Hyliion Holdings Corp. (NYSE: HYLN) (“Hyliion”), a leader in

electrified powertrain solutions for Class 8 semi-trucks, today

reported its fourth-quarter and full-year 2022 financial

results.

Key Business Highlights

- Achieved new Hypertruck ERX™ commercialization milestone

- Obtained a 10-unit order for the Hypertruck ERX powertrain from

DSV Logistics

- Announcing collaboration with Hyzon Motors to jointly develop a

fuel cell powered truck

- Met 2022 revenue guidance

- Ended 2022 with $422 million of available capital on the

balance sheet

- 2023 operating expense guidance of $130 - $140 million

Executive Commentary

“We remained on track by hitting all our commercialization

milestones for the Hypertruck ERX powertrain in 2022. The year was

marked by many impactful accomplishments for Hyliion. We achieved

our revenue guidance for Hybrid, including full truck sales, we

acquired the KARNO™ generator technology from GE, and we obtained

210 orders for production slots for the Hypertruck ERX powertrain,”

said Hyliion’s Founder and CEO, Thomas Healy.

Hypertruck ERX System Development

In the fourth quarter, the Company continued the

design-verification phase of its Hypertruck ERX system with

additional controlled fleet trials, most recently with Ruan

Transportation. The Company also launched winter testing.

Overall, Hyliion remains on schedule to start Hypertruck ERX

system production in late 2023, as the Company continues to achieve

the previously-announced commercialization milestones. This marks

the fifth consecutive quarter that the Company has met the

commercialization milestones initially laid out on the

third-quarter 2021 earnings call.

Hypertruck ERX System Orders

During the fourth quarter the Company received 10 Hypertruck ERX

system orders from DSV Logistics, with an option to buy 10

additional units. DSV is one of the largest third-party logistics

companies in the world and is focused on expanding its business in

the U.S. As the Company nears completion of its development and

testing milestones for the Hypertruck ERX system later in 2023, it

expects to see an uptick in additional customer orders for delivery

in 2024.

Hyzon Motors Collaboration

The Company is announcing a new agreement with Hyzon Motors to

develop a fuel cell powered vehicle. This development is the third

step in the Company’s multi-stage product roadmap towards a

hydrogen future. The vehicle will use Hyliion’s electric powertrain

system and Hyzon’s fuel cell technology as the generator. The

powertrain will be integrated into a Peterbilt chassis.

“Today, we are announcing an innovative collaboration with Hyzon

Motors to jointly develop a fuel cell powered vehicle. Hyzon is an

industry leader in developing and manufacturing fuel cells

purpose-built for heavy-duty applications, and Hyliion is an

industry leader in electric powertrain solutions. We are excited

about having the opportunity for our teams to work together,” said

Hyliion’s Founder and CEO, Thomas Healy.

Financial Highlights, Operating Expense and 2023

Guidance

In the fourth quarter, the Company recorded $1.1 million in

revenue related to Hybrid sales. The Company’s fourth quarter

operating expenses totaled $31.6 million for the quarter, $5

million higher than a year ago, mainly due to higher research and

development spending. Hyliion ended the fourth quarter with $422

million of cash, short-term and long-term investments, which is

expected to be sufficient to fund current commercialization

activities for the Hypertruck ERX powertrain, as well as initial

development activities for the KARNO product and the Hyzon Motors

collaboration project.

For full-year 2022, Hyliion’s net loss totaled $153.4 million,

or $124.6 million excluding $28.8 million of one-time research and

development expenses related to the KARNO generator acquisition in

the third quarter, up $28.5 million (excluding the KARNO

acquisition) compared to a $96.0 million net loss in the prior

year.

Looking forward, the Company expects full-year 2023 operating

expenses to be in the $130 to $140 million range. This estimate

reflects continued focus on delivering the Hypertruck ERX system in

late 2023 and efforts to develop the KARNO generator technology,

the Hyzon fuel cell collaboration project, and other development

projects. The Company is also expecting SG&A spending growth to

level off in 2023 as it invests further in in-house engineering and

development resources.

Fourth Quarter 2022 Conference Call

Hyliion will host a conference call and accompanying webcast at

11:00 a.m. EST / 10:00 a.m. CST on Wednesday, March 1 to discuss

its financial and business results, and outlook. The live webcast

of the call, as well as an archived replay following, will be

available online on the Investor Relations section of Hyliion’s

website. Those wishing to participate can access the call using the

links below:

Conference Call Online Registration:

https://conferencingportals.com/event/vjUOPPlo Access the Webcast:

https://events.q4inc.com/attendee/357822431

Full-year 2022 financial results for Hyliion Holdings Corp. will

also be filed with the SEC on Form 10-K.

