Graco Inc. (NYSE: GGG) today announced results for the

quarter and nine months ended September 25, 2009.

Summary

$ in millions except per share amounts

Thirteen Weeks Ended Thirty-nine Weeks

Ended Sep 25, Sep 26, %

Sep 25, Sep 26, % 2009

2008 Change 2009 2008 Change

Net Sales $ 147.3 $ 207.2 (29 )% $ 432.9 $ 650.6 (33 )% Net

Earnings 17.3 32.8 (47 )% 31.7 110.8 (71 )%

Diluted Net Earnings per

Common Share

$ 0.29 $ 0.54 (46 )% $ 0.53 $ 1.81 (71 )%

- Net earnings were $17 million in

the third quarter, on sales of $147 million.

- Sales of $147 million for the

quarter are steady compared to the second quarter and up 7 percent

compared to the first quarter. Compared to the third quarter last

year, sales and orders decreased in all segments and regions.

- Gross margin rate of 53 percent

for the third quarter improved from 49 percent in the second

quarter and 47 percent in the first quarter, and equals last year’s

third quarter rate.

- Currency translation had an

unfavorable effect on year-to-date sales ($14 million) and net

earnings ($5 million).

- Cash flow from year-to-date

operations totaled $110 million.

“While sales remain low compared to last year, we are pleased

with the improvement in profitability over the most recent two

quarters of 2009,” said Patrick J. McHale, President and Chief

Executive Officer. “Cash flow remains strong, and our focus on

managing working capital has reduced inventories by $31 million and

receivables by $21 million since the end of last year. We also

reduced long-term debt by $73 million and made a voluntary $15

million tax-deductible contribution to our defined benefit pension

plan. We intend to continue making targeted investments in our

strategic growth initiatives while managing working capital.”

Consolidated Results

Sales are down 29 percent for the quarter and 33 percent

year-to-date. For the quarter, sales decreased 25 percent in the

Americas, 39 percent in Europe (36 percent at consistent

translation rates) and 25 percent in Asia Pacific. Year-to-date

sales decreased 30 percent in the Americas, 44 percent in Europe

(38 percent at consistent translation rates) and 26 percent in Asia

Pacific.

Gross profit margin, expressed as a percentage of sales, was 53

percent for the quarter and 50 percent year-to-date, compared to 53

percent and 54 percent, respectively, for the comparable periods

last year. For the quarter, the favorable effects of pricing, lower

material costs and cost reduction actions are offset by decreases

from lower production volume and increased pension cost. Decreases

in the year-to-date rate were due to lower production volumes

(approximately 5 percentage points), unfavorable currency

translation rates (approximately 1 percentage point) and increased

pension cost (approximately 1 percentage point). Decreases were

offset somewhat by the effects of favorable material costs and

pricing.

Total operating expenses for the quarter and year-to-date are

down 10 percent and 8 percent, respectively. For both the quarter

and year-to-date, the effects of spending reductions and lower

volume-related expenses are partially offset by higher pension

expenses. Year-to-date, a $4 million decrease from translation

effects is partially offset by $2 million related to workforce

reductions.

Effective income tax rates were 30 percent for the quarter and

31 percent year-to-date, down from last year’s rates of 34 percent

for the quarter and 33 percent year-to-date. A higher-than-expected

benefit upon filing of prior year tax returns contributed to lower

rates in 2009. Effective rates were higher in 2008 because the

R&D tax credit was not renewed until the fourth quarter and no

credit was included in the provisions for the first three quarters

of 2008.

Segment Results

Certain measurements of segment operations are summarized

below:

Thirteen Weeks Thirty-nine Weeks

Industrial Contractor

Lubrication Industrial Contractor

Lubrication Net sales (in millions) $ 78.2 $

55.4 $ 13.7 $ 226.8 $ 163.2 $ 42.9

Net sales percentage

change from last year

(34)% (18)% (37)% (38)% (24)% (38)%

Operating earnings as

a percentage of net sales

2009

26% 20% (1)% 20% 15% (8)%

2008

30% 22% 16% 32% 23% 18%

All segments experienced double-digit percentage decreases in

sales compared to last year for both the quarter and year-to-date.

Improved third quarter operating earnings of all segments reflect

the lower cost structure resulting from workforce and other

spending reduction actions taken in the first quarter of 2009 and

the fourth quarter of 2008. Year-to-date operating earnings of all

segments reflect the impacts of low volume, workforce reduction

costs and higher pension cost. Contractor operating results are

affected by sales, costs and expenses related to the rollout of

entry-level paint sprayers to additional paint and home center

stores earlier in 2009 and in 2008. Mix of product sold and costs

related to discontinued products contributed to lower margin rates

in the Lubrication segment.

Outlook

“While economic conditions continue to create headwinds for our

business, we are encouraged by improved profitability in each of

the last two quarters, resulting from our efforts to improve

production costs and control expenses,” said Patrick J. McHale,

President and Chief Executive Officer. “We expect to continue

investing in growth initiatives including product development,

international expansion and entering new markets. We believe the

Company will emerge from the recession with strong, profitable

growth.”

