- Fiscal 2023 Sales growth driven by strength in aftermarket

sales to refining and petrochemical markets and diversification

into the space industry

- Net income for fiscal 2023 was $367 thousand, compared to loss

in prior fiscal year; achieved adjusted EBITDA* of $7.7 million

within guidance range despite $2.5 million reserve for inventory

and bad debt for large space customer, net of associated

performance-based compensation

- Fourth quarter revenue grew 8% to $43.0 million driven by

strength in aftermarket and space industry

- Fourth quarter net loss of $481 thousand impacted by reserves

for bad debt and inventory; adjusted EBITDA* of $1.2 million, or

2.9% of sales

- Fourth quarter orders of $50.8 million, including MK48 Mod 7

Heavyweight Torpedo follow-on order, leads to record fiscal year

orders of $202.7 million

- Expect fiscal 2024 revenue to grow to approximately $165

million to $175 million, up 8% at mid-point over prior fiscal year

with adjusted EBITDA* in the range of $10.5 million to $12.5

million, a 49% improvement over fiscal 2023 at the mid-point of the

range

- Raising original strategic financial goals to now deliver over

$200 million in revenue and achieve low to mid-teen adjusted EBITDA

Margin* in fiscal 2027

Graham Corporation (NYSE: GHM) (“GHM” or the “Company”), a

global leader in the design and manufacture of mission critical

fluid, power, heat transfer and vacuum technologies for the

defense, space, energy and process industries, today reported

financial results for its fourth quarter and full fiscal year ended

March 31, 2023 (“fiscal 2023”). Financial results include those of

Barber-Nichols, LLC (“BN” or “the acquisition”) from the date it

was acquired on June 1, 2021.

Daniel J. Thoren, President and CEO, commented, “We made great

strides in fiscal 2023 to stabilize our business, improve our

performance, and capture new opportunities. We ended fiscal 2023 on

a strong note, achieving our guidance for the year despite the

significant reserve related to a space market customer. We

delivered record revenue, achieved adjusted EBITDA of $7.7 million,

had record annual orders and ended with a strong backlog of $302

million that supports further growth and margin expansion. Further,

we believe our book-to-bill ratio for the fiscal year of 1.3x is

validation of the importance of the investments we have made, our

customer’s confidence in our execution, and the success we are

having in winning new business across our diversified markets.

Importantly, we are expanding our opportunity with existing

customers while diversifying with new customers and

applications.”

Fourth Quarter Fiscal 2023 Performance Review (All

comparisons are with the same prior-year period unless noted

otherwise.)

($ in millions except per share data)

Q4 FY23 Q4

FY22 $ Change Net sales

$

43.0

$

39.7

$

3.3

Gross profit

$

7.2

$

4.2

$

3.0

Gross margin

16.6%

10.6%

Operating loss

$

(0.4)

$

(2.1)

$

1.7

Operating margin

(0.8%)

(5.2%)

Net loss

$

(0.5)

$

(1.4)

$

0.9

Diluted net loss per share

$

(0.05)

$

(0.13)

$

0.08

Adjusted net income (loss)*

$

0.0

$

(0.2)

$

0.2

Adjusted diluted net income (loss) per share*

$

0.00

$

(0.02)

$

0.02

Adjusted EBITDA*

$

1.2

$

0.4

$

0.8

Adjusted EBITDA margin*

2.9%

1.0%

*Graham believes that adjusted EBITDA (defined as consolidated

net income (loss) before net interest expense, income taxes,

depreciation, amortization, other acquisition related expenses

(income), and other unusual/nonrecurring expenses), and adjusted

EBITDA margin (adjusted EBITDA as a percentage of net sales), which

are non-GAAP measures, help in the understanding of its operating

performance. Moreover, Graham’s credit facility also contains

ratios based on adjusted EBITDA as defined in the lending

agreement. Graham also believes that adjusted net income (loss) and

adjusted diluted net income (loss) per share, which excludes

intangible amortization, other costs related to the acquisition,

and other unusual/nonrecurring (income) expenses, provides a better

representation of the cash earnings of the Company. See the

attached tables and other information on pages 9 and 10 for

important disclosures regarding Graham’s use of adjusted EBITDA,

adjusted EBITDA margin, adjusted net income (loss), and adjusted

diluted net income (loss) per share, as well as the reconciliation

of net income (loss) to adjusted EBITDA, adjusted net income

(loss), and adjusted diluted net income (loss) per share.

