As filed with the Securities and Exchange Commission

on August 31, 2022

Registration No. 333-________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

HEICO CORPORATION

(Exact name of registrant as specified in its

charter)

Florida

(State or other jurisdiction of incorporation or

organization)

65-0341002

(IRS Employer Identification Number)

3000 Taft Street,

Hollywood, Florida 33021

(954) 987-4000

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Carlos L. Macau, Jr.

Executive Vice President - Chief Financial Officer

HEICO Corporation

3000 Taft Street

Hollywood, Florida 33021

(954) 987-4000

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

With a copy to:

Jonathan Awner, Esq.

Christina C. Russo, Esq.

Akerman LLP

Three Brickell City Centre

98 Southeast Seventh Street, Suite 1100

Miami, Florida 33131

(305) 374-5600

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this registration statement, as determined by the selling stockholder.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box: ☒

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box: ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☒ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PROSPECTUS

HEICO CORPORATION

576,338 Class A Common Stock

The selling stockholder may

offer and sell from time to time up to an aggregate of 576,338 shares of HEICO Corporation (the “Company”) Class A common

stock, par value $0.01 (the “Class A Common Stock”), issued to the selling stockholder. These securities were issued to the

selling stockholder in connection with the acquisition of Sensor Systems, Inc. on August 10, 2022.

For information concerning

the selling stockholder and the manner in which it may offer and sell shares of our Class A Common Stock, see “Selling Stockholder”

and “Plan of Distribution” in this prospectus.

We are not selling any securities

under this prospectus and we will not receive any proceeds from the sale by the selling stockholder of its shares of Class A Common Stock.

Our Class A Common Stock is traded on the New York Stock Exchange (“NYSE”),

under the symbol “HEI.A.” As of August 30, 2022, the last reported sale price of our Class A Common Stock on the NYSE was

$123.79.

---------------------------

Investing in our securities

involves risks. See “Risk Factors,” beginning on page 4 and in any other documents incorporated by reference herein or therein,

for factors you should consider before buying any of our securities.

You should rely only on the

information contained in this prospectus. We have not authorized any dealer, salesperson or other person to provide you with information

concerning us, except for the information contained in this prospectus. The information contained in this prospectus is complete and accurate

only as of the date on the front cover page of this prospectus, regardless of the time of delivery of this prospectus or the sale of any

Class A Common Stock. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is August 31, 2022

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part

of an automatic registration statement on Form S-3 that we filed with the Securities and Exchange Commission (“SEC”), as a

“well-known seasoned issuer” as defined in Rule 405 of the Securities Act of 1933, as amended (the “Securities Act”).

Under the shelf process, the selling stockholder may, from time to time, sell the offered securities described in this prospectus in one

or more offerings. Additionally, under the shelf process, in certain circumstances, we may provide a prospectus supplement that will contain

specific information about the terms of a particular offering by the selling stockholder. We may also provide a prospectus supplement

to add information to, or update or change information contained in, this prospectus.

This prospectus does not contain

all of the information set forth in the registration statement, portions of which we have omitted as permitted by the rules and regulations

of the SEC. Statements contained in this prospectus as to the contents of any contract or other document are not necessarily complete.

You should refer to the copy of each contract or document filed as an exhibit to the registration statement for a complete description.

You should rely only on the

information contained in or incorporated by reference into this prospectus or any applicable prospectus supplements filed with the SEC.

We have not authorized anyone to provide you with different or additional information and, if you are given any information or representation

about these matters that is not contained or incorporated by reference in this prospectus or a prospectus supplement, you must not rely

on that information. The selling stockholder is offering to sell and seeking offers to buy shares of our Class A Common Stock only in

jurisdictions in which offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of

this prospectus, regardless of the time of delivery of this prospectus or any sale of Class A Common Stock.

Unless

the context otherwise requires, all references in this prospectus to “HEICO,” the “Company,” “we,”

“us,” and “our” refer to HEICO Corporation and our consolidated subsidiaries. Unless otherwise stated or indicated

by context, the phrase “this prospectus” refers to the prospectus and any applicable prospectus supplement.

PROSPECTUS SUMMARY

This summary does not contain

all of the information that is important to you. You should read the entire prospectus carefully, including the “Risk Factors”

section and the consolidated financial statements and related notes included in this prospectus or incorporated by reference into this

prospectus, before making an investment decision.

Overview

HEICO

Corporation through its subsidiaries (collectively, “HEICO,” “we,” “us,” “our” or the

“Company”) believes it is the world’s largest manufacturer of Federal Aviation Administration (“FAA”)-approved

jet engine and aircraft component replacement parts, other than the original equipment manufacturers (“OEMs”) and their subcontractors.