About Hyliion

Hyliion’s mission is to reduce the carbon intensity and

greenhouse gas (GHG) emissions of Class 8 semi-trucks by being a

leading provider of electrified powertrain solutions. Hyliion

offers fleets efficient and practical systems to decrease fuel and

operating expenses while seamlessly integrating with their existing

fleet operations. Headquartered in Austin, Texas, Hyliion designs,

develops, and sells electrified powertrain solutions that can be

installed on most major Class 8 semi-trucks, and leverages advanced

software algorithms and data analytics to improve overall

efficiencies. Hyliion’s goal is to transform the commercial

transportation industry’s environmental impact at scale. For more

information, visit www.hyliion.com.

Forward Looking Statements

The information in this press release includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements, other than statements of

present or historical fact included in this press release,

regarding Hyliion and its future financial and operational

performance, as well as its strategy, future operations, estimated

financial position, estimated revenues, and losses, projected

costs, prospects, plans and objectives of management are forward

looking statements. When used in this press release, including any

oral statements made in connection therewith, the words “could,”

“should,” “will,” “may,” “believe,” “anticipate,” “intend,”

“estimate,” “expect,” “project,” the negative of such terms and

other similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

such identifying words. These forward-looking statements are based

on management’s current expectations and assumptions about future

events and are based on currently available information as to the

outcome and timing of future events. Except as otherwise required

by applicable law, Hyliion expressly disclaims any duty to update

any forward-looking statements, all of which are expressly

qualified by the statements herein, to reflect events or

circumstances after the date of this press release. Hyliion

cautions you that these forward-looking statements are subject to

numerous risks and uncertainties, most of which are difficult to

predict and many of which are beyond the control of Hyliion. These

risks include, but are not limited to, our status as an early stage

the Company with a history of losses, and our expectation of

incurring significant expenses and continuing losses for the

foreseeable future; our ability to develop to develop key

commercial relationships with suppliers and customers; our ability

to retain the services of Thomas Healy, our Chief Executive

Officer; our ability to disrupt the powertrain market; the effects

of our dynamic and proprietary solutions on commercial truck

customers; the ability to accelerate the commercialization of the

Hypertruck ERX; our ability to meet 2023 and future product

milestones; the impact of COVID-19 on long-term objectives; the

ability of our solutions to reduce carbon intensity and greenhouse

gas emissions, the expected performance and integration of the

KARNO generator and system, and the other risks and uncertainties

described under the heading “Risk Factors” in our other SEC filings

including in our Annual Report (See item 1A. Risk Factors) on Form

10-K filed with the Securities and Exchange Commission (the “SEC”)

on February 28, 2023 for the year ended December 31, 2022. Given

these risks and uncertainties, readers are cautioned not to place

undue reliance on such forward-looking statements. Should one or

more of the risks or uncertainties described in this press release

occur, or should underlying assumptions prove incorrect, actual

results and plans could different materially from those expressed

in any forward-looking statements. Additional information

concerning these and other factors that may impact Hyliion’s

operations and projections can be found in its filings with the

SEC. Hyliion’s SEC Filings are available publicly on the SEC’s

website at www.sec.gov, and readers are urged to carefully review

and consider the various disclosures made in such filings.

HYLIION HOLDINGS CORP.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Dollar amounts in thousands,

except share and per share data)

Three Months Ended December

31,

Year Ended December

31,

2022

2021

2022

2021

(Unaudited)

Revenues

Product sales and other

$

1,095

$

200

$

2,106

$

200

Total revenues

1,095

200

2,106

200

Cost of revenues

Product sales and other

1,618

2,737

8,778

2,737

Total cost of revenues

1,618

2,737

8,778

2,737

Gross loss

(523

)

(2,537

)

(6,672

)

(2,537

)

Operating expenses

Research and development

21,827

17,390

110,370

58,261

Selling, general and administrative

9,733

9,188

41,988

35,299

Total operating expenses

31,560

26,578

152,358

93,560

Loss from operations

(32,083

)

(29,115

)

(159,030

)

(96,097

)

Interest income

2,658

218

5,724

779

Gain (loss) on impairment and disposal of

assets

70

(730

)

(19

)

(730

)

Other expense, net

(32

)

—

(32

)

—

Net loss

$

(29,387

)

$

(29,627

)

$

(153,357

)

$

(96,048

)

Net loss per share, basic and diluted

$

(0.16

)

$

(0.17

)

$

(0.87

)

$

(0.56

)

Weighted-average shares outstanding, basic

and diluted

179,719,018

173,325,727

175,400,486

172,216,477

HYLIION HOLDINGS CORP.

