0000313143false00003131432024-12-032024-12-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 3, 2024

HAEMONETICS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Massachusetts | | 001-14041 | | 04-2882273 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

125 Summer Street

Boston, MA 02110

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: 781-848-7100

(Former name or former address, if changed since last report.)

| | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

|

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $.01 par value per share | HAE | New York Stock Exchange |

| | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

Emerging Growth Company |

| ☐ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Item 8.01 Other Events.

On December 3, 2024, Haemonetics Corporation (the “Company”) announced that it has entered into a definitive agreement to sell its whole blood assets within its Blood Center business unit to GVS, S.p.A (“GVS”), a leading manufacturer of filter solutions for applications in the healthcare and life sciences sectors. Under the terms of the agreement, GVS will acquire the Company’s complete portfolio of proprietary whole blood collection, processing and filtration solutions, along with the Company’s manufacturing facility in Covina, California where certain of these products are produced, and related equipment and assets located at the Company’s manufacturing facility in Tijuana, Mexico, for $44.6 million in cash and up to $22.5 million in contingent consideration based on sales growth over the next three years and achievement of certain other milestones. Haemonetics’ Blood Center business will continue to manufacture and provide customers with its full line of apheresis solutions for automated blood collection, which include devices and disposable kits that support a variety of apheresis collections, including platelets, plasma and red cells, and ensure efficient blood center operations. The transaction is expected to close in the first quarter of calendar 2025, subject to the satisfaction of customary closing conditions.

A copy of the Company’s press release announcing the transaction is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The press release shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall such information be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of the general incorporation language of such filing, except as shall be expressly set forth by specific reference in such filing.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements about the sale of the Company’s whole blood assets within its Blood Center business unit to GVS, including, but not limited to, statements related to (i) the timing of completion of the transaction and the consummation of the transaction and (ii) the anticipated benefits to the Company arising from the transaction. Such forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon the Company’s current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties, which include, without limitation, the risks that the transaction may not be completed in a timely manner or at all and that the future sales growth and other milestones on which the contingent consideration is based will not be achieved. Investors should consult the Company's filings with the Securities and Exchange Commission (including the Company’s reports on Forms 10-K, 10-Q and 8-K) for information about additional risks and uncertainties that could cause the Company’s actual results to differ materially from these forward-looking statements. The Company undertakes no duty or obligation to update any forward-looking statements contained in this Current Report on Form 8-K as a result of new information, future events or changes in its expectations.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| | Press Release issued by Haemonetics Corporation on December 3, 2024. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | | | | |

| | | | |

| | HAEMONETICS CORPORATION | |

| | | | |

| December 3, 2024 | | By: | /s/ Christopher A. Simon | |

| | Name: | Christopher A. Simon | |

| | Title: | President and Chief Executive Officer |

| | | | |

| | | | | | | | |

Investor Contacts: | | Media Contact: |

Olga Guyette, Vice President-Investor Relations & Treasury (781) 356-9763 olga.guyette@haemonetics.com | | Josh Gitelson, Sr. Director-Global Communications (781) 356-9776 josh.gitelson@haemonetics.com |

| | |

David Trenk, Manager-Investor Relations (203) 733-4987 david.trenk@haemonetics.com | | |

Haemonetics Announces Sale of Whole Blood Assets to GVS, S.p.A

BOSTON, December 3, 2024 -- Haemonetics Corporation (NYSE: HAE), a global medical technology company focused on delivering innovative medical solutions to drive better patient outcomes, today announced that it has entered into a definitive agreement to sell its whole blood assets to GVS, S.p.A (“GVS”), one of the world’s leading manufacturers of filter solutions for applications in the healthcare and life sciences sectors. The transaction comprises a total cash consideration of up to $67.1M, which includes $44.6M upfront and up to $22.5M in contingent earn-outs over the next four years. The Company intends to use the proceeds from this transaction for general corporate purposes and additional investments in growth initiatives.

Under the terms of the agreement, GVS will acquire Haemonetics’ complete portfolio of proprietary whole blood collection, processing and filtration solutions, along with Haemonetics’ manufacturing facility in Covina, California where certain of these products are produced, and related equipment and assets located at Haemonetics’ manufacturing facility in Tijuana, Mexico. This transaction is expected to close in the first quarter of calendar 2025, subject to the satisfaction of customary closing conditions.

Haemonetics’ Blood Center business will continue to manufacture and provide customers with its full line of apheresis solutions for automated blood collection. These include devices and disposable kits that support a variety of apheresis collections, including platelets, plasma and red cells, and ensure efficient blood center operations.

The transaction follows Haemonetics’ agreement in 2020 to sell its Fajardo, Puerto Rico manufacturing operations to GVS and enter a long-term supply and development agreement granting GVS exclusive rights to manufacture and supply the proprietary blood filters produced at the Fajardo facility for Haemonetics.

“As part of our long-range plan we are focused on portfolio evolution to enhance our leadership in commercial and non-commercial plasma and expand our presence in high-growth hospital markets,” said Chris Simon, Haemonetics' President and Chief Executive Officer. “Our agreement with GVS stems from our long partnership and will enable a smooth transition for Haemonetics’ whole blood customers worldwide while supporting our company’s goals."

ABOUT HAEMONETICS

Haemonetics (NYSE: HAE) is a global healthcare company dedicated to providing a suite of innovative medical products and solutions for customers, to help them improve patient care and reduce the cost of healthcare. Our technology addresses important medical markets: blood and plasma component collection, the surgical suite and hospital transfusion services. To learn more about Haemonetics, visit www.haemonetics.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements do not relate strictly to historical or current facts and may be identified by the use of words such as "may," "will," "should," "could," "would," "expects," "plans," "anticipates," "believes," "estimates," "projects," "predicts," "forecasts," "foresees," "potential" and other words of similar meaning in conjunction with statements regarding, among other things, (i) the consummation of the proposed transaction described in this press release, including the estimated cash proceeds and any additional contingent consideration; (ii) statements regarding Haemonetics’ strategies, positioning, resources, capabilities and expectations for future performance; and (iii) the assumptions underlying or relating to any such statement. Such forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon Haemonetics' current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties.

Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, any event, changes or other circumstance that delays or gives rise to termination of the proposed transaction, including the failure of the parties to satisfy conditions to completion of the transaction; the failure to realize the anticipated benefits of the transaction, including from non-achievement of any commercial milestone required to receive all or part of the additional contingent consideration, or the transaction, its announcement or pendency having an unanticipated impact; Haemonetics' ability to predict accurately the demand for its products and products under development and to develop strategies to address its markets successfully; and the impact of competitive products and pricing and technical innovations that could render products marketed or under development by Haemonetics obsolete. These and other factors are identified and described in more detail in Haemonetics' filings with the U.S. Securities and Exchange Commission. Haemonetics does not undertake to update these forward-looking statements.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

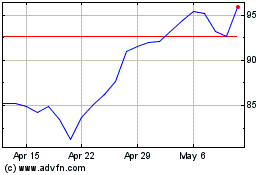

Haemonetics (NYSE:HAE)

Historical Stock Chart

From Nov 2024 to Dec 2024

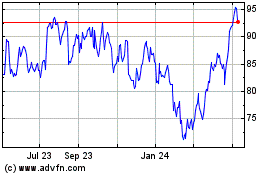

Haemonetics (NYSE:HAE)

Historical Stock Chart

From Dec 2023 to Dec 2024