Net sales of $43.0 million increased 8%, or $3.3 million. Growth

in the space market, as well as improvements in the commercial

aftermarket, offset continued weakness in large refining and

petrochemical capital investment projects. Aftermarket sales to the

refining and petrochemical markets were $7.1 million, up 45%. See

supplemental data for a further breakdown of sales by market and

region.

Compared with the prior year period, the 70% increase in gross

profit and 6 percentage point expansion of gross margin reflected

increased productivity, higher volume and improved mix of higher

margin sales. Offsetting gross profit and margin improvement were

$0.8 million in reserves related to the bankruptcy filing of a

major space customer, net of associated performance-based

compensation.

Selling, general and administrative expense (“SG&A”),

inclusive of amortization, in the fourth quarter of fiscal 2023 was

$7.5 million, or 17% of sales, up $1.4 million over the prior-year

period. Impacting SG&A in the quarter was $1.7 million, or 4%

of sales, in reserves related to the space customer, net of

associated performance-based compensation. The prior year’s fourth

quarter SG&A was impacted by $0.2 million in

acquisition-related costs.

Net loss and loss per diluted share were $481 thousand and

$0.05, respectively. On a non-GAAP basis, adjusted diluted net

income* and net income per share* were breakeven. Reserves related

to the space customer, net of associated performance-based

compensation, had an approximate $0.19 per share impact on earnings

in the quarter.

Full Year Fiscal 2023 Performance Review (All comparisons

are with the same prior-year period unless noted otherwise.)

($ in millions except per share data)

FY23 FY22

Change Net sales

$

157.1

$

122.8

$

34.3

Gross profit

$

25.4

$

9.1

$

16.3

Gross margin

16.2%

7.4%

Operating income (loss)

$

1.3

$

(11.3)

$

12.6

Operating margin

0.8%

(9.2%)

Net income (loss)

$

0.4

$

(8.8)

$

9.2

Diluted net income (loss) per share

$

0.03

$

(0.83)

$

0.86

Adjusted net income (loss)*

$

2.5

$

(6.6)

$

9.1

Adjusted diluted net income (loss) per share*

$

0.24

$

(0.62)

$

0.86

Adjusted EBITDA*

$

7.7

$

(5.0)

$

12.7

Adjusted EBITDA margin*

4.9%

(4.1%)

Net sales for fiscal 2023 were $157.1 million, up $34.3 million,

or 28%, driven by a $15.4 million increase in sales to multiple

customers in the space industry. Sales to the defense market

increased 5%, or $3.1 million, to $65.3 million, representing 42%

of total revenue. Aftermarket sales to the refining and

petrochemical markets increased 25.5% to $24.9 million, or 15.9% of

total revenue. See supplemental data for a further breakdown of

sales by market and region.

Year-over-year, gross margin improved 8.8 percentage points

reflecting improved mix of sales related to higher margin projects

(commercial space and aftermarket) and improved execution and

pricing on defense contracts. These improvements were partially

offset by the same impact of inventory reserves, net of associated

performance-based compensation, as noted in the fourth quarter.

Gross profit in fiscal 2022 included an estimated $10 million

impact related to labor and material cost overruns for first

article U.S. Navy projects. In fiscal 2023, the Company completed

four first article U.S. Navy projects, and remains on schedule to

complete its remaining two first article projects by the end of the

first half of fiscal 2024.

SG&A expense, inclusive of amortization, was $24.2 million,

up $2.9 million or 13% over the prior year. The increase reflects

the $1.7 million of reserves accrued for the space customer, net of

associated performance-based compensation, and $1.4 million

incremental SG&A expense from the full year of the acquisition.

Offsetting these increases were cost containment measures such as

the reduction of outside sales agents and delayed hiring of

non-critical positions, as well as the elimination of $0.6 million

in acquisition and integration costs incurred in the prior

year.

Net income and income per diluted share were $0.4 million and

$0.03, respectively. On a non-GAAP basis, adjusted net income* and

adjusted diluted net income per share* were $2.5 million and $0.24,

respectively.