HEICO also believes it is a leading manufacturer of various types of electronic equipment for the aviation, defense, space, medical, telecommunications

and electronics industries.

The

Company was originally organized in 1957 as a holding company known as HEICO Corporation. As part of a reorganization completed in 1993,

the original holding company (formerly known as HEICO Corporation) was renamed as HEICO Aerospace Corporation and a new holding corporation

known as HEICO Corporation was created. The reorganization did not result in any change in the business of the Company, its consolidated

assets or liabilities or the relative interests of its shareholders.

Our

business is comprised of two operating segments:

The

Flight Support Group. Our Flight Support Group (“FSG”), consisting of HEICO Aerospace Holdings Corp. and HEICO Flight

Support Corp. and their collective subsidiaries, accounted for 50%, 52% and 60% of our net sales in fiscal 2021, 2020 and 2019, respectively.

The FSG uses proprietary technology to design and manufacture jet engine and aircraft component replacement parts for sale at lower prices

than those manufactured by OEMs. These parts are approved by the FAA and are the functional equivalent of parts sold by OEMs. In addition,

the FSG repairs, overhauls and distributes jet engine and aircraft components, avionics and instruments for domestic and foreign commercial

air carriers and aircraft repair companies as well as military and business aircraft operators. The FSG also manufactures and sells specialty

parts as a subcontractor for aerospace and industrial original equipment manufacturers and the United States (“U.S.”) government.

Additionally, the FSG is a leading supplier, distributor, and integrator of military aircraft parts and support services primarily to

foreign military organizations allied with the U.S. and a leading manufacturer of advanced niche components and complex composite assemblies

for commercial aviation, defense and space applications. Further, the FSG engineers, designs and manufactures thermal insulation blankets

and parts as well as removable/reusable insulation systems for aerospace, defense, commercial and industrial applications; manufactures

expanded foil mesh for lightning strike protection in fixed and rotary wing aircraft; distributes aviation electrical interconnect products

and electromechanical parts; overhauls industrial pumps, motors, and other hydraulic units with a focus on the support of legacy systems

for the U.S. Navy; and performs tight-tolerance machining, brazing, fabricating and welding services for aerospace, defense and other

industrial applications.

The

Electronic Technologies Group. Our Electronic Technologies Group (“ETG”), consisting of HEICO Electronic Technologies

Corp. and its subsidiaries, accounted for 50%, 48% and 40% of our net sales in fiscal 2021, 2020 and 2019, respectively. The ETG derived

approximately 63%, 66% and 64% of its net sales in fiscal 2021, 2020 and 2019, respectively, from the sale of products and services to

U.S. and foreign military agencies, prime defense contractors and both commercial and defense satellite and spacecraft manufacturers.

The ETG collectively designs, manufactures and sells various types of electronic, data and microwave, and electro-optical products, including

infrared simulation and test equipment, laser rangefinder receivers, electrical power supplies, back-up power supplies, power conversion

products, underwater locator beacons, emergency locator transmission beacons, flight deck annunciators, panels, and indicators, electromagnetic

and radio frequency interference shielding and filters, high power capacitor charging power supplies, amplifiers, traveling wave tube

amplifiers, photodetectors, amplifier modules, microwave power modules, flash lamp drivers, laser diode drivers, arc lamp power supplies,

custom power supply designs, cable assemblies, high voltage power supplies, high voltage interconnection devices and wire, high voltage

energy generators, high frequency power delivery systems; memory products, including three-dimensional microelectronic and stacked memory,

static random-access memory (SRAM), and electronically erasable programmable read-only memory (EEPROM); harsh environment electronic connectors

and other interconnect products, radio frequency ("RF") and microwave amplifiers, transmitters, and receivers and integrated

assemblies, sub-assemblies and components; RF sources, detectors and controllers, wireless cabin control systems, solid state power distribution

and management systems, crashworthy and ballistically self-sealing auxiliary fuel systems, nuclear radiation detectors, communications

and electronic intercept receivers and tuners, fuel level sensing systems, high-speed interface products that link devices, high performance

active antenna systems for commercial aircraft, precision guided munitions, other defense applications and commercial uses; silicone material

for a variety of demanding applications; precision power analog monolithic, hybrid and open frame components; high-reliability ceramic-to-metal

feedthroughs and connectors, technical surveillance countermeasures (TSCM) equipment to detect devices used for espionage and information

theft; and rugged small-form factor embedded computing solutions.

HEICO

has continuously operated in the aerospace industry for over 60 years. Since assuming control in 1990, our current management has achieved

significant sales and profit growth through a broadened line of product offerings, an expanded customer base, increased research and development

expenditures and the completion of a number of acquisitions. As a result of internal growth and acquisitions, our net sales from continuing

operations have grown from $26.2 million in fiscal 1990 to $1,865.7 million in fiscal 2021, representing a compound annual growth rate

of approximately 15%. During the same period, we improved our net income from $2.0 million to $304.2 million, representing a compound

annual growth rate of approximately 18%.

