ATLANTA, April 30 /PRNewswire-FirstCall/ -- HAVERTY FURNITURE

COMPANIES, INC. (NYSE:HVTNYSE:andNYSE:HVT.A) today reported

earnings for the first quarter ended March 31, 2008. Net income for

the first quarter of 2008 increased to $1.0 million or $0.05 per

diluted common share, compared to the first quarter 2007 net income

of $0.8 million or $0.04 per diluted common share. As previously

reported, net sales for the first quarter of 2008 were $185.2

million, or 3.0% less than the sales in the corresponding quarter

in 2007. On a comparable-store basis, sales decreased 6.3% for the

quarter. Clarence H. Smith, president and chief executive officer,

said, "Our earnings for the first quarter were up 24.2% on a 3.0%

sales decline. Gross margins were strong at 52.1% compared to the

prior year's quarter of 49.9% and reflect the impact of several of

our strategies. We chose to use credit as a stimulant for sales

rather than emphasizing price discounting during the first quarter.

Slightly more than one third of the gross profit improvement was

due to our product mix and better pricing discipline. Heightened

diligence over our inventories reduced the levels of damaged and

close out merchandise and accounted for a third of the gross margin

improvement. Our gross profit is also impacted by the level of

sales financed using our in-house long-term no interest credit

promotions. During 2008, we shifted more of these promotions to the

third-party and the impact of this shift generated approximately

another third of the gross margin improvement. "We are pleased with

the progress of the initiatives we undertook last year to lower our

SG&A expenses and have seen improvement in most areas. The

savings were largely offset by the shift to longer term free

interest credit offers provided through the third-party which

increased our selling costs approximately $2.8 million for the

first quarter of 2008 compared to 2007 when credit promotions had

not been emphasized. Higher fuel costs were another offset that led

to flat overall SG&A expenses. "Our inventories are higher than

at year-end, due in part to our building stock because of the

impact of factory closures around the Chinese New Year. However,

they are in line with our budget and well balanced. Accounts

receivable continues to decrease as we shift away from in-house

financing of long-term promotions. We have experienced some

increases in write offs and delinquencies, but due to the reduction

in total receivables our allowance account has declined slightly.

"Our industry is still struggling to find the bottom of this cycle.

We are encouraged by our performance in certain of our markets but

we still see significant weakness in Florida. We began selling on

the web last month and have recently begun promoting havertys.com

more heavily using banner advertising and enhanced search engine

practices. Our approach remains to connect with the customer in

ways she chooses to shop and drive customers to our stores

pre-disposed to purchase. We believe that we can leverage our

existing organization and fixed cost structure with any positive

sales momentum. "Current indications for April sales are that total

written business was down approximately 7% to 8% with total

delivered sales flat. We will release April sales results next

week." Havertys is a full-service home furnishings retailer with

124 showrooms in 17 states in the Southern and Midwestern regions

providing its customers with a wide selection of quality

merchandise in middle- to upper-middle price ranges. Additional

information is available on the Company's website at

http://www.havertys.com/ . News releases include forward-looking

statements, which are subject to risks and uncertainties. Factors

that might cause actual results to differ materially from future

results expressed or implied by such forward-looking statements

include, but are not limited to, general economic conditions, the

consumer spending environment for large ticket items, competition

in the retail furniture industry and other uncertainties detailed

from time to time in the Company's reports filed with the SEC. The

company will sponsor a conference call Thursday, May 1, 2008 at

10:00 a.m. Eastern Daylight Time to review the first quarter.

Listen-only access to the call is available via the web at

http://www.havertys.com/ (For Investors) and at

http://www.streetevents.com/ (Individual Investor Center), both

live and for a limited time, on a replay basis. HAVERTY FURNITURE

COMPANIES, INC. and SUBSIDIARIES Condensed Consolidated Statements

of Income (Amounts in thousands except per share data) (Unaudited)

Three Months Ended March 31, 2008 2007 Net sales $185,253 $191,073

Cost of goods sold 88,818 95,642 Gross profit 96,435 95,431 Credit

service charges 565 655 Gross profit and other revenue 97,000

96,086 Expenses: Selling, general and administrative 95,037 95,127

Interest, net (131) (59) Provision for doubtful accounts 328 145

Other (income) expense, net (42) (480) Total expenses 95,192 94,733

Income before income taxes 1,808 1,353 Income taxes 776 522 Net

income $1,032 $831 Basic earnings per share: Common Stock $0.05

$0.04 Class A Common Stock $0.05 $0.03 Diluted earnings per share:

Common Stock $0.05 $0.04 Class A Common Stock $0.05 $0.03 Weighted

average shares - basic: Common Stock 17,112 18,486 Class A Common

Stock 4,127 4,197 Weighted average shares - assuming dilution(1):