Christopher Thome, Chief Financial Officer, commented, “We have

successfully diversified into the defense industry, as well as new

markets such as space and new energy. At fiscal year-end, we had

$8.2 million in backlog for the space market that reflected orders

from several space customers and a variety of programs. This

included no orders from the space customer that unfortunately filed

for bankruptcy protection in our fourth quarter. While a

disappointment, our improved operations enabled us to absorb the

impact of this event and still meet our guidance.” There remains

approximately $1 million to $2 million in potential additional

exposure related to the space customer depending on the outcome of

their proceedings and asset sale. However, at this time, the

Company does not expect further impact in fiscal 2024 or

beyond.

Cash Management and Balance Sheet

Cash generated from operations in the fourth quarter was $5.0

million. Cash and cash equivalents on March 31, 2023, were $18.3

million compared with $17.2 million on December 31, 2022. Capital

expenditures for the fourth quarter of fiscal 2023 were $1.3

million.

Debt at fiscal year-end was down $2.4 million to $11.7 million

compared with December 31, 2022. As of March 31, 2023, the Company

was in compliance with its lending agreement with a leverage ratio

as calculated in accordance with the terms of the credit facility

of 2.1x. At March 31, 2023, the amount available under the

revolving credit facility was approximately $10 million.

Orders and Backlog

See supplemental data for a further breakdown of orders and

backlog by market.

Q1 22 Q2 22 Q3 22 Q4 22 FY22

Q1 23 Q2 23 Q3 23 Q4 23 FY23

Orders

$

20.9

$

31.4

$

68.0

$

23.7

$

143.9

$

40.3

$

91.5

$

20.0

$

50.9

$

202.7

Backlog

$

235.9

$

233.2

$

272.6

$

256.5

$

256.5

$

260.7

$

313.3

$

293.7

$

301.7

$

301.7

Orders for the three-month period ended March 31, 2023, were up

$27.2 million, or 115%, to $50.8 million compared with $23.7

million for the same period of fiscal 2022. Aftermarket orders for

the refining and petrochemical markets were $11.5 million in the

fiscal 2023 fourth quarter, an increase of 37%.

Record orders in fiscal 2023 of $202.7 million were driven by

demand in most markets including defense, space, and new energy, as

well as aftermarket demand in refining and petrochemical markets.

Aftermarket orders were up 34% to $40.6 million for the year.

Backlog at fiscal year-end was $301.7 million, compared with

$293.7 million on December 31, 2022, and $256.5 million on March

31, 2022. Approximately 50% to 55% of orders currently in backlog

are expected to be converted to sales in fiscal 2024 and another

25% to 30% is expected to convert to sales within the next year.

The majority of orders expected to convert beyond twelve months are

for the defense industry, specifically the U.S. Navy.

Fiscal 2024 Outlook

Mr. Thoren concluded, “These are exciting times for our Company.

We continue to evolve our strategy to reduce our cyclicality and

further diversify our opportunities as we develop technologies that

help solve our customers’ problems. We are focusing our efforts

to:

- Pursue clearly defined markets where product and technology

differentiation matters

- Drive operational excellence while investing in process

optimization including digital and automated tools

- Build an elite team of people passionate about their work

- Engage all stakeholders to capture value

We have made significant progress with the advancements in our

business, which puts us ahead of schedule in achieving our fiscal

2027 goals. As a result, we now believe that we can achieve greater

than $200 million in revenue and adjusted EBITDA margins in the low

to mid-teens in fiscal 2027.”

The Company established guidance for fiscal 2024 as follows:

(as of June 8, 2023)

Fiscal 2024 Guidance

Revenue:

$165 million to $175 million

Gross margin:

~17%-18%

SG&A expense(1)

~15%-16% of sales

Adjusted EBITDA(2)

$10.5 million to $12.5

million

Effective tax rate

~22%-23%

Capital expenditures

$5.5 million - $7.0 million

(1)

SG&A expense as a % of sales includes

approximately $2 million to $3 million of BN performance bonus and

approximately $0.5 million to $1.0 million of enterprise resource

planning system (“ERP”) conversion costs.

(2)

Adjusted EBITDA excludes approximately $2

million to $3 million of BN performance bonus and approximately

$0.5 million to $1.0 million of ERP conversion costs. See

“Forward-Looking Non-GAAP Measures” below for additional

information about this non-GAAP measure.