Acquisition of SSI

On August 10, 2022, the Company

completed the acquisition of Sensor Systems, Inc. (“SSI”), one of the world’s leading designers and manufacturers of

airborne antennas for commercial and military applications pursuant to an agreement and plan of merger. The consideration for the acquisition

was $72,457,627 in cash, subject to post-closing adjustments, and 576,338 shares of the Company’s Class A Common

Stock (the “SSI Consideration Shares”). In connection with the acquisition, the Company and The Seymour Robin Living Trust

of 1987 entered into a Registration Rights Agreement, dated August 10, 2022 (the “Registration Rights Agreement”), which requires

the Company to file a resale registration statement covering the resale of the SSI Consideration Shares no later than sixty (60) days

after the closing date.

We

are registering the SSI Consideration Shares pursuant to the Registration Rights Agreement.

Corporate Information

HEICO’s corporate headquarters are located

at 3000 Taft Street, Hollywood, Florida 33021. Our telephone number is (954) 987-4000 and our Internet website address is www.heico.com.

The information on our website is not a part of, or incorporated in, this prospectus.

THE OFFERING

| Class A Common Stock outstanding prior to the offering: |

|

82,080,524 shares |

| |

|

|

| Class A Common Stock to be offered by the selling stockholder: |

|

576,338 shares |

| |

|

|

| Class A Common Stock outstanding immediately following the offering: |

|

82,080,524 shares |

| |

|

|

| Use of proceeds: |

|

We will not receive any

proceeds from the sale of the shares of Class A Common Stock by the selling stockholder. The selling stockholder will receive all of

the proceeds from the sale of shares of Class A Common Stock hereunder. See “Use of Proceeds.” |

| |

|

|

| Risk Factors: |

|

See “Risk Factors”

beginning on page 4 of this prospectus for a discussion of factors you should carefully consider before deciding to invest

in shares of our Class A Common Stock. |

| |

|

|

| Stock Symbol: |

|

NYSE: HEI.A |

The number of shares

of our Class A Common Stock to be outstanding after this offering is based on 82,080,524 shares of our Class A Common Stock outstanding

as of August 29, 2022, after giving effect to the assumptions set forth above and excluding the following:

| ● | 3,321,227

shares of Class A Common Stock reserved for issuance pursuant to future awards under our Incentive Compensation Plans, as amended (the

“Incentive Plans”); |

| ● | 2,095,779

shares of Class A Common Stock underlying outstanding options and restricted stock units granted pursuant to the Incentive Compensation

Plans; and |

| ● | 152,435

shares of Class A Common Stock reserved for issuance pursuant to future contributions under our HEICO Savings and Investment Plan. |

RISK FACTORS

Investing in our securities

involves significant risks. Before making an investment decision, you should consider carefully the risks, uncertainties and other factors

described under “Risk Factors” in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly

reports on Form 10-Q, current reports on Form 8-K that we have filed or will file with the SEC, and in other documents which are incorporated

by reference into this prospectus.

If any of these risks were

to occur, our business, affairs, prospects, assets, financial condition, results of operations and cash flow could be materially and adversely

affected. If this occurs, the market or trading price of our securities could decline, and you could lose all or part of your investment.

In addition, please read “Special Note Regarding Forward-Looking Statements” in this prospectus, where we describe additional

uncertainties associated with our business and the forward-looking statements included or incorporated by reference into this prospectus.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents

incorporated by reference in this prospectus contain “forward-looking statements” within the meaning of Section 27A of

the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements,

which in some cases, you can identify by terms such as “may,” “will,” “should,” “could,”

“would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,”

“projects,” “predicts,” “potential” and similar expressions intended to identify forward-looking statements,

relate to future events or to our future operating or financial performance and involve known and unknown risks, uncertainties and other

factors which may cause our actual results, performance or achievements to be materially different from any future results, performances

or achievements expressed or implied by the forward-looking statements. These statements include statements regarding our operations,

cash flows, and financial position. These statements reflect our current views with respect to future events and are based on assumptions

and subject to risks and uncertainties.

