% last year, according to research firm Mintel,

outpacing overall packaged-food sales.

Sales for older cereal-and-granola bar brands, though, fell 3.7%

in the year through August, according to Nielsen. As a result,

older brands, including Nature Valley, Special-K and Nutri-Grain,

that command the majority of snack-bar sales have lost market

share.

General Mills said last month that U.S. retail sales of snack

bars dropped 4% in its latest quarter. Chief Executive Jeff

Harmening said in an interview that the Minneapolis company is

investing in improvements such as a crispy-wafer Nature Valley bar

and a Fiber One bar with more protein and less sugar.

"We are on the right track," he said.

Kellogg CEO Steve Cahillane has said the company's Special K

bars are associated with low-fat diets that have fallen out of

fashion in favor of high-protein and low-carbohydrate eating

habits.

"We have to do a better job at innovating and making our foods

relevant for today's food beliefs," Mr. Cahillane said about

Special K bars at a conference last month.

Big companies have also acquired and invested in faster-growing

brands. Hershey Co. last month purchased One, a maker of low-sugar,

high-protein bars, for $397 million. Mondelez International Inc.

earlier this year purchased a majority stake in the owner of

Perfect Bar, a refrigerated, protein-rich product.

Kellogg in 2017 bought Rxbar, a protein bar made with egg whites

and dates. Kellogg has put Rxbars in more stores, helping sales

jump about 18% this year, the company said.

"Now it has all kinds of copycats," said Victor Lee, Rxbar's

chief marketing officer. Epic, a smaller brand owned by General

Mills, last year introduced date-and-egg-white bars that have a

similar look and taste as Rxbar.

M&M's maker Mars Inc. in 2017 took a stake in the company

that makes Kind bars that was estimated at more than $1 billion.

The brand was one of the more successful ones to appear in recent

years, but founder Daniel Lubetzky said that the introduction of

similar products from other companies recently has taken a toll on

Kind's sales. "There's not room for 400 whole-nut bars," he

said.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

October 07, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

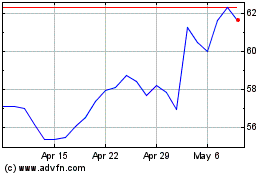

Kellanova (NYSE:K)

Historical Stock Chart

From Aug 2024 to Sep 2024

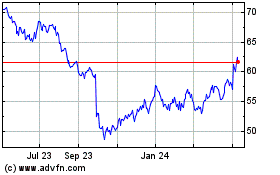

Kellanova (NYSE:K)

Historical Stock Chart

From Sep 2023 to Sep 2024