Webcast and Conference Call

GHM’s management will host a conference call and live webcast

today at 11:00 a.m. Eastern Time (“ET”) to review its financial

condition and operating results, as well as its strategy and

outlook. The review will be accompanied by a slide presentation,

which will be made available immediately prior to the conference

call on GHM’s investor relations website.

A question-and-answer session will follow the formal

presentation. GHM’s conference call can be accessed by calling

(201) 689-8560. Alternatively, the webcast can be monitored from

the events section of GHM’s investor relations website.

A telephonic replay will be available from 2:00 p.m. ET on the

day of the teleconference through Thursday, June 22, 2023 at 11:59

p.m. ET. To listen to the archived call, dial (412) 317-6671 and

enter conference ID number 13738114 or access the webcast replay

via the Company’s website at ir.grahamcorp.com, where a transcript

will also be posted once available.

About Graham Corporation

GHM is a global leader in the design and manufacture of mission

critical fluid, power, heat transfer and vacuum technologies for

the defense, space, energy, and process industries. The Graham

Manufacturing and Barber-Nichols’ global brands are built upon

world-renowned engineering expertise in vacuum and heat transfer,

cryogenic pumps, and turbomachinery technologies, as well as its

responsive and flexible service and the unsurpassed quality

customers have come to expect from the Company’s products and

systems.

Graham Corporation routinely posts news and other important

information on its website, grahamcorp.com, where additional

information on Graham Corporation and its businesses can be

found.

Safe Harbor Regarding Forward Looking Statements

This news release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as

amended.

Forward-looking statements are subject to risks, uncertainties

and assumptions and are identified by words such as “expects,”

“outlook,” “anticipates,” “believes,” “could,” “guidance,”

“should,” ”may”, “will,” “tends,” “focus,” “plan” and other similar

words. All statements addressing operating performance, events, or

developments that Graham Corporation expects or anticipates will

occur in the future, including but not limited to, profitability of

future projects and the business, its ability to deliver to plan,

its ability to meet customers’ shipment and delivery expectations,

the future impact of low margin defense projects and related cost

overruns, expected expansion and growth opportunities within its

domestic and international markets, anticipated sales, revenues,

adjusted EBITDA, adjusted EBITDA margins, capital expenditures and

SG&A expenses, the timing of conversion of backlog to sales,

orders, market presence, profit margins, tax rates, foreign sales

operations, its ability to improve cost competitiveness and

productivity, customer preferences, changes in market conditions in

the industries in which it operates, changes in general economic

conditions and customer behavior, forecasts regarding the timing

and scope of the economic recovery in its markets, and its

acquisition and growth strategy, are forward-looking statements.

Because they are forward-looking, they should be evaluated in light

of important risk factors and uncertainties. These risk factors and

uncertainties are more fully described in Graham Corporation’s most

recent Annual Report filed with the Securities and Exchange

Commission (the “SEC”), included under the heading entitled “Risk

Factors”, and in other reports filed with the SEC.

Should one or more of these risks or uncertainties materialize

or should any of Graham Corporation’s underlying assumptions prove

incorrect, actual results may vary materially from those currently

anticipated. In addition, undue reliance should not be placed on

Graham Corporation’s forward-looking statements. Except as required

by law, Graham Corporation disclaims any obligation to update or

publicly announce any revisions to any of the forward-looking

statements contained in this news release.

Forward-Looking Non-GAAP Measures

Forward-looking adjusted EBITDA and adjusted EBITDA margin are

non-GAAP measures. The Company is unable to present a quantitative

reconciliation of these forward-looking non-GAAP financial measures

to their most directly comparable forward-looking GAAP financial

measures because such information is not available, and management

cannot reliably predict the necessary components of such GAAP

measures without unreasonable effort largely because forecasting or

predicting our future operating results is subject to many factors

out of our control or not readily predictable. In addition, the

Company believes that such reconciliations would imply a degree of

precision that would be confusing or misleading to investors. The

unavailable information could have a significant impact on the

Company’s fiscal 2024 financial results. These non-GAAP financial

measures are preliminary estimates and are subject to risks and

uncertainties, including, among others, changes in connection with

purchase accounting, quarter-end, and year-end adjustments. Any

variation between the Company’s actual results and preliminary

financial estimates set forth above may be material.