Although we believe that these

statements are based upon reasonable assumptions, these statements expressing opinions about future outcomes and non-historical information

are subject to a number of risks and uncertainties, many of which are beyond our control, and reflect future business decisions that are

subject to change and, therefore, there is no assurance that the outcomes expressed in these statements will be achieved. Some of the

assumptions, future results and levels of performance expressed or implied in the forward-looking statements we have made or may make

in the future inevitably will not materialize, and unanticipated events may occur which will affect our results. Investors are cautioned

that forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from

the expectations expressed in forward-looking statements contained herein. Given these uncertainties, you should not place undue reliance

on these forward-looking statements. We discuss many of these risks and uncertainties in greater detail under “Risk Factors” discussed

under the caption “Item 1A. Risk Factors” in Part I of our most recent Annual Report on Form 10-K or any updates

discussed under the caption “Item 1A. Risk Factors” in Part II of our Quarterly Reports on Form 10-Q, together with

all of the other information appearing in or incorporated by reference into this prospectus. You should read this prospectus completely

and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking

statements in this prospectus by these cautionary statements. We undertake no obligation to publicly update any forward-looking statement,

whether as a result of new information, future events or otherwise, except as may be required under the securities laws of the United

States. You are advised, however, to consult any additional disclosures we make in our reports filed with the SEC.

USE OF PROCEEDS

We will not receive any proceeds

from the sale of the shares of Class A Common Stock by the selling stockholder. The selling stockholder will receive all of the proceeds

from the sale of shares of Class A Common Stock hereunder.

SELLING STOCKHOLDER

The following table provides

information about the selling stockholder, listing how many shares of our Class A Common Stock the selling stockholder owns on the date

of this prospectus, how many shares may be offered by this prospectus, and the number and percentage of outstanding shares the selling

stockholder will own after the offering, assuming all shares covered by this prospectus are sold. The information concerning beneficial

ownership has been provided by the selling stockholder. Information concerning the selling stockholder may change from time to time, and

any changed information will be set forth if and when required in prospectus supplements or other appropriate forms permitted to be used

by the SEC.

We do not know when or in

what amounts the selling stockholder may offer shares for sale. The selling stockholder may choose not to sell any or all of the shares

offered by this prospectus. Because the selling stockholder may offer all or some of the shares, and because there are currently no agreements,

arrangements or understandings with respect to the sale of any of the shares, we cannot accurately report the number of the shares that

will be held by the selling stockholder after completion of the offering. However, for purposes of this table, we have assumed that, after

completion of the offering, all of the shares covered by this prospectus will be sold by the selling stockholder.

The percentage of shares beneficially

owned prior to, and after, the offering is based on 82,080,524 shares of Class A Common Stock outstanding as of August 29, 2022. For the

purposes of the following table, the number of shares of Class A Common Stock beneficially owned has been determined in accordance with

Rule 13d-3 under the Exchange Act, and such information is not necessarily indicative of beneficial ownership for any other purpose. Under

Rule 13d-3, beneficial ownership includes any shares as to which the selling stockholder have sole or shared voting power or investment

power and also any shares which each selling shareholder, respectively, has the right to acquire within 60 days of the date of this prospectus

through the exercise of any stock option, warrant or other rights.

| Selling Stockholder | |

Shares of

Class A

Common Stock

Owned

Before the

Offering | | |

Percent of

Class A

Common Stock to

be Owned by

the Selling Stockholder

Before the

Offering | |

Shares of

Class A

Common Stock to

be Offered

for the

Selling

Stockholder’s

Account | | |

Shares of

Class A

Common Stock

Owned by the

Selling

Stockholder

After the

Offering | | |

Percent of

Class A

Common Stock to

be Owned by the

Selling

Stockholder

After the

Offering | |

| The Seymour Robin Living Trust of 1987(1)(2) | |

| 576,338 | | |

* | |

| 576,338 | | |

| - | | |

| - | |

| (1) | Seymour Robin and Lori Vreeke, the co-trustees of The Seymour

Robin Living Trust of 1987 (the “Seller”), have voting and dispositive power over the shares of Class A Common Stock held

by the Seller. |

| (2) | These shares of Class A Common Stock were issued in connection

with the acquisition of SSI, as described above under the Prospectus Summary – Acquisition of SSI. |

The selling stockholder has

not, nor within the past three years has had, any position, office or material relationship with us or any of our predecessors or affiliates.

PLAN OF DISTRIBUTION

Selling Stockholder

We are registering the shares

of Class A Common Stock to permit the resale of these shares of Class A Common Stock by the selling stockholder from time to time after

the date of this prospectus. We will not receive any of the proceeds from the sale by the selling stockholder of the shares of Class A

Common Stock. We will bear all fees and expenses incident to our obligation to register the shares of Class A Common Stock.