CONSOLIDATED BALANCE

SHEETS

(Dollar amounts in thousands,

except share data)

December 31,

2022

2021

Assets

Current assets

Cash and cash equivalents

$

119,468

$

258,445

Accounts receivable, net

1,136

70

Inventory

74

114

Prepaid expenses and other current

assets

9,795

9,068

Short-term investments

193,740

118,787

Total current assets

324,213

386,484

Property and equipment, net

5,606

2,235

Operating lease right-of-use assets

6,470

7,734

Intangible assets, net

200

235

Other assets

1,686

1,535

Long-term investments

108,568

180,217

Total assets

$

446,743

$

578,440

Liabilities and stockholders’

equity

Current liabilities

Accounts payable

$

2,800

$

7,455

Current portion of operating lease

liabilities

347

21

Accrued expenses and other current

liabilities

11,535

7,759

Total current liabilities

14,682

15,235

Operating lease liabilities, net of

current portion

6,972

8,623

Other liabilities

1,515

667

Total liabilities

23,169

24,525

Commitments and contingencies

Stockholders’ equity

Common stock, $0.0001 par value;

250,000,000 shares authorized; 179,826,309 and 173,468,979 shares

issued and outstanding at December 31, 2022 and 2021,

respectively

18

17

Additional paid-in capital

397,810

374,795

Retained earnings

25,746

179,103

Total stockholders’ equity

423,574

553,915

Total liabilities and stockholders’

equity

$

446,743

$

578,440

HYLIION HOLDINGS CORP.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Dollar amounts in

thousands)

Year Ended December

31,

2022

2021

2020

Cash Flows from Operating

Activities

Net (loss) income

$

(153,357

)

$

(96,048

)

$

324,117

Adjustments to reconcile net (loss) income

to net cash used in operating activities:

Depreciation and amortization

1,227

884

850

Amortization of investment premiums and

discounts

1,250

1,816

—

Loss on extinguishment of debt

—

—

10,170

Noncash lease expense

1,244

731

928

Inventory write-down

5,641

2,298

—

Loss on impairment and disposal of

assets

19

730

—

Paid-in-kind interest on convertible notes

payable

—

—

1,085

Amortization of debt discount

—

—

4,237

Share-based compensation

6,979

4,922

294

Provision for doubtful accounts

114

—

—

Change in fair value of convertible notes

payable derivative liabilities

—

—

1,358

Change in fair value of warrant

liability

—

—

(363,299

)

Acquired in-process research and

development

28,752

—

—

Change in operating assets and

liabilities, net of effects of business acquisition:

Accounts receivable

(1,180

)

22

53

Inventory

(5,601

)

(2,280

)

(132

)

Prepaid expenses and other assets

(571

)

(475

)

(8,150

)

Accounts payable

(4,660

)

5,319

734

Accrued expenses and other liabilities

4,571

2,155

5,764

Operating lease liabilities

(1,305

)

(576

)

(953

)

Net cash used in operating activities

(116,877

)

(80,502

)

(22,944

)

Cash Flows from Investing

Activities

Purchase of property and equipment and

other

(2,885

)

(2,380

)

(311

)

Proceeds from sale of property and

equipment

152

45

22

Purchase of in-process research and

development

(14,428

)

—

—

Payments for security deposit, net

—

(29

)

—

Purchase of investments

(268,584

)

(317,807

)

(237,851

)

Proceeds from sale and maturity of

investments

263,723

254,180

—

Net cash used in investing activities

(22,022

)

(65,991

)

(238,140

)

Cash Flows from Financing

Activities

Business Combination and PIPE financing,

net of issuance costs paid

—

—

516,454

Proceeds from exercise of stock warrants,

net of issuance costs

—

16,257

124,536

Proceeds from convertible notes payable

issuance and derivative liabilities

—

—

3,200

(Payments for)/proceeds from Paycheck

Protection Program loan

—

(908

)

908

Payments for deferred financing costs

—

—

(468

)

Repayments on finance lease

obligations

—

(42

)

(247

)

Proceeds from exercise of common stock

options

79

591

121

Taxes paid related to net share settlement

of equity awards

(157

)

—

—

Net cash (used in) provided by financing

activities

(78

)

15,898

644,504

Net (decrease) increase in cash and cash

equivalents and restricted cash

(138,977

)

(130,595

)

383,420

Cash and cash equivalents and restricted

cash, beginning of period

259,110

389,705

6,285

Cash and cash equivalents and restricted

cash, end of period

$

120,133

$

259,110

$

389,705

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230228006208/en/

Hyliion Holdings Corp. Ryann Malone

press@hyliion.com (833) 495-4466 Kellen Ferris

ir@hyliion.com (737) 292-8649

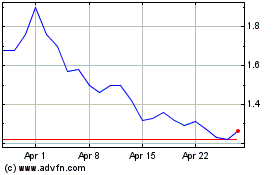

Hyliion (NYSE:HYLN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hyliion (NYSE:HYLN)

Historical Stock Chart

From Jul 2023 to Jul 2024