Key Performance Indicators

In addition to the foregoing non-GAAP measures, management uses

the following key performance metrics to analyze and measure the

Company’s financial performance and results of operations: orders,

backlog, and book-to-bill ratio. Management uses orders and backlog

as measures of current and future business and financial

performance and these may not be comparable with measures provided

by other companies. Orders represent written communications

received from customers requesting the Company to provide products

and/or services. Backlog is defined as the total dollar value of

net orders received for which revenue has not yet been recognized.

Management believes tracking orders and backlog are useful as it

often times is a leading indicator of future performance. In

accordance with industry practice, contracts may include provisions

for cancellation, termination, or suspension at the discretion of

the customer.

The book-to-bill ratio is an operational measure that management

uses to track the growth prospects of the Company. The Company

calculates the book-to-bill ratio for a given period as net orders

divided by net sales.

Given that each of orders, backlog and book-to-bill ratio is an

operational measure and that the Company's methodology for

calculating orders, backlog and book-to-bill ratio does not meet

the definition of a non-GAAP measure, as that term is defined by

the U.S. Securities and Exchange Commission, a quantitative

reconciliation for each is not required or provided.

FINANCIAL TABLES FOLLOW.

Graham Corporation

Consolidated Statements of Operations - Unaudited (Amounts

in thousands, except per share data)

Three Months Ended Year Ended March

31, March 31,

2023

2022

% Change

2023

2022

% Change Net sales

$

43,027

$

39,737

8%

$

157,118

$

122,814

28%

Cost of products sold

35,870

35,526

1%

131,710

113,685

16%

Gross profit

7,157

4,211

NA

25,408

9,129

NA

Gross margin

16.6%

10.6%

16.2%

7.4%

Other expenses and income:

Selling, general and administrative

7,235

5,852

24%

23,063

20,386

13%

Selling, general and administrative – amortization

274

274

0%

1,095

913

20%

Other operating expense (income), net

-

135

(100%)

-

(827)

(100%)

Operating profit (loss)

(352)

(2,050)

NA

1,250

(11,343)

NA

Operating margin

(0.8%)

(5.2%)

0.8%

-9.2%

Other income, net

(62)

(111)

(44%)

(250)

(527)

(53%)

Interest income

(58)

(7)

729%

(129)

(50)

158%

Interest expense

300

150

100%

1,068

450

137%

Income (loss) before provision (benefit) for income taxes

(532)

(2,082)

NA

561

(11,216)

NA

Provision (benefit) for income taxes

(51)

(657)

NA

194

(2,443)

NA

Net income (loss)

$

(481)

$

(1,425)

NA

$

367

$

(8,773)

NA

Per share data:

Basic:

Net income (loss)

$

(0.05)

$

(0.13)

NA

$

0.03

$

(0.83)

NA

Diluted:

Net income (loss)

$

(0.05)

$

(0.13)

NA

$

0.03

$

(0.83)

NA

Weighted average common shares outstanding: Basic

10,617

10,645

10,614

10,541

Diluted

10,617

10,645

10,654

10,541

Dividends declared per share

$

-

$

-

$

-

$

0.33

N/A: Not Applicable

Graham Corporation

Consolidated Balance Sheets – Unaudited (Amounts in

thousands, except per share data)

March 31, March 31,

2023

2022

Assets Current assets: Cash and cash equivalents

$

18,257

$

14,741

Trade accounts receivable, net of allowances ($1,841 and $87 at

March 31 and March 31, 2022, respectively)