The selling stockholder, which

as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares of Class A Common Stock or interests

in shares of Class A Common Stock received after the date of this prospectus from the selling stockholder as a gift, pledge, partnership

distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of Class A Common

Stock or interests in shares of Class A Common Stock on any stock exchange, market or trading facility on which the shares are traded

or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related

to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The selling stockholder may

use any one or more of the following methods when disposing of shares or interests therein:

| ● | ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| ● | block

trades in which the broker-dealer will attempt to sell the shares as agent, but may position

and resell a portion of the block as principal to facilitate the transaction; |

| ● | purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| ● | an

exchange distribution in accordance with the rules of the applicable exchange; |

| ● | privately

negotiated transactions; |

| ● | short

sales effected after the date the registration statement of which this prospectus is a part

is declared effective by the SEC; |

| ● | through

the writing or settlement of options or other hedging transactions, whether through an options

exchange or otherwise; |

| ● | broker-dealers

may agree with the selling stockholder to sell a specified number of such shares at a stipulated

price per share; and |

| ● | a

combination of any such methods of sale. |

The selling stockholder may,

from time to time, pledge or grant a security interest in some or all of the shares of Class A Common Stock owned by it and, if they default

in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of Class A Common Stock,

from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision

of the Securities Act amending the list of selling stockholder to include the pledgee, transferee or other successors in interest as selling

stockholders under this prospectus. The selling stockholder also may transfer the shares of Class A Common Stock in other circumstances,

in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale

of our Class A Common Stock or interests therein, the selling stockholder may enter into hedging transactions with broker-dealers or other

financial institutions, which may in turn engage in short sales of the Class A Common Stock in the course of hedging the positions they

assume. The selling stockholder may also sell shares of our Class A Common Stock short and deliver these securities to close out their

short positions, or loan or pledge the Class A Common Stock to broker-dealers that in turn may sell these securities. The selling stockholder

may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative

securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which

shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect

such transaction).

The aggregate proceeds to

the selling stockholder from the sale of the Class A Common Stock offered by them will be the purchase price of the Class A Common Stock

less discounts or commissions, if any. The selling stockholder reserves the right to accept and, together with their agents from time

to time, to reject, in whole or in part, any proposed purchase of Class A Common Stock to be made directly or through agents.

The selling stockholder also

may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that

the selling stockholder meets the criteria and conforms to the requirements of that rule.

The selling stockholder and

any underwriters, broker-dealers or agents that participate in the sale of the Class A Common Stock or interests therein may be “underwriters”

within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of

the shares may be underwriting discounts and commissions under the Securities Act. Selling stockholders who are “underwriters”

within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.

To the extent required, the

shares of our Class A Common Stock to be sold, the name of the selling stockholder, the respective purchase prices and public offering

prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will

be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that

includes this prospectus.

In order to comply with the

securities laws of some states, if applicable, the Class A Common Stock may be sold in these jurisdictions only through registered or

licensed brokers or dealers. In addition, in some states the Class A Common Stock may not be sold unless it has been registered or qualified

for sale or an exemption from registration or qualification requirements is available and is complied with.

We have advised the selling

stockholder that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to

the activities of the selling stockholder and its affiliates. In addition, to the extent applicable we will make copies of this prospectus

(as it may be supplemented or amended from time to time) available to the selling stockholder for the purpose of satisfying the prospectus

delivery requirements of the Securities Act. The selling stockholder may indemnify any broker-dealer that participates in transactions

involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

The selling stockholder and

any underwriters, brokers, dealers or agents that participate in the distribution of the securities may be deemed to be “underwriters”

within the meaning of the Securities Act, and any discounts, concessions, commissions or fees received by them and any profit on the resale

of the securities sold by them may be deemed to be underwriting discounts and commissions.

As set forth in the Registration

Rights Agreement, we have agreed to register for resale the shares of Class A Common Stock issued in the acquisition of SSI. The Registration

Rights Agreement provides for indemnification of the selling stockholder against specific liabilities in connection with the offer and

sale of the shares of Class A Common Stock, including liabilities under the Securities Act.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate

by reference” information into this prospectus, which means that we can disclose important information about us by referring to

another document filed separately with the SEC. The information incorporated by reference is considered to be a part of this prospectus.

This prospectus incorporates by reference the documents and reports listed below other than portions of these documents that are furnished

under Item 2.02 or Item 7.01 of a Current Report on Form 8–K:

| ● | The

Annual Report on Form 10–K for the fiscal year ended October 31, 2021, filed with the SEC on December 21, 2021, including portions

of the Company’s proxy statement on Schedule 14A, filed with the SEC on February 4, 2022, to the extent incorporated by reference into

such Annual Report on Form 10-K; |

| ● | Our

Quarterly Report on Form 10-Q for the quarter ended January 31, 2022, filed with the SEC on February 25, 2022; |

| ● | Our

Quarterly Report on Form 10-Q for the quarter ended April 30, 2022, filed with the SEC on May 25, 2022; |

| ● | Our

Quarterly Report on Form 10-Q for the quarter ended July 31, 2022, filed with the SEC on August 31, 2022; |

| ● | The

description of our Common Stock contained in our Registration Statement on Form 8-A, filed with the SEC on April 28, 1993, as amended

