Current Report Filing (8-k)

March 17 2020 - 4:08PM

Edgar (US Regulatory)

false 0000921582 0000921582 2020-03-11 2020-03-11 0000921582 dei:OtherAddressMember 2020-03-11 2020-03-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

March 11, 2020

Date of report (Date of earliest event reported)

IMAX Corporation

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Canada

|

|

001-35066

|

|

98-0140269

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

|

|

|

|

|

2525 Speakman Drive

|

|

902 Broadway, Floor 20

|

|

Mississauga, Ontario, Canada L5K 1B1

|

|

New York, New York, USA 10010

|

|

(905) 403-6500

|

|

(212) 821-0100

|

(Address of principal executive offices, zip code, telephone numbers)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Shares, no par value

|

|

IMAX

|

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

Amendment to Employment Agreement with Robert D. Lister

On March 11, 2020, IMAX Corporation (the “Company”) and Robert D. Lister, the Company’s Chief Legal Officer and Senior Executive Vice President, executed an amendment to Mr. Lister’s employment agreement with the Company dated December 18, 2017 (the “Prior Agreement”). Pursuant to the amendment, Mr. Lister’s term of employment was extended through December 31, 2023. Further, his annual base salary was increased to $738,450, subject to annual review, and the grant date fair value of his annual equity awards for 2021, 2022 and 2023 was set at $1.45 million. The grant date fair value of his annual equity awards for 2020 remained at $1.4 million, but the award mix was adjusted to include performance stock units (“PSUs”) to be consistent with the awards granted to other senior executives. Mr. Lister will continue to be entitled to medical and other welfare and fringe benefits on the same basis as generally provided to other senior executives, and his entitlement to reimbursement for certain expenses will increase from the current $10,000 per year to $15,000 per year for 2021, 2022 and 2023.

With respect to equity awards, the amendment provides that: (i) PSUs will receive the same treatment upon termination of employment (not in connection with a change of control) as is currently in place for awards of options and restricted share units (“RSUs”), provided that PSUs remain subject to the achievement of performance conditions; (ii) following termination of employment by the Company without cause or by Mr. Lister for good reason, equity awards granted in 2021, 2022 and 2023 will continue to vest for a period equal to the greater of 18 months and the remainder of the agreement term (such period, the “Severance Period”), and options will remain exercisable until 12 months following the end of the Severance Period (or original expiration, if earlier); (iii) upon termination of employment within 24 months following a change of control and prior to the expiration of the term by the Company without cause or by Mr. Lister for good reason, outstanding equity awards will accelerate in full, except that PSUs will vest in an amount measured at the greater of the Company’s performance on the last trading day before the change in control or the actual performance as of the end of the applicable performance period and (iv) equity awards outstanding upon a non-renewal of Mr. Lister’s employment at the end of the term will continue to vest according to the applicable vesting schedule due to meeting the Company’s age and service requirements for continued vesting that is available to all employees.

All other terms of the Prior Agreement, including other terms with respect to treatment of options and RSUs following a termination of employment and restrictive covenants, remain as previously disclosed.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

IMAX Corporation

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

Date: March 17, 2020

|

|

|

|

By:

|

|

/s/ Jacqueline Bassani

|

|

|

|

|

|

Name:

|

|

Jacqueline Bassani

|

|

|

|

|

|

Title:

|

|

Executive Vice President and Chief People Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Kenneth Weissman

|

|

|

|

|

|

Name:

|

|

Kenneth Weissman

|

|

|

|

|

|

Title:

|

|

Senior Vice President, Legal Affairs and Corporate Secretary

|

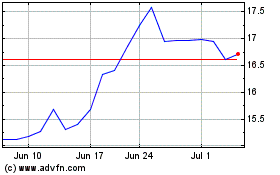

IMAX (NYSE:IMAX)

Historical Stock Chart

From Aug 2024 to Sep 2024

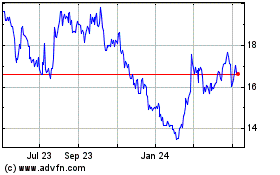

IMAX (NYSE:IMAX)

Historical Stock Chart

From Sep 2023 to Sep 2024