24,000

27,645

Unbilled revenue

39,684

25,570

Inventories

26,293

17,414

Prepaid expenses and other current assets

1,534

1,391

Income taxes receivable

302

459

Total current assets

110,070

87,220

Property, plant and equipment, net

25,523

24,884

Prepaid pension asset

6,107

7,058

Operating lease assets

8,237

8,394

Goodwill

23,523

23,523

Customer relationships, net

10,718

11,308

Technology and technical know-how, net

9,174

9,679

Other intangible assets, net

7,610

8,990

Deferred income tax asset

2,798

2,441

Other assets

158

194

Total assets

$

203,918

$

183,691

Liabilities and stockholders’ equity Current

liabilities: Current portion of long-term debt

$

2,000

$

2,000

Current portion of finance lease obligations

29

23

Accounts payable

20,222

16,662

Accrued compensation

10,401

7,991

Accrued expenses and other current liabilities

6,434

6,047

Customer deposits

46,042

25,644

Operating lease liabilities

1,022

1,057

Income taxes payable

16

-

Total current liabilities

86,166

59,424

Long-term debt

9,744

16,378

Finance lease obligations

85

11

Operating lease liabilities

7,498

7,460

Deferred income tax liability

108

62

Accrued pension and postretirement benefit liabilities

1,342

1,666

Other long-term liabilities

2,042

2,196

Total liabilities

106,985

87,197

Stockholders’ equity: Preferred stock, $1.00 par

value, 500 shares authorized

-

-

Common stock, $0.10 par value, 25,500 shares authorized, 10,774 and

10,801 shares issued and 10,635 and 10,636 shares outstanding at

March 31, 2022 and 2021, respectively

1,075

1,080

Capital in excess of par value

28,061

27,770

Retained earnings

77,443

77,076

Accumulated other comprehensive loss

(7,463

)

(6,471

)

Treasury stock (138 and 164 shares at March 31, 2022 and 2021,

respectively)

(2,183

)

(2,961

)

Total stockholders’ equity

96,933

96,494

Total liabilities and stockholders’ equity

$

203,918

$

183,691

Graham Corporation

Consolidated Statements of Cash Flows – Unaudited (Amounts

in thousands)

Year Ended March 31,

2023

2022

Operating activities: Net income (loss)

$

367

$

(8,773

)

Adjustments to reconcile net income (loss) to net cash provided

(used) by operating activities: Depreciation

3,511

3,077

Amortization

2,476

2,522

Space accounts receivable and inventory reserves

3,050

-

Amortization of actuarial losses

672

996

Amortization of debt issuance costs

212

-

Equity-based compensation expense

806

809

Gain on disposal or sale of property, plant and equipment

-

23

Change in fair value of contingent consideration

-

(1,900

)

Deferred income taxes

(120

)

(3,233

)

(Increase) decrease in operating assets: Accounts receivable

1,520

(2,055

)

Unbilled revenue

(14,228

)

1,550

Inventories

(9,919

)

3,483

Prepaid expenses and other current and non-current assets

(97

)

(340

)

Income taxes receivable

139

(1,208

)

Operating lease assets

1,206

1,059

Prepaid pension asset

(651

)

(1,207

)

Increase (decrease) in operating liabilities: Accounts payable

3,467

(3,238

)

Accrued compensation, accrued expenses and other current and

non-current liabilities

2,654

1,164

Customer deposits

20,526

5,523

Operating lease liabilities

(1,049

)

(962

)

Long-term portion of accrued compensation, accrued pension

liability and accrued postretirement benefits

(628

)

491

Net cash provided (used) by operating activities

13,914

(2,219

)

Investing activities: Purchase of property, plant and

equipment

(3,749

)

(2,324

)

Redemption of investments at maturity

-

5,500

Acquisition of Barber-Nichols, LLC

-

(60,282

)

Net cash used by investing activities

(3,749

)

(57,106

)

Financing activities: Borrowings of short-term debt

obligations

5,000

-

Principal repayments on debt

(11,000

)

(39,750

)

Proceeds from the issuance of debt

-

58,250

Principal repayments on finance lease obligations

(23

)

(21

)

Repayments on lease financing obligations

(275

)

(225

)

Payment of debt issuance costs

(122

)

(271

)

Dividends paid

-

(3,523

)

Purchase of treasury stock

(21

)

(41

)

Net cash (used) provided by financing activities

(6,441

)

14,419

Effect of exchange rate changes on cash

(208

)

115

Net increase (decrease) in cash and cash equivalents

3,516

(44,791

)

Cash and cash equivalents at beginning of period

14,741

59,532

Cash and cash equivalents at end of period

$

18,257

$

14,741

Graham Corporation

Adjusted EBITDA Reconciliation (Unaudited, $ in thousands,

except per share amounts)

Three Months Ended Year Ended March

31, March 31,

2023

2022

2023

2022

Net income (loss)

$

(481

)

$

(1,425

)

$

367

$

(8,773

)

Acquisition related inventory step-up expense

-

27

-

95

Acquisition & integration costs

-

189

54

562

Change in fair value of contingent consideration

-

-

-

(1,900

)