January 27, 1999; and |

| ● | The

description of our Class A Common Stock contained in our Registration Statement on Form 8-A, filed with the SEC on April 8, 1998, as

amended January 27, 1999. |

In addition to the items

listed above, we also incorporate by reference additional documents that we file with the SEC pursuant to Sections 13(a), 13(c), 14 or

15(d) of the Exchange Act after the date of this prospectus through the completion of the offering. We will not, however, incorporate

by reference any documents or portions thereof that are not deemed “filed” with the SEC, including any information furnished

pursuant to Items 2.02 or 7.01 of our current reports on Form 8-K or certain exhibits furnished pursuant to Item 9.01 of Form 8-K. Any

statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded

for purposes of this prospectus to the extent that a statement contained herein or in any subsequently filed document that also is or

is deemed to be incorporated by reference herein, as the case may be, modifies or supersedes such statement. Any such statement so modified

or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will provide, without charge,

to any person, including any beneficial owner, to whom a copy of this prospectus is delivered, upon oral or written request of such person,

a copy of any or all of the documents that have been incorporated by reference in this prospectus but not delivered with the prospectus,

including any exhibits to such documents that are specifically incorporated by reference in those documents.

Please make your request by writing or telephoning

us at the following address or telephone number:

HEICO Corporation

3000 Taft Street

Hollywood, Florida 33021

(954) 987-4000

WHERE YOU CAN FIND MORE INFORMATION

We are currently subject

to the information requirements of the Exchange Act and in accordance therewith file periodic reports, proxy statements and other information

with the SEC. Our SEC filings will also be available to you on the SEC’s website at http://www.sec.gov. We have filed with

the SEC a registration statement on Form S–3 under the Securities Act for the shares of Class A Common Stock being offered by the

selling stockholder. This prospectus does not contain all of the information in the registration statement and the exhibits and schedules

that were filed with the registration statement. For further information with respect to us and our Class A Common Stock, we refer you

to the registration statement and the exhibits that were filed with the registration statement. Anyone may obtain the registration statement

and its exhibits and schedules from the SEC as described above.

LEGAL MATTERS

The validity of the shares of Class A Common

Stock offered through this prospectus has been passed on by Akerman LLP, Miami, Florida.

EXPERTS

The financial statements of

HEICO Corporation and subsidiaries incorporated by reference in this prospectus, and the effectiveness of HEICO Corporation and subsidiaries’

internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting

firm, as stated in their reports. Such financial statements are incorporated by reference in reliance upon the reports of such firm, given

their authority as experts in accounting and auditing.

PART II

INFORMATION NOT REQUIRED IN

THE PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

| SEC registration fee | |

$ | 6,722.13 | |

| Legal fees and expenses | |

$ | 35,000.00 | * |

| Accounting fees and expenses | |

$ | 25,000.00 | * |

| Miscellaneous expenses | |

$ | 1,277.87 | * |

| Total | |

$ | 68,000.00 | |

| * | All amounts are estimates, other than the SEC’s registration

fee. |

We are paying all expenses of the offering listed

above. No portion of these expenses will be borne by the selling stockholder. The selling stockholder, however, will pay all underwriting

discounts and selling commissions, if any.

Item 15. Indemnification of Directors and Officers.

Under section 607.0831 of the Florida Business

Corporation Act, a director is not personally liable for monetary damages to the corporation or any other person for any statement, vote,

decision, or failure to act regarding corporate management or policy unless (a) the director breached or failed to perform his or her

duties as a director, and (b) the director's breach of, or failure to perform, those duties constitutes any of the following: (i) a violation

of the criminal law, unless the director had reasonable cause to believe his or her conduct was lawful or had no reasonable cause to believe

his or her conduct was unlawful. A judgment or other final adjudication against a director in any criminal proceeding for a violation

of the criminal law estops that director from contesting the fact that his or her breach, or failure to perform, constitutes a violation

of the criminal law; but does not estop the director from establishing that he or she had reasonable cause to believe that his or her

conduct was lawful or had no reasonable cause to believe that his or her conduct was unlawful; (ii) a circumstance under which the transaction

at issue is one from which the director derived an improper personal benefit, either directly or indirectly; (iii) a circumstance under

which the liability provisions of section 607.0834 (which relates to liability for unlawful distributions) are applicable; (iv) in a proceeding

by or in the right of the corporation to procure a judgment in its favor or by or in the right of a shareholder, conscious disregard for

the best interest of the corporation, or willful or intentional misconduct; or (v) in a proceeding by or in the right of someone other

than the corporation or a shareholder, recklessness or an act or omission which was committed in bad faith or with malicious purpose or

in a manner exhibiting wanton and willful disregard of human rights, safety, or property.

