Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

August 26 2020 - 1:22PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-221740

HYATT HOTELS CORPORATION

FLOATING RATE SENIOR NOTES DUE 2022

PRICING TERM SHEET

DATED AUGUST 26, 2020

This term

sheet to the preliminary prospectus supplement dated August 26, 2020 should be read together with the preliminary prospectus supplement before making a decision in connection with an investment in the Notes (as defined herein). The information in

this term sheet supersedes the information contained in the preliminary prospectus supplement to the extent that it is inconsistent therewith. Terms used but not defined herein have the meaning ascribed to them in the preliminary prospectus

supplement.

|

|

|

|

|

Issuer:

|

|

Hyatt Hotels Corporation

|

|

|

|

|

Format:

|

|

SEC Registered

|

|

|

|

|

Trade Date:

|

|

August 26, 2020

|

|

|

|

|

Settlement Date:

|

|

September 1, 2020 (T+4)

|

|

|

|

|

Security Ratings:

|

|

Baa3 by Moody’s / BBB- by Standard and Poor’s1

|

|

|

|

|

Security Offered:

|

|

Floating Rate Senior Notes due 2022 (the “Notes”)

|

|

|

|

|

Principal Amount:

|

|

$750,000,000

|

|

|

|

|

Maturity Date:

|

|

September 1, 2022

|

|

|

|

|

Interest Rate:

|

|

Three-month LIBOR plus 3.00% per annum, reset quarterly

|

|

|

|

|

Interest Payment Dates:

|

|

March 1, June 1, September 1 and December 1, commencing December 1, 2020

|

|

|

|

|

Interest Determination Dates:

|

|

Second London banking day preceding the first day of the applicable interest period

|

|

|

|

|

Initial Interest Determination Date:

|

|

August 27, 2020

|

|

|

|

|

Interest Rate Adjustment:

|

|

The interest rate payable on the Notes will be subject to adjustment based on certain rating events as described under the caption “Description of the Notes—Interest Rate Adjustment of the Notes Based on Certain Rating

Events” in the preliminary prospectus supplement dated August 26, 2020.

|

|

1

|

The securities ratings above are not a recommendation to buy,

sell or hold the securities offered hereby and may be subject to revision or withdrawal at any time by Moody’s and Standard and Poor’s. Each of the security ratings above should be evaluated independently of any other security rating.

|

|

|

|

|

|

Price to Public:

|

|

100.00% of the principal amount, plus accrued interest, if any

|

|

|

|

|

Underwriting Discounts and Commissions

|

|

0.40%

|

|

|

|

|

CUSIP/ISIN:

|

|

448579 AK8 / US448579AK81

|

|

|

|

|

Optional Redemption:

|

|

At any time on or after September 1, 2021, the issuer may redeem some or all of the Notes at a price equal to 100% of the principal amount of the Notes redeemed plus accrued and unpaid interest.

|

|

|

|

|

Joint Book-Running Managers:

|

|

Deutsche Bank Securities Inc.

BofA Securities,

Inc.

J.P. Morgan Securities LLC

|

|

|

|

|

Co-Managers:

|

|

Wells Fargo Securities, LLC

Goldman

Sachs & Co. LLC

Scotia Capital (USA) Inc.

|

* *

*

Where similar language or information to that set forth above appears in other sections of the preliminary prospectus supplement dated

August 26, 2020, that language or information is deemed modified accordingly as set forth above.

We expect that delivery of the Notes will be

made to investors on or about the Settlement Date indicated above, which will be the fourth business day following the Trade Date indicated above (such settlement being referred to as “T+4”). Under Rule

15c6-1 of the Exchange Act, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who

wish to trade the Notes on any day prior to the second business day before the delivery of the Notes hereunder will be required, by virtue of the fact that the Notes initially will settle in T+4, to specify an alternative settlement cycle at the

time of any such trade to prevent failed settlement. Such purchasers should consult their own advisors in this regard.

* *

*

The issuer has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (the “SEC”) for

the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and the other documents the issuer has filed with the SEC for more complete information about the issuer and the

offering. You may get these documents for free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you

request it by contacting: Deutsche Bank Securities Inc. toll-free at +1 (800) 503-4611.

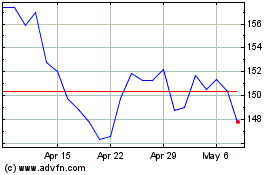

Hyatt Hotels (NYSE:H)

Historical Stock Chart

From Apr 2024 to May 2024

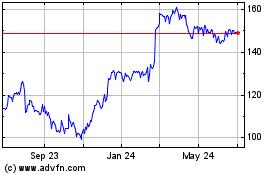

Hyatt Hotels (NYSE:H)

Historical Stock Chart

From May 2023 to May 2024