Gorman-Rupp Completes Debt Refinancing

June 03 2024 - 7:30AM

Business Wire

The Gorman-Rupp Company (NYSE: GRC) (the “Company”), a leading

designer, manufacturer, and international marketer of pumps and

pump systems, announced the completion of a series of transactions

to refinance its debt. These transactions are expected to reduce

interest expense, and will extend and stagger the Company’s debt

maturities.

Summary:

- Upsized, amended and extended the existing Senior Term Loan

Facility to $370.0 million;

- Amended and extended the existing $100.0 million revolving

Credit Facility;

- Issued $30.0 million of new 6.40% Senior Secured Notes due

2031; and

- Retired the existing $90.0 million unsecured Subordinated

Credit Facility.

Loans under the upsized, amended and extended Amended and

Restated Senior Secured Credit Agreement will initially accrue

interest at an annual rate of Adjusted Term SOFR plus 2.25%,

subject to an improved leverage based pricing grid. Amortization is

payable quarterly on the term loans with the balance due on a new

maturity date of May 31, 2029, which was extended from May 31,

2027. The maturity date for the existing $100.0 million revolving

Credit Facility, which remained at a zero balance following the

refinancing, was similarly extended to May 31, 2029. The Company

privately placed $30.0 million aggregate principal amount of new

Senior Secured Notes which accrue interest at a fixed annual rate

of 6.40%, with interest paid semi-annually and the principal due in

full on May 31, 2031. The proceeds from the upsized Amended and

Restated Senior Secured Credit Agreement and the issuance of the

new Senior Secured Notes, as well as $10.0 million of cash on hand,

were used to retire the Company’s $90.0 million unsecured

Subordinated Credit Facility. The retired Subordinated Credit

Facility had been accruing interest at an annual rate of Adjusted

Term SOFR plus 9.10% and was scheduled to mature on December 1,

2027.

The combined transactions are expected to reduce annual interest

expense by approximately $7.0 million, subject to changes in the

underlying interest rates. In the second quarter of 2024, the

Company will record a $1.8 million prepayment fee related to the

early retirement of the unsecured Subordinated Credit Facility and

will expense approximately $1.3 million of transaction related

fees. In addition, the Company will record a non-cash charge of

approximately $4.4 million to write-off unamortized previously

deferred transaction fees related to both the unsecured

Subordinated Credit Facility and a portion of the existing Senior

Term Loan Facility.

Jim Kerr, Executive Vice President and Chief Financial Officer

commented, “Since the acquisition of Fill-Rite in May 2022 we have

been focused on reducing the debt incurred to finance the

acquisition and improving our leverage. Our financial results and

working capital management have improved our leverage and allowed

us to retire the higher interest unsecured subordinated debt,

replacing it with lower interest secured debt with a later maturity

date. We believe the new structure provides flexibility and

continues to position us to execute on our strategic initiatives

and create value for our shareholders.”

The Company will provide more details about the terms and

conditions in a Form 8-K filing with the Securities and Exchange

Commission (SEC).

About The Gorman-Rupp Company

Founded in 1933, The Gorman-Rupp Company is a leading designer,

manufacturer and international marketer of pumps and pump systems

for use in diverse water, wastewater, construction, dewatering,

industrial, petroleum, original equipment, agriculture, fire

suppression, heating, ventilating and air conditioning (HVAC),

military and other liquid-handling applications.

Forward-Looking Statements

In connection with the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, The Gorman-Rupp Company

provides the following cautionary statement: This news release

contains various forward-looking statements based on assumptions

concerning The Gorman-Rupp Company’s operations, future results and

prospects. These forward-looking statements are based on current

expectations about important economic, political, and technological

factors, among others, and are subject to risks and uncertainties,

which could cause the actual results or events to differ materially

from those set forth in or implied by the forward-looking

statements and related assumptions. Such uncertainties include, but

are not limited to, our estimates of future interest rate expense,

earnings and cash flows, general economic conditions and supply

chain conditions and any related impact on costs and availability

of materials, integration of the Fill-Rite business in a timely and

cost effective manner, retention of supplier and customer

relationships and key employees, the ability to achieve synergies

and cost savings in the amounts and within the time frames

currently anticipated and the ability to service and repay

indebtedness incurred in connection with the transaction. Other

factors include, but are not limited to: company specific risk

factors including (1) loss of key personnel; (2) intellectual

property security; (3) acquisition performance and integration; (4)

the Company’s indebtedness and how it may impact the Company’s

financial condition and the way it operates its business; (5)

general risks associated with acquisitions; (6) the anticipated

benefits from the Fill-Rite transaction may not be realized; (7)

impairment in the value of intangible assets, including goodwill;

(8) defined benefit pension plan settlement expense; (9) risk of

reserve and expense increases resulting from the LIFO inventory

method; and (10) family ownership of common equity; and general

risk factors including (11) continuation of the current and

projected future business environment; (12) highly competitive

markets; (13) availability and costs of raw materials and labor;

(14) cybersecurity threats; (15) compliance with, and costs related

to, a variety of import and export laws and regulations; (16)

environmental compliance costs and liabilities; (17) exposure to

fluctuations in foreign currency exchange rates; (18) conditions in

foreign countries in which The Gorman-Rupp Company conducts

business; (19) changes in our tax rates and exposure to additional

income tax liabilities; and (20) risks described from time to time

in our reports filed with the Securities and Exchange Commission.

Except to the extent required by law, we do not undertake and

specifically decline any obligation to review or update any

forward-looking statements or to publicly announce the results of

any revisions to any of such statements to reflect future events or

developments or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240603610275/en/

Brigette A. Burnell Corporate Secretary The Gorman-Rupp Company

Telephone (419) 755-1246 For additional information, contact James

C. Kerr, Chief Financial Officer, Telephone (419) 755-1548.

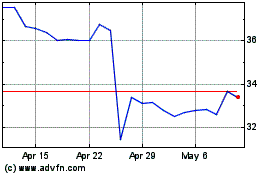

Gorman Rupp (NYSE:GRC)

Historical Stock Chart

From Oct 2024 to Nov 2024

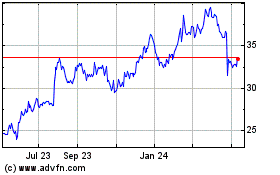

Gorman Rupp (NYSE:GRC)

Historical Stock Chart

From Nov 2023 to Nov 2024