Common Stock 21,443 22,977 Class A Common Stock 4,127 4,197 Cash

dividends per common share: Common Stock $0.0675 $0.0675 Class A

Common Stock $0.0625 $0.0625 (1) See additional details at the end

of this release. HAVERTY FURNITURE COMPANIES, INC. and SUBSIDIARIES

Condensed Consolidated Balance Sheets (Amounts in thousands)

(Unaudited) March 31, December 31, March 31, 2008 2007 2007 Assets

Cash and cash equivalents $2,195 $167 $7,984 Accounts receivable,

net of allowance 49,866 58,748 64,736 Inventories, at LIFO cost

109,598 102,452 119,795 Other current assets 16,825 17,569 17,426

Total Current Assets 178,484 178,936 209,941 Accounts receivable,

long-term 4,863 8,003 14,105 Property and equipment, net 206,161

209,912 219,225 Other assets 25,021 25,086 13,425 $414,529 $421,937

$456,696 Liabilities and Stockholders' Equity Notes payable to

banks $8,250 $- $10,550 Accounts payable and accrued liabilities

73,322 84,527 79,738 Current portion of long-term debt and lease

obligations 6,357 8,353 10,366 Total Current Liabilities 87,929

92,880 100,654 Long-term debt and lease obligations, less current

portion 20,261 20,331 36,618 Other liabilities 29,232 29,881 26,688

Stockholders' equity 277,107 278,845 292,736 $414,529 $421,937

$456,696 HAVERTY FURNITURE COMPANIES, INC. and SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows (Amounts in

thousands) (Unaudited) Quarter Ended March 31, 2008 2007 Operating

Activities Net income $1,032 $831 Adjustments to reconcile net

income to net cash provided by (used in) operating activities:

Depreciation and amortization 5,447 5,646 Provision for doubtful

accounts 328 145 Loss (gain) on sale of property and equipment 18

(208) Other 329 315 Changes in operating assets and liabilities

(6,674) (13,949) Net cash provided by (used in) operating

activities 480 (7,220) Investing Activities Capital expenditures

(1,852) (2,453) Proceeds from sale of property and equipment 197

877 Other investing activities 237 45 Net cash used in investing

activities (1,418) (1,531) Financing Activities Proceeds from

borrowings under revolving credit facilities 69,075 302,425

Payments of borrowings under revolving credit facilities (60,825)

(294,475) Net increase in borrowings under revolving credit

facilities 8,250 7,950 Payments on long-term debt and lease

obligations (2,066) (2,068) Treasury stock acquired (1,806) -

Proceeds from exercise of stock options - 224 Dividends paid

(1,412) (1,510) Net cash provided by financing activities 2,966

4,596 Increase (decrease) in cash and cash equivalents 2,028

(4,155) Cash and cash equivalents at beginning of period 167 12,139

Cash and cash equivalents at end of period $2,195 $7,984 HAVERTY

FURNITURE COMPANIES, INC. and SUBSIDIARIES Earnings per Share The

following details how the number of shares in calculating the

diluted earnings per share for Common Stock are derived under SFAS

128 and EITF 03-6 (shares in thousands): Quarter Ended March 31,

2008 2007 Common Stock: Weighted-average shares outstanding 17,112

18,486 Assumed conversion of Class A Common shares 4,127 4,197

Dilutive options and awards 204 294 Total weighted-average diluted

common shares 21,443 22,977 The amount of earnings used in

calculating diluted earnings per share of Common Stock is equal to

net income since the Class A shares are assumed to be converted.

Diluted earnings per share of Class A Common Stock includes the

effect of dilutive common stock options and awards which reduces

the amount of undistributed earnings allocated to the Class A

Common Stock. Contact for information: Dennis L. Fink, EVP &

CFO or Jenny Hill Parker, VP, Secretary & Treasurer

404-443-2900 DATASOURCE: Haverty Furniture Companies, Inc. CONTACT:

Dennis L. Fink, EVP & CFO or Jenny Hill Parker, VP, Secretary

& Treasurer, of Haverty Furniture Companies, Inc.,

+1-404-443-2900 Web site: http://www.havertys.com/

Copyright

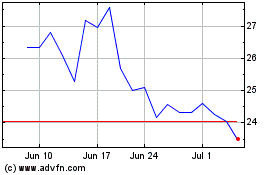

Haverty Furniture Compan... (NYSE:HVT)

Historical Stock Chart

From Jun 2024 to Jul 2024

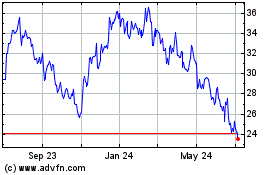

Haverty Furniture Compan... (NYSE:HVT)

Historical Stock Chart

From Jul 2023 to Jul 2024