CEO and CFO transition costs

-

244

-

1,182

Debt amendment costs

-

278

194

278

Net interest expense

242

143

939

400

Income taxes

(51

)

(657

)

194

(2,443

)

Depreciation & amortization

1,519

1,602

5,987

5,599

Adjusted EBITDA

$

1,229

$

401

$

7,735

$

(5,000

)

Adjusted EBITDA margin %

2.9

%

1.0

%

4.9

%

(4.1

%)

Adjusted Net Income (Loss) and

Adjusted Diluted Earnings (Loss) per Share Reconciliation

(Unaudited, $ in thousands, except per share amounts)

Three Months Ended Year Ended March

31, March 31,

2023

2022

2023

2022

Net income (loss)

$

(481

)

$

(1,425

)

$

367

$

(8,773

)

Acquisition related inventory step-up expense

-

27

-

95

Acquisition & integration costs

-

189

54

562

Amortization of intangible assets

619

757

2,476

2,522

Change in fair value of contingent consideration

-

-

-

(1,900

)

CEO and CFO transition costs

-

244

-

1,182

Debt amendment costs

-

278

194

278

Normalize tax rate(1)

(130

)

(299

)

(572

)

(548

)

Adjusted net income (loss)

$

8

$

(229

)

$

2,519

$

(6,582

)

GAAP diluted net income (loss) per share

$

(0.05

)

$

(0.13

)

$

0.03

$

(0.83

)

Adjusted diluted net income (loss) per share

$

0.00

$

(0.02

)

$

0.24

$

(0.62

)

Diluted weighted average common sharesoutstanding

10,617

10,645

10,654

10,541

(1) Applies a normalized tax rate to non-GAAP adjustments,

which are pre-tax, based upon the statutory tax rate of 21%.

Non-GAAP Financial Measures

Adjusted EBITDA is defined as consolidated net income (loss)

before net interest expense, income taxes, depreciation,

amortization, other acquisition related expenses, and other

unusual/nonrecurring expenses. Adjusted EBITDA margin is defined as

Adjusted EBITDA as a percentage of sales. Adjusted EBITDA and

Adjusted EBITDA margin are not measures determined in accordance

with generally accepted accounting principles in the United States,

commonly known as GAAP. Nevertheless, Graham believes that

providing non-GAAP information, such as Adjusted EBITDA and

Adjusted EBITDA margin, is important for investors and other

readers of Graham's financial statements, as it is used as an

analytical indicator by Graham's management to better understand

operating performance. Moreover, Graham’s credit facility also

contains ratios based on EBITDA. Because Adjusted EBITDA and

Adjusted EBITDA margin are non-GAAP measures and are thus

susceptible to varying calculations, Adjusted EBITDA, and Adjusted

EBITDA margin, as presented, may not be directly comparable to

other similarly titled measures used by other companies.

Adjusted net income (loss) and adjusted diluted earnings (loss)

per share are defined as net income (loss) and diluted earnings

(loss) per share as reported, adjusted for certain items and at a

normalized tax rate. Adjusted net income (loss) and adjusted

diluted earnings (loss) per share are not measures determined in

accordance with GAAP, and may not be comparable to the measures as

used by other companies. Nevertheless, Graham believes that

providing non-GAAP information, such as adjusted net income and

adjusted diluted earnings (loss) per share, is important for

investors and other readers of the Company’s financial statements

and assists in understanding the comparison of the current

quarter’s and current fiscal year's net income (loss) and diluted

earnings (loss) per share to the historical periods' net income

(loss) and diluted earnings (loss) per share. Graham also believes

that adjusted earnings (loss) per share, which adds back intangible

amortization expense related to acquisitions, provides a better

representation of the cash earnings of the Company.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230608005202/en/

Christopher J. Thome Vice President - Finance and CFO Phone:

(585) 343-2216 Deborah K. Pawlowski Kei Advisors LLC Phone: (716)

843-3908 dpawlowski@keiadvisors.com

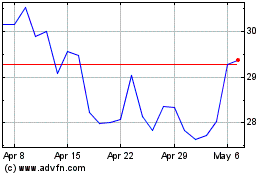

Graham (NYSE:GHM)

Historical Stock Chart

From Apr 2024 to May 2024

Graham (NYSE:GHM)

Historical Stock Chart

From May 2023 to May 2024