We have authority under Section 607.0851 of the

Florida Business Corporation Act to indemnify our directors and officers to the extent provided in such statute. Our Articles of Incorporation

provide that we shall indemnify and hold harmless each person who shall serve at any time as a director or executive officers. The Florida

Business Corporation Act also provides, under Section 607.0852, that a corporation must indemnify an individual who is or was a director

or officer who was wholly successful, on the merits or otherwise, in the defense of any proceeding to which the individual was a party

because he or she is or was a director or officer of the corporation against expenses incurred by the individual in connection with the

proceeding. Further, under Section 607.0853 of the Florida Business Corporation Act, a corporation may, before final disposition of a

proceeding, advance funds to pay for or reimburse expenses incurred in connection with the proceeding if the director or officer delivers

to the corporation a signed written undertaking of the director or officer to repay any funds advanced if: (a) the director or officer

is not entitled to mandatory indemnification under Section 607.0852; and (b) it is ultimately determined that the director or officer

has not met the relevant standard of conduct described in Section 607.0851 or the director or officer is not entitled to indemnification

under Section 607.0859 (as described below).

Under Section 607.0858 of the Florida Business

Corporation Act, the indemnification provided pursuant to Sections 607.0851 and 607.0852 and the advancement of expenses provided pursuant

to Section 607.0853 of the Florida Business Corporation Act are not exclusive, and a corporation may by a provision in its articles of

incorporation, bylaws, or any agreement, by vote of shareholders or disinterested directors, or otherwise, obligate itself in advance

of the act or omission giving rise to a proceeding to provide any other or further indemnification or advancement of expenses to any of

its directors or officers. However, under Section 607.0859, indemnification or advancement of expenses may not be made to or on behalf

of any director or officer if a judgment or other final adjudication establishes that his or her actions, or omissions to act, were material

to the cause of action so adjudicated and constitute: (a) willful or intentional misconduct or a conscious disregard for the best interests

of the corporation in a proceeding by or in the right of the corporation to procure a judgment in its favor or in a proceeding by or in

the right of a shareholder; (b) a transaction in which the director or officer derived an improper personal benefit; (c) a violation of

the criminal law, unless the director or officer had reasonable cause to believe his or her conduct was lawful or had no reasonable cause

to believe his or her conduct was unlawful; or (d) in the case of a director, a circumstance under which the liability provisions of Section

607.0834 are applicable.

Item 16. Exhibits.

| Exhibit Number |

|

Exhibit Description |

| 3.1 |

|

Articles of Incorporation of the Registrant are incorporated by reference to Exhibit 3.1 to the Company's Registration Statement on Form S-4 (Registration No. 33-57624) Amendment No. 1 filed on March 19, 1993.* |

| 3.2 |

|

Articles of Amendment of the Articles of Incorporation of the Registrant, dated April 27, 1993, are incorporated by reference to Exhibit 3.2 to the Company's Registration Statement on Form 8-B dated April 29, 1993.* |

| 3.3 |

|

Articles of Amendment of the Articles of Incorporation of the Registrant, dated November 3, 1993, are incorporated by reference to Exhibit 3.3 to the Form 10-K for the year ended October 31, 1993.* |

| 3.4 |

|

Articles of Amendment of the Articles of Incorporation of the Registrant, dated March 19, 1998, are incorporated by reference to Exhibit 3.4 to the Company’s Registration Statement on Form S-3 (Registration No. 333-48439) filed on March 23, 1998.* |

| 3.5 |

|

Articles of Amendment of the Articles of Incorporation of the Registrant, dated as of November 2, 2003, are incorporated by reference to Exhibit 3.5 to the Form 10-K for the year ended October 31, 2003.* |

| 3.6 |

|

Articles of Amendment of the Articles of Incorporation of the Registrant, dated March 26, 2012, are incorporated by reference to Exhibit 3.1 to the Form 8-K filed on March 29, 2012.* |

| 3.7 |

|

Articles of Amendment of the Articles of Incorporation of the Registrant, dated March 16, 2018, are incorporated by reference to Exhibit 3.1 to the Form 8-K filed on March 20, 2018.* |

| 3.8 |

|

Amended and Restated Bylaws of the Registrant, effective as of September 22, 2014, are incorporated by reference to Exhibit 3.1 to the Form 8-K filed on September 25, 2014.* |

| 5.1 |

|

Opinion of Akerman LLP.** |

| 10.1 |

|

Registration Rights Agreement, dated August 10, 2022, between HEICO Corporation and The Seymour Robin Living Trust of 1987.** |

| 23.1 |

|

Consent of Akerman LLP. (contained in Exhibit 5.1). |

| 23.2 |

|

Consent of Deloitte & Touche LLP.** |

| 24.1 |

|

Power of Attorney (included with signature page on this Form S-3). |

| 107 |

|

Filing Fee Table.** |

Item 17. Undertakings.

