false

0001600438

0001600438

2023-12-18

2023-12-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): December 18, 2023

GMS INC.

(Exact name of

registrant as specified in charter)

| Delaware |

|

001-37784 |

|

46-2931287 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

100 Crescent Centre Parkway, Suite 800

Tucker, Georgia |

|

30084 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (800) 392-4619

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

GMS |

|

New York Stock Exchange |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act ¨

Item 7.01. Regulation FD Disclosure.

On December 18, 2023, GMS Inc., a Delaware

corporation (the “ Company ”), and its wholly owned subsidiary, Empire Construction Supply, Inc.,

a Georgia corporation (“Purchaser”), entered into an Asset Purchase Agreement (the “Purchase Agreement ”)

with the Sellers (as defined therein), the Owners (as defined therein), the Seller Related Principals (as defined therein) and the Sellers’

Representative (as defined therein), pursuant to which, among other things, Purchaser, has agreed to acquire substantially all of the

assets of the Sellers (the “ Acquisition ”) for an aggregate purchase price of approximately $317 million

on a debt-free, cash-free basis (the “Purchase Consideration”). The Purchase Consideration is subject to a customary

net working capital adjustment, as set forth in the Purchase Agreement.

The Company expects to fund the Acquisition

with cash on hand and borrowings under the Company’s established revolving credit facility. The Purchase Agreement contains customary

representations, warranties, indemnification (and related escrows), confidentiality obligations, and other provisions. The Acquisition

is expected to close in our fourth quarter fiscal 2024, which ends on April 30, 2024, subject to the satisfaction or waiver of customary

closing conditions, including the expiration or early termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust

Improvements Act of 1976, as amended.

A copy of the press release issued by the

Company announcing the proposed Acquisition is furnished as Exhibit 99.1 to this report and is incorporated by reference herein.

In accordance with General Instruction B.2

of Form 8-K, the information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto,

shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing

under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such

a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

*Furnished herewith

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GMS INC. |

| |

|

|

|

| |

|

|

|

| Date: December 22, 2023 |

By: |

/s/ Scott M. Deakin |

| |

|

Name: |

Scott M. Deakin |

| |

|

Title: |

Chief Financial Officer |

Exhibit 99.1

GMS to Acquire Kamco Supply Corporation

Transaction to Significantly Expand GMS’s

Presence in the Greater New York City Area

TUCKER, Ga.— December 21, 2023 -- GMS Inc. (NYSE:

GMS), a leading North American specialty building products distributor, today announced that it has entered into an agreement to acquire

Kamco Supply Corporation and affiliates (“Kamco” or the “Company”). The transaction is expected to close during

the fourth quarter of fiscal 2024 for GMS, which ends on April 30, 2024.

Founded in 1939 by the Swerdlick family, and headquartered

in Brooklyn, New York, Kamco is a leading supplier of ceilings, wallboard, steel, lumber, and other related construction products. The

Company operates five distribution facilities in the Greater New York City area and services the New York metro and tri-state area. For

the 12 months ended June 30, 2023, Kamco recorded revenues of approximately $245 million.

John C. Turner, Jr., President, and Chief Executive Officer

of GMS, said, “Kamco is a long-established leader in the building materials industry with an experienced and successful team. They

are known for exceptional service and have outstanding customer relationships and an impressive suite of products from numerous leading

brands, including Armstrong, CertainTeed, National Gypsum, USG, Owens Corning and others. This acquisition represents a unique opportunity

to advance GMS’s strategic priorities, including expanding share in our core product categories and continuing to develop our presence

in the New York metropolitan market, the largest remaining MSA where we do not have a significant presence. We look forward to continuing

Kamco’s impressive legacy of excellence that Allen Swerdlick and his team have built and grown over the last eight decades. We expect

the addition of this business to GMS to provide enhanced customer service capability, significant cross-selling opportunities, a strengthened

value proposition and a broader suite of top tier-product offerings in the largest metropolitan area in the United States.”

Scott Little, President of Kamco said, “We share

GMS’s vision of building long-term relationships and providing best-in-class customer service to our customers. As such, we believe

that partnering with an industry leader whose values are well aligned with our own presents excellent opportunities for our employees

and customers alike, and we look forward to driving continued success as part of GMS.”

Transaction Details, Leadership and Closing

GMS expects to fund this transaction with cash on hand

and borrowings under the Company’s established revolving credit facility.

Following the close of the transaction, Kamco’s

current President, Mr. Little and its senior leadership team, will continue to lead the business and the Company will continue to operate

under the “Kamco” brand as it has for over 80 years.

GMS expects to capitalize on cross-selling opportunities

with Kamco and GMS’s other operations in the region, including the recently acquired Tanner Bolt and Nut, Inc. business. Expanded

Wallboard distribution and Complementary Products expansion present compelling opportunities for the company to better capitalize on potential

growth in the market and provide an even higher level of service to customers.

The transaction is expected to close in the fourth quarter

of GMS’s fiscal year 2024, subject to the satisfaction of customary closing conditions, including HSR approval. At such time, additional

information will be made available concerning the transaction.

About GMS

Founded in 1971, GMS operates a network of over 300 distribution

centers with extensive product offerings of Wallboard, Ceilings, Steel Framing and Complementary Products. In addition, GMS operates more

than 100 tool sales, rental and service centers, providing a comprehensive selection of building products and solutions for its residential

and commercial contractor customer base across

the United States and Canada. The Company’s unique

operating model combines the benefits of a national platform and strategy with a local go-to-market focus, enabling GMS to generate significant

economies of scale while maintaining high levels of customer service.

For more information about GMS, please visit www.gms.com.

Forward-Looking Statements and Information –

This press release includes "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act of 1995. You can generally identify forward-looking statements by our

use of forward-looking terminology such as "anticipate," "believe," "continue," "could," "estimate,"

"expect," "intend," "may," "might," "plan," "potential," "predict,"

"seek," or "should," or the negative thereof or other variations thereon or comparable terminology. We have based

these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations,

assumptions, estimates, and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown

risks and uncertainties, many of which are beyond our control. The following important factors could cause the future results, to differ:

the company’s growth strategy, changes in economic or industry conditions, competition, inflation and deflation, input costs, timing

and integration of acquisitions, timing and implementation of price increases for the Company’s products, consumer markets, and

other factors identified our filings with the SEC. We undertake no obligation to update any of the forward-looking statements made herein,

whether as a result of new information, future events, changes in expectation or otherwise.

Contacts

Carey Phelps

Vice President, Investor Relations

Phone: 770-723-3369

Email: ir@gms.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

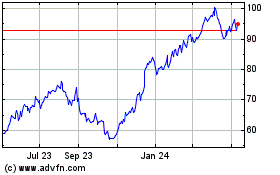

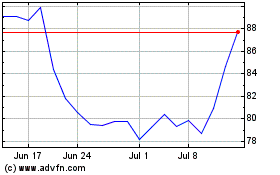

GMS (NYSE:GMS)

Historical Stock Chart

From Dec 2024 to Jan 2025

GMS (NYSE:GMS)

Historical Stock Chart

From Jan 2024 to Jan 2025