Cautionary Statement Regarding Forward-Looking

Statements

A forward-looking statement is any statement made in this

earnings release and other reports that the Company files

periodically with the Securities and Exchange Commission, as well

as in press releases, analyst briefings, conference calls and the

Company’s Annual Report to shareholders, which reflects the

Company’s current thinking on market trends and the Company’s

future financial performance at the time they are made. All

forecasts and projections are forward-looking statements. The

Company undertakes no obligation to update these statements in

light of new information or future events.

The Company desires to take advantage of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995

by making cautionary statements concerning any forward-looking

statements made by or on behalf of the Company. The Company cannot

give any assurance that the results forecasted in any

forward-looking statement will actually be achieved. Future results

could differ materially from those expressed, due to the impact of

changes in various factors. These risk factors include, but are not

limited to: economic conditions in the United States and other

major world economies, currency fluctuations, political

instability, changes in laws and regulations, and changes in

product demand. Please refer to Item 1A of, and Exhibit 99 to, the

Company’s Annual Report on Form 10-K for fiscal year 2008 (and most

recent Form 10-Q, if applicable) for a more comprehensive

discussion of these and other risk factors. These reports are

available on the Company’s website at www.graco.com and the

Securities and Exchange Commission’s website at www.sec.gov.

Conference Call

Graco management will hold a conference call, including slides

via webcast, with analysts and institutional investors on Thursday,

October 22, 2009, at 11:00 a.m. ET to discuss Graco’s third quarter

results.

A real-time Webcast of the conference call will be broadcast

live over the Internet. Individuals wanting to listen and view

slides can access the call at the Company’s website at www.graco.com. Listeners should go to the

website at least 15 minutes prior to the live conference call to

install any necessary audio software.

For those unable to listen to the live event, a replay will be

available soon after the conference call at Graco’s website, or by

telephone beginning at approximately 2:00 p.m. ET on October 22,

2009, by dialing 800.406.7325, Conference ID #4170310, if calling

within the U.S. or Canada. The dial-in number for international

participants is 303.590.3030, with the same Conference ID #. The

replay by telephone will be available through October 27, 2009.

Graco Inc. supplies technology and expertise for the management

of fluids in both industrial and commercial applications. It

designs, manufactures and markets systems and equipment to move,

measure, control, dispense and spray fluid materials. A recognized

leader in its specialties, Minneapolis-based Graco serves customers

around the world in the manufacturing, processing, construction and

maintenance industries. For additional information about Graco

Inc., please visit us at www.graco.com.

GRACO INC. AND SUBSIDIARIES

Consolidated Statement of Earnings (Unaudited)

Thirteen Weeks Ended Thirty-nine Weeks Ended Sep 25, Sep 26, Sep

25, Sep 26, (in thousands, except per share amounts) 2009 2008 2009

2008

Net Sales $ 147,308 $ 207,231 $ 432,900 $

650,581 Cost of products sold 69,167 97,071

217,423 299,805

Gross

Profit 78,141 110,160 215,477 350,776 Product development 8,752

9,626 28,584 26,605 Selling, marketing and distribution 26,589

32,420 86,814 102,083 General and administrative 16,613

15,585 49,317 50,142

Operating Earnings 26,187 52,529 50,762 171,946

Interest expense 1,148 1,934 3,735 5,443 Other expense (income),

net 203 623 889

606

Earnings Before Income Taxes 24,836 49,972 46,138

165,897 Income taxes 7,500 17,200

14,400 55,100

Net Earnings $

17,336 $ 32,772 $ 31,738 $ 110,797

Net Earnings per Common Share Basic $ 0.29 $ 0.55 $

0.53 $ 1.83 Diluted 0.29 0.54 $ 0.53 $ 1.81

Weighted Average

Number of Shares Basic 59,940 59,769 59,827 60,521 Diluted

60,314 60,365 60,133 61,168

Segment Information

(Unaudited) Thirteen Weeks Ended Thirty-nine Weeks Ended

Sep 25, Sep 26, Sep 25, Sep 26, 2009 2008 2009 2008

Net

Sales Industrial $ 78,242 $ 117,685 $ 226,808 $ 365,028

Contractor 55,379 67,751 163,213 215,992 Lubrication 13,687

21,795 42,879 69,561

Consolidated $ 147,308 $ 207,231 $

432,900 $ 650,581

Operating Earnings

Industrial $ 20,332 $ 35,874 $ 45,262 $ 117,847 Contractor 11,138

15,226 24,420 49,663 Lubrication (167 ) 3,409 (3,348 ) 12,333

Unallocated corporate (5,116 ) (1,980 )

(15,572 ) (7,897 )

Consolidated $ 26,187 $

52,529 $ 50,762 $ 171,946 All figures

are subject to audit and adjustment at the end of the fiscal year.

The Consolidated Balance Sheets, Consolidated Statements of Cash

Flows and Management's Discussion and Analysis are available in our

Quarterly Report on Form 10-Q on our website at

www.graco.com.

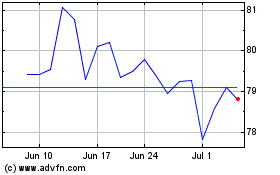

Graco (NYSE:GGG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Graco (NYSE:GGG)

Historical Stock Chart

From Jul 2023 to Jul 2024