The undersigned registrant

hereby undertakes:

(a)(1) To file, during any period

in which offers or sales are being made, a post–effective amendment to this registration statement:

(i) To

include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the

prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the

registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar

value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated

maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the

aggregate, the changes in the volume and price represent no more than 20 percent change in the maximum aggregate offering price set

forth in the “Calculation of Registration Fee” table in the effective registration statement;

(iii) To include any material

information with respect to the plan of distribution not previously disclosed in this registration statement or any material change to

such information in the registration statement;

Provided, however, that:

paragraphs (a)(1)(i), (a)(1)(ii), and

(a)(1)(iii) of this section do not apply if the registration statement is on Form S-3 or Form F-3 and the information required to be included

in a post–effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant

pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration

statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of

determining any liability under the Securities Act of 1933, each such post–effective amendment shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof.

(3) To

remove from registration by means of a post–effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4) That, for the purpose of

determining liability under the Securities Act of 1933 to any purchaser, each prospectus filed pursuant to Rule 424(b) as part of a registration

statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance

on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness.

Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made

in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration

statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was

made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately

prior to such date of first use.

(b) That,

for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant

to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration

statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers, and controlling persons

of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities

and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred

or paid by a director, officer, or controlling person of the registrant in the successful defense of any action, suit, or proceeding)

is asserted by such director, officer, or controlling person in connection with the securities being registered, the registrant will,

unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the

final adjudication of such issue.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized

in the City of Hollywood, Florida, on this 31st day of August, 2022.

| |

HEICO CORPORATION |

| |

|

|

| |

By: |

/s/ Carlos L. Macau, Jr. |

| |

|

Carlos L. Macau, Jr. |

| |

|

Executive Vice President – Chief Financial

Officer and Treasurer

(Principal Financial Officer) |

| |

|

|

| |

By: |

/s/ Steven M. Walker |

| |

|

Steven M. Walker |

| |

|

Chief Accounting Officer and

Assistant Treasurer

(Principal Accounting Officer) |

KNOW ALL MEN BY THESE PRESENTS,

that each person whose signature appears below constitutes and appoints Carlos L. Macau, Jr. and Joseph W. Pallot and each of them, his

or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his or

her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration

Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange

Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every

act and thing requisite and necessary to be done, as fully to all intents and purposes as he or she might or could do in person, hereby

ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or his substitute or substitutes, may lawfully do

or cause to be done by virtue hereof.

Pursuant to the requirements

of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates

indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

/s/ Laurans A. Mendelson |

|

Chairman of the Board; Chief Executive Officer; and Director |

|

August 31, 2022 |

| Laurans A. Mendelson |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

/s/ Thomas M. Culligan |

|

Director |

|

August 31, 2022 |

| Thomas M. Culligan |

|

|

|

|

| |

|

|

|

|

/s/ Adolfo Henriques |

|

Director |

|

August 31, 2022 |

| Adolfo Henriques |

|

|

|

|

| |

|

|

|

|

/s/ Mark H. Hildebrandt |

|

Director |

|

August 31, 2022 |

| Mark H. Hildebrandt |

|

|

|

|

| |

|

|

|

|

/s/ Eric A. Mendelson |

|

Co-President and Director |

|

August 31, 2022 |

| Eric A. Mendelson |

|

|

|

|

| |

|

|

|

|

/s/ Victor H. Mendelson |

|

Co-President and Director |

|

August 31, 2022 |

| Victor H. Mendelson |

|

|

|

|

| |

|

|

|

|

/s/ Julie Neitzel |

|

Director |

|

August 31, 2022 |

| Julie Neitzel |

|

|

|

|

| |

|

|

|

|

/s/ Alan Schriesheim |

|

Director |

|

August 31, 2022 |

| Alan Schriesheim |

|

|

|

|

| |

|

|

|

|

/s/ Frank J. Schwitter |

|

Director |

|

August 31, 2022 |

| Frank J. Schwitter |

|

|

|

|

II-5

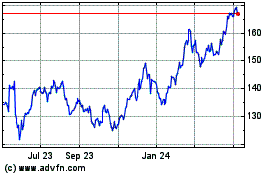

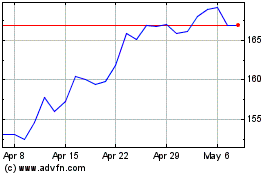

HEICO (NYSE:HEI.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

HEICO (NYSE:HEI.A)

Historical Stock Chart

From Apr 2023 to Apr 2024